2023-08-31 10:22:00 Thu ET

stock market technology facebook covid-19 apple microsoft google amazon data platform network scale artificial intelligence antitrust alpha patent model tech titan tesla global macro outlook machine software algorithm

Nowadays, many governments tend to eschew common ownership of the means of production (capital, labor, and technology). From 1990 to 2023, states have sold total assets worth almost $4 trillion around the world. Within the OECD club of rich countries, the government sector still owns about $11 trillion of common shares in public corporations, or more than 10% of global stock market capitalization in early-2023. About 40% of governmental equity stakes by value represent minority stakes in some 13,400 businesses. Out of the government-majority stock ownership, the top 1,000 corporations are much bigger and employ professional senior managers to maximize shareholder returns. In these corporations, few bureaucrats intervene the day-to-day business operations and often defer to the long prevalent business judgment rule. Sovereign wealth funds hold more than 20% of governmental equity stakes, and pension funds hold another 13% of governmental equity stakes around the world. Saudi Aramco remains one of the most profitable companies worldwide and continues to dominate as the oil colossus in the middle east. The top 4 biggest banks are still subject to government control and intervention in Beijing. From 2000 to 2023, 82 Chinese state-run corporations have become sufficiently profitable to enter the Fortune Global 500 list of the biggest companies worldwide.

On the surface, the state seems to be more laissez-faire with a hands-off approach to product market competition worldwide. However, direct ownership is not the only way to influence businesses. Instead of owning capital, labor, and technology as the common means of production, governments increasingly apply other levers of control. These other levers of business control include state support for particular industries and high tech advances, non-price product differentiation, stringent ESG regulation, and tax policy pluralism. To the extent that the government offers state support for specific industries and high-tech advances, this support leads to more higher-skill jobs and capital-intensive factors for national security (semiconductor microchips) and the green energy transition (lithium batteries). This state support often manifests in the common form of both subsidies and tax credits for free trade, finance, and technology.

Also, American, Chinese, and European multinational corporations now focus less on price discrimination and focus more on non-price product differentiation through product quality improvements and AIoT-led high-tech advances. Broader support of corporate power helps defend small businesses and state enterprises. Another lever of business control relates to ESG rules and regulations over the environment, labor protection, and corporate governance. These ESG rules and regulations now cut across both public and private sectors to influence big businesses. In addition to these other levers of business control, the government can introduce corporate income tax cuts, windfall tax credits, and other similar carrots for free trade, finance, and technology worldwide. This mega trend seems irreversible as politicians follow voters to reward big businesses as the catalysts to economic growth, employment, future tax revenue, and disruptive innovation.

In world trade, finance, and technology, greater government involvement is unlikely to lead to better outcomes (than in the old days). Modern episodes of booms and busts often lead to a near-universal consensus on freer trade. By contrast, this new interventionism coincides with new barriers to global trade. These new barriers to free trade include tariffs, quotas, embargoes, and even fragile global supply chains (for semiconductor microchips and 5G telecom networks). Many governments now need to achieve a delicate balance between these trade frictions and the levers of business control. In an equilibrium interplay of economic reasons, national security concerns become part of the equation. Substantially more government intervention reflects not only economic motives but also geopolitical tensions these days.

Since the stagflation of the late-1970s, governments have increasingly decided to allow corporate behavior to follow commercial logic with less state intervention. In practice, U.S. and European multinational corporations set up shop where they re-allocate capital investment, outsource labor, and automate tech-savvy production for better cost leadership. This worldwide trade liberalization has lifted billions out of poverty even as these multinational corporations continue to deliver high returns for shareholders.

What delivers high returns to shareholders is not necessarily in the best economic interest of a nation. Social and other non-economic considerations revolve around free market failures, anti-competitive oligopolies, or high technology spillovers and externalities. In China, greater state involvement seems to be the proper answer to these concerns. The Middle Kingdom now re-prioritizes social fairness, national security, and common prosperity. These new industrial policy priorities differ from the old mentality of economic growth at all costs of the past 30 years. China uses its new model of state capitalism to set strategic missions for better fiscal-monetary policy coordination. In turn, this macro mandate coordination helps better balance different special interests between the public and private sectors.

