2019-09-19 15:30:00 Thu ET

federal reserve monetary policy treasury dollar employment inflation interest rate exchange rate macrofinance recession systemic risk economic growth central bank fomc greenback forward guidance euro capital global financial cycle credit cycle yield curve

U.S. yield curve inversion can be a sign but not a root cause of the next economic recession. Treasury yield curve inversion helps predict each of the U.S. recessions since the 1970s. However, no fundamental reason can help explain whether this inversion causes each recession. Correlation may not imply causation.

Many stock market analysts focus on the 3 root causes of an economic recession. First, the monetary authority tends to institute interest rate hikes to better contain inflation or money supply growth. A sustainable series of interest rate hikes help prevent macroeconomic instability; otherwise, high inflation would become a major source of economic disturbance.

Second, key energy prices often increase substantially in the dawn of an economic recession. Oil and natural gas prices tend to fluctuate due to geopolitical risks and military confrontations.

Third, stock market analysts would expect to see high unemployment, low capital investment, and low industrial production several months before a major recession. In this key alternative scenario, subpar labor and capital productivity can cause the economy to slide into at least 2 consecutive quarters of negative real GDP growth. Whether Treasury yield curve inversion serves as a sign but not a root cause of the next economic recession remains open to controversy.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2020-11-03 08:30:00 Tuesday ET

Agile lean enterprises break down organizational silos to promote smart collaboration for better profitability and customer loyalty. Heidi Gardner (2017

2017-08-01 09:40:00 Tuesday ET

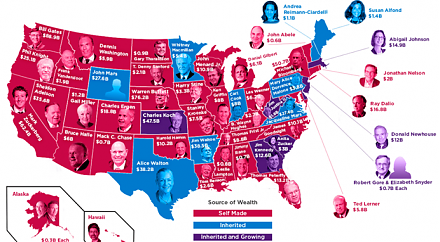

In American states, all of the Top 4 richest people are self-made billionaires: Bill Gates in Washington, Warren Buffett in Nebraska, Michael Bloomberg in N

2019-10-29 13:36:00 Tuesday ET

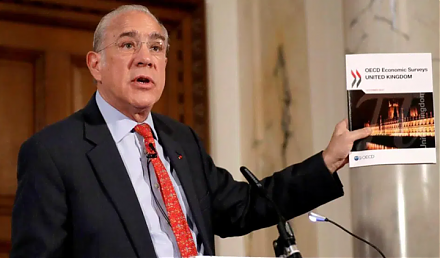

The OECD projects global growth to decline from 3.2% to 2.9% in the current fiscal year 2019-2020. This global economic growth projection represents the slo

2019-11-03 12:30:00 Sunday ET

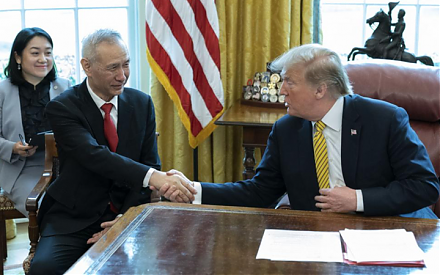

Chinese trade delegation offers to boost purchases of U.S. agricultural products to reach an interim trade deal with the Trump administration. Chinese Vice

2018-09-11 18:36:00 Tuesday ET

President Trump tweets that Apple can avoid tariff consequences by shifting its primary supply chain from China to America. These Trump tariffs on another $

2023-05-28 10:24:00 Sunday ET

Thomas Piketty connects the dots between economic growth and inequality worldwide with long-term global empirical evidence. Thomas Piketty (2017) &nbs