2024-10-31 09:26:00 Thu ET

stock market technology facebook covid-19 apple microsoft google amazon data platform network scale artificial intelligence antitrust alpha patent model tech titan tesla global macro outlook machine software algorithm alphabet meta

The top generative artificial intelligence (Gen AI) tools include OpenAI ChatGPT, Google Gemini and NotebookLM, Microsoft Copilot, Meta Llama, Amazon Alexa and Nova, Anthropic Claude, Twitter xAI Grok, Perplexity, Alibaba Qwen, DeepSeek, Mistral, Midjourney, Synthesia, Jasper, and so forth. These Gen AI search engines apply large language models (LLM) and content generation tools to help enhance human lives with significantly greater productivity. Productivity gains often manifest in the common forms of AI-driven scripts, articles, images, podcasts, films, movies, and many other online contents. Gen AI avatars help translate text, imagery, and sound recognition into interpretable contents within only seconds. This recent Gen AI hype transforms and even revolutionizes the current high-tech stock market rally. Since the successful launch of OpenAI’s ChatGPT back in November 2022, these Gen AI virtual assistants have grown significantly to leverage the high performance of AI semiconductor microchips from Nvidia, AMD, Micron, TSMC, Pegatron, and many of their trade partners. In recent quarters, stock market investors revive their current interest in this modern Gen AI technology worldwide.

Foundational LLMs and Gen AI virtual tools, assistants, and avatars substantially enhance the high-skill process of online content generation. As a result, the stocks of Gen AI companies have had more than double-digit improvements in their stock market valuation, top-line sales revenue growth, and bottom-line profitability. Gen AI technology can help create new content generation in the form of text, imagery, video, audio, and code through natural language communication, rather than code snippets and arcane programming languages. These key transformative features distinguish the current Gen AI technology from the vast majority of its predecessors. We can view this Gen AI technology as the third generation of AI software research. Earlier iterations of AI technology either required computer scientists and software engineers to write deterministic code programs to perform specific tasks (Software 1.0), or required these specialists to statistically train complex neural networks on big data for specific tasks and predictions (Software 2.0). With Software 3.0 today, the foundational models leverage out-of-the-box capabilities to enhance their niche businesses with natural language reasons, explanations, and knowledge spillovers worldwide. These Gen AI base models help substantially transform both the logical and reasonable content generation through open-source application programming interfaces (API) without any laborious collection of big data.

This Gen AI transformation has begun to translate into a new economic reality. In some cases, developer productivity gains amount to double-digit percentages (at least 15% to 20% per annum) via Gen AI technology. This Gen AI technology can further enhance human-robot interactions and several other adjacent applications, especially in traditional service markets such as law, finance, medicine, illustration, as well as audio, voice, and video generation with smart data analytics. Many stock market investors regard this Gen AI technology as a major platform shift across all aspects of both the consumer and enterprise experiences.

This Gen AI transformation can cause new profound ripple effects, macroeconomic consequences, and policy implications. Recent empirical studies show that Gen AI usage can help boost U.S. annual labor productivity growth by 1.5-2.5 percentage points over the current decade. In the U.S. and many other rich economies, AI can eventually help raise annual global GDP by 7% to 15%. This global productivity lift can turn a relatively narrow AI-led U.S. stock market rally into a much broader one over the longer run. Specifically, S&P 500 stocks have already experienced 9% to 25% increases in fair asset market valuation in recent years, especially in the post-pandemic period. This Gen AI stock market trend turns out to be the new friend for many institutional investors worldwide.

However, the neural networks of these Gen AI tools differ from the neural networks of human brains. Gen AI machines can indeed perform reflexive statistical analysis, but these machines have virtually little capacity for human-like logical deliberations and reasons. Although these Gen AI machines learn and recognize patterns in text, imagery, audio, and video etc, the vast majority of machine-learning algorithms still revolve around the deep statistics of both words and proper responses to prompts. Specifically, these machine-learning algorithms cannot function like human brains to completely understand abstract concepts, such as the broad business judgment rule in law, dynamic equilibrium fair market valuation in finance, and the dopamine hypothesis in medicine. As a result, there is no internal model for these AI machine-learning algorithms to understand the world around them. One day the human race may achieve artificial general intelligence (AGI), but we are still far from AGI today. No finite dollar amount of stock market investment can change this current reality. When push comes to shove, stock market investors would need to make prudent investment decisions in support of better stock portfolio profitability, resilience, and diversification.

