2022-05-15 10:29:00 Sun ET

stock market corporate finance fama and french graham and harvey david hirshleifer andrei shleifer corporate innovation corporate research and development innovative efficiency market efficiency stock return performance operational performance economic development

Corporate investment can be in the form of real tangible investment or intangible investment. The former concerns real asset expansion through capital expenditures and mergers and acquisitions while the latter involves corporate innovation through research and development (R&D). This literature review focuses on the empirical corporate finance studies on the key implications of R&D intensity for firm performance. The other empirical corporate finance studies on capital expenditures, mergers and acquisitions, and real asset growth flow into the other separate literature reviews. These literature reviews jointly paint a more holistic picture of the empirical facts about corporate investment decisions.

Eberhart, Maxwell, and Siddique (2004) examine a sample of 8,313 cases between 1951 and 2001 where firms unexpectedly increase their R&D expenditures by a significant margin. Both the long-run buy-and-hold portfolio strategies and Fama-French-Carhart (1993, 1996, 1997) time-series regressions show that significantly positive abnormal stock returns follow these R&D increases. Also, there is robust evidence that the same sample firms experience significant improvements in long-run operating performance after the R&D increases. These empirical results reject the null efficient-markets hypothesis and thus suggest that the market is slow to recognize both the nature and extent of R&D increases as valuable investments.

Eberhart, Maxwell, and Siddique (2004) contribute to the behavioral finance literature on investor under-reaction that occurs in response to key corporate events such as SEOs, stock repurchases, and stock splits (e.g. Eberhart and Siddique (2002), Ikenberry, Lakonishok, and Vermaelen (1995, 2000), Ikenberry and Ramnath (2002), and Loughran and Ritter (1995)). This contribution echoes Daniel and Titman’s (2006) thesis that investors tend to underreact to intangible information but not to tangible information. In this sense, R&D increases provide a natural experiment to test the market’s capability to correctly incorporate the intangible content of R&D increases. To the extent that investors underreact to the intangible benefit of R&D increases, significantly positive abnormal stock returns follow these R&D increases up to the 5-year time horizon. In the larger context of a unified theory of gradual news diffusion (e.g. Jegadeesh and Titman (1993, 2001), Hong and Stein (1999), and Hong, Lim, and Stein (2000)), Eberhart, Maxwell, and Siddique’s (2004) study corroborates the behavioral story of investor underreaction to the positive effect of R&D investments on shareholder value.

Although shareholders and bondholders both benefit from an increase in firm value due to an increase in R&D investment, shareholders benefit at the expense of bondholders from a concomitant increase in firm risk because stocks are analogous to call options that bondholders implicitly sell on the underlying firm value. The benefit of an increase in R&D investment to shareholders that some earlier studies report may reveal the effect of a wealth transfer from bondholders to shareholders (Shi, 2003), not any benefit to the entire firm value. Eberhart, Maxwell, and Siddique (2008) gauge R&D investment intensity as the ratio of R&D to sales or R&D to assets and report a positive relationship between these R&D intensity metrics and bond returns. The net effect of higher R&D investment intensity is positive for bondholder value. In fact, the negative nexus between R&D intensity and default risk accords with the recent investment asset pricing conjecture (Berk, Green, and Naik, 1999; Gomes, Kogan, and Zhang, 2003; Carlson, Fisher, and Giammarino, 2004; Zhang, 2005; Cooper, 2006; Li, Livdan, and Zhang, 2009; Liu, Whited, and Zhang, 2009; Anderson and Garcia-Feijoo, 2006). As a firm invests and exercises real growth options via R&D innovation, this investment transforms the real growth options into safer assets in place with steady cash flows. As a result, the firm’s relative risk declines. Nonetheless, Eberhart, Maxwell, and Siddique’s (2008) evidence suggests a positive relation between R&D investment expansion and subsequent stock return. This evidence seems more consistent with the alternative behavioral mispricing hypothesis in contrast to the rational pricing theory.

R&D usually provides strong positive externalities because R&D investment yields benefits that accrue to parties other than the R&D investor (Bernstein and Nadiri, 1988; Jaffe, 1986). Given the positive spill-over effects of R&D investment, Chen, Chen, Liang, and Wang (2014) empirically report that there is a positive relationship between R&D incoming spillovers and firm performance improvements. This nexus indicates that the market does not immediately incorporate positive R&D externalities into stock market valuation. Chen, Chen, Liang, and Wang (2014) attribute this evidence to the behavioral story that many investors underreact to firm-specific increases in R&D investment with both positive long-term abnormal stock returns and operating performance improvements (Eberhart, Maxwell, and Siddique, 2004, 2008).

