2020-02-02 11:32:00 Sun ET

stock market federal reserve monetary policy treasury fiscal policy deficit debt dollar technology employment inflation amazon fintech global macro outlook china trade brexit tariff interest rate exchange rate

Our fintech finbuzz analytic report shines fresh light on the current global economic outlook. As of Winter-Spring 2020, the analytical report delves into the proverbial Phillips curve disappearance, the pervasive Amazon effect of high-tech progress on inflation expectations, the global synchronization of inflation and interest rates, and the likely OECD implementation of new fiscal stimulus in the form of tax cuts and government expenditures. The recent Sino-American interim trade agreement and Brexit developments can contribute to the early resolution of global economic policy uncertainty. We focus on these new aspects of the global economic outlook.

We provide a soft PDF version of this analytic report in the cloud: http://bit.ly/2FZA7M5

This analytic report cannot constitute any form of financial advice, analyst opinion, recommendation, or endorsement. We refrain from engaging in financial advisory services, and we seek to offer our analytic insights into the latest economic trends, stock market topics, investment memes, and other financial issues. Our proprietary alpha investment algorithmic system helps enrich our AYA fintech network platform as a new social community for stock market investors: https://ayafintech.network.

OECD economies comprise at least one billion consumers and maybe millions of corporations. Each of these economies features mighty public institutions that seek to steer both fiscal and monetary policies. The central bank often needs to evaluate the inexorable and mysterious trade-off between inflation and unemployment. The government needs to decide fiscal revenues and budget expenditures. Statesmen, legislators, and other politicians focus on the long-term size of the state and myriad other priorities such as asset market stabilization and cross-border capital control. Technocrats serve the public role of taming the economic cycle with minimal credit and asset price fluctuations. In early-2020, the global economy welcomes the early resolution of core economic policy uncertainty due to the landmark Sino-American fair trade accord and Brexit parliamentary approval.

Most of the OECD countries now enjoy a credit boom as central banks undershoot inflation targets in the range of 1% to 3%. The U.S. unemployment rate persists at 3.5% or the lowest level since 1969, and U.S. inflation remains only 1.5% to 1.7% or well below the 2% monetary policy target. American interest rates and inflation expectations are so low that central banks have little room to further cut the federal funds rate if the U.S. economy moves into an economic recession. In other words, the U.S. Phillips curve remains flat when the American economy operates near full employment with low inflation. This new normal state of U.S. economic affairs may seem peculiar at this stage of the current global business cycle. The recent Federal Reserve interest rate adjustments lead global rate cuts and even negative rates in Australia, Brazil, China, Europe, India, and Japan etc. When push comes to shove, the law of inadvertent consequences counsels caution.

Inflation no longer rises reliably when unemployment is low because the public has come to expect modest price increases despite higher wage growth. Robust global supply chains suggest that prices cannot fully reflect local labor market conditions. Meanwhile, corporate treasuries remain reluctant to boost investments in mergers and acquisitions and capital facilities. In addition to this investment retrenchment, retail investors tend to save more in the form of government bonds and other safe assets. In combination, these financial excesses effectively push down bond yields and interest rates. As a result, Treasury bond yield inversion recurs sporadically in recent times. The global glut of debt shows that $15 trillion investment-grade bonds carry negative interest yields. In this light, the lenders must pay to hold these bonds to maturity. In global economic history, Treasury yield curve inversion often signals the arcane harbinger of a subsequent economic recession.

The balance sheets of central banks in America, Britain, Europe, and Japan hover around more than 35% of their total GDP. Because interest rates are low or even negative, high public debt is more sustainable. In many cases, government bonds finance long-term infrastructure expenditures that can enhance economic growth. Modern monetary theorists advocate the core notion that the Trump administration should continue to issue government bonds at relatively low interest rates to fund more public investment projects such as infrastructure, health care, education, and immigration etc. In contrast, the Sargent-Wallace unpleasant monetarist arithmetic analysis shows that the central bank cannot contain money supply growth (or high inflation) if the fiscal authority engages in incessant government bond issuance to fund public investment projects for better economic growth and employment. In the latter scenario, the central bank loses monetary policy independence due to a lack of fiscal prudence. As a consequence, the central bank would eventually have to tolerate higher inflation sooner or later as money supply growth accelerates due to the gradual accumulation of fiscal deficits over time. In effect, national debt caps constrain the positive fruits of macro policy coordination between the central bank and the fiscal authority.