In terms of stock market valuation, the current AI stock market rally is pretty much like the past innovation booms. During the past innovation-led productivity booms, such as the widespread adoption of electricity from 1919 to 1929 and PCs and the Internet from 1996 to 2005, sharp and steady increases in stock market prices and returns turn into asset bubbles over the medium. These asset bubbles eventually burst in due course. In response to the widespread adoption of electricity, the Great Depression ensued in the 1930s. In response to the dotcom bubble, the subprime mortgage crisis and Global Financial Crisis arose in 2008-2009. Although the rising tide seems to lift all boats in the AI-led high-tech sector, the current AI stock market rally would eventually experience a more reasonable correction in due course.

In the meantime, the vast majority of Gen AI stocks continue to trade at reasonably attractive P/E and P/B multiples. It can be quite reasonable for many tech titans to drive the current powerful AI stock market rally. In light of this positive platform shift, the current AI stock market rally may or may not be a fundamentally shallow hype cycle. To the extent that many tech titans continue to apply AI foundational models for business purposes, the picks-and-shovels businesses are likely to benefit from this continuation. For AI, these fundamental picks-and-shovels businesses include semiconductor microchip manufacturers (Nvidia, AMD, TSMC, Micron, Intel, and so on), cloud computing hyperscalers (Amazon, Google, Microsoft, IonQ, Alibaba, and Tencent), and online infrastructure companies (Cisco, Oracle, AT&T, T-Mobile, and Verizon).

Many technologists and stock market investors retain an active interest in modern AI research progress. Deep machine-learning algorithms drive the success stories of many tech titans such as Google, Meta, Uber, Instagram, LinkedIn, and TikTok. These algorithmic tech titans leverage deep machine-learning algorithms for online ads, platform services, product recommendations, and early warning signals about online spam and fraud, among many other applications. In the cyber security space, some specialists such as Awake, Abnormal, and Obsidian Security often decipher fundamental signals from a ton of statistical noise. Also, traditional call centers now complement many brand-new business use cases such as electric vehicles (EVs), autonomous robotaxis, and food and drink delivery robots. Beyond the current tech titans, many companies would want to apply both machine-learning algorithms and algorithmic capabilities to ferret out fresh business opportunities in those picks and shovels with state-of-the-art Gen AI tools, robots, assistants, and avatars.

Across the current online infrastructure, architectural advancements in AI have led to deep and complex convolutional neural networks (CNN), generative adversarial networks (GAN), long-short-term memory recurrent neural networks (LSTM RNN), and reinforcement learning algorithms, in academic and industrial labs in the past 10 to 15 years. These AI research developments usher in a full paradigm shift from Software 1.0 and Software 2.0 to Software 3.0, where the new foundational models enhance human-robot interactions and online content generations with little or no labor-intensive collection of big data. This new paradigm shift helps accelerate the next wave of technological advancements in many business applications.

Earlier iterations of AI technology either required computer scientists and software engineers to write deterministic code programs to perform specific tasks (Software 1.0), or required these specialists to statistically train complex neural networks on big data for specific tasks and predictions (Software 2.0). With Software 3.0 today, the foundational models leverage out-of-the-box capabilities to enhance their niche businesses with natural language reasons, explanations, and knowledge spillovers worldwide. These Gen AI base models help substantially transform both the logical and reasonable content generation via free and unique open-source APIs with no labor-intensive collection of big data.

The current Gen AI research progress is not just more of the same. The new more general and more powerful capabilities expand the relevant scope of deep complex machine-learning algorithms for significant improvements in user experiences. In support of the lean startup business method with iterative continual improvements, the new machine-learning software development cycle no longer entails the labor-intensive collection of big data. In fact, the relatively tedious manual data collection has been a central technical impediment to the widespread adoption of machine-learning algorithms, especially in the transition from Software 1.0 to Software 2.0. Today, the current Gen AI technological advancements break through the new era of Software 3.0, where the base models can act as out-of-the-box capabilities for many business applications. In practice, the foundational base models, LLMs, and other algorithmic capabilities are free and open-source via rare unique APIs. These base models apply natural language communication for human-robot interactions. Multiple layers of neural networks help embed general knowledge and technology spillovers as part of these foundational base models. In this new paradigm, many companies apply these Gen AI tools and robots for rapid online content generation in a cost-effective manner. Indeed, these human-robot interactions require virtually no manual collection of big data. End users would not need to train deep complex LLMs, CNNs, or RNNs on big data. Any company that chooses to invest in Gen AI can readily adapt these foundational base models to enhance both their consumer and enterprise experiences.

