2022-10-05 08:24:00 Wed ET

corporate finance corporate cash management cash-to-assets ratio internal capital market precautionary motive agency theory managerial entrenchment excess cash utilization offshore tax avoidance liquidity risk refinancing risk internal capital allocation corporate diversification rene stulz jarrad harford

Bates, Kahle, and Stulz (JF 2009) empirically find that public firms have doubled their cash reservoirs due to both more volatile cash flows and larger risky R&D expenditures in recent decades. This substantial increase in precautionary cash-to-assets intensity is primarily due to an increase in cash flow volatility and idiosyncratic risk (Keynes, 1936; Opler, Pinkowitz, Stulz, and Williamson, JF 1999; Campbell, Lettau, Malkiel, and Xu, JF 2001; Almeida, Campello, and Weisbach, JF 2004; Acharya, Almeida, and Campello, JFI 2006; Riddick and Whited, JF 2009). Share issuance has become a dominant source of external finance for firms with precautionary motives due to large risky R&D cash outlays and volatile cash flows (McLean, JFE 2011).

The agency conflict of interest between corporate incumbents and shareholders affects the typical firm's propensity to stockpile cash reserves (Jensen and Meckling, AER 1976; Jensen, AER 1986; Stulz, JFE 1990; Lang, Stulz, and Walkling, JFE 1991; Harford, JF 1999; Pinkowitz, Stulz, and Williamson, JF 2006). This agency theory predicts that corporate incumbents prefer to stockpile free cash flows for better private benefits of control rather than disgorge cash to outside shareholders. Shareholders assign a lower marginal value to an additional dollar of cash when agency problems are likely to be more severe (Dittmar and Mahrt-Smith, JFE 2007). Cross-country evidence further lends credence to the agency prediction that weaker shareholder rights correlate with larger cash stockpiles (Dittmar, Marhrt-Smith, and Servaes, JFQA 2003). Harford, Mansi, and Maxwell (JFE 2008) find evidence in support of the alternative spending hypothesis that corporate incumbents often spend cash quickly on M&A and capital overinvestments. Firms with weaker managerial governance and lower incumbent stock ownership also tend to repurchase stock rather than increase dividend payout. This tendency reflects a lack of firm commitment to regular and smooth dividend payout in the future (Fama and French, JFE 2001, JFE 2004; DeAngelo, DeAngelo, and Skinner, JFE 2004; Skinner, JFE 2008; Leary and Michaely, RFS 2011; Michaely and Roberts, RFS 2011). Harford, Mansi, and Maxwell's (JFE 2008) empirical analysis serves as an ingenious resurrection of the agency explanation for corporate cash management. Gao, Harford, and Li (JFE 2013) find that relative to public firms, private firms face less severe agency conflict, lower leverage, and better investment efficiency (in terms of greater ROA and R&D intensity). This agency difference helps explain why on average private firms retain about half as much cash as public firms do. Also, private firms adjust their cash ratios toward the target ratios faster than public firms do.

Harford, Klasa, and Maxwell (JF 2014) suggest that cash reserves allow a firm to mitigate the adverse effects of debt refinancing risk. Because debt exerts a disciplinary effect on the agency costs of large cash stockpiles (Jensen, AER 1986; Stulz, JFE 1990; Harford, JF 1999; Dittmar and Mahrt-Smith, JFE 2007; Harford, Mansi, and Maxwell, JFE 2008), it is important for the econometrician to account for the potential endogeneity of both corporate cash retention and debt maturity. The econometrician applies a simultaneous-equations framework with a host of control variables to find that a decrease in debt maturity leads the firm to retain more cash to counteract potential refinancing risk.

Following Almeida, Campello, and Weisbach (JF 2004), the econometrician regresses changes in cash-to-assets on cash-flow-to-assets and several control variables (cf. the cash flow sensitivity of cash). Firms that land in the top quintile of long-term debt due in 3 years save 5 cents out of each dollar of cash flow in comparison to only 3 cents for the average firm. This evidence corroborates the proposition that firms save more cash out of their cash flows in order to mitigate potential refinancing risk.

Following Faulkender and Wang (JF 2006), the econometrician regresses firm value changes on cash-to-assets and several control variables. Firms with high debt refinancing risk face a $1.14 marginal value of each incremental dollar of cash in comparison to a marginal cash value of only $0.89 for the average firm. These respective figures increase to $1.37 and $1.03 during tight credit years of the global financial crisis 2008-2009. Firms with high debt refinancing risk thus face a higher marginal value of cash, especially when these firms face greater financial-constraints risk.

