2026-02-14 11:26:00 Sat ET

stock market technology facebook covid-19 apple microsoft google amazon data platform network scale artificial intelligence antitrust alpha patent model tech titan tesla global macro outlook machine software algorithm central bank cbdc

We would like to share our current AYA podcasts in reverse chronological order.

These podcasts discuss the new global trends, topics, and issues in macro finance, political economy, public policy, strategic management, innovation, entrepreneurship, and broader technological advancements in artificial intelligence (AI), virtual reality (VR), algorithmic asset management (Algo AM), central bank digital currencies (CBDC), recurrent and convolutional neural networks (RNN and CNN) for smart asset return prediction, electric vehicles (EV), autonomous robotaxis (AR), high-speed broadband telecoms, green power plants, cloud services, Magnificent 7 tech titans, China Internet stocks, and many more.

Each fun podcast is about 10 minutes long (with AI podcast generation from Google NotebookLM).

In the broader context of stock market valuation, financial statement analysis, and smart-beta asset portfolio optimization, our AYA flagship podcasts, research surveys, research articles, literature reviews, analytic reports, ebooks, blog posts, and social media comments, discussions, and connections can help inform better stock market investment decisions for long-term investors, asset managers, hedge funds, investment banks, insurers, broker-dealers, and many other non-bank financial institutions and intermediaries (credit unions, building societies, and finance companies).

These better stock market investment decisions often lead to reasonably higher, more stable, more robust, and more profitable capital gains, cash dividends, and share repurchases in a cost-effective manner.

With U.S. fintech patent approval, accreditation, and protection for 20 years, our AYA fintech network platform provides proprietary alpha stock signals and personal finance tools for stock market investors worldwide.

We build, design, and delve into our new and non-obvious proprietary algorithmic system for smart asset return prediction and fintech network platform automation. Unlike our fintech rivals and competitors who chose to keep their proprietary algorithms in a black box, we open the black box by providing the free and complete disclosure of our U.S. fintech patent publication. In this rare unique fashion, we help stock market investors ferret out informative alpha stock signals in order to enrich their own stock market investment portfolios. With no need to crunch data over an extensive period of time, our freemium members pick and choose their own alpha stock signals for profitable investment opportunities in the U.S. stock market.

Smart investors can consult our proprietary alpha stock signals to ferret out rare opportunities for transient stock market undervaluation. Our analytic reports help many stock market investors better understand global macro trends in trade, finance, technology, and so forth. Most investors can combine our proprietary alpha stock signals with broader and deeper macro financial knowledge to win in the stock market.

Through our proprietary alpha stock signals and personal finance tools, we can help stock market investors achieve their near-term and longer-term financial goals. High-quality stock market investment decisions can help investors attain the near-term goals of buying a smartphone, a car, a house, good health care, and many more. Also, these high-quality stock market investment decisions can further help investors attain the longer-term goals of saving for travel, passive income, retirement, self-employment, and college education for children. Our AYA fintech network platform empowers stock market investors through better social integration, education, and technology.

With manual human content curation, we wrote these major ebooks over the recent years from 2020 to present. These ebooks complement our proprietary alpha stock signals and personal finance tools for stock market investors worldwide. We provide hyperlinks to these ebooks in reverse chronological order.

Industry Analysis

AYA ebook hyperlink: https://bit.ly/4hxvrwy

AYA ebook length: 283 pages (21 chapters and 122,241 words)

Stock Synopses for the Top 20 Tech Titans

AYA ebook hyperlink: https://bit.ly/3VR7Ka5

AYA ebook length: 449 pages (20 chapters and 168,639 words)

Top-Tier Self-Improvement Book Reviews

AYA ebook hyperlink: https://bit.ly/46Iqkrc

AYA ebook length: 133 pages (10 chapters and 54,529 words)

Bidenomics

AYA ebook hyperlink: https://bit.ly/44CdDu7

AYA ebook length: 206 pages (18 chapters and 90,405 words)

Trump Economic Reforms

AYA ebook hyperlink: https://bit.ly/2ZwYfiE

AYA ebook length: 507 pages (21 chapters and 97,854 words)

Modern management macro themes, insights, and worldviews

AYA ebook hyperlink: https://bit.ly/2IezdQh

AYA ebook length: 225 pages (top 40 recent management book reviews)

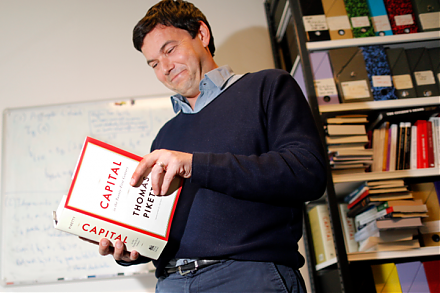

Economic science macro themes, insights, and worldviews

AYA ebook hyperlink: https://bit.ly/3FaegyI

AYA ebook length: 220 pages (top 40 recent economic science book reviews)

President Trump refreshes American fiscal fears and sovereign debt concerns through the One Big Beautiful Bill Act.