As with the prior major disruptive innovations for the Internet, mobile smartphones, and cloud computing data centers, some winners arose right away with first-mover competitive advantages, whereas, many others emerged only 10 to 15 years later. Both technologists and stock market investors should never lose sight of the recent lessons across all stages of the high-tech markets. In a fundamental view, all public corporations inevitably face their true and fair stock market valuation as reasonable P/E and P/B multiples relative to the wider stock market benchmarks such as S&P 500, Russell 3000, and MSCI USA. As early-stage stock market investors who can loosen the fair bounds of near-term stock market valuation, we should focus more on cherry-picking the next few Gen AI winners in the adjacent industries. This focus helps stock market investors specifically focus on the fundamental value drivers in support of positive network effects, information cascades, and scale economies.

Full-stack investors should delve into the most compelling business use cases for Gen AI. Such business use cases include semiconductor microchip manufacturers, cloud computing data centers, and online infrastructure tech titans. To attain higher returns on their Gen AI investments, stock market investors should reimagine both the picks and shovels as well as online infrastructure tech titans, data centers, and software engineering workflows. There is insatiable demand worldwide for Nvidia GPU capacity. At the same time, however, we continue to see immature cloud data center management and allocation of GPU clusters. This high technology still lags well behind CPUs. Additional stock market investments should help make Gen AI infrastructure more accessible and more cost-effective to all end users, developers, consumers, and enterprises.

Across the myriad Gen AI tech titans (OpenAI, Microsoft, DeepMind, Google, Meta, and Amazon), we would witness attractive brand-new business use cases for base models, LLMs, and many other deep machine-learning algorithms in human-robot interactions in support of fast and accurate text, imagery, voice, and video content generation. We would welcome the recent ongoing democratization of AI software development through better code models. Through rare unique APIs, open-source language models have become increasingly powerful and capable for smooth and healthy human-robot interactions due to key technical contributions from the extant tech titans Meta, Apple, Microsoft, Google, and Amazon.

The current Gen AI technology would probably not displace too much human work. In law, solicitors and barristers can benefit substantially from AI case law analysis of myriad landmark precedents in Anglo-Saxon common law. To the extent that AI contributes to a major productivity boost for many lawyers, Gen AI would probably not replace judges, solicitors, barristers, and many law clerks. In finance, AI would enhance the fundamental analysis of financial statements, such as balance sheets, income statements, and cash flow statements. Institutional investors, analysts, and fund managers benefit substantially from AI-driven proprietary alpha stock signals and personal finance tools for stock market investors. In this positive light, Gen AI would further lead to a major productivity boost for banks, insurers, broker-dealers, asset managers, and most other investment companies around the world. Only the traditional financial service providers that fail to leverage the modern AI technology become the ultimate losers in the financial system. In medicine, AI would probably further enhance the fast and accurate diagnoses and medications from doctors. In a similar manner, AI would not replace high-skill surgeons, psychiatrists, and many other health care specialists. Gen AI would help doctors sharpen the saw to better distinguish different diseases, symptoms, and side effects etc in search of the most suitable treatments, medications, and therapies. Overall, the Gen AI technological advancements would not replace high-skill jobs and industries overnight.

This Gen AI technology can further enhance human-robot interactions and several other adjacent applications, especially in traditional service sectors such as finance, law, medicine, illustration, as well as audio, voice, and video generation with smart data analytics. Now there is a huge amount of work and creativity in applying non-deterministic, or stochastic, foundational base models to perform well in new use cases. Both tech titans and lean startups leverage these algorithmic capabilities to substantially improve online security, customer relationship management (CRM), and the practical use of digital twins in support of extensive simulations for Gen AI factories and GPU clusters. Central bank digital currencies (CBDC) and most other cryptocurrencies (Bitcoin, Ethereum, Dogecoin, Stablecoin, and so on) would likely benefit from this AI technological advancement. Specifically, the blockchain ledger technology empowers the central bank to process a large number of atomic micro-payments with real-time payment settlement. In support of CBDC micro-payments, the blockchain ledger technology contributes to low-cost payment settlement in an efficient manner. In effect, the blockchain ledger technology can help each central bank process millions of CBDC micro-payments per second. Quantum computing technology continues to develop substantially in response to the new risk of cyber security vulnerabilities. In recent years, the latest technological developments help break current classical cryptography in several payment systems worldwide today. A new generation of post-quantum cryptography (PQC) can help make new CBDC system design highly resistant to cyber attacks by quantum computers.

