2019-12-25 19:46:00 Wed ET

treasury deficit debt employment inflation interest rate macrofinance fiscal stimulus economic growth fiscal budget public finance treasury bond treasury yield sovereign debt sovereign wealth fund tax cuts government expenditures

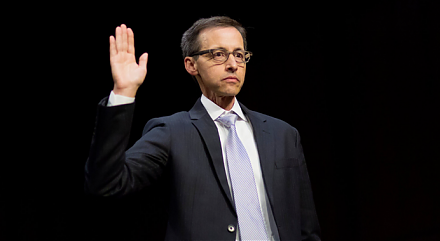

Former White House chief economic advisor Nouriel Roubini discusses the major limits of central-bank-driven fiscal deficits. The International Monetary Fund (IMF) projects subpar global economic growth due to the recent trifecta of the tentative Sino-U.S. trade agreement, geopolitical energy tension in the middle east, and a cloudy economic outlook for Britain and E.U. in light of soft Brexit trade uncertainty. These primary global tail risks anchor inflation expectations worldwide, so central banks engage in tacit monetary policy coordination in accordance with the tripartite congressional mandate of maximum sustainable employment, price stability, and financial market stabilization.

With greater government bond issuance, central banks can help fund fiscal deficits that manifest in the form of both tax cuts and infrastructure expenditures. Left-wing proponents of Modern Monetary Theory argue that larger permanent fiscal deficits help stimulate economic growth when central banks monetize these fiscal deficits in the absence of runaway inflation and economic slack.

However, Roubini argues that the current monetization of fiscal deficits cannot be a sustainable policy response in the long run. Either the global economy eventually experiences a supply shock due to pervasive shortages of oil and natural gas, or an inflationary shock becomes a major economic disturbance worldwide.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-01-05 11:39:00 Saturday ET

Reuters polls show that most Americans blame President Trump for the recent U.S. government shutdown. President Trump remains adamant about having to shut d

2017-09-19 05:34:00 Tuesday ET

Facebook, Twitter, and Google executives head before the Senate Judiciary Committee to explain the scope of Russian interference in the U.S. presidential el

2019-01-23 11:32:00 Wednesday ET

Higher public debt levels, global interest rate hikes, and subpar Chinese economic growth rates are the major risks to the world economy from 2019 to 2020.

2019-04-19 12:35:00 Friday ET

Federal Reserve proposes to revamp post-crisis rules for U.S. banks. The current proposals would prescribe materially less strict requirements for community

2023-10-21 11:32:00 Saturday ET

Walter Scheidel indicates that persistent European fragmentation after the collapse of the Roman Empire leads to modern economic growth and development.

2019-08-14 10:31:00 Wednesday ET

Netflix suffers its first major loss of U.S. subscribers due to the recent price hikes. The company adds only 2.7 million new subscribers in 2019Q2 in stark