Podcast: https://bit.ly/4eSEU1w

President Trump poses new threats to Fed Chair monetary policy independence again.

Podcast: https://bit.ly/4ebeoQH

What are the mainstream legal origins of President Trump’s tariff policies?

Podcast: https://bit.ly/3ZnNMG7

Article: https://ayafintech.network/blog/mainstream-legal-origins-of-recent-trump-tariffs/

American exceptionalism often turns out to be the heuristic rule of thumb for better economic growth, low and stable inflation, full employment, and macro-financial stability.

Podcast: https://bit.ly/4iuWuJ9

In the broader modern monetary policy context, central banks learn to weigh the trade-offs between output and inflation expectations and macro-financial stress conditions.

Podcast: https://bit.ly/42SwrXG

Today, tech titans, billionaires, serial entrepreneurs, and venture capitalists continue to reshape and even disrupt global pharmaceutical investments for both better healthspan and longer lifespan.

Podcast: https://bit.ly/41KDNLp

Artificial intelligence continues to reshape the current global market for better biotech advances, medical innovations, and healthcare services.

Podcast: https://bit.ly/4hBVimM

The global market for GLP-1 anti-obesity weight-loss treatments now grows substantially to benefit more than 1 billion people worldwide by 2030.

Podcast: https://bit.ly/4bz6vmI

Is higher stock market concentration good or bad for Corporate America?

Podcast: https://bit.ly/3F1fpgN

As he moves into his second term, President Trump continues to blame China for the long prevalent U.S. trade deficits and several other social and economic deficiencies.

Podcast: https://bit.ly/42ucDKt

Geopolitical alignment often reshapes and reinforces asset market fragmentation in the broader context of financial deglobalization.

Podcast: https://bit.ly/3ZpGMcD

The global cloud infrastructure helps accelerate the next high-tech revolutions in electric vehicles (EV), virtual reality (VR) headsets, artificial intelligence (AI) online services, and the metaverse.

Podcast: https://bit.ly/47pDk3z

The new homeland industrial policy stance tilts toward greater global resilience across the major high-tech supply chains worldwide.

Podcast: https://bit.ly/3B6xY12

China poses new threats to the U.S. and its western allies.

Podcast: https://bit.ly/3XGWrD1

How can generative AI tools and LLMs help enhance human productivity?

Podcast: https://bit.ly/4elAFKv

What are the macrofinancial ripple effects of central bank digital currency (CBDC) design, issuance, and broad user adoption?

Podcast: https://bit.ly/3XNMwM8

Both BYD and Tesla have become serious global manufacturers of electric vehicles (EV) worldwide.

Podcast: https://bit.ly/3BgL0sL

Article: https://ayafintech.network/blog/mainstream-technological-advances-in-the-global-auto-industry/

The new world order of trade helps promote both economic and non-economic policy goals (such as national security, technological dominance, workplace safety, net-zero carbon emission, and climate risk management).

Podcast: https://bit.ly/47vjEuY

The bank-credit-card model and fintech platforms have adapted well to the recent digitization of cashless finance.

Podcast: https://bit.ly/4ebkYGg

Government intervention remains a major influence over global trade, finance, and technology.

Podcast: https://bit.ly/3XWobDX

What are the current worldwide risks in global trade, finance, and technology?

Podcast: https://bit.ly/3zmI3q3

Article: https://ayafintech.network/blog/top-global-risks-in-trade-finance-and-technology-may-2023/

The Inflation Reduction Act is central to modern world capitalism in support of price stability (as inflation is almost always and everywhere a monetary phenomenon).

Podcast: https://bit.ly/3Xwqufc

Climate change risk management accords with the mainstream spirit of ESG woke capitalism (environmental protection, social harmony, and corporate governance).