In a fundamental business view, any additional AI research efforts should translate into better sales growth rates, profit margins, free cash flows, and fair values. The current wave of Gen AI advancements can be worthwhile in substantially improving business profitability and stock market valuation. Resourcing AI efforts helps with better confronting the innovator’s dilemma that some AI automation may displace a significant amount of human work. Whether the profitable gains from AI outweigh the new costs of labor displacement remains an open controversy for many public corporations, tech titans, and even lean startups. Amid the business transformation of Gen AI, most companies need not build everything from scratch. It can be a rare unique strategic advantage for these companies to choose the right trade partners with Gen AI technology. In a positive light, many companies would need to disrupt their own niche markets by rapidly staffing up AI product teams and then creatively pricing new online products and services in response to user data demands, needs, and concerns about privacy protection. When AI products account for a significant share of incremental sales and profits, it would be quite hard for many companies to argue with that kind of performance, especially in light of better consumer usage, engagement, and inventory management. It would be a shame if key governments regulate AI research to a halt worldwide before this technology has had a chance to deliver on its immense potential business value.

Gen AI differs dramatically from traditional AI in 2 fundamental ways. First, Gen AI is capable of generating new online contents in the common forms of text, imagery, audio, video, code snippets, and computer programs etc, whereas, most traditional AI algorithmic systems train computers to make statistical predictions about human behaviors and business outcomes. Second, Gen AI empowers humans, especially computer scientists and software engineers, to communicate with robots, avatars, and computers etc in their natural language, whereas, traditional AI systems would require the use of command prompts via specific programming languages such as Julia, Python, R, SAS, Stata, Matlab, Fortran, C++, C#, HTML, CSS, SQL, MySQL, Java, and JavaScript. When Gen AI can help generate high-quality online contents, people better spend their valuable time and energy on many other human activities with higher economic value.

It took several years for Apple’s iPhone and several of its successors to become a popular mobile device with widespread consumer adoption at scale. ChatGPT was the fastest Gen AI software application to attract 200 million monthly active users (MAU) in the first few months since its landmark launch back in November 2022. The vast majority of AI companies that have outperformed the broader world stock market benchmarks, such as S&P 500, Nasdaq, and Dow Jones, continue to trade at relatively reasonable and attractive P/E and P/B multiples. In modern economic history, asset bubbles are usually about excessively high enterprise values relative to clicks and impressions, addressable market dynamism, and sheer euphoria and irrational exuberance as non-fundamental drivers of market valuation. The current AI stock market rally differs dramatically from the prior tech asset bubbles because many AI stocks still trade at more reasonable P/E and P/B multiples.

Since the successful launch of OpenAI’s ChatGPT, consumer Internet companies build, design, and develop their own internal foundational models for specific niche markets, industries, and adjacent business sectors. These software solutions need to enhance practical applications for stock market investors to witness what works well, scales, and achieves broader user adoption in the real world. A good analogy for thinking about the time frame of impact of Gen AI is the fundamental shift from desktop PCs to mobile smartphones. It took tech titans such as Alphabet and Meta 4 years after the successful launch of iPhone to begin referring to themselves as mobile-first high-tech conglomerates. Over the medium run, many companies now regard Gen AI as the next major disruptive innovation with substantial productivity gains. These early technology adopters test and learn to see how Gen AI may help add tremendous economic value to their businesses over the next 3 to 7 years.

Meanwhile, AI-driven productivity gains tend to concentrate at the developer level. Recent empirical studies show that more than 15% to 20% developer productivity gains arise from the automation of some of the manual, rote, and routine processes of writing, debugging, and revamping code snippets and software programs. The resultant cost-benefit analysis suggests enormous economic value for the practical use of Gen AI tools, robots, avatars, and virtual assistants. The next population of knowledge workers who are likely to test-drive this modern Gen AI technology are young adults in sales, marketing support, and customer relationship management (CRM). In recent years, this current population of knowledge workers accounts for more than a third of the professional population in North America, Britain, Europe, Australia, and East Asia. Specifically, software companies should experience the positive impact of Gen AI. This impact now seems to trickle down from tech titans to midsize tech companies and lean startups in law, finance, medicine, health care, education, science, and technology etc.

Although ChatGPT scaled to more than 200 million MAUs within a short time frame, the positive impact of Gen AI has yet to reach traditional Internet search queries in Google, Bing, Yahoo, and DuckDuckGo. Gen AI helps dramatically enhance user experiences at these state-of-the-art search engines. In due time, the total volume of search queries continues to increase at a steady and reasonable pace. After all, Gen AI need not replace the basic need for end users, consumers, and businesses to look for information on the Internet. Specifically, Gen AI sorts search results with precise guidance so that most users can benefit from this sharper precision as part of their online search experiences. These online search user experiences are likely to improve incrementally with greater precision, recency, and relevance as Gen AI better sorts, targets, and deciphers Internet search results, pages, messages, and newsfeeds.

