2024-04-30 09:30:00 Tue ET

stock market federal reserve monetary policy treasury fiscal policy deficit debt bankruptcy currency dollar renminbi payment technology paypal alibaba tencent facebook covid-19 employment inflation fintech global macro outlook stock investment electric vehicle

Both BYD and Tesla have now become serious electric vehicle (EV) makers. Their recent emergence reflects technological upheaval in the global auto industry. The fundamental shift is electrification. Although a few carmakers still apply hydrogen fossil-fuel cells, lithium-ion batteries have become the mainstream technology for EVs worldwide. Today, China accounts for more than 6 million sales of new-energy vehicles (NEVs) and plug-in-hybrid electric vehicles (PHEVs). The top Chinese EV maker, BYD, has already surpassed Tesla in selling more than 3 million EVs with $43 billion in net revenue in the fiscal year 2023. In the same year, Tesla sold 1.8 million EVs by comparison. In terms of new-energy resources and batteries, BYD and Tesla are way ahead of all other major EV producers worldwide: Volkswagen (994,000 EVs), Geely-Volvo (925,000 EVs), SAIC (791,000 EVs), BMW (598,000 EVs), Stellantis (550,000 EVs), Hyundai-Kia (490,000 EVs), as well as the smaller EV producers GM, Mercedes-Benz, and the Renault-Nissan-Mitsubishi strategic alliance.

The relative simplicity of both batteries and electric motors helps break down many barriers to entry into the global auto industry. From Fisker, Lordstown, Lucid, and Rivian in the U.S. to Li Auto, Nio, and Xpeng in China, these regional startups are now following the lead of both BYD and Tesla. Electrification has given a leg-up to the well-known carmakers in America, China, Germany, Japan, and South Korea. Outside Britain and North America, the vast majority of new EV trailblazers rely on government support and special access to regional car markets. China specifically encourages the extant state enterprises and private companies to build a domestic EV industry in order to sidestep petrol power.

Across a wide range of reasonable scenarios, McKinsey estimates that the annual global production of modern vehicles is likely to increase from 62 million to 70-95 million by 2035. Legacy carmakers face a brand-new challenge from Chinese EV producers as these newcomers retain competitive advantages over massive land, population, and technology for cleaner energy and safer navigation. In future cars, the experience of driving EVs (NEVs, PHEVs, and so on) differentiates auto brands worldwide. Instead of hardware, software now defines and determines the quality of modern super-computers on wheels. The EVs provide ever more features and functions such as infotainment, ambient design, and voice control. In addition, the over-the-air software updates help improve all of these features and functions on an ongoing basis after each EV has left the factory. Thus far, BYD, Nio, and Xpeng have beaten Tesla to provide AI-driven karaoke microphones in their EVs. In China, young adults expect and even demand that their EVs offer a smart and seamless extension of their digital lifestyles. This trend sets a new course for the modern EV transformation worldwide.

Geopolitical tensions between China and the U.S. may complicate the current EV transformation. In its own pragmatic view, the U.S. government launches unilateral tariffs on Chinese EVs, restrictions on EV tech transfers and investments, greater subsidies for home-grown EV production, and shorter supply chains of EVs across North America. These U.S. industrial policy instruments all threaten to slow down, halt, or even reverse the globalization of modern EV design and production around the world. Nowadays most carmakers face this new challenge to adapt to the faster pace of the modern EV. Not all legacy carmakers are likely to survive this modern EV transformation worldwide.

A recent Bloomberg survey estimates that EVs are likely to account for more than a quarter of global car sales by 2025. The same survey further shows that EVs are likely to account for 40%-50% of car sales in Europe and China by 2025. By 2040, at least 3 quarters of new-car sales worldwide are likely to be fully electric, as better batteries make even PHEVs redundant in due course.

