2024-05-27 03:23:34 Mon ET

stock market monetary policy inflation interest rate health care regulation compliance federal reserve system medicine medicare competitive advantage economic inequality social safety net insurance metlife voya new york life globe life allianz life massmutual financial group

We review and analyze the recent market share data in the U.S. life insurance industry. Our analysis shines light on the mainstream competitive advantages and industry rotation trends among U.S. life insurers. We remain cautious toward the long-term fundamental outlook for U.S. life insurers, but we are constructive on some individual stocks in light of the next wave of dovish interest rate pivots by the Federal Reserve System from mid-2024 to 2029. Recent actuarial studies show that climate change has recently caused significant increases in both the severity and frequency of rare disasters. Specifically, these disasters have become more severe and less rare due to extreme weather hazards. In summary, these disasters include floods, droughts, earthquakes, cyclones, typhoons, wildfires, heatwaves, storms, hurricanes, landslides, tornadoes, tsunamis, pandemic outbreaks, and even volcanic eruptions. Unless the major lifer insurers gradually and steadily raise their annuity premiums over the next few decades, these insurers would probably confront the new reality that their annuity premiums cannot completely cover extreme losses due to these climate hazards in the long run.

Over the next couple of decades, we can expect the major life insurers to experience modest returns on equity (ROE), slow sales growth rates, and relatively volatile profits, primarily due to higher hidden tail risk in legacy liabilities. However, the current macro backdrop continues to be relatively favorable with strong and solid stock market performance and asset market valuation in light of high interest rates near the recent peak of 5.25% to 5.5%. Despite recent concerns about midsize bank failures and higher delinquencies in the commercial real estate market, the fundamental prospects for some life insurers remain healthy and robust. Further, some life insurers may choose to continue their stock buyback programs (albeit at a slower pace). Overall, we are more upbeat about some lifer insurers with less risky legacy liabilities and strong and robust fortress balance sheets, such as Globe Life (GL), MetLife (MET), and Voya Financial Group (VOYA). At the same time, we would avoid high-beta life insurers with less common stock capital flexibility. These life insurers include Brighthouse Financial Group (BHF) and Lincoln National Corporation (LNC). For all practical purposes, our fundamental analysis focuses on the mainstream competitive advantages and market niches in the major life insurers. Specifically, we rank the top 25 life insurers in terms of their respective annuity premiums per year. These top 25 core life insurers account for more than 95% of total sales across the life insurance industry with $377 billion to $453 billion annual sales (life insurance premiums) as of May 2024. Some of the major life insurers remain private mutual investment companies, but not public corporations with liquid tradable stocks on NYSE, NASDAQ, and AMEX.

We expect the current decade of healthy stock market performance to boost both fees and assets under management for variable annuities, index annuities, longer-term care products, retirement plans, pension products, and many other asset management businesses for the top 25 major life insurers. As of mid-2024, high interest rates bode well for core profit margins in interest spread products such as index annuities, group insurance products, and interest-driven funding agreements for some of the major U.S. life insurers. Until the Federal Reserve System curtails inflation down to the long-run average inflation target of 2% to launch dovish interest rate pivots, the current real business cycle helps reduce the risk of reserve charges for all life insurers. In addition, this current cycle should help improve sales and profits in life insurance products that rely heavily on interest spreads between the prime interest rate and the federal funds rate over the Treasury term structure of interest rates. In this fundamental view, institutional investors would probably focus on the unique asset portfolios and capital levels for the major life insurers. We expect the major life insurers to experience substantially better common equity capital positions in the next few years, due to positive statutory income, modest credit asset impairment, and lower economic policy uncertainty in the current macro environment of strong and solid stock market performance with relatively high interest rates. The vast majority of life insurers attempt to derisk their legacy liabilities by shifting their sales targets toward interest-sensitive life insurance products. Also, these life insurers accelerate selling their runoff liabilities to shift focus away from life insurance products with guarantees and macro tailwinds. As these life insurers rotate their asset portfolios and capital levels, the consensus view seems to be the widespread medium-term anticipation of gradual rate cuts from mid-2024 or late-2024 to 2029. In this positive light, these major life insurers emphasize higher policy premiums and net profit margins over sales growth rates in the current decade.