On balance, the recent international monetary policy coordination appears to help anchor low-inflation expectations over time. This generic price moderation serves as an economic rationale for the recent prevalent low or negative interest rates in key OECD countries from America and Canada to Britain, Europe, and Japan etc. In addition to global economic integration and monetary policy coordination, fiscal prudence is quite essential for striking a delicate balance in long-run public finance. In recent times, several OECD countries introduce fiscal stimulus packages such as tax credits and new infrastructure expenditures to help promote better economic growth and domestic employment.

The vast majority of rich countries no longer struggle with runaway prices. Instead these countries need to confront the current economic reality of low inflation below the conventional monetary policy target of 2% to 3%. A decade of low interest rates near rock-bottom cannot change the status quo. Neither can central banks expand their balance sheets beyond the sum of $15 trillion or 35% of their GDP in America, Britain, Europe, and Japan. Many OECD economies now tend to operate near full employment with low inflation more than a decade after the Global Financial Crisis of 2008-2009.

To the extent that both the recent global economic integration and monetary policy coordination conspire to anchor low interest rates and inflation expectations in key rich countries, technological progress, fair trade, and cross-border capital control make inflation a less malleable economic indicator. The recent real business cycle evidence corroborates the low welfare cost of inflation (e.g. a 10-percentage point increase in inflation tends to trigger a very small fraction of 1% real GDP economic growth). Many central banks find it harder to hit their inflation targets. At the same time, monetary policy constraints mean that the imminent risk of inflation shortfalls looms larger than the more distant risk of excessive asset price increases. Central banks, fiscal authorities, and politicians must find novel ways to adapt public policy solutions to this new normal state of economic affairs worldwide.

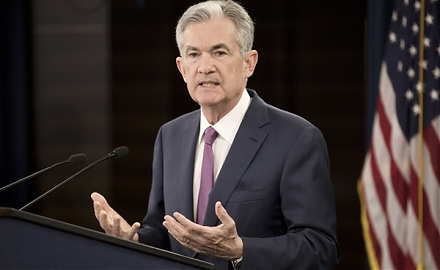

In the short run, low inflation seems to defy the Phillips curve or the inverse relation between inflation and unemployment. In America, the recent credit boom and stock market rally collectively help boost domestic employment. The Sino-American fair trade deal contributes to agribusiness economic revival in the form of farm exports. Brexit helps reduce economic policy uncertainty in the U.K. and many other parts of Europe. Brexit can contribute to Eurozone capital and labor mobility with modest wage growth. Through these global economic developments, the recent increases in private credit, capital investment, and employment have not brought substantial generic price and wage acceleration. As the new head of European Central Bank, Christine Lagarde indicates that it can be difficult for most monetary authorities to tame inflation or money supply growth in the long run. Bank of England incumbent governor Mark Carney warns of the 2% inflation target as an untenable economic policy consensus. Finally, Federal Reserve Chairman Jerome Powell regards low global inflation as one of the major macro challenges of our time. The recent dovish interest rate adjustments reflect the fact that inflation cannot be an imminent threat.

When low inflation persists relative to the 2%-3% monetary policy target, this status quo poses at least 3 economic problems. First, the worrisome status quo triggers the fear of missing out macro opportunities among central banks. Monetary policy-makers could have instituted more dovish interest rate cuts to promote better real GDP economic growth and domestic employment in the absence of price pressure. Second, central banks that miss their inflation targets may inadvertently undermine their monetary policy independence and credibility. When inflation targets are not credible, the future tends to spring a surprise to the optimal economic growth path. This macro surprise manifests in the form of more expensive debt contracts in real terms (because the loan value cannot shrink at a faster pace). Third, low inflation may transform into a disinflationary slump. As the public now expects low inflation and interest rates to persist, central banks lack the monetary policy levers or interest rate cuts to tame the next global economic recession.

