Brass Ring International Density Enterprise (BRIDE)

This webpage explains in detail Brass Ring International Density Enterprise's (BRIDE) core mission statement. While we design this webpage to be concise and succinct, our main mission statement can turn BRIDE's core competencies, specialties, and executive functions into a verbal description of what all of our team members seek to accomplish at the early-to-mid stage of the prototypical corporate lifecycle. Overall, this mission statement serves as a set of executive management guidelines and principles for the typical team member to share a unique corporate vision throughout his or her journey in strategic management, fintech research and development, business administration and operation, and marketing execution and implementation.

BRIDE specializes in fintech network platform orchestration, econometric estimation, and dynamic conditional asset pricing analysis. Our primary fintech network platform, Andy Yeh Alpha (AYA), offers financial intelligence to multiple users in a modular cloud network platform. With dual cost leadership and software differentiation, BRIDE orchestrates AYA fintech network platform automation and proprietary software technology for interactive uses to optimize user experience. This dynamic positioning strategy contributes to our effective and incremental adaptation to the gradual evolution of fintech software systems, algorithmic analytics, social networks, and other software applications. BRIDE maintains and enhances its longer-term sustainable competitive advantage in proprietary software technology and macrofinancial research under patent law protection and accreditation.

BRIDE focuses on international reach with American focus, optimal user engagement, advisory financial software service provision, and relevant financial information exchange for financial market investors. Due to close intra-industry rivalry, upstream data provision, downstream user engagement, and open market entry, Andy Yeh Alpha (AYA) withstands intense competition in the fintech industry. We design and develop BRIDE's unique state-of-the-art proprietary analytic algorithm and dynamic conditional asset-pricing system for both tech-savvy and ordinary investors. This proprietary design draws from the seminal contributions of several Nobel Laureates in the economic science in the past decades from 1969 to present. These prolific and eminent economists include Robert Engle, Gene Fama, Ragnar Frisch, Lars Hansen, Robert Lucas, Robert Merton, Ed Prescott, Thomas Sargent, Christopher Sims, and William Sharpe. On our Andy Yeh Alpha (AYA) fintech network platform, BRIDE faces few close substitutes and also attracts new complements from innovative ideas in quantitative fintech research. These key ideas encompass permanent capital, dynamic conditional alpha, macrofinancial contagion, conditional value-at-risk, and memetic corporate finance etc.

BRIDE comprises the main corporate executive management functions of strategic management, financial research, business administration, and marketing implementation. Our lean strategic management structure allows intellectually curious fintech developers to test backend innovations for efficient frontend marketing implementation and business execution. In effect, our lean modern corporate strategy knits an interwoven nexus between fintech software innovation and network platform automation throughout a prototypical lifecycle. The eventual duration of each software lifecycle becomes commensurate with optimal user experience, technical sophistication, continual improvement, and fintech network platform customization for different mobile users and investors.

BRIDE's core competencies are business intelligence management and fintech research in dynamic asset pricing model design, capital structure, and financial risk management. These competencies revolve around internal knowledge transfer and resource dynamism within the broader context of hyper competitive fintech specialty. Indeed, our rare and valuable thought leadership often precedes client relationship management, so the effective continuance of research endeavors reinforces BRIDE's core competencies and value drivers. For better inimitable value creation, BRIDE strives to strengthen its longer-term sustainable competitive advantage by trying to enrich the core financial literacy, inclusion, and freedom of the global general public. Due to the fact that we now live in an increasingly tolerant and inclusive global society, BRIDE and its AYA network platform welcome diverse ideas on financial reform and regulation.

Andy Yeh Alpha (AYA) is a new fintech network platform for smart stock market investors. Today numerous online stock investment software solutions focus on artificial intelligence, investor sentiment, macro momentum, algorithmic trading signal recognition, and so forth. The vast majority of Internet stock investment software solutions lack the intellectual algorithmic rigor and technicality for fast and efficient fintech network platform automation. Specifically, these software solutions cannot connect their fundamental investment portfolio philosophy to quantitative analysis in the canonical dynamic asset pricing literature. Moreover, these financial software solutions lack patent-law protection and accreditation in terms of inventive novelty, non-obviousness, and industrial applicability. The major examples are Betterment, Wealthfront, and StockTwits. Other examples include Acorns, AI Holly, Aidyia, AlgoBellCurve, Alpaca, Alpha Architect, Alpha Modus, Alpha Shark, ArtQuant, Calastone, Call Levels, Cloud9Trader, Dogs of the Dow, Ellevest, Epic Stock Research, Etoro, Euklid, FinMason, Fugle, Future Advisor, Hedge Mind, Investors Exchange (IEX), Kapitall Pocket, Kaizen Global, Kings of Capital, Momentum Edge, Market Trend Signal, Neokami, PipSumo, Profitly, Quandl, Quanffett, QuantConnect, Quantiacs, Quantopian, Rebellion, Renaissance, Sentient, Sentieo, SigFig, Sillicon Market, SimFin, SocialPicks, Spark Cognition, Stock Investor Pro, TechMeetsTrader, Trade-24, Trade Desk 24, Trade Ideas Pro, TradingView, TradingValley, Tixguru, Two Sigma, Walnut Algorithm, WB21, and XtraInvestor etc.