Since the Covid-19 pandemic crisis of 2020-2022, many countries have attempted to emulate elements of the Chinese playbook. In Japan, 57 domestic corporations receive around $500 million in state subsidies to invest in high technology at home. With this new mandate of economic security, the Japanese government intervenes in high-tech trade affairs from cybersecurity to semiconductor microchip production. Also, the European Union doubles down on a consortium to make lithium batteries for electric cars. The European Union further earmarks $180 billion of its Covid-19 recovery fund for digital innovations, especially 5G telecom networks and graphical processing units (GPUs). In Britain, the government provides tax relief for onshore research and development in high technology. The critical tech advances include pharmaceutical vaccines and medications, AIoT-led software solutions, microchips, 5G telecommunications, and smart home appliances. In combination, these state subsidies and tax credits help fund the gap between the marginal social and private costs of critical tech advancement, which would otherwise be far below the optimal level in the absence of these state subsidies and tax credits.

In Washington, the new industrial policy with more state intervention reverberates through the White House, Congress, think-tanks, and special interest groups. The Biden administration has issued a new executive order for all relevant government agencies to review the global supply chains for semiconductors, microchips, AIoT-led large language models (LLM), and 5G telecom networks. In due course, these global supply chains should become more resilient in response to post-pandemic aftershocks. Further, the Biden administration includes lots of business incentives in the signature $2 trillion Build Back Better bill for more government expenditures on climate change, health care, inflation, inequality, and other social and economic problems in America. Since Joe Biden won his presidential bid, the U.S. microchip provision has grown into $52 billion as part of the $250 billion American Innovation and Competition Act. This tech legislation includes $80 billion for modern research on artificial intelligence (AI), robotic automation, and biotechnology, $23 billion on space navigation, and $10 billion for tech hubs outside Silicon Valley.

Western leaders justify this new industrial policy in 2 fundamental ways. First, the new tech legislation helps preserve the rightful place for America, Britain, Canada, and Europe in the global pecking order. Second, this tech legislation reinvigorates domestic economic development with new high-tech clusters. On national defense grounds, a dose of self-reliance may make sense. Powerful semiconductor chips are critical to military arms and missiles. This consideration has become important since the Russian surprise invasion of Ukraine in early-2022. In fact, Taiwan Semi-conductor Manufacturing Corporation (TSMC) produces the world’s cutting-edge microchips in the major science parks in the northern parts of Taiwan. Taiwan has been an American ally since World War II; and since the Nationalist Party lost the Chinese Civil War and then retreated to Taiwan in 1949, today China continues to claim that Taiwan is part of the mother mainland (under the One-China policy). The former fact troubles Beijing, and the latter claim worries Washington. Adversaries understandably covet at least some independent microchip production capacity. In the Taiwan Strait, both sides should not undertake unilateral actions to change the status quo (in support of peace and prosperity in the Asia-Pacific region). In recent decades, strategic engagement has long served as an important complement to creative ambiguity in the peaceful resolution of long prevalent geopolitical tensions between China and Taiwan. Since the Trump administration launched 25% tariffs in the trade war against China, this trade conflict has already exacerbated broader anti-China investor sentiments under the Biden administration.

For Western governments, the modern industrial policy features AI, biotech, clean energy, quantum cloud service provision, and semiconductor microchip production. In the short run, extra demand risks bidding up the cost of inputs. In the longer run, extra demand may mean a supply glut. The industrial-policy arms race may turbo-charge boom-bust cycles for the capital-intensive industries from semiconductors and microchips to 5G telecom networks and AIoT hubs. Recent proponents of the venture-capitalist state are not fans of wasteful pork-barrel fiscal expenditures. In practice, these proponents would like governments to support genuinely full-blown commercial ideas with crystal-clear performance yardsticks. The venture-capitalist state should be as ruthless as Silicon Valley at pulling the plug on failures. In this fresh light, the state need not pick winners, but the state has to let losers go.

In reality, political incentives make governments worse at withdrawing support from duds than at identifying the next disruptive innovation. Decarbonizing Europe, and fully vaccinating America, would involve an awful lot of social coordination. Some proponents of industrial policy doubt that the medium-term goals of boosting R&D complement each other. The modern human history of high technology shows that promoting mass production may not help much for domestic employment. In many East Asian countries such as Japan, South Korea, Taiwan, and Vietnam, the share of manufacturing production to GDP has risen at constant prices even as the share of manufacturing employment has kept falling in recent decades. With high-tech automation, robots and machines replace manpower. On the one hand, Western governments prefer to maximize domestic employment for better economic growth. On the other hand, the gradual accumulation of national assets in high technology often causes the inevitable disappearance of low-skill labor. From picking winners to letting go of losers, the new industrial policy should take into account these near-term trade-offs.