Tough carbon-emission regulations have done much to promote EVs. A recent law from the European Union may mean a total ban on all future new cars with internal combustion emissions, although Germany has won an exception for new cars with carbon-neutral synthetic fuels. Many governments and cities now attempt to crack down on carbon and other emissions, which tend to be the main root cause of local air pollution. In China, the Xi administration now demands that at least a quarter of new cars must be NEVs or PHEVs by 2035. In America, the Biden administration sets strict limits on vehicle emissions. To the extent that the Biden administration seeks to reduce auto manufacturers’ reliance on fossil fuels, these strict limits now require about 70% of new cars to be fully electric by 2032. Specifically, the Inflation Reduction Act subsidizes sales of America-made EVs with domestic batteries, raw materials, and other car components from U.S. allies.

Around the world, consumers have overcome the biggest deterrents to buying EVs: price and range. Tight bottlenecks and global supply chains for raw materials (such as lithium and nickel) still contribute to a sizable fraction of EV battery prices, which represent almost half of the cost of a typical EV. Nonetheless, economic scale and new tech have pushed prices down by as much as 95% since both BYD and Tesla made substantial progress in EV lithium-ion batteries in 2008. Better batteries can mean longer ranges. This technological progress helps alleviate concerns about a slow rollout of public power-charging infrastructure. With an ever increasing choice of new EV models, generous state subsidies suggest that a handful of unattractive compliance cars are no longer the only options. Over a multi-year horizon, the total cost of owning an EV is already approximately equivalent to the total cost of owning a nonelectric car with internal combustion engines. This total cost includes ongoing operational costs, repairs, and new energy resources. For this positive reason, the global EV transformation is likely to help stabilize vehicle prices with cleaner power resources. Thus, we can expect this modern EV transformation to help bring about low and stable inflation in the longer run.

At Tesla, Elon Musk continues to bring up-to-date his disruptive innovation of EVs. This approach borrows heavily the full stack business model from the tech industry. Vertical integration now ensures lean agility while the EV makers keep more profits. In the past decade or so, Tesla boosted its EV sales from 3,100 EVs and net sales of $413 million to more than 1.5 million EVs and net sales of $81 billion (as of late-2023). At one stage, there was a widespread market belief that Tesla might come to dominate the global auto industry. In November 2021, this belief boosted Tesla’s stock market capitalization to more than $1 trillion. More recently, a wider tech sell-off and further concerns about Tesla’s operational performance dragged its stock market capitalization back down to $550 billion. In addition to the recent AI-driven slideshow, this stellar stock market capitalization remains reasonably higher than the total stock market capitalization of all of the next 5 U.S. EV makers.

Elon Musk reiterates his longer-term aspiration that Tesla will be making 20 million EVs per year by 2030. As many stock market analysts suggest, 5 million EVs per year would be nearer the mark. Yet, even this conservative estimate would still be a huge achievement. In time, the modern EV transformation that Tesla has brought to the global auto industry will gradually become the new industry standard.

Many other EV makers find that battery supply is the inexorable constraint on the modern EV transformation. Among these EV producers, Volkswagen has the most ambitious electrification plans: the German car manufacturer expects all of its EV sales in North America and Asia, and at least 80% of its EV sales in Europe, to be fully electric by 2030. However, EV battery production now concentrates in only a few oligopolies in China, Japan, and South Korea. In fact, 6 of the top 10 EV battery producers are Chinese. These EV battery producers supply more than 65% of EV batteries worldwide. Also, China retains a firm grip on both EV software processing capacity and raw materials (such as lithium, graphite, and nickel etc).

Another fundamental shift is the move toward giga factories. Most EV makers have joint ventures with well-known battery manufacturers. For instance, GM enters into a long-term agreement with the South Korean EV battery supplier LG Chem; and Mercedes-Benz has a similar agreement with the biggest EV battery maker CATL in China. At Volkswagen, the EV battery subsidiary PowerCo plans to invest $20 billion in at least 5 factories by 2030, and then adds to an ongoing partnership with Volvo in Northvolt, a Swedish EV battery startup run by Peter Carlsson (the former Head of Supply Chain at Tesla). As the PowerCo president Kai Muller emphasizes, Volkswagen has the financial clout to stay in control of EV battery supply. Leaving it to a joint venture would mean putting up half the money but handing direction to a third party. In this sphere of influence over EV corporate finance, cash is king in a good sense of control and optimism.