Podcast: https://bit.ly/4e5xB5A

Article: https://ayafintech.network/blog/climate-change-and-esg-woke-capitalism/

The global financial services industry now needs fewer banks worldwide.

Podcast: https://bit.ly/3MOdwVb

Article: https://ayafintech.network/blog/the-financial-services-industry-needs-fewer-banks-worldwide/

The recent semiconductor microchip demand-supply imbalance remains severe for American tech titans such as Meta, Apple, Microsoft, Google, Amazon, Nvidia, and Tesla (MAMGANT or Magnificent 7).

Podcast: https://bit.ly/4e5eWGT

The global asset management industry garners greater ownership and control over many public corporations worldwide.

Podcast: https://bit.ly/3ZrOPFH

The U.S. judiciary subcommittee delves into the market dominance of online platforms in the broader context of the antitrust, commercial, and administrative law in America.

Podcast: https://bit.ly/4e5n8ag

Bidenomics better balances fiscal deficits and government expenditures with new corporate and capital income tax hikes.

Podcast: https://bit.ly/4er189k

Artificial intelligence, 5G high-speed telecommunication, and virtual reality can help transform global trade, finance, and technology.

Podcast: https://bit.ly/3B4YesG

The global pandemic crisis helps reshape cross-border trade, finance, and technology worldwide.

Podcast: https://bit.ly/3ZthrOT

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fundamental analysis of Meta Platforms (U.S. stock symbol: $META).

Podcast: https://bit.ly/3Vt1Sng

Article: https://ayafintech.network/blog/gen-ai-fundamental-analysis-of-meta-platforms-meta/

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fundamental analysis of Alphabet Google (U.S. stock symbol: $GOOG).

Podcast: https://bit.ly/46yuX5T

Article: https://ayafintech.network/blog/gen-ai-fundamental-analysis-of-alphabet-google-goog/

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fundamental analysis of Nvidia (U.S. stock symbol: $NVDA).

Podcast: https://bit.ly/3Kh8Qta

Article: https://ayafintech.network/blog/gen-ai-fundamental-analysis-of-nvidia-nvda/

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fundamental analysis of Tesla (U.S. stock symbol: $TSLA).

Podcast: https://bit.ly/4nRGLqy

Article: https://ayafintech.network/blog/gen-ai-fundamental-analysis-of-tesla-tsla/

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fundamental analysis of Apple (U.S. stock symbol: $AAPL).

Podcast: https://bit.ly/4ndXt3K

Article: https://ayafintech.network/blog/gen-ai-fundamental-analysis-of-apple-aapl/

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fundamental analysis of Amazon (U.S. stock symbol: $AMZN).

Podcast: https://bit.ly/46fUWQE

Article: https://ayafintech.network/blog/gen-ai-fundamental-analysis-of-amazon-amzn/

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fundamental analysis of Microsoft (U.S. stock symbol: $MSFT).

Podcast: https://bit.ly/46biKoG

Article: https://ayafintech.network/blog/gen-ai-fundamental-analysis-of-microsoft-msft/

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fundamental analysis of IonQ (U.S. stock symbol: $IONQ).

Podcast: https://bit.ly/3IXfnss

Article: https://ayafintech.network/blog/gen-ai-fundamental-analysis-of-ionq-ionq/

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fundamental analysis of Oracle (U.S. stock symbol: $ORCL).

Podcast: https://bit.ly/47fF94u

Article: https://ayafintech.network/blog/gen-ai-fundamental-analysis-of-oracle-orcl/

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fundamental analysis of Netflix (U.S. stock symbol: $NFLX).

Podcast: https://bit.ly/4q7cTss

Article: https://ayafintech.network/blog/gen-ai-fundamental-analysis-of-netflix-nflx/

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fundamental analysis of Palantir (U.S. stock symbol: $PLTR).

Podcast: https://bit.ly/4gZTiWO

Article: https://ayafintech.network/blog/gen-ai-fundamental-analysis-of-palantir-pltr/

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fundamental analysis of AT&T (U.S. stock symbol: $T).

Podcast: https://bit.ly/4q2VfG4

Article: https://ayafintech.network/blog/gen-ai-fundamental-analysis-of-att-t/

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fundamental analysis of T-Mobile (U.S. stock symbol: $TMUS).

Podcast: https://bit.ly/4mV2ays

Article: https://ayafintech.network/blog/gen-ai-fundamental-analysis-of-t-mobile-tmus/

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fundamental analysis of Cisco Systems (U.S. stock symbol: $CSCO).