In China, bureaucrats have sometimes used state media to arouse outrage against the abuse of market power. This lever suffices to clobber both sales and profits of oligopolies. In the absence of antitrust control, the People’s Bank of China (PBoC) uses strict financial regulation and its bully pulpit to cow online payments platforms in China. Alibaba and Tencent, the 2 tech titans with an online payments duopoly, have no choice but to integrate online payments with virtual shopping experiences across their platforms. In order to further curb big tech, the Chinese National Press and Publication Administration prohibits children from playing over 3 hours of video games per week most of the year. Another state agency bars the ride-hailing firm Didi from Chinese app stores for data violations.

In combination, these state actions differ from the old antitrust philosophy of judicial decisions and regulations of the past half-century. Today the only goals of antitrust law should be consumer welfare with reasonably intense competition, rather than the antitrust regulation of particular competitors. Business practices are largely fine as long as they result in no or little harm to consumers from excessive prices. Most mergers and acquisitions are either competitively neutral or efficient in the Pareto sense, even if these deals led to oligopoly. Only those deals that led to a dominant monopoly would be detrimental to consumers from a normative antitrust viewpoint. In recent years, however, several proponents of stakeholder capitalism argue that size is nefarious in itself. In this alternative view, it is important for the government to curtail market power as a basic way to solve other social and economic problems in relation to ESG rules and regulations. These ESG rules and regulations can help protect the economic interests of many stakeholders such as suppliers, customers, workers, environmentalists, and regulators. With proper government intervention, the typical corporation has to act in the best interests of not only shareholders but also stakeholders. ESG rules and regulations focus on the triple bottom-line.

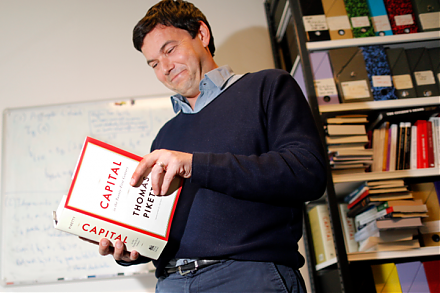

Following the recent wave of technological transformation, antitrust concerns have already evolved sufficiently to highlight the potential abuses of market power. This evolution reflects many new antitrust concerns about market power, concentration, and super-star dominance. Recent proponents focus on the U.S. tech titans such as Meta, Apple, Microsoft, Google, and Amazon (M.A.M.G.A.). Antitrust regulators attack Amazon for its mistreatment of workers, suppliers, and third-party sellers in e-commerce. Apple and Google might have engaged in anti-competitive practices against software developers in their exclusive iOS and Android app stores. Before its rebrand to Meta, Facebook might have launched killer acquisitions to neutralize former challengers such as Instagram and WhatsApp. Although these tech titans deny these antitrust claims and concerns, the recent investigations by U.S. Justice Department and Federal Trade Commission probe into these complex issues.

In both North America and Europe, antitrust regulators further argue that we need to push for a broader notion of consumer welfare in relation to not only reasonable prices but also product quality improvements, more alternative choices, and after-sale maintenance services. This traditional consumer welfare standard has never been as scientific as what antitrust regulators and interest groups would like to see in due course. Perhaps antitrust regulators should upgrade this old standard to the new competition doctrine that takes into consideration the speed and pace of both killer acquisitions and other anti-competitive business practices.

This new competition doctrine remains a work in progress. However, its contours have become sharper in recent years. This doctrine expands the goals of antitrust scrutiny in 2 major areas: merger control and business model regulation. For most mergers and acquisitions, antitrust regulators restrict a small number of horizontal deals between incumbent tech titans in the same market. In this context, antitrust concerns would arise from any horizontal deals that might reduce competition to allow incumbents to raise prices to the detriment of consumers. In addition to this merger control, trustbusters now further investigate vertical integrations between incumbent tech titans with separate business lines. New antitrust procedures allow both U.S. and E.U. regulators to assess potential kill acquisitions and many other monopolistic business practices, especially in the high-tech AI-led digital, pharma, and biotech industries.