Chen, Chen, Liang, and Wang (2014) use a stochastic frontier production function to capture R&D spill-overs, which can be estimated as non-negative stochastic random covariates. Firms with high R&D spill-overs tend to recruit more key employees from other firms. Thus, firms that hire more key personnel to take advantage of technical expertise from other firms enjoy higher R&D incoming spillovers.

Chen, Chen, Liang, and Wang (2014) run the Fama-French (1993, 1996) and Carhart (1997) time-series regressions of excess stock returns that the econometrician sorts on R&D incoming spillovers. The mean monthly alpha is 0.67%-1.08% for firms with higher R&D incoming spillovers in comparison to no more than 0.58% for firms with lower R&D incoming spillovers. Thereby, R&D investments are beneficial to other firms, but the market is slow to recognize the full extent of this benefit.

Following the convention of Denis and Sarin (2001), Chan, Ikenberry, and Lee (2004), and Titman, Wei, and Xie (2004), Chen, Chen, Liang, and Wang (2014) examine abnormal stock returns around earnings announcements over the post-R&D-increase 5-year period. The evidence suggests significantly positive earnings-announcement abnormal returns for firms with high incoming spillovers, but this evidence does not hold for firms with low incoming spillovers. Thereby, the long-term stock return outperformance of R&D-intensive firms with high incoming spillovers is unlikely to be driven by benchmark measurement noise (Lyon, Barber, and Tsai, 1999).

Brown, Fazzari, and Petersen (2009) explore whether supply shifts in finance can explain a significant portion of the 1990s R&D boom and subsequent decline. With a firm-level panel dataset of 1,347 high-tech publicly traded firms from 1990 to 2004, Brown, Fazzari, and Petersen (2009) use GMM estimation of dynamic R&D models to find sharp differences in R&D finance when Brown et al split the data into young and mature firms. For mature firms, the point estimates for the financial variables are insignificant. For young firms, the measures of access to internal and external equity finance have significantly positive effects on R&D intensity. The financial effects for the young high-tech firms alone are large enough to explain most of the aggregate R&D cycle in the 1990s. In the larger context of endogenous growth theory, stock markets provide an important source of external finance and in turn contribute to economic growth by directly funding R&D innovation, particularly for young firms.

Brown, Martinsson, and Petersen (2013) analyze the explanatory power of investor protection and access to stock market finance in capturing the variation in long-term R&D intensity. Legal rules and institutions and financial developments affect the availability of external equity finance. This empirical mechanism is particularly important for risky and intangible R&D investments that are not easily financed with debt. Brown, Martinsson, and Petersen’s (2013) empirical study connects both law and finance with firm-level innovative R&D investments that help promote economic growth.

An extensive literature suggests that countries with robust legal protection of minority shareholders have larger and more accessible stock markets (La Porta, Lopez-de-Silanes, and Shleifer, 2006, 2008). Several studies report evidence of a positive relationship between stock market development and broad measures of economic growth (e.g. Levine and Zervos (1998) and Bekaert, Harvey, and Lundblad (2005)). Legal contracting institutions help enhance stock market development (Acemoglu and Johnson, 2005), and also stock market liberalization boosts aggregate productivity (Bekaert, Harvey, and Lundblad, 2011). Access to stock market finance is particularly important for R&D investments because the intangible nature of R&D with little collateral value sharply limits the firm’s ability to use debt. Since creditors share only in downside returns, the design of standard debt contracts does not work well for financing innovative R&D investments that are characterized by a high probability of failure but only some thin chance of extremely large upside returns. Thereby, legal institutions and financial developments that better facilitate access to stock market equity are more important for R&D innovative productivity growth than for tangible capital accumulation.

Brown, Martinsson, and Petersen (2013) use several exogenous instruments for legal origin, enforcement, and anti-self-dealing protection in two-stage least squares (2SLS) regressions of R&D intensity and stock market development (Demirguc-Kunt and Maksimovic, 2002; Beck and Levine, 2005; La Porta, Lopez-de-Silanes, and Shleifer, 1997, 2008). The key interaction term between stock market development and industry dependence on external finance carries a significantly positive coefficient in the small-firm and young-firm subsamples. The R&D differential measure for the interquartile range of industry dependence on external finance is significant at 2% in these subsamples.