Many other EV functions gradually move in-house. The main EV makers worldwide continue to develop software updates for modern features and functions. Both BYD and Tesla make some of their own EV batteries, microchips, motors, and other car components (such as bar glass panels, wheels, and tires). Also, these EV makers enter the power-charging business themselves. Tesla’s Supercharger network can become a big business, as the U.S. EV titan has opened up this network to other EV makers. This strategic alliance may mean as much as $25 billion per year. With a reasonable range of scenarios, the EV-charging business can rake in $300 billion in sales revenue in the next few years. Recently, GM has invested $750 billion in 40,000 EV-charging points in North America. In Europe, Mercedes-Benz keeps an equity stake in the largest regional EV-charging network Ionity with BMW, Hyundai, and Volkswagen. Moreover, Mercedes-Benz plans to invest $1 billion in a new U.S. company that the European board intends to manage along with ChargePoint, the latter of which is one of the world’s biggest EV-charging companies.

In summary, economic scale, tech adoption, experience, brand loyalty, and access to capital are no longer huge barriers to entry into the global auto industry. Around the world, EV manufacturers welcome vertical integration in the common form of both strategic alliances and joint ventures. It seems easier for tech titans to tap into the world market for EVs. These newcomers can draw valuable business lessons from the recent experiences of both BYD and Tesla.

At the dawn of the millennium, more than 30 international auto manufacturers were making expensive cars with internal combustion engines. Many auto makers tried to imitate the lean production model of Toyota in Japan. The familiar economics of mass production led to high concentration of the global auto industry in a few vast multinational corporations. Today the EV production process has gone into reverse. In China, there are now more than 300 lean startups in the auto industry, and these companies specialize in the modern production of EV lithium-ion batteries, electric motors, and AI-driven software updates for EV infotainment, ambient design, voice control, and safe navigation. These batteries and electric motors can be bought off the shelf, accounting for 60% to 70% of the total cost of a typical EV. Indeed, these batteries and electric motors obviate the prior need for auto producers to spend up to billions developing several internal combustion engines to serve a range of cars with different specifications. One sort of battery can come in a wide variety of sizes; and one sort of electric motor can suit a wide variety of EVs with high performance. As the marginal cost of EV software is near the zero lower bound, many EV makers can make hefty profits at a substantially smaller scale of lean production. Both BYD and Tesla continue to enjoy impressive net profit margins above 15%. From BMW and Mercedes-Benz to Geely-Volvo and Volkswagen, many other EV makers can sustain double-digit net profit margins too.

After all, the lean production of EVs (and cars without internal combustion engines) is still a scale business: economies of scale often lead to a substantial reduction in the average cost of an additional EV. Teaming up with specialist assemblers helps reduce the risks of manufacturing EVs worldwide. Fisker manufactures its smaller and cheaper EV model, the Pear, with Foxconn, the latter of which is better known for manufacturing Apple iPhones across Mainland China, Hong Kong, and Taiwan. The Chinese EV maker, Geely, now owns Sweden’s Volvo, and then keeps a 10% equity stake in Mercedes-Benz. In recent times, Geely enters into a new deal with Foxconn to manufacture modern EVs and electric buses and trucks for third parties. Foxconn has further bought a substantial equity stake in Lordstown’s EV factory in Ohio. If any company has greater ambitions even than BYD and Tesla, Foxconn’s long-term plan is to manufacture at least half of the world’s EVs.

