2019-03-01 13:36:00 Fri ET

federal reserve monetary policy treasury dollar employment inflation interest rate exchange rate macrofinance recession systemic risk economic growth central bank fomc greenback forward guidance euro capital global financial cycle credit cycle yield curve

Global economic uncertainty now lurks in a thick layer of mystery. This uncertainty arises from Sino-U.S. trade tension, Brexit fallout, monetary policy normalization, and financial fragility due to U.S. interest rate and greenback appreciation. As the Trump administration makes positive progress on Sino-U.S. trade negotiations, most economic pundits and experts expect U.S. monetary policy normalization to continue in 2019-2020 as most asset returns and factor premiums reflect structural changes in the interest rate and dollar valuation. Also, the British parliament may initiate a major delay or a second referendum on Brexit.

At the turn of the new century, artificial intelligence, cloud computation, smart data analysis, and robotic automation displace many workers and thus irrevocably alter the tech structure of employment. Globalization is another powerful force. The free movement of goods, services, and people transforms economic integration and global value creation. The macroeconomic trend intensifies competition in the labor market, and the middle class now faces higher wage growth, price inflation, human capital depreciation, and unemployment in OECD countries.

In the financial intermediary sector, deregulation and capital account liberalization boost international capital flows well above trade. Post-crisis fintech improvements such as crowd funds, peer-to-peer loans, and shadow banks shed skeptical light on the role of financial intermediaries in the key monetary transmission mechanism. As a result, several central banks encounter real wage stagnation, deterioration in both income and wealth distribution, and a major slowdown in productivity growth. E-commerce tech titans such as Amazon and Alibaba induce frequent, accurate, and competitive retail price adjustments. These faster price adjustments effectively flatten the New Keynesian Phillips curve (or the inexorable and mysterious trade-off between inflation and unemployment). This economic transformation coincides with the new cycle of U.S. interest rate hikes. Through cross-border capital flows and exchange rate gyrations, U.S. monetary policy changes and trade imbalances can create global financial cycles that radically distort credit conditions in European and Asian economies.

Central banks now need to adopt a cautious, gradual, and data-driven monetary policy approach for prudent financial risk management in light of substantial macro uncertainty. Also, central banks need to monitor a wide variety of macroprudential indicators such as asset prices, risk premiums, credit supply surprises, and other financial imbalances. To the extent that both supply-side shocks and global capital flows aggravate exchange rate volatility, central banks need to preserve greater price flexibility and monetary autonomy. When push comes to shove, the law of inadvertent consequences counsels caution.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-07-11 10:48:00 Thursday ET

France and Germany are the biggest beneficiaries of Sino-U.S. trade escalation, whereas, Japan, South Korea, and Taiwan suffer from the current trade stando

2022-02-15 14:41:00 Tuesday ET

Modern themes and insights in behavioral finance Lee, C.M., Shleifer, A., and Thaler, R.H. (1990). Anomalies: closed-end mutual funds. Journal

2020-09-03 10:26:00 Thursday ET

Agile business firms beat the odds by building faster institutional reflexes to anticipate plausible economic scenarios. Christopher Worley, Thomas Willi

2017-09-19 05:34:00 Tuesday ET

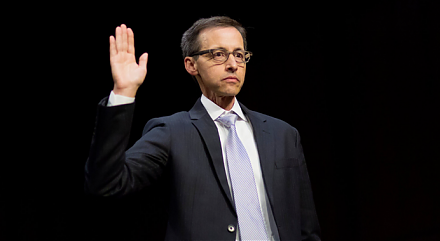

Facebook, Twitter, and Google executives head before the Senate Judiciary Committee to explain the scope of Russian interference in the U.S. presidential el

2018-02-15 07:43:00 Thursday ET

Fed minutes reflect gradual interest rate normalization in response to high inflation risk. FOMC members revise up the economic projections made at the Dece

2019-01-10 17:31:00 Thursday ET

The recent Bristol-Myers Squibb acquisition of American Celgene is the $90 billion biggest biotech deal in history. The resultant biopharma goliath would be