We can expect the major life insurers to sustain low-double-digit returns on equity (ROE) in the reasonable range of 12% to 15% in the next few years. Given the ubiquitous use of stock buyback programs, the actual ROEs would probably be high-single-digit percentage points in the more realistic range of 8% to 10%. These near-term ROE adjustments are only slightly above the average cost of capital across the broader life insurance industry. In addition, we are wary of hidden tail risk in legacy liabilities for long-term care products, variable annuities, and universal life insurance blocks. New costs and charges from universal life for secondary guarantees (ULSG) may constrain common stock capital flexibility for several insurers, such as Allianz Life, Lincoln National Corporation (LNC), Prudential Financial Group (PRU), and Brighthouse Financial Group (BHF).

As of May 2024, the top 25 group of major life insurers now trades in the low target range of 0.95 to 1.15 times total book value with some AOCI accounting adjustments (although some of these life insurers are non-public, private mutual investment companies). Further, the P/E ratio for the same group of life insurers hovers from 7.5 to 9.3 in recent years. In fact, these life insurers trade at hefty historical discounts to the property and casualty (P&C) sector, the broader asset management industry, and the overall U.S. stock market. Investor sentiments are relatively negative on many life insurers due to the pervasive concerns about commercial real estate delinquencies, recent bank failures, and relatively high interest rates. In summary, our top pick for life insurance is Voya Financial Group (VOYA), and we continue to be bullish on Globe Life (GL), MetLife (MET), and New York Life. Across the rest of the life insurance industry, we remain cautious about Brighthouse Financial Group (BHF) and Lincoln National Corporation (LNC).

Many life insurers experience low to modest returns on equity (ROE) and sales growth rates due to intense competition from new entrants. Alternative asset managers act as cash cows to back these new entrants in the life insurance market. In recent decades, many life insurers have raised product prices and premiums due to near-zero or low interest rates, higher costs for financial hedges (especially for variable annuities), mispricing errors (for longer-term care insurance contracts), and higher costs of financial reserves (for both universal and term life insurance contracts). In the unique market for 401(k) retirement plans and pension products, fees have steadily declined in recent years, especially for the Baby-Boomers and Joneses. Post-Covid, the major life insurers regard the pandemic crisis as a rare standalone disaster with no semblance to climate disasters.

We maintain a negative long-term outlook for variable annuities in the broader life insurance industry. Variable annuities are likely to generate relatively low returns on equity (ROE) after proper risk adjustments. In recent years, the total sales for variable annuities have declined steadily to only $81 billion per year. This target level of total sales is about half of total sales for variable annuities about a decade ago. In our fundamental view, the secular sales decline arises from life insurance price hikes, benefit reductions, significantly lower churn rates, and a lesser emphasis on variable annuities by many life insurers. Traditional insurance products such as variable annuities and long-term health care insurance contracts have been hurt by the greater appeal of alternative index annuities. Slow sales growth and the complete runoff of legacy blocks should further drive outflows in the overall market for variable annuities for the foreseeable future. Alternatively, the total sales for index annuities have grown at a brisk pace, and we can expect this sales momentum to continue in the next few years, especially for the major life insurers that specialize in attracting interest spreads in index annuities over the current decade. In addition, the market for variable annuities would witness fresh intense competition from new 401(k) retirement plans and pension products under the Setting Every Community Up for Retirement Enhancement (SECURE) Act of May 2019. Under this brand-new legislation, American small business owners can set up cost-effective safe-harbor 401(k) retirement plans, and many part-time workers are eligible to participate in 401(k) retirement plans (well up to the new retirement age of 72 years old). For many legacy variable annuities, the major life insurers may prioritize policy premiums and profit margins over market shares and sales in the current decade.