AI monetization can happen sooner for software companies. This monetization can result from the general ability of software companies to steer freemium customers toward premium products with exclusively generative AI capabilities. At the outset, these software companies may charge each freemium customer a low fee per year to play around with the new Gen AI technology. This low fee represents relatively low barriers to widespread user adoption. Once these products evolve and become more complex, these software companies retain greater pricing power to earn hefty double-digit profit margins in the reasonable range of 35% to 55% per year.

Cloud computing companies provide online computing power and storage services at scale. These companies include Amazon, Google, Microsoft, Oracle, Salesforce, Cisco, IBM, Alibaba, Baidu, Tencent, Ionq, and so forth. With these cloud services, software companies can deploy Gen AI with digital twins and GPUs in AI factories. This massive scale of AI virtual simulations can help significantly improve both the precision and quality of software development processes. These virtual simulation capabilities are particularly vital and important for fintech network platforms (such as AYA, Palantir, and PayPal) as well as video game publishers (such as Activision Blizzard and Electronic Arts). Cloud hyperscalers face a fundamentally strong and robust future because they have spent the past 15 years and hundreds of billions of dollars building out the world cloud infrastructure. On top of a rock-solid base of cloud sales and profits, many software companies deploy their Gen AI capabilities in addition to the core extant business operations, features, and functions. Instead of starting everything from scratch, these software companies can readily leverage cloud resources to engage in large-scale virtual simulations at a safe and fast pace. In practice, this new software development cycle accords with the primary spirit of applying the lean startup business method with iterative continuous improvements to further enhance the minimum viable product (MVP) over time. As a result of Gen AI deployment, these software companies leverage a rare and unique competitive advantage to substantially shorten their long prevalent average capital investment cycle of global supply chains (in support of better high-performance semiconductor microchip design and omniverse cloud infrastructure).

At the core of all these current Gen AI tools, robots, avatars, and virtual assistants is an auto-complete function that relies heavily on a substantial portion of available public information on the Internet (especially the New York Times and many other mainstream news publishers). These virtual tools cannot understand the real world around them, so many of these Gen AI chatbots often hallucinate or make up false statements. In reality, these Gen AI tools excel at carrying out predictable human tasks, behaviors, and business outcomes. Yet, these tools can hardly function like human brains, or real physical neural networks as part of human brains, to provide accurate legal judgments, medical diagnoses, financial forecasts, and many other deep and complex high-skill tasks, expert opinions, and professions. The baseline autocomplete function is not deep, complex, and proficient enough to apply subject matter expertise and knowledge with sound sophistication to help inform business decisions.

The real neural network of a human brain works nothing like those neutral networks that many Gen AI tools apply to train on a sufficiently large set of data. Contrary to what some computer scientists may arguably agree to disagree, these Gen AI tools cannot reason anything like human brains, or real neutral networks therein. At most, AI machines only apply what the Nobel Laureate Daniel Kahneman characterizes as System 1 reflexive statistical analysis with virtually no or little System 2 human deliberation. What AI machines learn relates to the statistical probabilities of words, images, sounds, voices, films, or movies. With reinforcement learning algorithms, these AI machines learn to properly respond to some prompts from code snippets and programs. Yet, these AI machines cannot learn abstract concepts, such as the broad business judgment rule in law, dynamic equilibrium fair market valuation in finance, and the dopamine hypothesis in medicine. As a result, there is no internal model for AI machine and robots to understand the world around them.

Humans have an internal model (aka the human brain) of the world, and this model allows humans to understand each other and their external environment. AI robots, machines, and systems have no such model and no intellectual curiosity about the world. As part of the broader base of Gen AI robots, machines, and systems, LLMs learn what words tend to follow other words in particular contexts. As humans, we learn much more information, for example, from facial expressions, tones, voices, gestures, and postures, just in the course of interacting with each other in the wider world. Indeed, human wisdom and intelligence tend to accumulate over the years. Human brains often pick up and process a much richer array of information through both natural languages and non-verbal cues.

In recent times, OpenAI’s ChatGPT passed the undergraduate exams in computer science at MIT, a business school exam, several law school exams, and even the U.S. medical licensure exam. However, ChatGPT 4.0 failed to pass these exams well enough for those base models to resemble subject matter experts. Should we ever find ourselves in a situation where those AI robots come to us, we can simply close the door. These AI robots still cannot open doors. Neither can these AI robots drive cars reliably to earn human trust. Indeed, many of these human tasks require understanding some specific abstract concepts of turning the doorknob or entering a 4-digit passcode, earning the trust of others, or becoming a trustworthy resource over the course of consistently performing human tasks well at scale. For all these reasons, we are far from achieving artificial general intelligence (AGI) at this early stage of AI automation.