Both BYD and Tesla rise up to the challenge that it is relatively hard to establish a new car brand. Indeed, the old market rules about brand loyalty tend to break down in the modern EV market worldwide. In the mass market for EVs, brand loyalty has always been much weaker. Both BYD and Great Wall Motor (GWM) with Ora (its budget brand) showcase their attractive EVs online. The Chinese EV startups, Nio and Xpeng, are ambitious enough to sell EVs in Europe. Along with Li Auto, these lean startups sell more than 120,000 EVs apiece in China each year. With SAIC’s MG and Geely’s Polestar, China accounts for more than 6% of EV sales in Europe. For many years, BYD plans to build a European EV factory and another EV factory in post-Brexit Britain. A recent Gartner survey suggests that more than 45% of EVs sold worldwide will be Chinese by 2026.

Chinese EV makers can lean on the vast scale and low costs of serving their home market, their firm grip on the battery business, and their unique access to generous state subsidies. In fact, China’s market size and excess capacity combine to make EV exports important for future growth. Low volumes and high costs of EV batteries often make it hard for western legacy carmakers to switch to making EVs profitably. Specifically, most western legacy carmakers experience higher operating costs by 50% to 60%, primarily due to the highly technical production of both batteries and electric motors. The U.S. carmaker Ford reports that its own EV division now loses $3 billion per year. With comparable cost structures, Chinese EVs are now on par with global auto brands on range and efficiency; yet, the vast majority of these EVs are more cost-effective and less expensive to consumers around the world. BYD’s Atto 3 sells for $38,000 in Germany, 15%-20% cheaper than Volkswagen’s similar all-electric ID.4.

In light of these price comparisons, some western economic media commentators favor imposing more tariffs on Chinese EVs. However, several European firms face a dilemma. Unlike Stellantis (which sells fewer cars in China), Volkswagen, BMW, and Mercedes-Benz are big carmakers in China and so rely on the middle kingdom for much of their profitability there. Specifically, Volkswagen keeps 33 car factories with joint-venture partners and more than 100,000 Chinese employees. Any move for western countries to punish Chinese EV makers with tariffs would inadvertently invite retaliation.

With big plans on paper but fewer EVs to sell worldwide, many EV makers attract high stock market valuation at IPOs or private offers via special-purpose vehicles. When Rivian floated through its debut IPO in 2021, the U.S. EV producer garnered an impressive stock market capitalization of $130 billion. Also, Nio hit a peak stock market capitalization of $97 billion. More recently, the global stock market feels the pervasive negative investor sentiments about tech stocks and Tesla’s stock market valuation. These investor sentiments batter many newcomers in the global market for EVs and electric buses and trucks. Post-IPO, several EV makers often struggle with constantly having to meet market expectations of sales targets with limits and strains on lean production capacity. As a result, Nio, Rivian, and Xpeng are now in the more reasonable range of $9 billion to $15 billion stock market valuation. In the broader context, the modern EV transformation is a bit like the dotcom bubble: high technology allows some tech titans to tap into the global auto industry; yet, it is not easy for legacy carmakers to become high-tech solution providers.

Nio views itself as a lifestyle brand, in addition to a lean startup in EV technology. The focus is on the user experience. Using a Nio EV is about enjoying the journey and the community built around its unique and inimitable car brand. Nio EVs come with high-definition screens and state-of-the-art sound systems. In both Berlin and Beijing, Nio EV owners, potential owners, and anyone else can drop by the coffee bars and lounge rooms, buy local goods, or even leave their children in a high-tech play area.

Future EV drivers and passengers want to make the most of their trips. The myriad features and functions that help enhance the EV user experience rely on software rather than hardware. EV customers cannot care less about panel gaps and other car components. From both BYD and Tesla to many other EV makers, the software updates that keep EV technology fresh and up-to-date matter much more.

In the modern EV transformation, the EV has become a third living space between home and work. EV software updates control robust performance, safe navigation, infotainment, and the unique experience of sitting in the vehicle. Each modern EV already includes standard safety features such as automatic brakes, lane changes, and adaptive cruise control. Many other EV software features and functions make the entire user experience more fun. Good examples are the best navigation maps, sound systems, high-resolution screens, movies, video games, and voice control dashboards. Indeed, many smart mobile devices substantially improve the market expectations of early tech adopters. Spending $100,000 on a smart EV comes with the same demand for personalization as buying a $900 smart phone.