It has become harder for central banks to fine-tune both inflation and interest rates in their baseline macroeconomic calibrations. Monetary policymakers should adapt to take a more fundamental view of long-run dynamic equilibrium. As central banks lack monetary policy levers in the form of low interest rates, the fiscal authority can share the macro responsibility of taming low inflation with reasonable fiscal deficits and national debt mountains.

Demographic changes can help address at least part of the concern and suspicion about the weak relation between inflation and employment. The present proportion of 15-to-65-year-olds with jobs hits a record high in almost 70% of OECD countries. The absent deflationary bias has become low inflation over a decade. The Phillips curve is extraordinarily flat. For instance, a 1-percentage-point decline in American unemployment correlates with a modest 0.2-percentage-point rise in U.S. inflation ceteris paribus. In this logic, it has become increasingly feasible for economists to forecast inflation with no regard to unemployment.

There are at least 3 plausible explanations for a flat Phillips curve. First, the Phillips curve may be a statistical artefact. A trade-off between inflation and unemployment is subject to the Goodhart law that many observable economic relations disappear once economic policymakers exploit these relations to tame the business cycle (cf. the biblical example of Joseph preparing for the 7-year famine in advance with the 7-year harvest in Egypt). When unemployment is low, hawkish central banks react to any sign of fast generic price increases with interest rate hikes. Over time, these preferences create a spurious correlation between inflation and unemployment; in effect, this correlation may inadvertently offset the causal relation that runs in the opposite direction. As a result, the Phillips curve becomes flat with no econometric significance nor economic substance.

Second, the general public can anticipate inflationary momentum before this force boosts widespread inflation expectations. Households, corporations, and financial intermediaries may be able to anticipate higher costs, wages, and markups etc as soon as these representative economic agents face a credit boom. Recent central bank studies show slow price increases in key OECD countries. Nowadays, it may not be worth paying attention to inflationary economic events.

Third, the Phillips curve can co-exist with an inevitably non-linear trade-off between inflation and unemployment. Both prices and wages can accelerate all of a sudden if unemployment falls beneath some specific threshold. At this particular threshold, monetary policymakers can anchor inflation expectations with gradual interest rate adjustments over time. This key explanation reflects tighter labor market conditions in America, Britain, China, Europe, and Japan etc. In effect, this non-linear trade-off encapsulates both nominal wage rigidities and structural demographic changes in a coherent economic story.

Keynesian search theory poses a conceptual challenge to the Phillips curve. In a dynamic equilibrium steady-state, exogenous stock market beliefs (or self-fulfilling prophecies) drive the macro ebbs and flows through the real business cycle. When stock market shocks persist over several years, these exogenous shocks transmit into macroeconomic fluctuations in real variables such as household consumption, employment, capital investment, private credit, and government debt. Often times, a typical stock market crash precedes a severe but brief economic recession; and then the macro economy recovers quickly with major rebounds in economic growth, household consumption, employment, and capital investment etc. The next macro economic expansion typically sustains over 8-to-9 years before financial excesses build up to sow the seeds of the next economic retreat.

On balance, the Phillips curve appears to flatten in recent times. In this economic logic, it may or may not be productive to view the inexorable and mysterious trade-off between inflation and unemployment. Most central banks such as U.S. Federal Reserve and European Central Bank, however, can continue to mull over the dual mandate of maximum sustainable employment and price stability. Over time, it is important for these central banks to embed financial intermediary capital changes and technological advances in the monetary policy purview.

Technological progress makes inflation statistics an unreliable guide to the macro economy. Alberto Cavallo of Harvard Business School demonstrates that Amazon prices are 6% lower than the generic prices of 8 large retailers in the U.S. and 5% lower than the generic prices available on the websites of the same U.S. retailers. In America, online e-commerce prices have been falling steadily since 2000. This proverbial Amazon effect reflects how technological progress can affect inflation in OECD countries. The winds of disinflation have been blowing through the U.S. and European retail space for decades. In the 1990s and early-2000s, big-box retailers such as Walmart and Target ruthlessly cut product prices via the local optimization of supply chains. Cost-effective imports from China, South Korea, and Taiwan etc further squeeze U.S. and European domestic low-cost producers. Apart from food and energy, there has been no cumulative rise in U.S. and European retail prices for more than 20 years.