We can regard these LLMs and many other AI foundational base models as giant approximation machines. It is relatively easy to build-and-monetize these models, so many computer scientists and software engineers focus on these base models rather than some other ideas, the latter of which may have more merit but are hard to implement quickly in practice. For instance, it is relatively easy to develop some base models of sorting and displaying key financial ratios, reports, and statements on social media outlets, websites, and exchanges. Good examples include FINVIZ, Nasdaq, Motley Fool, MarketWatch, Bloomberg, Google Finance, Yahoo Finance, Seeking Alpha, and so on. However, it is much harder for fintech network platforms to provide proprietary alpha stock signals and personal finance tools with USPTO patent accreditation for stock market investors worldwide.

The problem of human intelligence is an extremely difficult one. Most of the efforts for better interpreting human intelligence are less than 75 years old. Apart from IQ scores, human intelligence comprises many aspects. A person usually has to learn to perform many different human activities. He or she follows a conversation; sings a new song; plays some musical instrument; learns new dance moves; figures out the solution to a basic algebra problem; observes the emotions of others; drives a car in a big city; speaks a second language; or performs any kind of human activity with human intelligence of many different sorts. It is not realistic for us to expect AI machines, robots, and avatars to master all of those human skills, tasks, and even whole professions in only 75 years.

Today people can conceptualize what AGI might look like in practice, but they have yet to develop sound sophistication to better understand how they can build human intelligence into AI machines, robots, and avatars. Modern Gen AI technology may or may not reach the critical inflection point in light of significant amounts of money that tech titans have already poured into AI research and development. Throwing massive amounts of money at a problem does not mean that people can eventually solve this problem in due course. At Google’s autonomous car factory back in 2015, the self-driving cars had learned to recognize that it was safe to drive over piles of leaves on the road, because this specific scenario was not part of the training data set. In April 2022, a Tesla autonomous car ran directly into a $3.5 million jet across a parking lot at an airplane trade show, because its training data set did not contain jets. In this car crash, the AI machine had no abstract concept that the autonomous car should not drive into large expensive objects. In the meantime, many computer scientists and software engineers dogmatically pursue the idea that LLMs are the answer to achieving AGI. However, these LLMs may be part of the answer, but the current Gen AI base models are not the whole answer. Hence, the deep machine-learning community has to reorient at some point. Given this recent AI hype, stock market investors still need to perform careful due diligence on any potential capital investments in AI research and development. It is relatively easy for companies to claim that they are AI companies. However, the longer-term returns on AI research investments may or may not support this simple claim. Would these AI companies sustain rare unique competitive advantages for long-term success and profitability? Would these AI companies retain competitive moats around their niche businesses both in the current and adjacent markets? Answers to these fundamental questions can help shine new light on the potential winners amid the current AI stock market rally.

The recent emergence of Gen AI technology raises the question of whether we are on the brink of a rapid acceleration in task automation with substantially lower costs of time, labor, and energy. This acceleration can lead to a productivity burst at the faster pace of economic growth. Although significant economic policy uncertainty continues to revolve around the Gen AI base models, capabilities, and timelines of widespread user adoption, some recent empirical studies show that Gen AI usage can help boost U.S. annual labor productivity growth by 1.5-2.5 percentage points over the current decade. In the U.S. and many other rich economies, AI helps raise annual global GDP by 7% to 15% in due course. This global productivity boost can turn a relatively narrow AI-driven U.S. stock market rally into a much broader one over the longer run. Specifically, S&P 500 stocks have already experienced 9% to 25% increases in fair asset market valuation in recent years, especially in the post-pandemic period. This Gen AI stock market trend turns out to be the new friend for many institutional investors worldwide.

Many high-skill knowledge workers spend a lot of time performing rote and routine tasks that some AI base models can help automate in due course. Approximately 65% to 70% of U.S. jobs face exposure to at least some degree of AI automation. For the foreseeable future, AI automation would likely replace a significant fraction of human workload. Over a reasonable range of AI displacement for human work, administrative and legal professions face high exposure to AI automation, whereas, labor-intensive professions such as construction and maintenance face relatively low exposure to AI automation. In many high-skill professions such as law, finance, medicine, and computer science, AI models, chatbots, and avatars would probably lead to substantial improvements in labor productivity. In addition to the ubiquitous use of PCs, smartphones, and the Internet, AI helps high-skill knowledge workers achieve the same amount of both data and information outputs with fundamentally fewer factor inputs in a cost-effective manner.