Podcast: https://bit.ly/48gGjxM

Article: https://ayafintech.network/blog/gen-ai-fundamental-analysis-of-cisco-systems-csco/

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fundamental analysis of AMD (U.S. stock symbol: $AMD).

Podcast: https://bit.ly/470BoPm

Article: https://ayafintech.network/blog/gen-ai-fundamental-analysis-of-amd-amd/

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fundamental analysis of Salesforce (U.S. stock symbol: $CRM).

Podcast: https://bit.ly/46LpXvZ

Article: https://ayafintech.network/blog/gen-ai-fundamental-analysis-of-salesforce-crm/

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fundamental analysis of Uber Technologies (U.S. stock symbol: $UBER).

Podcast: https://bit.ly/4nOTVFm

Article: https://ayafintech.network/blog/gen-ai-fundamental-analysis-of-uber-technologies-uber/

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fundamental analysis of IBM (International Business Machines) (U.S. stock symbol: $IBM).

Podcast: https://bit.ly/4ohozqT

Article: https://ayafintech.network/blog/gen-ai-fundamental-analysis-of-ibm-ibm/

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fundamental analysis of Intuit (U.S. stock symbol: $INTU).

Podcast: https://bit.ly/4ohAKUE

Article: https://ayafintech.network/blog/gen-ai-fundamental-analysis-of-intuit-intu/

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fundamental analysis of Texas Instruments (U.S. stock symbol: $TXN).

Podcast: https://bit.ly/4nVq0Ly

Article: https://ayafintech.network/blog/gen-ai-fundamental-analysis-of-texas-instruments-txn/

Wharton e-commerce professor Karl Ulrich explains that many elite universities now provide many massive open online courses (MOOCs) for lifelong learners to achieve their medium-term goals, tasks, and missions for better intellectual focus, personal growth, self-efficacy, self-improvement, and social engagement in modern life, business, innovation, and entrepreneurship.

Podcast: https://bit.ly/3URUam1

UCLA organizational psychology expert Dr Chip Espinoza et al explain, propose, and emphasize the 9 new core competences for better managing millennials in the modern workplace.

Podcast: https://bit.ly/3H0svMH

Article: https://ayafintech.network/blog/self-improvement-book-review-managing-millennials-by-chip-espinoza/

Consumer psychology experts Nir Eyal and Ryan Hoover explain why keystone habits often lead us to purchase products, goods, and services in our daily lives.

Podcast: https://bit.ly/3H5Ne1v

Article: https://ayafintech.network/blog/self-improvement-book-review-hooked-by-nir-eyal/

Mitch Anthony explains why it is often important for sales leaders to apply sound social skills and emotional competences to fulfill various customer needs, wants, demands, desires, and other preferences.

Podcast: https://bit.ly/44nPsST

Former New York Times science author and Harvard social psychologist Daniel Goleman explains why working with emotional intelligence can help hone social skills for smarter, better, and more effective leaders, teams, and organizations in modern life, business, innovation, and entrepreneurship.

Podcast: https://bit.ly/4khouAU

Former New York Times science author and Harvard social psychologist Daniel Goleman explains why greater mental focus serves as a vital mainstream driver of personal growth, success, virtue, happiness, and fulfillment in life, business, innovation, and entrepreneurship.

Podcast: https://bit.ly/44z2ZH5

Article: https://ayafintech.network/blog/self-improvement-book-review-focus-by-daniel-goleman/

Former New York Times science author and Harvard social psychologist Daniel Goleman explains why emotional intelligence often serves as a more important critical success factor than high IQ for our success, virtue, and happiness in life, business, innovation, and entrepreneurship.

Podcast: https://bit.ly/43O7TzP

Former New York Times prolific team author, and Pulitzer Prize winner Charles Duhigg delves into how we can change our lives for the better by mastering our habits from day to day.

Podcast: https://bit.ly/3FUTSHs

Article: https://ayafintech.network/blog/self-improvement-book-review-the-power-of-habit-by-charles-duhigg/

Serial venture capitalist Ben Horowitz describes many hard truths, lessons, and insights from his rare unique entrepreneurial journey of running LoudCloud from a Silicon Valley tech startup to a $1.65 billion sale to Hewlett-Packard.

Podcast: https://bit.ly/3FJ3fKl

Stanford psychology professor Carol Dweck describes, discusses, and delves into the reasons why the growth mindset helps motivate individuals, teams, and senior managers to accomplish more with greater grit, focus, and resilience.