We can expect more than 85% of EVs to be Internet-connective in the next decade. This better connectivity allows all kinds of over-the-air EV software updates in the automatic mode. This unique aspect of EVs suggests that the global auto industry has a new opportunity to make iterative continuous improvements to the business case with up-to-date software features and functions. Legacy carmakers now have the hardest job replicating the competitive advantages of lean startups. EV makers view software as the unique value proposition for lean startups instead of designing, manufacturing, and delivering cars on budget and on time. In China and probably elsewhere, many young adults expect to see a seamless extension of their digital lifestyles in their cars.

EV software can be lucrative. UBS forecasts $700 billion each year in sales of EV software updates by 2030. The global auto industry operates on approximately 7-year to 8-year model cycles, with research and development frozen before the start of production. The slow pace is far from the conventional timescales of EV software updates: small updates typically take place weekly or monthly and large overhauls occur perhaps every year, as many software updates do for smartphones.

For both BYD and Tesla and other EV makers, what these trailblazers should keep in-house remains a central issue. Volkswagen reiterates its ambition to develop at least 60% of in-house software as a means to reinforce the importance of software in each modern EV. Most other EV makers are less ambitious on this front and so settle on developing no more than 20% to 30% software in-house. On balance, EV makers that want to design all software alone may be set up for expensive failures, whereas, the other EV makers that rely on all external software are the worst case for brand equity. Most EV makers realize that they should concentrate only on what they can do better in terms of software design.

Each EV maker should attempt to become the software architect of the house. The EV maker usually creates and designs its unique operating system and then teams up with the best contractors, such as Nvidia and TSMC for AI microchips, Google and Baidu for online maps and navigation systems, and Apple and Amazon for e-commerce as part of the EV user experience. From both BYD and Tesla to Renault and Toyota, EV software must be a seamless part of the smartphone ecosystem.

The latest version of Apple’s CarPlay connects iPhones to each EV’s infotainment screens and voice control dashboards. Specifically, CarPlay provides a seamless user experience for online maps, safe navigation tours, and wireless connections to smart-phone apps by taking over these screens and dashboards in each EV. To ensure better privacy protection, Apple keeps and encrypts all of the personal data on drivers. Each major EV maker attempts to achieve the same sort of in-car user experience for EV drivers and passengers.

For both BYD and Tesla, this high-tech approach is not a major problem. Disruptive innovation is right at the core of what these EV trailblazers can accomplish in due course. These EV makers can rapidly turn out new software features and functions. In terms of EV software patent protection, both BYD and Tesla are at least 5 years ahead of legacy carmakers. Many western EV startups are quick, but their Chinese counterparts are quicker still. These EV startups often manage to roll out software updates in hours or days rather than weeks or months. In essence, it is increasingly hard for legacy carmakers to find the right EV software by marrying the speed and agility of high technology to the old art and science of mass production of cars.

Fully autonomous electric robotaxis once seemed to disrupt the entire global auto industry. These robotaxis would be key for the dramatic shift to integrative systems that wove together public transport with private fleets of e-scooters and e-bikes. In essence, these mobile platforms would provide one-click online payments for each journey that might use several methods of transport. Smartphone apps would offer clean, green, and efficient urban travel at a fraction of the cost of car ownership.

In the new online era of information revolution, young adults are no longer so keen to own, buy, and/or drive cars. The screen-obsessive youth of the rich world would rather play with smartphones than driving at their own peril. The inevitable outcome appears to be a widespread plunge in car sales worldwide. Yet, autonomous EVs and many other mobile services may create new opportunities for both EV makers and tech titans.

