Home > Library

2026-10-01This report delves into how today tech titans reshape global pharmaceutical investments for both better healthspan and longer lifespan.

2026-07-01This report delves into American exceptionalism and economic growth outperformance both by historical standards and in comparison to the rest of the world in recent decades.

2026-04-01This article delves into AI-driven new medications, treatments, therapies, and healthcare services worldwide.

2026-03-14This ebook delves into the fundamental analysis of new competitive advantages in many global macro industries.

2026-01-01This report delves into the key lessons from recent monetary policy framework reviews worldwide.

2025-10-01This report delves into the technological advances in the global market for GLP-1 anti-obesity weight-loss medications.

2025-09-11This ebook delves into the fundamental analysis of new competitive advantages in many global macro industries.

2025-07-01Geopolitical alignment often reshapes and reinforces asset market fragmentation in the broader context of financial deglobalization.

2025-04-01This analytic report delves into the recent technological advancements in the global cloud infrastructure.

2025-03-03This new ebook delves into the fundamental analysis of competitive advantages in the global financial system.

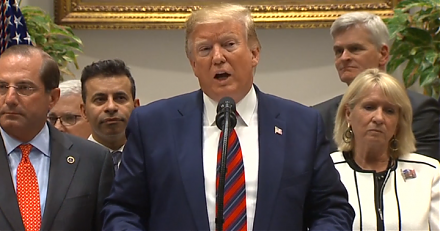

2019-05-11 10:28:00 Saturday ET

The Trump administration still expects to reach a Sino-U.S. trade agreement with a better mechanism for intellectual property protection and enforcement. Pr

2021-08-01 07:26:00 Sunday ET

The Biden administration launches economic reforms in fiscal and monetary stimulus, global trade, finance, and technology. President Joe Biden proposes s

2018-08-03 07:33:00 Friday ET

President Trump escalates the current Sino-American trade war by imposing 25% tariffs on $200 billion Chinese imports. These tariffs encompass chemical prod

2022-11-25 09:29:00 Friday ET

Uniform field theory of corporate finance While the agency and precautionary-motive stories are complementary, these stories can be nested as special cas

2018-06-07 10:36:00 Thursday ET

AT&T wins court approval to take over Time Warner with a trademark $85 billion bid despite the Trump administration prior dissent due to antitrust conce

2022-04-25 10:34:00 Monday ET

Corporate ownership governance theory and practice The genesis of modern corporate governance and ownership studies traces back to the seminal work