Podcast: https://bit.ly/3HGF67P

Article: https://ayafintech.network/blog/self-improvement-book-review-mindset-by-carol-dweck/

Stock market alphas help predict macroeconomic innovations and vice versa.

Podcast: https://bit.ly/3Wz3QmH

We propose some new bank capital bias adjustment through the macroeconomic cycle.

Podcast: https://bit.ly/40ytFVr

Article: https://ayafintech.network/blog/bank-capital-regulation-through-the-real-business-cycle/

Is international divergence from broader Berle-Means stock ownership dispersion a suboptimal corporate outcome?

Podcast: https://bit.ly/3WET9ix

Article: https://ayafintech.network/blog/berle-means-corporate-ownership-governance/

The permanent capital hypothesis predicts bank capital structure choices as an optimal response to the trade-offs between foregone tax shields and cash payout restrictions.

Podcast: https://bit.ly/4giwvDS

Article: https://ayafintech.network/blog/response-to-uspto-fintech-patent-protection-and-accreditation/

We propose a new and non-obvious algorithmic system for dynamic conditional asset return prediction and fintech network platform automation.

Podcast: https://bit.ly/40Feiu6

Article: https://ayafintech.network/blog/uspto-fintech-patent-protection-and-accreditation/

From Alibaba and Tencent to Baidu, JD, and iQiyi, China Internet tech titans continue to enjoy global reach, business model monetization, and new improvements in sales and profits worldwide.

Podcast: https://bit.ly/3Cv4T0f

We combine our proprietary alpha stock signals and ESG scores to derive the optimal value and momentum stock portfolio strategies.

Podcast: https://bit.ly/4hyFLok

High-speed 5G broadband cloud telecoms deliver more efficient Internet network management.

Podcast: https://bit.ly/4jNrdTQ

Article: https://ayafintech.network/blog/stock-synopsis-high-speed-5g-broadband-telecommunication/

Pharmaceutical biotech titans continue to enjoy competitive moats in the post-pandemic patent development cycle.

Podcast: https://bit.ly/4aETckn

From Activision Blizzard and Electronic Arts to Tencent and Zynga, global video game publishers continue to enjoy high sales growth with greater screen time and mobile monetization worldwide.

Podcast: https://bit.ly/40uoc1C

Life insurers emphasize greater net profits over sales in the next couple of decades.

Podcast: https://bit.ly/4aGU2NG

Economic incrementalism serves as the mainstream baseline for fiscal-monetary policy coordination worldwide.

Podcast: https://bit.ly/4aL6mfF

We delve into the recent U.S. bank failure resolution and financial risk management for Silicon Valley Bank, Signature Bank, and First Republic Bank.

Podcast: https://bit.ly/4aG74dZ

Tax policy pluralism serves as the mainstream baseline for addressing special interests in many countries worldwide.

Podcast: https://bit.ly/3WCZtY1

Article: https://ayafintech.network/blog/tax-policy-pluralism-for-addressing-special-interests/

International trade and immigration policies often reflect elite-mass conflict resolution worldwide.

Podcast: https://bit.ly/40zhGqB

Article: https://ayafintech.network/blog/international-trade-immigration-and-elite-mass-conflict/

We delve into American federalism and domestic institutional arrangements.

Podcast: https://bit.ly/4hhzZrq

Article: https://ayafintech.network/blog/american-federalism-and-domestic-institutional-arrangements/

We delve into the recent empirical tests of multi-factor models for asset return prediction.

Podcast: https://bit.ly/4jF8Sbl

Article: https://ayafintech.network/blog/empirical-tests-of-multi-factor-models-for-asset-return-prediction/

We discuss the more recent empirical tests of multi-factor models for asset return prediction in behavioral finance.

Podcast: https://bit.ly/3Ef5xzs

We review and assess the recent empirical results both against and in support of the mainstream corporate capital structure theories.

Podcast: https://bit.ly/40w5wP2

Article: https://ayafintech.network/blog/capital-structure-theory-and-practice/

We review and discuss the recent empirical results in support of the mainstream choices, reasons, and decisions for corporate cash management.

Podcast: https://bit.ly/3CrZEyz

Article: https://ayafintech.network/blog/corporate-cash-management/

We review and explain the recent empirical results in relation to corporate diversification.