Harford, Klasa, and Maxwell (JF 2014) find that the secular increase in the proportion of long-term debt due in 3 years helps explain nearly 30% of the increase in cash-to-assets intensity from 1980 to 2006. This increase is about 32% of the secular 90% upward trend in cash-to-assets intensity from 8.5% to 16.2% for the median firm (Bates, Kahle, and Stulz, JF 2009). While the agency prediction is valid to some extent, nowadays many firms retain more cash primarily due to precautionary concerns in light of potential debt refinancing risk.

This analytic essay cannot constitute any form of financial advice, analyst opinion, recommendation, or endorsement. We refrain from engaging in financial advisory services, and we seek to offer our analytic insights into the latest economic trends, stock market topics, investment memes, personal finance tools, and other self-help inspirations. Our proprietary alpha investment algorithmic system helps enrich our AYA fintech network platform as a new social community for stock market investors: https://ayafintech.network.

We share and circulate these informative posts and essays with hyperlinks through our blogs, podcasts, emails, social media channels, and patent specifications. Our goal is to help promote better financial literacy, inclusion, and freedom of the global general public. While we make a conscious effort to optimize our global reach, this optimization retains our current focus on the American stock market.

This free ebook, AYA Analytica, shares new economic insights, investment memes, and stock portfolio strategies through both blog posts and patent specifications on our AYA fintech network platform. AYA fintech network platform is every investor's social toolkit for profitable investment management. We can help empower stock market investors through technology, education, and social integration.

We hope you enjoy the substantive content of this essay! AYA!

Andy Yeh

Chief Financial Architect (CFA) and Financial Risk Manager (FRM)

Brass Ring International Density Enterprise (BRIDE) ©

Do you find it difficult to beat the long-term average 11% stock market return?

It took us 20+ years to design a new profitable algorithmic asset investment model and its attendant proprietary software technology with fintech patent protection in 2+ years. AYA fintech network platform serves as everyone's first aid for his or her personal stock investment portfolio. Our proprietary software technology allows each investor to leverage fintech intelligence and information without exorbitant time commitment. Our dynamic conditional alpha analysis boosts the typical win rate from 70% to 90%+.

Our new alpha model empowers members to be a wiser stock market investor with profitable alpha signals! The proprietary quantitative analysis applies the collective wisdom of Warren Buffett, George Soros, Carl Icahn, Mark Cuban, Tony Robbins, and Nobel Laureates in finance such as Robert Engle, Eugene Fama, Lars Hansen, Robert Lucas, Robert Merton, Edward Prescott, Thomas Sargent, William Sharpe, Robert Shiller, and Christopher Sims.

Follow our Brass Ring Facebook to learn more about the latest financial news and fantastic stock investment ideas: http://www.facebook.com/brassring2013.

Follow AYA Analytica financial health memo (FHM) podcast channel on YouTube: https://www.youtube.com/channel/UCvntmnacYyCmVyQ-c_qjyyQ

Free signup for stock signals: https://ayafintech.network

Mission on profitable signals: https://ayafintech.network/mission.php

Model technical descriptions: https://ayafintech.network/model.php

Blog on stock alpha signals: https://ayafintech.network/blog.php

Freemium base pricing plans: https://ayafintech.network/freemium.php

Signup for periodic updates: https://ayafintech.network/signup.php

Login for freemium benefits: https://ayafintech.network/login.php

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-02-03 13:39:00 Sunday ET

It can be practical for the U.S. to impose the 2% wealth tax on the rich. Democratic Senator Elizabeth Warren proposes a 2% wealth tax on the richest Americ

2018-01-10 08:40:00 Wednesday ET

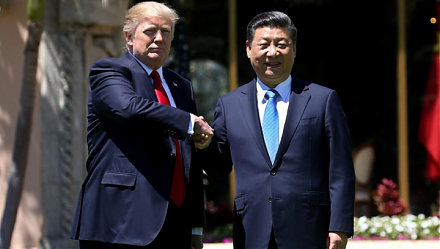

President Trump considers imposing retaliatory economic sanctions on Chinese products and services in direct response to China's theft and infringement

2018-05-03 07:34:00 Thursday ET

Sprint and T-Mobile propose a major merger in order to better compete with AT&T and Verizon. This mega merger is worth $26.5 billion and involves an all

2016-11-09 00:00:00 Wednesday ET

Universally dismissed as a vanity presidential candidate when he entered a field crowded with Republican talent, the former Democrat and former Independent

2019-01-04 11:41:00 Friday ET

Chinese President Xi JingPing calls President Trump to reach Sino-American trade conflict resolution. Xi sends a congratulatory message to mark 40 years sin

2018-07-17 08:35:00 Tuesday ET

Henry Paulson and Timothy Geithner (former Treasury heads) and Ben Bernanke (former Fed chairman) warn that people seem to have forgotten the lessons of the