2019-11-15 13:34:00 Fri ET

federal reserve monetary policy treasury dollar employment inflation interest rate exchange rate macrofinance recession systemic risk economic growth central bank fomc greenback forward guidance euro capital global financial cycle credit cycle yield curve

The Economist offers a special report that the new normal state of economic affairs shines fresh light on the division of labor between central banks and governments. The recent U.S. economic outlook combines full employment with low inflation, and this rare combination accords with the Federal Reserve dual mandate of maximum sustainable employment and price stabilization. The New Keynesian Phillips Curve becomes flat in recent times, and there is no inexorable trade-off between inflation and unemployment. The U.S. unemployment rate reaches 3.5% or the lowest level since 1969. The core inflation rate hovers in the range of 1.5%-1.7% or well below the 2% target inflation rate. On the one hand, the Federal Reserve may continue to reduce the interest rate to help sustain the U.S. economic expansion and stock market rally in response to a vocal president.

On the other hand, the dovish interest rate cuts suggest that the U.S. central bank may have fewer monetary policy levers to cope with the next economic recession. Meanwhile, U.S. Treasury continues to offer Americans fiscal stimulus packages in the generic form of both tax incentives and infrastructure expenditures. Whether fiscal deficits can cause higher inflation remains a major economic policy concern.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-11-19 09:38:00 Monday ET

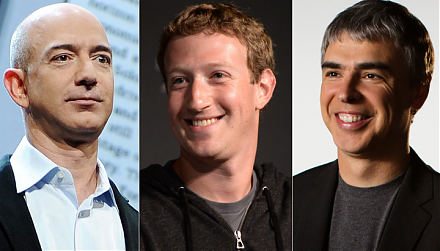

The Trump administration mulls over antitrust actions against Amazon, Facebook, and Google. President Trump indicates that the $5 billion fine against Googl

2019-05-23 10:33:00 Thursday ET

Berkeley professor and economist Barry Eichengreen reconciles the nominal and real interest rates to argue in favor of greater fiscal deficits. French econo

2019-09-03 14:29:00 Tuesday ET

Due to U.S. tariffs and other cloudy causes of economic policy uncertainty, Apple, Nintendo, and Samsung start to consider making tech products in Vietnam i

2018-04-07 09:36:00 Saturday ET

Facebook CEO Mark Zuckerberg testifies in Congress to rise up to the challenge of public outrage in response to the Cambridge Analytica data debacle and use

2019-03-23 09:31:00 Saturday ET

Congresswoman Alexandria Ocasio-Cortez proposes greater public debt finance with minimal tax increases for the Green New Deal. In accordance with the modern

2018-08-21 11:40:00 Tuesday ET

President Trump criticizes his new Fed Chair Jerome Powell for accelerating the current interest rate hike with greenback strength. This criticism overshado