Harvard financial economist Alberto Cavallo empirically shows the recent Amazon effect that online retailers such as Amazon, Alibaba, and eBay etc use fast multi-channel pricing algorithms to determine the retail prices of consumption goods and services. In America and Europe, online purchases account for a larger share of retail sales, the Cavallo study shows that the average duration of U.S. retail prices at Amazon and Walmart significantly declines from about 7 months to slightly more than 3 months. For central bankers and monetary policymakers who often need to track transitional dynamism and money supply growth, retail prices are subject to more frequent adjustments with less insulation from pervasive nationwide shocks. Amazon, Alibaba, eBay, and so forth can now use artificially intelligent retail-pricing algorithms to take into account energy prices, exchange-rate fluctuations, as well as other fundamental forces the may affect both production and delivery costs.

This important empirical evidence shakes confidence in the conventional wisdom of sticky prices that retailers often cannot adjust prices (or menu costs) right away in response to systemic changes in aggregate macroeconomic demand and supply. For better monetary policy conduct, the Cavallo study shows that our macro focus has to move beyond nominal price-and-wage downward rigidities in most dynamic stochastic general equilibrium (DSGE) macrofinancial models. As the e-commerce giants such as Amazon and Alibaba etc continue to apply smart algorithms to price consumer goods and services, key labor market frictions, information asymmetries, and even behavioral inattention costs often tend to disappear, or at least diminish in relative importance.

This public policy implication poses a conceptual challenge to the New Keynesian Phillips Curve that depicts an inverse link between inflation and unemployment at least in the short run. Many OECD countries can thus revert to the long-run steady-state at a faster pace as the prevalent Amazon effect induces more frequent retail price adjustments toward dynamic equilibrium values. At this current stage of the real business cycle, there is no clear trade-off between inflation and unemployment.

U.S. core inflation excludes both food and energy prices and hovers around 1.5% to 1.7% (or well below the 2% target) in early-2020. As the economy operates near full employment with fresh inflationary momentum, the high-tech adoption of smart algorithms can drive fast and smooth retail price adjustments in due course. Both Federal Reserve and European Central Bank may need to consider precautionary interest rate hikes for better inflation containment. In light of the recent Trump tax credits, infrastructure expenditures, and key tariffs on imports from China, Canada, Europe, Japan, and Mexico etc, this international monetary policy coordination can accord with the dual mandate of both maximum sustainable employment and price stability. Both international economic integration and monetary policy coordination can help synchronize inflation expectations, interest rates, and exchange rates etc.

Key fundamental forces help shape the commensurate synchronization of inflation expectations, economic output gaps, interest rates, and exchange rates worldwide. There are at least 3 main sources of global influence on inflation: commodity prices, tradable goods, and capital flows. First, inflation synchronicity rises after pervasive fluctuations in the oil price from the 1970s to present. In recent times, commodity prices often reflect changes in aggregate demand in capital-intensive economies such as China, Hong Kong, Singapore, South Korea, and Taiwan.

Second, globalization brings down the prices of tradable goods as their production has shifted to capital-intensive economies with low labor costs in recent decades. From the 1970s to present, tradable goods have become more cost-effective than services. The recent rise of cross-border supply chains creates conduits that allow cost changes in one part of the world to flow into the prices of tradable goods that arise from factories elsewhere. Relative costs and prices exhibit closer correlations in regional trade blocs such as America, Canada, and Mexico as well as Eurozone and China. Global factors help explain a greater share of inflation variation in core countries that participate more in global supply chains.