Brown, Martinsson, and Petersen’s (2013) evidence suggests that there is a micro-level channel through which stock market development causes economic growth by supplying critical external finance to fund intangible R&D investments (which in turn help spur productivity growth) (e.g. Levine (2005: 870) and Bekaert, Harvey, and Lundblad (2011)). Further, the same evidence suggests a new nexus between legal contracting institutions and innovative R&D activities (the latter of which in turn drive economic growth) (e.g. Acemoglu and Johnson (2005)). This nexus is particularly important when R&D firms are likely to face considerable difficulty in substituting debt for equity. In addition, the interaction between financial development and access to stock market finance matters more for the R&D investment intensity among small and young firms in comparison to large and mature firms (e.g. Beck et al (2008)). In essence, the market-centric system may have a significant advantage in spurring economic growth through a sequence of creative destruction that emerges from the continual innovative R&D investments of small and young firms (e.g. Brown and Petersen (2011)).

Hirshleifer, Hsu, and Li (2013) examine the relation between innovative efficiency and subsequent stock return and operating performance. Hirshleifer et al’s (2013) measures of innovative efficiency reflect a firm’s ability to generate patents and patent citations per dollar of R&D investment. A firm’s recent past innovative efficiency can be less salient to investors than explicitly forward-looking information about the prospects for the particular R&D investment projects that the firm undertakes. For instance, investors devote considerable attention to analyst reports and news articles about the potential outcomes of clinical phase trials conducted by pharmaceutical firms, while the historical performance of R&D efforts receive less media attention. According to Kahneman and Lovallo (1993: 17), people often tend to consider the judgment or decision problem under study as unique and thus neglect the hard statistics of the past when these people evaluate current plans. This rationale suggests that investors may underreact to the economic content of R&D innovative efficiency due to the difficulty that these investors face when they evaluate the quantitative implications of both patents and patent citations. In this case, firms that are more efficient in R&D innovations tend to be undervalued relative to firms that are less efficient in R&D innovations. In turn, the econometrician expects a positive relationship between innovative efficiency and subsequent stock return and operating performance.

Fama-MacBeth (1973) regressions suggest that a higher measure of R&D innovative efficiency predicts significantly higher profitability (i.e. cash flow and return on assets), equity market-to-book, and future stock return performance. Hirshleifer, Hsu, and Li (2013) empirically confirm the view that their metrics of R&D innovative efficiency contain rich and distinct information about future operating performance and market valuation after one takes into account extensive controls such as several other R&D intensity metrics and firm characteristics. As Hirshleifer, Hsu, and Li (2013) sort individual firms into portfolios in terms of their R&D innovative efficiency in the Fama-French (1993, 1996) and Carhart (1997) time-series regressions, the monthly alpha spread between the extreme portfolios with high and low metrics of innovative efficiency is statistically significant and lands in the intermediate range of 0.32% to 0.46%. While this evidence bolsters the explanatory role of innovative efficiency in capturing the variation in stock portfolio excess returns, the return spread between the high and low innovative efficiency portfolios does not serve as a valid and significant risk factor in the Fama-French (1993, 1996), Cahart (1997), and Chen-Novy-Marx-Zhang (2011) asset pricing models.

If the relation between innovative efficiency and future stock return performance represents the existence of market inefficiency that arises from psychological constraints such as limited attention and investor underreaction, one expects to see greater return predictability among stocks with low investor attention. To test this hypothesis, Hirshleifer, Hsu, and Li (2013) use size and analyst coverage as proxies for media attention to an individual stock (Hong, Lim, and Stein, 2000) and firm age, turnover, and idiosyncratic volatility as proxies for stock valuation uncertainty (Kumar, 2009). Fama-MacBeth regressions suggest a greater impact of innovative efficiency on subsequent stock return performance among firms with small capitalization, low analyst coverage, young firm age, high turnover, and high idiosyncratic volatility. In summary, the preponderance of the above results points to the conjecture that the mispricing factor partly helps explain the innovative efficiency phenomenon: there is commonality in stock price discrepancies that reflect differences in R&D innovative efficiency. This commonality can arise from a propensity for investors to fail to fully impound news about the technological shifts in innovative efficiency. Overall, this mispricing commonality resonates with the crux of canonical behavioral asset pricing models (Daniel, Hirshleifer, and Subrahmanyam, 2001; Barberis and Shleifer, 2003).