We can dispel the common myth that young people are giving up driving a car for good. In car-mad America with about 890 cars per 1,000 people, only 1% of new cars belong to young adults under the age of 24. The fraction of 16-year-olds with car licenses fell from 46% to 23% between 1983 and 2023. Yet, the same decline for older people was less precipitous. Just as they prefer to defer much else, such as settling down or having children, young adults often choose to get their licenses later. In North America, Britain, and Europe, the average age of a typical buyer of a new car is well over 50.

Autonomous rides happen to be the next new trend in the global auto industry. As the autonomous EV subsidiary of GM, Cruise runs driverless rides in some major U.S. cities such as Phoenix, Arizona, San Francisco, California, and Austin, Texas. The autonomous EV subsidiary of Alphabet, Waymo, operates in Phoenix and San Francisco. Uber’s app runs ride-hailing services with autonomous EVs on the basis of a joint venture between the U.S. supplier Aptiv and Hyundai from South Korea. Amazon runs its autonomous Zoox robotaxis between offices and warehouses in the major cities in California (after a smooth $1.3 billion acquisition back in 2020). In China, the online search tech titan, Baidu, operates similar services in the major cities on the east coast of the mainland. Didi and WeRide run ride-hailing services in these major cities too.

However, it will be a long time before it is common for people to jump in a robotaxi. Many governments geo-fence autonomous mobile services to particular cities and regions. For instance, Cruise’s autonomous EVs must avoid the financial district in San Francisco for now. Many other driverless EV services limit their operations to specific off-peak hours of less traffic congestion. Due to the high costs and distant profits of autonomous EV services, most carmakers have less grandiose plans on this front. For this reason, profitable, fully autonomous EVs at scale remain a long way off. To master autonomous EV services, many carmakers team up and share sales with tech titans. In this business case, these tech titans serve as EV software solution providers. A recent McKinsey survey shows that autonomous EV services for passenger cars alone are likely to produce sales worth $400 billion by 2035.

Autonomous EV services should eventually change long car journeys from a chore to a better use of time. For EV makers, these autonomous mobile services can be a new business worldwide. More free time in autonomous EVs should create new opportunities to sell more infotainment features and services such as music, video, and AI-driven voice control. This new approach to autonomous EV services is one more sign of a recent switch from car ownership to usership.

Even as key foreign carmakers begin to struggle in China, Chinese hopes of selling millions of EVs abroad may fall foul of a recent deterioration in geopolitical relations. The sour relations between America and China mean bilateral tensions, tariffs, and a relentless race of state subsidies for domestic EV makers. In the broader context, new trade barriers can arise from global supply chain bottlenecks and restrictions on access to western EV technology. These developments may further add to the recent deglobalization of the archetypal world auto industry in many ways.

At the same time, many legacy carmakers now attempt to reconfigure their global supply chains to reduce their reliance on China with significantly less exposure to geopolitical concerns. China is still one of the world’s biggest exporters of car parts, well over $45 billion each year. At least a quarter of these exports flow to America. During the pandemic crisis, China’s zero-Covid policy led to widespread lockdowns and further delays in the mainland supply chains for the global auto industry. It can be a lengthy and arduous business for many carmakers to form new relations with other auto suppliers and manufacturers from India, Vietnam, and Mexico. Indeed, most carmakers change global suppliers and manufacturers only when they intend to make new models. Yet, the gradual process of shifting supply chains away from China is clearly under way.

Another sea change arises from restrictions on access to western EV technology. The U.S. now bars Chinese EV makers from some high technology. These efforts include a ban by the Commerce Department on exporting AI graphical processing units (GPUs) and semiconductor microchips to China. At the same time, the U.S. CHIPS and Science Act offers new state subsidies for manufacturing EVs and their internal semiconductors in North America. Although Chinese carmakers may lead the world in some aspects of EV software and autonomous car navigation, these carmakers rely almost exclusively on semiconductor imports from America, Europe, Japan, South Korea, and Taiwan. For this reason, many Chinese EV makers now plan to produce their own AI microchips and other semiconductor products. These Chinese EV makers include BYD, Geely, Nio, Li Auto, and Xpeng. In the meantime, the Xi administration further plans to spend billions on a domestic chip industry in China.