In a fundamental view, AI automation helps boost global GDP and productivity via at least 2 major channels. First, the next widespread user adoption of AI machines would likely direct at least some of their free capacity toward productive activities. To the extent that many jobs face at least some direct exposure to AI automation, the next long prevalent use of AI machines would likely lead to a 2-to-3-percentage annual boost to labor productivity growth in the new few decades. Second, Gen AI would probably displace some human work, and some knowledge workers may no longer be fit for their current jobs. These knowledge workers would further seek re-employment in new jobs. These new occupations emerge either from widespread AI adoption or in response to the higher levels of macro labor demand due to the productivity boost from high-skill knowledge workers.

The re-employment of knowledge workers due to AI technological advancements has plenty of historical precedent. In the mid-to-late-2000s, the long prevalent use of PCs, smartphones, and the Internet displaced some knowledge workers in some jobs. However, this brand-new era of information technology led to the creation of new occupations such as webpage designers, software engineers, app developers, digital marketers, and so forth. In addition, this new era further led to another major increase in aggregate labor demand in several service sectors such as health care, education, transportation, and food and drink delivery.

In recent years, the average AI adoption rate by U.S. companies has dramatically risen from no more than 5% in 2019 to well more than 75% in 2024. Many midsize and lean startups still need to assess how wider AI adoption can help substantially improve their core business operations. More than 35% of U.S. companies expect their AI workforces to expand in the next 5 to 7 years. These U.S. companies need to navigate several technical barriers to widespread AI adoption. For instance, the early AI technology adopters would still need to strictly enforce online protocols for data access, usage, and privacy protection. In reality, the vast majority of AI lovers would need to overcome these barriers before AI base models become part of their everyday workflows. For these reasons, the positive ripple effects of AI automation would likely not be visible in macro productivity data for at least several more years. Some recent empirical studies suggest that the next widespread user adoption of Gen AI may eventually drive a 7%-15% increase in annual global GDP over a 10-year time horizon. This reasonably conservative estimate translates into an almost $7 trillion increase in annual global GDP in the current decade. In this positive light, we regard AI automation more broadly as a significant upside fundamental factor to our longer-term global economic growth projections.

As with the prior major disruptive innovations for the Internet, mobile smartphones, and cloud computing data centers, some winners arose right away with first-mover competitive advantages, whereas, many others emerged only 10 to 15 years later. Both technologists and stock market investors should never lose sight of the recent lessons across all stages of the high-tech markets. In a fundamental view, all public corporations inevitably face their true and fair stock market valuation as reasonable P/E and P/B multiples relative to the wider stock market benchmarks such as S&P 500, Russell 3000, and MSCI USA. As early-stage stock market investors who can loosen the fair bounds of near-term stock market valuation, we should focus more on cherry-picking the next few Gen AI winners in the adjacent industries. This focus helps stock market investors specifically focus on the fundamental value drivers in support of positive network effects, information cascades, and scale economies.

Full-stack investors should delve into the most compelling business use cases for Gen AI. Such business use cases include semiconductor microchip manufacturers, cloud computing data centers, and online infrastructure tech titans. To attain higher returns on their Gen AI investments, stock market investors should reimagine both the picks and shovels as well as online infrastructure tech titans, data centers, and software engineering workflows. There is insatiable demand worldwide for Nvidia GPU capacity. At the same time, however, we continue to see immature cloud data center management and allocation of GPU clusters. This high technology still lags well behind CPUs. Additional stock market investments should help make Gen AI infrastructure more accessible and more cost-effective to all end users, developers, consumers, and enterprises.

Across the myriad Gen AI tech titans (OpenAI, Microsoft, DeepMind, Google, Meta, and Amazon), we would witness attractive brand-new business use cases for base models, LLMs, and many other deep machine-learning algorithms in human-robot interactions in support of fast and accurate text, imagery, voice, and video content generation. We would welcome the recent ongoing democratization of AI software development through better code models. Through rare unique APIs, open-source language models have become increasingly powerful and capable for smooth and healthy human-robot interactions due to key technical contributions from the extant tech titans Meta, Apple, Microsoft, Google, and Amazon.

As of mid-2024, we provide our proprietary dynamic conditional alphas for the U.S. top tech titans Meta, Apple, Microsoft, Google, and Amazon (MAMGA). Our unique proprietary alpha stock signals enable both institutional investors and retail traders to better balance their key stock portfolios. This delicate balance helps gauge each alpha, or the supernormal excess stock return to the smart beta stock investment portfolio strategy. This proprietary strategy minimizes beta exposure to size, value, momentum, asset growth, cash operating profitability, and the market risk premium. Our unique proprietary algorithmic system for asset return prediction relies on U.S. trademark and patent protection and enforcement.