In practice, monetary policy decisions and interest rate adjustments work only with a delay, so relative price changes matter at least in the short run. Because the key Phillips curve seems to flatten in recent years, central banks often need to react to short-term trends and relative price gyrations with interim dovish monetary policy accommodation. As the general welfare loss of low inflation remains small, it may be better for central bankers to engage in closer public policy coordination with the fiscal authority. In combination, fiscal discipline and asset market stabilization help promote better economic prosperity in the long-term steady-state.

Third, cross-border capital flows move in tandem with global investment excesses. These financial imbalances help anchor low inflation and interest rates across key national borders. The global glut of financial excesses arises from myriad reasons such as a ubiquitous demographic increase in the proportion of residents near their retirement age, subpar productivity, a scarcity of safe assets relative to risky ones, and a dearth of lucrative opportunities for private institutional investors. On balance, cross-border capital flows can cause substantial changes in exchange rates, asset prices, and economic output gaps etc.

Overall, the global economic integration helps synchronize economic output gaps, inflation expectations, interest rates, and exchange rates. Tradable goods, global supply chains, and commodity prices help anchor low interest rates and inflation expectations. Furthermore, transnational capital flows drive fundamental changes in exchange rates, asset prices, and so forth. In the future, monetary policymakers may need to better coordinate their interest rate adjustments in collaboration with the fiscal authority. This fiscal-monetary policy coordination can help maintain price stability, maximum employment, economic growth, and asset market stabilization.

President Trump approves a phase one trade agreement with China. This approval averts the introduction of new tariffs on Chinese imports. In return, China seeks to purchase $40 billion to $50 billion U.S. agribusiness exports to better balance the current Sino-American terms of trade. The Trump administration expects to phase out gradual tariff reductions for Chinese imports.

Meanwhile, the Trump administration reduces tariffs on $120 billion to $160 billion Chinese imports from 15% to 7.5%, but the separate 25% levies would remain on $250 billion Chinese imports. On the brighter side, the current trade accord proves to be mutually beneficial to China and America, so the key U.S. and Chinese stock market indices surge in response to this great deal. The greenback depreciates a bit against a basket of U.S. fair-trade partners in response to the bilateral Sino-U.S. phase-one trade deal.

On the dark side, Chinese 5G technology now crystallizes as a clear challenger to the U.S. business model. A bifurcation of global supply chains has thus gone from a new niche to a mainstream consensus view. It is hence important for the Trump administration to strike a delicate balance between fair trade details and high-tech advances.

Conservative Party wins the British parliamentary majority in the general election with hefty British pound appreciation. In response to this general election outcome, British stock and bond markets surge with much investor optimism. As this election result resolves economic policy uncertainty, British pound reaps reasonable gains against the greenback, euro, and several other hard currencies. The Conservative Party 365-seat majority can help push for the early resolution of both fair trade and fine Brexit negotiations with the European Union. Many stock market analysts and economic media commentators now expect Brexit to take place in early-2020. As a result, a second referendum on Brexit is less likely as Labour Party garners only 203 seats in the U.K. parliament.

London School of Economics political scientist Sara Hobolt critiques that the first-past-the-post system may not translate U.K. voter beliefs into parliamentary seats. At the heart of the Brexit debate, many British voters consider domestic healthcare and infrastructure subsidies to outweigh in relative importance trade, immigration, and membership in the European Union. In democratic countries with proportional representation, this result has become a major party realignment. This realignment reflects the pervasive British voter sentiment that U.K. politicians should get Brexit done in due course.

Many macro economists now need to consider whether the prevalent low inflation and interest rates are likely to persist in light of low economic growth rates among OECD countries. These macro economists further need to mull over whether some secular endogenous factors anchor these key economic indicators in the medium term. Some economists and politicians advocate the modern monetary notion that the current Trump administration can afford to issue public bonds for funding fiscal expenditures in infrastructure, health care, education, and residential formation etc due to the low interest rates and therefore low costs of public debt. However, many other economists disagree with this notion. The government cannot fund big fiscal deficits on top of high public debt mountains in the long run. Sooner or later these fiscal deficits may inadvertently trigger sudden and substantial increases in money supply growth. As a result, high inflation arises from this specific context. The ripple repercussions erode the purchasing power of both individual and corporate income and wealth. High inflation and its attendant economic policy uncertainty can cause disruptive losses to the global growth prospects and cross-border supply chains.