The U.S. already imposes unreasonably hefty tariffs on Chinese cars: 27.5% tariffs versus only 10% tariffs by the European Union. This special trade barrier may not hold back Chinese EV makers forever, as cheaper EV imports from China remain attractive and competitive for most car lovers in North America, Britain, and Europe. On the flip side, the U.S. Inflation Reduction Act provides huge state subsidies and tax incentives to American-made EVs with batteries and components made on the U.S. homeland. In a practical view, these economic carrots and sticks combine to tilt the delicate balance of power between China and America. Overall, geopolitical tensions between China and the U.S. may thus further complicate the current EV transformation in the global auto industry.

Electrification, software, and autonomous EV services may revolutionize the global auto industry at a faster pace. Many legacy carmakers should reinvent themselves to better cope with intense competition from new EV makers starting from scratch or emerging from China (or both). With better EV software, the new switch is from one-time transaction to lifetime user engagement. Around the world, not all legacy carmakers can manage to survive the modern EV transformation. While scale has become less of an issue for EV makers, many major current EV makers must pay for massive global supply-chain reconfigurations. In light of potential consolidation in the global auto industry, the weaker, smaller EV makers may team up with bigger ones via mergers and acquisitions, joint ventures, or strategic alliances.

Due to the pervasive decline in mass production capacity worldwide, the major EV makers attempt to adjust their cost structures to ensure better sales and profits in due course. Both BYD and Tesla snap at the heels of Audi, BMW, and Mercedes-Benz. In China, Nio and Xpeng and many smaller startups follow suit. In America, the big 3 carmakers, Ford, GM, and Stellantis’s Chrysler, make most of their money selling pickups and thus face new entrants such as Lordstown, Rivian, and Tesla’s Cybertruck. European mid-market carmakers such as Renault and Volvo now face the hardest job of all to fend off the Chinese EV makers in the mass market where competition is fiercest, brand loyalty is lowest, and profit margins are slimmest. For this reason, we expect to see cross-border consolidation in the global auto industry over the next decade.

The road from rickety contraptions of iron and steel to driverless super-computers on wheels still has many twists and turns. EV software technology can cause most upheaval in the global auto industry. The size, reach, and impact of the current EV transformation combine to change personal mobility in due time. Despite the new trade wars and geopolitical tensions between China and America, the arrival of EV makers may help reduce car costs with greater green energy efficiency. As a result, these efficiency gains altogether render EVs more affordable in the long run. New entrants, EV specialists, and many other lean startups from China further force the major carmakers to speed up electrification. Better software features and services enhance the EV user experience through AI-driven infotainment, music, video, and so forth. The journey becomes more important than the destination.

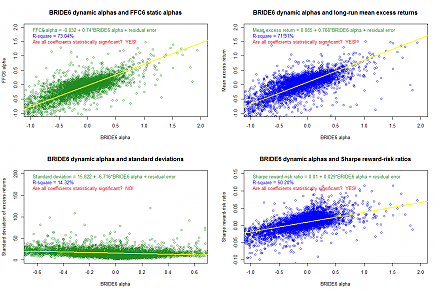

As of mid-2024, we provide our proprietary dynamic conditional alphas for the U.S. top tech titans Meta, Apple, Microsoft, Google, and Amazon (MAMGA). Our unique proprietary alpha stock signals enable both institutional investors and retail traders to better balance their key stock portfolios. This delicate balance helps gauge each alpha, or the supernormal excess stock return to the smart beta stock investment portfolio strategy. This proprietary strategy minimizes beta exposure to size, value, momentum, asset growth, cash operating profitability, and the market risk premium. Our unique proprietary algorithmic system for asset return prediction relies on U.S. trademark and patent protection and enforcement.