Podcast: https://bit.ly/4hhxUMf

Article: https://ayafintech.network/blog/corporate-diversification-theory-and-evidence/

We deep-dive into the recent empirical evidence in relation to corporate investment management (mergers and acquisitions (M&A), capital expenditures (CAPEX), and research and development (R&D) projects).

Podcast: https://bit.ly/4aEKfaB

Article: https://ayafintech.network/blog/corporate-investment-management/

We review and discuss the recent empirical results in relation to stock ownership dispersion and corporate governance worldwide.

Podcast: https://bit.ly/4gpMkIK

Article: https://ayafintech.network/blog/corporate-ownership-governance-theory-and-practice/

We review and assess the recent empirical results in relation to corporate payout management (specifically, cash dividends and share repurchases).

Podcast: https://bit.ly/3PZJQ9a

Article: https://ayafintech.network/blog/corporate-payout-management/

We review and discuss the recent empirical results in relation to R&D innovative investment management.

Podcast: https://bit.ly/42Anene

Article: https://ayafintech.network/blog/innovative-investment-theory-and-practice/

We review and assess the recent empirical results in relation to net stock issuance (specifically, IPOs and SEOs).

Podcast: https://bit.ly/3EsDv3v

Article: https://ayafintech.network/blog/net-stock-issuance-theory-and-practice/

We delve into the recent empirical tests of capital structure choices for private firms.

Podcast: https://bit.ly/4jF9Sw7

Article: https://ayafintech.network/blog/capital-structure-choices-for-private-firms/

We deep-dive into the recent empirical tests of the mainstream reasons for share repurchases.

Podcast: https://bit.ly/3EenmPo

Article: https://ayafintech.network/blog/main-reasons-for-share-repurchases/

We discuss and explain the precautionary-motive and agency reasons for corporate cash management.

Podcast: https://bit.ly/40AcyTb

We review and discuss the recent empirical results in relation to internal capital markets and financial constraints.

Podcast: https://bit.ly/4hFYXRf

Article: https://ayafintech.network/blog/internal-capital-markets-and-financial-constraints/

We delve into the mainstream corporate investment insights from mergers and acquisitions (M&A).

Podcast: https://bit.ly/3PYgNmp

Article: https://ayafintech.network/blog/corporate-investment-insights-from-mergers-and-acquisitions/

We review and discuss the recent empirical results on both the bright and dark sides of CEO overconfidence (specifically, its adverse impact on corporate performance).

Podcast: https://bit.ly/3Q2joM4

Article: https://ayafintech.network/blog/ceo-overconfidence-and-corporate-performance/

We delve into the empirical implications of stock market misvaluation for corporate investment and payout decisions.

Podcast: https://bit.ly/3CkDQ85

Article: https://ayafintech.network/blog/catering-theory-in-the-corporate-investment-and-payout-literature/

We review and discuss the recent uniform field theory of corporate finance.

Podcast: https://bit.ly/3CySGrx

Article: https://ayafintech.network/blog/uniform-field-theory-of-corporate-finance/

Top 40 economic book reviews

https://ayafintech.network/blog/ayafintech-network-platform-update-notification/

Top 40 business book reviews

https://ayafintech.network/blog/ayafintech-network-platform-update-notification/

With U.S. fintech patent approval, accreditation, and protection for 20 years, our AYA fintech network platform provides proprietary alpha stock signals and personal finance tools for stock market investors worldwide.

We build, design, and delve into our new and non-obvious proprietary algorithmic system for smart asset return prediction and fintech network platform automation. Unlike our fintech rivals and competitors who chose to keep their proprietary algorithms in a black box, we open the black box by providing the free and complete disclosure of our U.S. fintech patent publication. In this rare unique fashion, we help stock market investors ferret out informative alpha stock signals in order to enrich their own stock market investment portfolios. With no need to crunch data over an extensive period of time, our freemium members pick and choose their own alpha stock signals for profitable investment opportunities in the U.S. stock market.

Smart investors can consult our proprietary alpha stock signals to ferret out rare opportunities for transient stock market undervaluation. Our analytic reports help many stock market investors better understand global macro trends in trade, finance, technology, and so forth. Most investors can combine our proprietary alpha stock signals with broader and deeper macro financial knowledge to win in the stock market.

