2017-10-09 09:34:00 Mon ET

stock market gold oil stock return s&p 500 asset market stabilization asset price fluctuations stocks bonds currencies commodities funds term spreads credit spreads fair value spreads asset investments

The current Trump stock market rally has been impressive from November 2016 to October 2017. S&P 500 has risen by 21.1% since the 2016 presidential election, and the Dow has gained 28.5% in the same period. In addition, NASDAQ is up 30.3%.

Since the surprise Trump election victory, banks and tech stocks have been the best performers. The former include Citigroup, JPMorgan Chase, and Bank of America while the latter include FAMGA or Facebook, Apple, Microsoft, Google, and Amazon as well as Nvidia, Netflix, and Broadcom.

The Trump administration's pro-growth and business-friendly economic policy reforms such as fiscal stimulus, new infrastructure, and financial deregulation give investors good reasons to inject capital into stocks. Insofar as the Federal Reserve keeps its gradual and dovish monetary policy contraction, the Trump stock market rally can continue over the medium term.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-11-03 12:30:00 Sunday ET

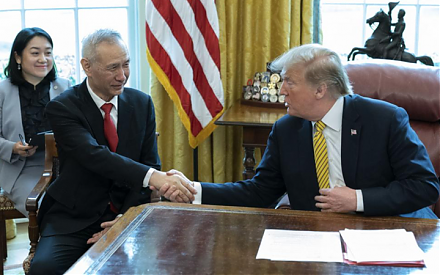

Chinese trade delegation offers to boost purchases of U.S. agricultural products to reach an interim trade deal with the Trump administration. Chinese Vice

2020-09-11 10:22:00 Friday ET

AYA fintech network platform provides proprietary alpha stock signals and personal finance tools. In recent times, we have completed our fresh website up

2017-01-27 17:19:00 Friday ET

Tony Robbins explains in his latest book on personal finance that *patience* is the top secret to successful stock investment. The stock market embeds an

2019-06-13 10:26:00 Thursday ET

The Chinese Xi administration may choose to leverage its state dominance of rare-earth elements to better balance the current Sino-U.S. trade war. In recent

2019-10-25 07:49:00 Friday ET

U.S. fiscal budget deficit hits $1 trillion or the highest level in 7 years. The current U.S. Treasury fiscal budget deficit rises from $779 billion to $1.0

2023-05-28 10:24:00 Sunday ET

Thomas Piketty connects the dots between economic growth and inequality worldwide with long-term global empirical evidence. Thomas Piketty (2017) &nbs