Former IMF chief economist Olivier Blanchard contends that low real interest rates have been quite persistent since the 1990s. The current U.S. Treasury yield curve shows that interest rates can remain relatively low in the next couple of years. As interest rates are low (especially if the real interest rate is lower than the real GDP growth rate), high government expenditures may incur lower costs of fiscal deficits. For this reason, Blanchard regards public debt dynamism as more favorable at this current stage of the real business cycle. Blanchard favors more public investments with no pivotal focus on tax cuts nor public expenditures on health care, education, infrastructure, and so on. Insofar as fiscal deficits cannot constrain business debt, new fiscal stimulus can help boost economic growth and employment in America, Britain, China, France, Germany, Japan, and most other OECD countries.

Goldman Sachs chief economist Jan Hatzius agrees with the prior view that fiscal deficits may be less worrisome in most OECD countries because the interest rates and future costs of capital can remain rather low in the foreseeable future. Hatzius expresses his concern about U.S. business debt accumulation. U.S. business debt escalation is problematic as the government typically cannot go bankrupt, whereas, American corporations can. To the extent that government expenditures crowd out private business investments at least at the margin, the ripple repercussions may inadvertently incur welfare losses to U.S. economic growth, capital accumulation, and employment.

Both Blanchard and Hatzius are skeptical of the aggressive form of fiscal stimulus such as the modern monetary notion whereby the government prints new interest-free money to fund public expenditures. Higher public debt levels would likely lead to more volatile stock and bond prices and eventually higher inflation rates in most OECD nations. When push comes to shove, the law of inadvertent consequences counsels caution.

Harvard political economy professor Alberto Alesina is not as sanguine about the use of fiscal stimulus. Alesina argues that greater fiscal stimulus may make sense in Japan and some parts of Europe. However, he advises maintaining a long-term perspective: the U.S. Federal Reserve and many other central banks can continue interest rate hikes again for better inflation containment. After all, only a few OECD countries such as the U.S. and Germany can afford to run substantial fiscal deficits as inflationary concerns ratchet up over several years. Moreover, Alesina indicates that not all fiscal measures are equal because tax credits can result in higher fiscal multipliers in comparison to government expenditures. In this positive light, Alesina favors fiscal stimulus in the form of further tax cuts under the Trump administration.

Our fintech finbuzz analytic report shines fresh light on the current global economic outlook. As of Winter-Spring 2020, the analytical report delves into the proverbial Phillips curve disappearance, the pervasive Amazon effect of high-tech progress on inflation expectations, the global synchronization of inflation and interest rates, and the likely OECD implementation of new fiscal stimulus in the form of tax cuts and government expenditures. The recent Sino-American interim trade agreement and Brexit developments can contribute to the early resolution of global economic policy uncertainty. We focus on these new aspects of the global economic outlook.

Do you find it difficult to beat the long-term average 11% stock market return?

It took us 20+ years to design a new profitable algorithmic asset investment model and its attendant proprietary software technology with fintech patent protection in 2+ years. AYA fintech network platform serves as everyone’s first aid for his or her personal stock investment portfolio. Our proprietary software technology allows each investor to leverage fintech intelligence and information without exorbitant time commitment. Our dynamic conditional alpha analysis boosts the typical win rate from 70% to 90%+.

Our new alpha model empowers members to be a wiser stock market investor with profitable alpha signals! The proprietary quantitative analysis applies the collective wisdom of Warren Buffett, George Soros, Carl Icahn, Mark Cuban, Tony Robbins, and Nobel Laureates in finance such as Robert Engle, Eugene Fama, Lars Hansen, Robert Lucas, Robert Merton, Edward Prescott, Thomas Sargent, William Sharpe, Robert Shiller, and Christopher Sims.