Through our proprietary alpha stock signals and personal finance tools, we can help stock market investors achieve their near-term and longer-term financial goals. High-quality stock market investment decisions can help investors attain the near-term goals of buying a smartphone, a car, a house, good health care, and many more. Also, these high-quality stock market investment decisions can further help investors attain the longer-term goals of saving for travel, passive income, retirement, self-employment, and college education for children. Our AYA fintech network platform empowers stock market investors through better social integration, education, and technology.

Our unique algorithmic system for asset return prediction includes 6 fundamental factors such as size, value, momentum, asset growth, profitability, and market risk exposure.

Our proprietary alpha stock investment model outperforms the major stock market benchmarks such as S&P 500, MSCI, Dow Jones, and Nasdaq. We implement our proprietary alpha investment model for U.S. stock signals. A comprehensive model description is available on our AYA fintech network platform. Our U.S. Patent and Trademark Office (USPTO) patent publication is available on the World Intellectual Property Office (WIPO) official website.

Our core proprietary algorithmic alpha stock investment model estimates long-term abnormal returns for U.S. individual stocks and then ranks these individual stocks in accordance with their dynamic conditional alphas. Most virtual members follow these dynamic conditional alphas or proprietary stock signals to trade U.S. stocks on our AYA fintech network platform. For the most recent historical out-of-sample backtest from February 2017 to February 2026, our algorithmic alpha stock investment model outperforms the vast majority of global stock market benchmarks such as S&P 500, MSCI USA, MSCI Europe, MSCI World, Dow Jones, and Nasdaq etc., our algorithmic alpha stock investment model outperforms the vast majority of global stock market benchmarks such as S&P 500, MSCI USA, MSCI Europe, MSCI World, Dow Jones, and Nasdaq etc.

Do you find it difficult to beat the long-term average 11% stock market return? It took us 20+ years to design a new profitable algorithmic asset investment model and its attendant proprietary software technology with fintech patent protection in 2+ years. AYA fintech network platform serves as everyone’s first aid for his or her personal stock investment portfolio. Our proprietary software technology allows each investor to leverage fintech intelligence and information without exorbitant time commitment. Our dynamic conditional alpha analysis boosts the typical win rate from 70% to 90%+.

Our new alpha model empowers members to be a wiser stock market investor with profitable alpha signals! The proprietary quantitative analysis applies the collective wisdom of Warren Buffett, George Soros, Carl Icahn, Mark Cuban, Tony Robbins, and Nobel Laureates in finance such as Robert Engle, Eugene Fama, Lars Hansen, Robert Lucas, Robert Merton, Edward Prescott, Thomas Sargent, William Sharpe, Robert Shiller, and Christopher Sims.

Free signup for stock signals: https://ayafintech.network

Mission on profitable signals: https://ayafintech.network/mission.php

Model technical descriptions: https://ayafintech.network/model.php

Blog on stock alpha signals: https://ayafintech.network/blog.php

Freemium base pricing plans: https://ayafintech.network/freemium.php

Signup for periodic updates: https://ayafintech.network/signup.php

Login for freemium benefits: https://ayafintech.network/login.php

Andy Yeh (online brief biography)

Co-Chair

AYA fintech network platform

Brass Ring International Density Enterprise ©

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2020-07-12 08:30:00 Sunday ET

The lean CEO encourages iterative continuous improvements and collaborative teams to innovate around core value streams. Jacob Stoller (2015)

2017-11-17 09:42:00 Friday ET

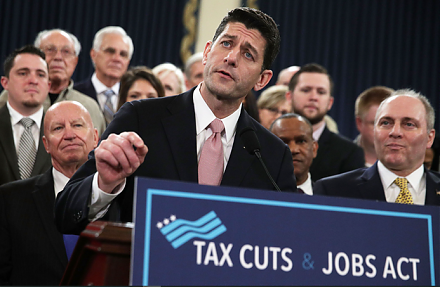

The Trump administration garners congressional support from both Senate and the House of Representatives to pass the $1.5 trillion tax overhaul (Tax Cuts &a

2017-11-03 06:41:00 Friday ET

Broadcom, a one-time division of Hewlett-Packard and now a semiconductor maker whose chips help power iPhone X, has announced its strategic plans to move it

2025-10-01 10:29:00 Wednesday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2018-01-04 07:36:00 Thursday ET

The world now faces an economic inequality crisis with few policy options. Some recent U.S. Federal Reserve data suggest that both income and wealth inequal

2019-07-17 12:37:00 Wednesday ET

Gold prices surge above $1400 per ounce amid global trade tension and economic policy uncertainty. Both European Central Bank and Bank of Japan may consider