Andy Yeh

AYA fintech network platform founder

Brass Ring International Density Enterprise (BRIDE)

Email andy.yeh.alpha@ayafintech.network service@ayafintech.network

2027-04-30 12:31:00 Friday ET

In recent years, the current AI-driven stock market rally may or may not turn out to be another major asset bubble in global human history. For the pract

2026-02-28 10:29:00 Saturday ET

AYA fintech network platform provides proprietary alpha stock signals and personal finance tools for stock market investors. As of March 2026, we have up

2026-02-14 11:26:00 Saturday ET

Our AYA fun podcasts deep-dive into the current global trends, topics, and issues in macro finance, political economy, public policy, strategic management,

2026-02-02 12:30:00 Monday ET

With U.S. fintech patent approval, accreditation, and protection for 20 years, our proprietary alpha investment model outperforms most stock market indexes

2026-01-19 10:30:00 Monday ET

Andy Yeh Alpha (AYA) fintech network platform: major milestones, key product features, and online social media services Introduction

2023-06-19 10:31:00 Monday ET

A brief biography of Dr Andy Yeh (PhD, MFE, MMS, BMS, FRM, and USPTO patent accreditation) Dr Andy Yeh is responsible for ensuring maximum sustainable me

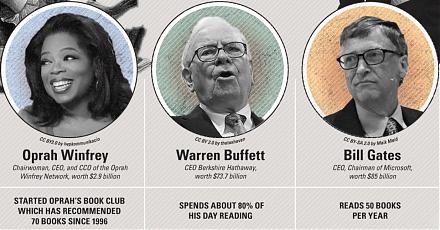

Better financial literacy, inclusion, and freedom for the general public

This webpage explains in detail Brass Ring International Density Enterprise's (BRIDE) core mission statement can turn BRIDE's core competencies, specialties, and executive functions into a verbal description of what all of our team members seek to accomplish at the early-to-mid stage of the prototypical corporate lifecycle. Overall, this mission statement serves as a set of executive management guidelines and principles for the typical team ...