In our fundamental view, the vast majority of variable annuities would likely generate weaker returns on equity (ROE) (after we make proper risk adjustments for financial hedges, hedge imperfections, and balance sheet charges). The procyclical nature of variable annuities acts as another major risk as their total sales can only improve after strong and solid stock market performance with significantly lower future ROEs. To the extent that these ROEs may match the bare minimum average cost of capital for the major life insurers, variable annuities may or may not produce rock-solid sales, profits, and returns for the foreseeable future.

Still, higher interest rates bode well for the risk profile of legacy variable annuities. In addition, some divestitures of legacy blocks by Equitable Financial Group (EQH), Prudential Financial Group (PRU), American International Group (AIG), Manulife Financial Corporation (MFC), and Voya Financial Group (VOYA) suggest a higher tendency for third-parties to take on this unique risk of variable annuities (albeit at low market values). Among the major life insurers, Jackson (JXN), Brighthouse (BHF), and Lincoln National Corporation (LNC) have the largest exposure to traditional variable annuities (each with at least 50% to 83% of net profits from the total sales of variable annuities).

We can now expect the total sales for index annuities to grow by 20% to 25% per annum in the next few years. As of May 2024, more than 75% of index annuities arise from origination efforts by independent agents who confront the greatest exposure to the life insurance sales suitability standards and fiduciary standards for index annuities. In reality, the total sales for index annuities have grown to more than $80 billion in early-2024 (from only $30 billion back in 2009 or about 15 years ago). Overall, we now regard new entrants, product features, and additional distribution channels through banks and insurers as the major fundamental drivers of further sales growth for index annuities. The major extant market competitors include both traditional insurers, Symetra, Pacific Life, Nationwide, and Jackson (JXN), and fintech firms with financial support from alternative asset managers, Athene (ATH), Security Benefit, FGL, and Global Atlantic Financial Corporation (KKR). The latter fintech firms view the market for index annuities as a fundamentally new source of investable assets. While these recent new entrants have taken significant market shares from the incumbent life insurers, the resultant greater awareness of index annuities among bank distributors and consumers has led to an expansion of the increasingly vital market for index annuities.

However, there are still several potential tailwinds for further growth in the extant market for index annuities. These tailwinds include an ageing population in America, strong consumer interest in both lifetime income and principal protection, and intense competition from banks, broker-dealers, and many other life insurers (all of which can serve as alternative distribution channels for index annuities). In recent years, some of these major life insurers have chosen to sweeten sales for index annuities by partially reducing relatively high sales commissions, surrender charges, and surrender periods. Moreover, several states have imposed harsher regulations on the mainstream product features for index annuities. Specifically, these states have set the maximum surrender charge at the 10% upper bound and maximum surrender charge period to 10 years. In response, many banks, broker-dealers, and life insurers have started selling index annuities with substantially shorter surrender periods.

As of May 2024, some of the major life insurers face the greatest exposure to index annuities. The life insurers compete vigorously with one another with more attractive product features. In a nutshell, these life insurers include Athene (ATH), Jackson (JXN), MassMutual Financial Group (MCI), Security Benefit, and Global Atlantic Financial Corporation (KKR). In the next few years, we can expect the total sales for index annuities to substantially surpass the total sales for variable annuities, especially as the former overtake the latter in due course. The broader macro backdrop seems to support this gradual transition in the life insurance sector. After all, index annuities almost always ensure better lifetime income and principal protection than some other traditional life insurance products such as variable annuities and long-term care contracts, especially as both the U.S. real economy and stock market survive and thrive through boom-bust fluctuations in the next couple decades.

In recent years, the pandemic shelter-in-place mandates have hurt total sales for universal life insurance policies. Over the longer run, these individual life insurance contracts are likely to grow at a modest and sluggish pace in light of the increasingly vital proportion of protection bought through group life insurance plans at the workplace. At the same time, the major life insurers still struggle to penetrate the mid-to-low-income social strata. Tighter underwriting standards further impact sales for universal life insurance policies.

