2018-05-11 09:37:00 Fri ET

stock market gold oil stock return s&p 500 asset market stabilization asset price fluctuations stocks bonds currencies commodities funds term spreads credit spreads fair value spreads asset investments

OPEC countries have cut the global glut of oil production in recent years while the resultant oil price has surged from $30 to $78 per barrel from 2015 to 2018. Also, President Trump has withdrawn America from the key multilateral Iran nuclear deal and thus revives draconian economic sanctions on Iran.

Saudi Arabia may deliberately boost short-term oil prices in order to support the Aramco IPO in 2019. These major geopolitical events sustain the recent oil price increase in the medium term.

Several economic news sources such as Forbes, CNBC, Bloomberg, Reuters, and The Economist suggest that the new target oil price range is $80-$95 per barrel in the next 18 months. Many market observers suggest that the geopolitical concerns seem to outweigh demand-supply adjustments in relative importance at least over the short-to-medium run.

U.S. inflation expectations gravitate toward the 2% target inflation rate. A further interest rate hike may be plausible such that the neutral interest rate helps contain inflationary pressures near full employment. These financial market developments have important monetary policy implications for U.S. firms, financial intermediaries, consumers, producers, and stock market investors etc.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-08-05 13:30:00 Monday ET

China continues to sell U.S. Treasury bonds amid Sino-U.S. trade truce uncertainty. In mid-2019, China reduces its U.S. Treasury bond positions by $20.5 bil

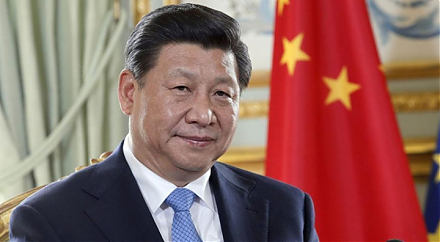

2018-03-03 11:37:00 Saturday ET

President Xi seeks Chinese congressional approval and constitutional amendment for abolishing his term limits of strongman rule with more favorable trade de

2023-05-07 10:27:00 Sunday ET

William Easterly critiques several economic development policies and then indicates that bottom-up solutions often result in macro policy success in spite o

2019-01-25 13:34:00 Friday ET

Netflix raises its prices by 13% to 18% for U.S. subscribers. The immediate stock market price soars 6.5% as a result of this upward price adjustment. The b

2018-08-21 11:40:00 Tuesday ET

President Trump criticizes his new Fed Chair Jerome Powell for accelerating the current interest rate hike with greenback strength. This criticism overshado

2018-08-01 11:43:00 Wednesday ET

Apple becomes the first company to hit $1 trillion stock market valuation. The tech titan sells about the same number of smart phones or 41 million iPhones