Our unique algorithmic system for asset return prediction includes 6 fundamental factors such as size, value, momentum, asset growth, profitability, and market risk exposure.

Our proprietary alpha stock investment model outperforms the major stock market benchmarks such as S&P 500, MSCI, Dow Jones, and Nasdaq. We implement our proprietary alpha investment model for U.S. stock signals. A comprehensive model description is available on our AYA fintech network platform. Our U.S. Patent and Trademark Office (USPTO) patent publication is available on the World Intellectual Property Office (WIPO) official website.

Our core proprietary algorithmic alpha stock investment model estimates long-term abnormal returns for U.S. individual stocks and then ranks these individual stocks in accordance with their dynamic conditional alphas. Most virtual members follow these dynamic conditional alphas or proprietary stock signals to trade U.S. stocks on our AYA fintech network platform. For the recent period from February 2017 to February 2024, our algorithmic alpha stock investment model outperforms the vast majority of global stock market benchmarks such as S&P 500, MSCI USA, MSCI Europe, MSCI World, Dow Jones, and Nasdaq etc.

Andy Yeh

Postdoc Co-Chair

Brass Ring International Density Enterprise (BRIDE) ©

Do you find it difficult to beat the long-term average 11% stock market return?

It took us 20+ years to design a new profitable algorithmic asset investment model and its attendant proprietary software technology with fintech patent protection in 2+ years. AYA fintech network platform serves as everyone’s first aid for his or her personal stock investment portfolio. Our proprietary software technology allows each investor to leverage fintech intelligence and information without exorbitant time commitment. Our dynamic conditional alpha analysis boosts the typical win rate from 70% to 90%+.

Our new alpha model empowers members to be a wiser stock market investor with profitable alpha signals! The proprietary quantitative analysis applies the collective wisdom of Warren Buffett, George Soros, Carl Icahn, Mark Cuban, Tony Robbins, and Nobel Laureates in finance such as Robert Engle, Eugene Fama, Lars Hansen, Robert Lucas, Robert Merton, Edward Prescott, Thomas Sargent, William Sharpe, Robert Shiller, and Christopher Sims.

Follow AYA Analytica financial health memo (FHM) podcast channel on YouTube: https://www.youtube.com/channel/UCvntmnacYyCmVyQ-c_qjyyQ

Follow our Brass Ring Facebook to learn more about the latest financial news and fantastic stock investment ideas: http://www.facebook.com/brassring2013.

Free signup for stock signals: https://ayafintech.network

Mission on profitable signals: https://ayafintech.network/mission.php

Model technical descriptions: https://ayafintech.network/model.php

Blog on stock alpha signals: https://ayafintech.network/blog.php

Freemium base pricing plans: https://ayafintech.network/freemium.php

Signup for periodic updates: https://ayafintech.network/signup.php

Login for freemium benefits: https://ayafintech.network/login.php

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-08-30 11:35:00 Friday ET

The conventional wisdom suggests that chameleons change their skin coloration to camouflage their presence for survival through Darwinian biological evoluti

2018-11-19 09:38:00 Monday ET

The Trump administration mulls over antitrust actions against Amazon, Facebook, and Google. President Trump indicates that the $5 billion fine against Googl

2019-01-10 17:31:00 Thursday ET

The recent Bristol-Myers Squibb acquisition of American Celgene is the $90 billion biggest biotech deal in history. The resultant biopharma goliath would be

2019-01-04 11:41:00 Friday ET

Chinese President Xi JingPing calls President Trump to reach Sino-American trade conflict resolution. Xi sends a congratulatory message to mark 40 years sin

2023-01-03 09:34:00 Tuesday ET

USPTO fintech patent protection and accreditation As of early-January 2023, the U.S. Patent and Trademark Office (USPTO) has approved

2019-03-11 10:32:00 Monday ET

Lyft seeks to go public with a dual-class stock ownership structure that allows the co-founders to retain significant influence over the rideshare tech unic