Follow AYA Analytica financial health memo (FHM) podcast channel on YouTube:

https://www.youtube.com/channel/UCvntmnacYyCmVyQ-c_qjyyQ

Follow our Brass Ring Facebook to learn more about the latest financial news and fantastic stock investment ideas:

http://www.facebook.com/brassring2013.

Free signup for stock signals: https://ayafintech.network

Mission on profitable signals: https://ayafintech.network/mission.php

Model technical descriptions: https://ayafintech.network/model.php

Blog on stock alpha signals: https://ayafintech.network/blog.php

Freemium base pricing plans: https://ayafintech.network/freemium.php

Signup for periodic updates: https://ayafintech.network/signup.php

Login for freemium benefits: https://ayafintech.network/login.php

We update and refresh part of memetic financial information on a sporadic basis. We aim to facilitate this information exchange only for illustrative purposes. Some information may be stale and incomplete. Therefore, we recommend each member to consult the respective external website(s) for more up-to-date information.

This analytic report cannot constitute any form of financial advice, analyst opinion, recommendation, or endorsement. We refrain from engaging in financial advisory services, and we seek to offer our analytic insights into the latest economic trends, stock market topics, investment memes, and other financial issues. Our proprietary alpha investment algorithmic system helps enrich our AYA fintech network platform as a new social community for stock market investors: https://ayafintech.network.

The conventional disclaimers apply to this key case where each freemium member bewares, understands, and acknowledges the service terms and conditions for our courteous fintech network platform. Any omissions, errors, or other blemishes do not necessarily reflect the official views and opinions of our AYA fintech platform orchestrator. We make a conscious effort to keep most major omissions to 1% to 5% of the fintech information for about 6,000 U.S. stocks on NYSE, NASDAQ, and AMEX. These omissions tend to concentrate around some rare corporate events (e.g. IPO, delisting occurrence and recurrence, abrupt trading suspension, and M&A initiation etc). Overall, these disclaimers, terms, and conditions of our service should be viewed as baseline house rules for fintech network platform usage and development.

Under pending subsequent patent-law confirmation, the relevant legal text protects our proprietary alpha software technology for ubiquitous knowledge transfer. Each freemium member enjoys his or her interactive usage and information exchange on our AYA algorithmic fintech network platform with sound and efficient dynamic conditional asset return prediction.

Our AYA fintech network platform helps promote better financial literacy, inclusion, and freedom of the global general public with an abiding interest in core economic reforms, financial markets, and stock market investments. In this broader context, each freemium member can consult our mission statement that provides more in-depth explanatory details on our long-term aspiration.

Andy Yeh Alpha (AYA)

AYA fintech network platform founder

Brass Ring International Density Enterprise (BRIDE)

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-01-08 17:46:00 Tuesday ET

President Trump forces the Federal Reserve to normalize the current interest rate hike to signal its own monetary policy independence from the White House.

2019-12-13 09:32:00 Friday ET

Saudi Aramco aims to initiate its fresh IPO in December 2019. Several investment banks indicate to the Saudi government that most investors may value the mi

2018-11-27 10:37:00 Tuesday ET

Warren Buffett offloads a few stocks from the Berkshire Hathaway portfolio in mid-November 2018. The latest S.E.C. report shows that the Oracle of Omaha sol

2023-11-14 08:24:00 Tuesday ET

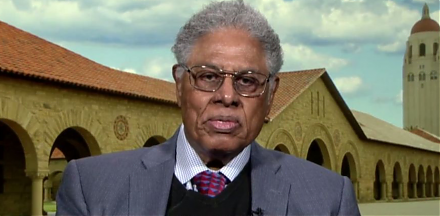

Thomas Sowell argues that some economic reforms inadvertently exacerbate economic disparities. Thomas Sowell (2019) Discrimination and econo

2019-07-25 16:42:00 Thursday ET

Platforms benefit from positive network effects, scale economies, and information cascades. There are at least 2 major types of highly valuable platforms: i

2019-08-12 07:30:00 Monday ET

Facebook reaches a $5 billion settlement with the Federal Trade Commission over Cambridge Analytica user privacy violations. The Federal Trade Commission (F