2019-04-21 10:07:54 Sun ET

federal reserve monetary policy treasury dollar employment inflation interest rate exchange rate macrofinance recession systemic risk economic growth central bank fomc greenback forward guidance euro capital global financial cycle credit cycle yield curve

Central bank independence remains important for core inflation containment in the current age of political populism. In accordance with the dual mandate of both price stability and maximum sustainable employment, most central banks seek to solve the dynamic consistency problem on the basis of a key desire to insulate monetary policy decisions from political influence.

A landmark empirical study of cross-country comparisons by Alberto Alesina and Lawrence Summers confirms that countries with better central bank independence experience lower inflation without suffering any real economic output or labor force penalty. An independent central bank can enhance fiscal discipline by reducing the relative likelihood of fiscal dominance and monetization of perennial budget deficits.

Historical experience and economic theory teach us an informative lesson. When monetary policy is subject to political control, people expect dovish expansionary interest rate adjustments and so anticipate higher wages and prices in response. The undesirable economic outcome is stagflation (or the worst-case scenario of both high inflation and high unemployment). It can cost prohibitive welfare losses for the central bank to bring down inflation with subsequent interest rate hikes. Key credible apolitical monetary policy decisions would thus promote price stability with minimal real impact on economic growth, employment, and capital investment.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2017-09-13 10:35:00 Wednesday ET

CNBC reports the Top 5 features of Apple's iPhone X. This new product release can be the rising tide that lifts all boats in Apple's upstream value

2024-03-19 03:35:58 Tuesday ET

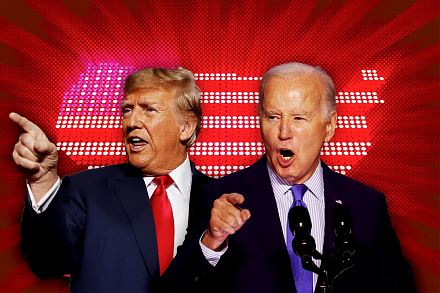

U.S. presidential election: a re-match between Biden and Trump in November 2024 We delve into the 5 major economic themes of the U.S. presidential electi

2023-12-10 09:23:00 Sunday ET

U.S. federalism and domestic institutional arrangements A given country is federal when both of its national and sub-national governments exercise separa

2019-10-05 07:27:00 Saturday ET

Treasury Secretary Steven Mnuchin indicates that there is a good conceptual trade agreement between China and the U.S. in regard to intellectual property pr

2021-11-22 11:29:00 Monday ET

U.S. judiciary subcommittee delves into the market dominance of online platforms in terms of the antitrust, commercial, and administrative law in America.

2018-06-11 07:44:00 Monday ET

Facebook, Apple, Amazon, Netflix, and Google (FAANG) have been the motor of the S&P 500 stock market index. Several economic media commentators contend