Brass Ring International Density Enterprise (BRIDE) provides a unique fintech network platform that differs substantially from these other software solutions. BRIDE orchestrates the world's first cloud virtual investment network platform, Andy Yeh Alpha (AYA), that carries its professional logo as an official trademark. In addition, BRIDE receives proper patent-law protection and accreditation of its current implementation of a new algorithmic system for dynamic conditional asset pricing analysis on this fintech network platform.

Andy Yeh Alpha (AYA) is the world's first cloud network platform for automatic financial intelligence. This platform provides software solutions for econometric alpha estimation, financial risk quantification, core financial ratio summary, and financial statement analysis. AYA receives legal protection from the recent U.S. utility patent specification, "An algorithmic system for dynamic conditional asset pricing analysis and financial intelligence technology platform automation". AYA fintech network platform orchestrates the fast provision of financial intelligence drawn from the seminal contributions of numerous Nobel Laureates in financial economics. These laureates are Ragnar Frisch (1969), William Sharpe (1990), Robert Lucas (1995), Robert Merton (1997), Robert Engle (2003), Ed Prescott (2004), Thomas Sargent (2011), Christopher Sims (2011), Gene Fama (2013), and Lars Peter Hansen (2013). AYA integrates their life-time financial research accomplishments into useful mobile applications for the U.S. and international general public. Further, AYA promotes social interactions among investors who maintain an active interest in investment portfolio strategies such as size, value, momentum, asset investment growth, operating profitability, contrarian reversal, accounting accrual, and so on. Through its key social network, AYA reveals the real-time polls on investment portfolio strategies and asset-pricing anomalies. Each investor can register his or her current portfolio composition with specific buy-versus-sell trades. In essence, this asset-pricing anomaly discovery helps categorize individual assets into numerous portfolio tilts over the multi-year time horizon. As a consequence, AYA caters these multiple asset investment styles to salient investor tastes and preferences. The collective wisdom of aggregate investor demand and sentiment in turn shines fresh light on speedy asset price discovery and portfolio sophistication. In effect, BRIDE accelerates the software development lifecycle through the AYA fintech network platform automation. At any rate, BRIDE strives to encourage ubiquitous usage of algorithmic financial intelligence via our AYA fintech network platform and its subsequent boutique design of cloud software applications. These fintech applications are available for smart phones, tablets, laptops, desktops, and other mobile devices.

Andy Yeh Alpha (AYA) serves as an algorithmic fintech network platform where users learn about the probable prospect of each U.S. stock's long-term average return after the econometrician filters out dynamic conditional factor exposures to systematic risk. On this fintech network platform, users steer their own virtual portfolio transactions and then learn from the Top 100 AYA investors who have earned the highest net overall returns in terms of "virtual talents". All AYA users share, save, view, favorite, and transmit the Top 500 U.S. individual stocks that one ranks by their respective dynamic conditional alphas with 10% to 40% long-term average returns. This virtuous cycle repeats as all AYA users interact with one another to share topical financial intelligence on this social network platform.

A long-term value investor, Andy Yeh, founded Brass Ring International Density Enterprise (BRIDE) as a fintech firm (first incorporation in Hong Kong). BRIDE orchestrates Andy Yeh Alpha (AYA) fintech network platform customization and cloud automation with its delicate trademark logo design. AYA fintech network platform makes use of $cashtags, #hashtags, and @usertags to organize post streams, premium member interactions (such as likes, comments, shares, and private messages etc), virtual stock trades in terms of virtual dollars or "talents", and Top 100 AYA investors and Top 500 stocks with proprietary alpha signals. These core social network features provide fresh economic insights, ideas, and news that both institutional analysts and retail investors can then apply to help inform their own strategies, tactics, and decisions for better asset allocation and portfolio optimization.