However, higher individual and estate taxes would help boost broader demand for individual life insurance contracts for the legal, legitimate, and practical purposes of tax avoidance. In the current macro environment, both universal life insurance sales and volumes can benefit substantially from relatively high interest rates. In recent years, the total sales for individual life insurance contracts have arisen to almost $135 billion to $150 billion per year.

In our fundamental view, the individual life insurance business would likely generate returns on equity (ROE) in the reasonable range of 8% to 10% per annum. In fact, these ROEs are only slightly above the average cost of capital across the broader life insurance sector. This inevitable financial outcome may have arisen from product commoditization and competition from mutual investment companies with lower return targets. In recent years, many of these major life insurers have chosen to focus on better net profit margins near the pre-pandemic levels of 20% to 25%, especially when their ROEs have substantially declined to low-to-mid single-digit percentage points (or slightly above the average cost of capital). New accounting adjustments should further help smooth lifetime income and principal protection for universal life insurance contracts in the current couple decades. For traditional individual life insurance contracts, we can expect their profit margins to exhibit greater volatility because many of the major life insurers have raised retention rates due to higher reinsurance prices.

After all, universal life insurance contracts continue to be one of the most popular individual life insurance products sold by several public life insurers. These insurers include Prudential Financial Group (PRU), MetLife (MET), Jackson (JXN), American International Group (AIG), and Lincoln National Corporation (LNC). Universal life insurance contracts represent almost 33% to 37% of total sales for these public life insurers. In light of the next declines in Covid infections and deaths, individual life insurance profit margins are likely to improve in the next few years. As of early-2024, Worldometer places U.S. Covid deaths at approximately 12,000 per annum. This ballpark figure shows a sharp decline from 35,000 deaths in the first quarter of 2023. All-cause mortality remains higher than pre-pandemic levels. U.S. CDC data show approximately 3.45 million deaths from April 2023 to March 2024. In light of these summary statistics, Americans still need universal life insurance coverage very much. As a result, we can expect broad demand for individual life insurance contracts to persist in the next couple decades. Several life insurers benefit substantially for this persistent macro trend, especially when universal life insurance contracts often represent more than one third of annual sales. These major life insurers would choose to jump on the bandwagon in the post-pandemic era as their sales efforts come to fruition in time.

We can expect group life insurance sales to grow at mid-single-digit percentages per annum in the current decade. With relatively high wage inflation, the strong labor market serves as a key contributor to the recent group insurance sales growth. However, a potential uptick in unemployment remains a fundamental concern. The profit margins for supplemental group insurance sales for dental care, vision, and accident and health (A&H) are likely to be healthy too, but these supplemental sales may eventually revert to the pre-pandemic levels as post-Covid group insurance usage declines in due course. In the next couple decades, the group life insurance market would probably expand further due to new sales growth in the voluntary segments as employers increasingly shift more benefit costs to employees. In addition, one would expect to see normal and rational competition in the group life insurance business. In recent years, several landmark M&A deals appear to boost market power and concentration in the life insurance sector. These M&A deals include New York Life’s acquisition of Cigna’s group life insurance business, HIG’s acquisition of Aetna’s group insurance operations, and Lincoln National Corporation’s (LNC) acquisition of Liberty Mutual group insurance business. We can expect to see further consolidation in this group life insurance market over the longer run, but there are now more cash-cow buyers than keen sellers these days.

The current fundamental outlook for long-term health care insurance is negative. We expect long-run care insurance plans to generate subpar sales and profits with significant recurrent charges over time. The immediate adverse impact of Covid is tragic on the older population. However, this chain reaction has helped boost the net profit margins for long-run health care insurance plans due to early policy terminations through premature deaths. Also, people are rather hesitant to visit nursing homes due to fears of Covid infections in the pandemic period. From early-2023 to mid-2024, the margin lift from Covid continues to wane for long-run care insurance contracts. As of May 2024, the major life insurers retain relatively low reserves for long-term care insurance plans, and the profit margins for long-run care are likely to remain lackluster. Although an ageing population and the increasingly higher costs of medicine both bode well in support of demand for long-term health care insurance plans, the higher costs of coverage can cause downward pressure on new sales for the long-run care business. In addition, some life insurers have chosen to retrench from this market, and there is poor mass market distribution support for long-term health care insurance these days. The vast majority of low-to-mid-income residents with the greatest need for coverage cannot afford these long-term health care insurance plans, whereas, the richer individuals who can afford these long-term care insurance plans often choose to self-insure with tax credits and incentives in more cost-effective ways.