Our unique algorithmic system for asset return prediction includes 6 fundamental factors such as size, value, momentum, asset growth, profitability, and market risk exposure.

Our proprietary alpha stock investment model outperforms the major stock market benchmarks such as S&P 500, MSCI, Dow Jones, and Nasdaq. We implement our proprietary alpha investment model for U.S. stock signals. A comprehensive model description is available on our AYA fintech network platform. Our U.S. Patent and Trademark Office (USPTO) patent publication is available on the World Intellectual Property Office (WIPO) official website.

Our core proprietary algorithmic alpha stock investment model estimates long-term abnormal returns for U.S. individual stocks and then ranks these individual stocks in accordance with their dynamic conditional alphas. Most virtual members follow these dynamic conditional alphas or proprietary stock signals to trade U.S. stocks on our AYA fintech network platform. For the recent period from February 2017 to February 2024, our algorithmic alpha stock investment model outperforms the vast majority of global stock market benchmarks such as S&P 500, MSCI USA, MSCI Europe, MSCI World, Dow Jones, and Nasdaq etc.

Andy Yeh

Postdoc Co-Chair

Brass Ring International Density Enterprise (BRIDE) ©

Do you find it difficult to beat the long-term average 11% stock market return?

It took us 20+ years to design a new profitable algorithmic asset investment model and its attendant proprietary software technology with fintech patent protection in 2+ years. AYA fintech network platform serves as everyone’s first aid for his or her personal stock investment portfolio. Our proprietary software technology allows each investor to leverage fintech intelligence and information without exorbitant time commitment. Our dynamic conditional alpha analysis boosts the typical win rate from 70% to 90%+.

Our new alpha model empowers members to be a wiser stock market investor with profitable alpha signals! The proprietary quantitative analysis applies the collective wisdom of Warren Buffett, George Soros, Carl Icahn, Mark Cuban, Tony Robbins, and Nobel Laureates in finance such as Robert Engle, Eugene Fama, Lars Hansen, Robert Lucas, Robert Merton, Edward Prescott, Thomas Sargent, William Sharpe, Robert Shiller, and Christopher Sims.

Follow AYA Analytica financial health memo (FHM) podcast channel on YouTube: https://www.youtube.com/channel/UCvntmnacYyCmVyQ-c_qjyyQ

Follow our Brass Ring Facebook to learn more about the latest financial news and fantastic stock investment ideas: http://www.facebook.com/brassring2013.

Free signup for stock signals: https://ayafintech.network

Mission on profitable signals: https://ayafintech.network/mission.php

Model technical descriptions: https://ayafintech.network/model.php

Blog on stock alpha signals: https://ayafintech.network/blog.php

Freemium base pricing plans: https://ayafintech.network/freemium.php

Signup for periodic updates: https://ayafintech.network/signup.php

Login for freemium benefits: https://ayafintech.network/login.php

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-09-15 14:35:00 Sunday ET

U.S. Treasury officially designates China a key currency manipulator in the broader context of Sino-American trade dispute resolution. The U.S. Treasury cla

2019-07-05 09:32:00 Friday ET

Warwick macroeconomic expert Roger Farmer proposes paying for social welfare programs with no tax hikes. The U.S. government pension and Medicare liabilitie

2018-10-30 10:41:00 Tuesday ET

Personal finance author Ramit Sethi suggests that it is important to invest in long-term gains instead of paying attention to daily dips and trends. It

2018-07-27 10:35:00 Friday ET

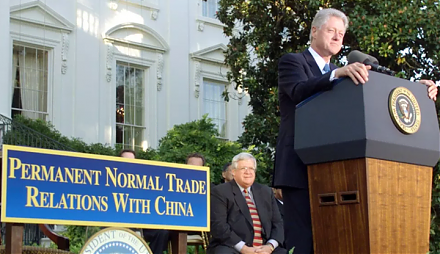

Admitting China to the World Trade Organization (WTO) and other international activities seems ineffective in imparting economic freedom and democracy to th

2019-04-09 11:29:00 Tuesday ET

The U.S. Treasury yield curve inverts for the first time since the Global Financial Crisis. The key term spread between the 10-year and 3-month U.S. Treasur

2019-10-25 07:49:00 Friday ET

U.S. fiscal budget deficit hits $1 trillion or the highest level in 7 years. The current U.S. Treasury fiscal budget deficit rises from $779 billion to $1.0