This analytic essay cannot constitute any form of financial advice, analyst opinion, recommendation, or endorsement. We refrain from engaging in financial advisory services, and we seek to offer our analytic insights into the latest economic trends, stock market topics, investment memes, personal finance tools, and other self-help inspirations. Our proprietary alpha investment algorithmic system helps enrich our AYA fintech network platform as a new social community for stock market investors: https://ayafintech.network.

We share and circulate these informative posts and essays with hyperlinks through our blogs, podcasts, emails, social media channels, and patent specifications. Our goal is to help promote better financial literacy, inclusion, and freedom of the global general public. While we make a conscious effort to optimize our global reach, this optimization retains our current focus on the American stock market.

This free ebook, AYA Analytica, shares new economic insights, investment memes, and stock portfolio strategies through both blog posts and patent specifications on our AYA fintech network platform. AYA fintech network platform is every investor's social toolkit for profitable investment management. We can help empower stock market investors through technology, education, and social integration.

We hope you enjoy the substantive content of this essay! AYA!

Andy Yeh

Chief Financial Architect (CFA) and Financial Risk Manager (FRM)

Brass Ring International Density Enterprise (BRIDE) ©

Do you find it difficult to beat the long-term average 11% stock market return?

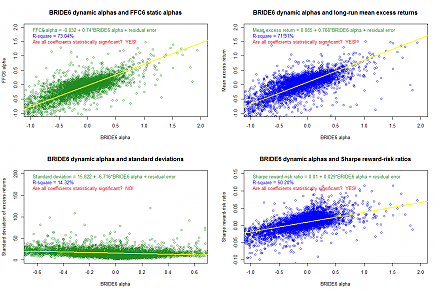

It took us 20+ years to design a new profitable algorithmic asset investment model and its attendant proprietary software technology with fintech patent protection in 2+ years. AYA fintech network platform serves as everyone's first aid for his or her personal stock investment portfolio. Our proprietary software technology allows each investor to leverage fintech intelligence and information without exorbitant time commitment. Our dynamic conditional alpha analysis boosts the typical win rate from 70% to 90%+.

Our new alpha model empowers members to be a wiser stock market investor with profitable alpha signals! The proprietary quantitative analysis applies the collective wisdom of Warren Buffett, George Soros, Carl Icahn, Mark Cuban, Tony Robbins, and Nobel Laureates in finance such as Robert Engle, Eugene Fama, Lars Hansen, Robert Lucas, Robert Merton, Edward Prescott, Thomas Sargent, William Sharpe, Robert Shiller, and Christopher Sims.

Follow our Brass Ring Facebook to learn more about the latest financial news and fantastic stock investment ideas: http://www.facebook.com/brassring2013.

Follow AYA Analytica financial health memo (FHM) podcast channel on YouTube: https://www.youtube.com/channel/UCvntmnacYyCmVyQ-c_qjyyQ

Free signup for stock signals: https://ayafintech.network

Mission on profitable signals: https://ayafintech.network/mission.php

Model technical descriptions: https://ayafintech.network/model.php

Blog on stock alpha signals: https://ayafintech.network/blog.php

Freemium base pricing plans: https://ayafintech.network/freemium.php

Signup for periodic updates: https://ayafintech.network/signup.php

Login for freemium benefits: https://ayafintech.network/login.php

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-11-23 08:33:00 Saturday ET

MIT financial economist Simon Johnson rethinks capitalism with better key market incentives. Johnson refers to the recent Business Roundtable CEO statement

2019-01-05 11:39:00 Saturday ET

Reuters polls show that most Americans blame President Trump for the recent U.S. government shutdown. President Trump remains adamant about having to shut d

2018-01-21 07:25:00 Sunday ET

As he refrains from using the memorable phrase *irrational exuberance* to assess bullish investor sentiments, former Fed chairman Alan Greenspan discerns as

2023-01-03 09:34:00 Tuesday ET

USPTO fintech patent protection and accreditation As of early-January 2023, the U.S. Patent and Trademark Office (USPTO) has approved

2017-01-17 12:42:00 Tuesday ET

Former Treasury Secretary and Harvard President Larry Summers critiques that the Trump administration's generous tax holiday for American multinational

2017-11-17 09:42:00 Friday ET

The Trump administration garners congressional support from both Senate and the House of Representatives to pass the $1.5 trillion tax overhaul (Tax Cuts &a