For many life insurers, adding long-term care riders to their extant life insurance policies can help mitigate mortality risk with lower costs of insurance coverage. Life insurance products with long-term care riders can further help address the long prevalent policyholder concerns about paying expensive premiums on standalone long-term health care insurance plans. In comparison to older legacy blocks, the recently sold long-term care insurance plans are less risky. However, we remain wary of poor profit margins and recurrent charges in those legacy blocks. Both sales and profits for long-term health care insurance continue to face downward pressure from the macro trends of negative claims due to health care inflation and an overall increase in life expectancy. In light of negative investor sentiments about long-term care life insurance, the major life insurers would probably further rotate their current asset portfolios toward index annuities and universal life insurance contracts for better premiums and profits, despite subpar sales growth over time. As of March 2024, MassMutual Financial Corporation (MFC), MetLife (MET), and Prudential Financial Group (PRU) have chosen to cease selling long-term care insurance plans altogether.

With relatively high wage inflation, the strong labor market lifts employee deferrals, employer matches, and net flows in support of fees and profits for 401(k) retirement plans and pension products in the next couple decades. Under the Setting Every Community Up for Retirement Enhancement (SECURE) Act of May 2019, the retirement reforms drive sales growth at the smaller end of the mass market for 401(k) retirement plans and pension products. Moreover, these retirement reforms further encourage the increasingly popular use of both index funds and annuities inside 401(k) retirement plans. The recent retirement of both Baby-Boomers and Joneses should suppress sales growth in the mass market for 401(k) retirement plans as most retirees roll over all assets under management (AUM) from their 401(k) retirement plans to individual retirement accounts (IRA). The major life insurers are probably not in the best competitive positions to weather this new rollover storm, as many asset managers and broker-dealers capture these rollover assets with better retail investment platforms, stronger brands, and a wider variety of investment options. In a fundamental view, fee compression and other negative secular macro trends should drive ongoing margin pressure in the 401(k) business.

We can expect the pension risk transfer market to grow at a fast and strong pace over time. Higher interest rates and recent stock market gains have significantly improved the current funding positions for pension plans. These macro trends should provide fresh incentives for corporations to derisk their pension liabilities. In recent quarters, we witness several sizable pension closeout deals in America and Europe. These deals include the recent joint venture transaction with IBM between MetLife (MET) and Prudential Financial Group (PRU), the use of longevity risk transfer swaps between Prudential Financial Group (PRU) and Reinsurance Group of America (RGA) in Europe, and the new pension risk transfer between Athene (ATH) and MetLife (MET) in both America and Europe.

Covid has been a major headwind for life reinsurance profit margins in recent years. As the pandemic crisis recedes in recent quarters, many life reinsurance contracts return to healthy profitability again. The total sales for life reinsurance contracts are likely to grow at a modest pace of 3%-5% per annum. Cession rates recover the reasonable range of 30% to 33% from the low range of 20% to 25% back in 2015. These cession rates remain well below the all-time peak of 60% in the early-2000s. For life reinsurance contracts, these cession rates are not likely to rise significantly from the current levels. As a result, life reinsurance sales growth depends more on business volumes in the primary life insurance market.

Several fundamental factors may impact cession rates for life reinsurance contracts. These factors include higher reinsurance prices, less demand for capital-intensive reinsurance due to stronger primary company balance sheets, and the desire of primary life insurers to retain more mortality risk in support of more diverse legacy liabilities. In Britain, Europe, and North America, more stringent global capital standards, such as Basel III and Solvency II, are likely to heighten broad demand for reinsurance as both banks and insurers divest, reinsure, and retire capital-intensive legacy liabilities.