At least half of American investors hold direct equity stakes or some other forms of stock investments in public corporations. Both U.S. and non-U.S. institutional investors such as pension funds, mutual funds, hedge funds, investment banks, insurance companies, corporate treasuries, and other financial institutions keep an active interest in most Top 6,000 U.S. stocks that represent 97%-98% of the net market capitalization for NYSE, NASDAQ, and AMEX. With a critical mass of active premium members, AYA fintech network platform yields post streams that can reach over 35 million U.S. stock market investors across the financial web, mainstream media, and other social network platforms.

Post, like, share, and comment on Andy Yeh Alpha (AYA)

Andy Yeh Alpha (AYA) post streams comprise core financial news, charts, links, insights, ideas, metrics, proprietary alpha signals, and other important financial ratios and statements. Freemium end users, premium members, stock analysts, professional forecasters, media commentators, and asset investors of all types, as well as the public companies themselves, can contribute to our post streams, likes, comments, shares, and messages on AYA fintech network platform. Most of our premium members can feel free to share their posts to most other social networks such as Facebook, Twitter, LinkedIn, Google+, YouTube, Messenger, Instagram, WhatsApp, Reddit, Pinterest, Vine, Tumblr, Amazon, Yahoo, LINE, Flipboard, Baidu, Weibo, Wechat, WordPress, and Blogger etc. This integration makes it easy for our active members to include their financial communication into more ubiquitous social interactions from time to time.

Andy Yeh Alpha (AYA) focuses primarily on financial content curation for better and wiser stock investment decisions. For this reason, our fintech network team works well together to filter out irrelevant and malicious posts, comments, and messages (spam and scam) to ensure that our financial content curation helps promote more valuable and relevant discussions and interactions about stocks in particular and financial markets in general. Furthermore, our financial content curation provides regular and sporadic blog posts and free finbuzz ebooks. All of these endeavors can help enrich the financial literacy, inclusion, and freedom of active freemium members on our AYA fintech network platform.

AYA is every investor's first aid for profitable investment management

Anyone can feel free to browse the individual streams of $cashtags, #hashtags, and @usertags for at least 3 times every week subject to our paywall limitations. Freemium users, analysts, media commentators, professional forecasters, and asset investors of all types, as well as public corporations, treasuries, pension funds, mutual funds, hedge funds, investment banks, insurance firms, and other financial institutions can create "premium member accounts" to start following individual stocks, influencers, contributors, and other end users on AYA fintech network platform. All of the premium members can contribute ideas and insights to interact with other investors within the AYA fintech network community. All of these interactions help enhance the financial literacy, inclusion, and freedom of the global general public. This latter ultimate goal accords with BRIDE's mission statement and corporate value proposition. AYA fintech network platform hence serves as every smart and serious stock market investor's first aid for profitable investment management, cost-effective diversification, portfolio optimization, or global asset allocation.

We empower investors through technology, education, and social integration.

Please feel free to Sign Up or Log In on Andy Yeh Alpha (AYA) fintech network platform now!!

Andy Yeh

AYA fintech network platform founder

Brass Ring International Density Enterprise (BRIDE)

Email andy.yeh.alpha@ayafintech.network service@ayafintech.network

2017-07-01 08:40:00 Saturday ET

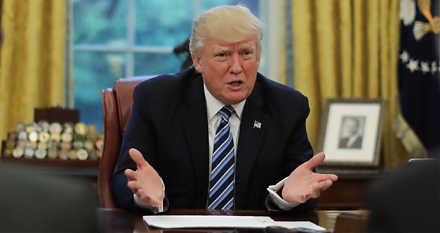

The Economist interviews President Donald Trump and spots the keyword *reciprocity* in many aspects of Trumponomics from trade and taxation to infrastructur

2022-04-05 17:39:00 Tuesday ET

Corporate diversification theory and evidence A recent strand of corporate diversification literature spans at least three generations. The first generat

2018-03-15 07:41:00 Thursday ET

The Trump administration's $1.5 trillion hefty tax cuts and $1 trillion infrastructure expenditures may speed up the Federal Reserve interest rate hike

2019-08-22 11:35:00 Thursday ET

Fundamental factors often reflect macroeconomic innovations and so help inform better stock investment decisions. Nobel Laureate Eugene Fama and his long-ti

2019-12-01 10:31:00 Sunday ET

Goop Founder and CEO Gwyneth Paltrow serves as a great inspiration for female entrepreneurs. Paltrow designs Goop as an online newsletter, and this newslett

2018-06-21 10:42:00 Thursday ET

Harley Davidson plans to move its major production for European customers out of America due to European Union tariff retaliation. European Union retaliator