This analytic essay cannot constitute any form of financial advice, analyst opinion, recommendation, or endorsement. We refrain from engaging in financial advisory services, and we seek to offer our analytic insights into the latest economic trends, stock market topics, investment memes, personal finance tools, and other self-help inspirations. Our proprietary alpha investment algorithmic system helps enrich our AYA fintech network platform as a new social community for stock market investors: https://ayafintech.network.

We share and circulate these informative posts and essays with hyperlinks through our blogs, podcasts, emails, social media channels, and patent specifications. Our goal is to help promote better financial literacy, inclusion, and freedom of the global general public. While we make a conscious effort to optimize our global reach, this optimization retains our current focus on the American stock market.

This free ebook, AYA Analytica, shares new economic insights, investment memes, and stock portfolio strategies through both blog posts and patent specifications on our AYA fintech network platform. AYA fintech network platform is every investor's social toolkit for profitable investment management. We can help empower stock market investors through technology, education, and social integration.

We hope you enjoy the substantive content of this essay! AYA!

Andy Yeh

Postdoc Co-Chair

Brass Ring International Density Enterprise (BRIDE) ©

Do you find it difficult to beat the long-term average 11% stock market return?

It took us 20+ years to design a new profitable algorithmic asset investment model and its attendant proprietary software technology with fintech patent protection in 2+ years. AYA fintech network platform serves as everyone's first aid for his or her personal stock investment portfolio. Our proprietary software technology allows each investor to leverage fintech intelligence and information without exorbitant time commitment. Our dynamic conditional alpha analysis boosts the typical win rate from 70% to 90%+.

Our new alpha model empowers members to be a wiser stock market investor with profitable alpha signals! The proprietary quantitative analysis applies the collective wisdom of Warren Buffett, George Soros, Carl Icahn, Mark Cuban, Tony Robbins, and Nobel Laureates in finance such as Robert Engle, Eugene Fama, Lars Hansen, Robert Lucas, Robert Merton, Edward Prescott, Thomas Sargent, William Sharpe, Robert Shiller, and Christopher Sims.

Free signup for stock signals: https://ayafintech.network

Mission on profitable signals: https://ayafintech.network/mission.php

Model technical descriptions: https://ayafintech.network/model.php

Blog on stock alpha signals: https://ayafintech.network/blog.php

Freemium base pricing plans: https://ayafintech.network/freemium.php

Signup for periodic updates: https://ayafintech.network/signup.php

Login for freemium benefits: https://ayafintech.network/login.php

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-05-23 10:33:00 Thursday ET

Berkeley professor and economist Barry Eichengreen reconciles the nominal and real interest rates to argue in favor of greater fiscal deficits. French econo

2019-02-09 08:33:00 Saturday ET

Apple provides positive forward guidance on both revenue and profit forecasts for iPhones, iPads, and MacBooks. In the Christmas 2018 festive season, MacBoo

2018-03-09 08:33:00 Friday ET

David Solomon succeeds Lloyd Blankfein as the new CEO of Goldman Sachs. Unlike his predecessors Lloyd Blankfein and Gary Cohn, Solomon has been an investmen

2018-08-13 12:39:00 Monday ET

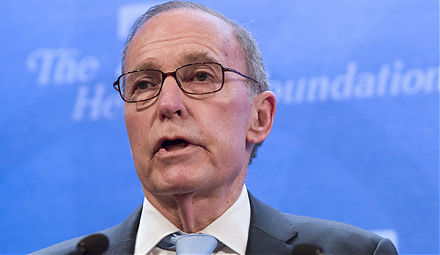

White House chief economic adviser Larry Kudlow points out that the recent U.S. dollar strength shows a clear sign of investor confidence and optimism. Gree

2018-06-17 10:35:00 Sunday ET

In the past decades, capital market liberalization and globalization have combined to connect global financial markets to allow an ocean of money to flow th

2019-05-30 16:44:00 Thursday ET

AYA Analytica finbuzz podcast channel on YouTube May 2019 In this podcast, we discuss several topical issues as of May 2019: (1) Our proprietary alp