In America, Federal Trade Commission and Justice Department now make merger guidelines more stringent. These antitrust agencies ask more questions about the impact of merger deals on the labor market. Further, these agencies look beyond direct pecuniary harm to consumers. Specifically, the Federal Trade Commission backs an ongoing lawsuit that attempts to break up Meta into Facebook, Instagram, and WhatsApp. Justice Department is likely to oppose Amazon’s $8.5 billion killer acquisition of MGM Studios, especially if the new merger would further strengthen Amazon’s online hegemony in e-commerce with less competition. In America, the online entertainment industry is fractal, and Amazon lets its customers binge-watch Prime-subscription video programs at constant prices. These online facts present the current competitive landscape for Amazon. Any further killer acquisitions would hence be subject to stringent antitrust scrutiny.

New antitrust rules and regulations should forestall any unfair and even deceptive business practices in the online platforms. Recent proposals would view Amazon’s online marketplace and Google’s search engine as essential to commerce, rather like a dominant railway operator. In this normative view, antitrust regulators should prohibit these platform orchestrators from favoring their own products and services over others. In addition, antitrust regulators would force Apple and Google to open up their own app stores to alternative in-app payment methods and search results. These dominant tech titans now bear the burden of proof to show that any mergers or acquisitions would not reduce competition. All these tech titans have Democratic and Republican co-sponsors in both upper and lower chambers of Congress.

Tech titans argue that they increasingly compete with one another as they expand into new adjacent markets. In recent years, Amazon has become the third-biggest online advertiser behind Facebook and Google. Apple and Microsoft now attempt to power their own search engines with AI to challenge Google. In time, Google’s cloud-computing group now takes on Amazon Web Services (AWS) and Microsoft Azure. Further, Meta seeks to expand into e-commerce with online marketplaces across Facebook, Instagram, and WhatsApp. The metaverse empowers Facebook, Instagram, and WhatsApp to better compete with other social media outlets such as Twitter, Snapchat, Reddit, and so forth. Whether these tech titans face vigorous competition remains an open controversy.

A corollary of Leviathan economic growth is rising bureaucracy. More government intervention means the creation of new regulatory agencies. These new regulatory agencies expand in size and red tape over time, and these state agencies seldom discontinue their public operations. As substantially more government involvement enriches the day-to-day lives of citizens, red tape continues to spread inexorably. This bureaucracy becomes pervasive through global emulation.

We track and pace the occurrence of prescriptive words, “shall” and “must”, in the U.S. federal code and its equivalents in Australia, Britain, Canada, and Europe. In summary, these prescriptive words have become more pervasive from 400,000 in the 1970s to more than 1 million today. Many prescriptions may be out of date, as more than 65% of sections in the U.S. federal code had not been subject to change since the relevant state agencies first drafted these prescriptions.

Governments now regulate in new areas such as climate change, data encryption, and privacy protection. New ESG rules and regulations specifically tell businesses how they should fairly treat workers, women, ethnic and racial minorities, and other stakeholders such as suppliers, customers, and special interest groups. ESG rules and regulations further dictate new corporate disclosures. These disclosures serve as a basis for how institutional investors effectively challenge senior management, as well as who represent special interests on corporate boards of directors. As the rift between the U.S. and China deepens, both constrain the corporate choices of business partners in world trade, finance, and technology.

One sign is the arrival of big laws. Under the Biden administration, the U.S. federal code ballooned after the major non-incremental passage of the Dodd-Frank Act of 2010 for the U.S. government to better regulate the financial system. In the past 3 years, the Senate and House have already passed 2 huge Covid-19 fiscal stimulus programs and the $1.2 trillion infrastructure plan. The Biden administration further broke Build Back Better into the smaller and incremental CHIPS and Science Act and Inflation Reduction Act with fewer special provisions to ensure congressional approval.

In Europe, the Digital Services and Digital Markets acts are likely to take on lives of their own as each member country translates them into national law. Even if the toughest provisions target the U.S. tech titans Meta, Apple, Microsoft, Google, and Amazon (M.A.M.G.A.), any multinational corporations that peddle data can expect to be caught up in red tape. Many cases arise from egregious violations of the E.U. General Data Protection Regulation in recent years.

In environmental, social, and governance (ESG) practice, many policymakers and companies now move in the same direction. Many companies have embraced both diversity and inclusion in Occupational Safety and Health Act (OSHA) compliance, independent directorship, and ESG reformation. In the new era of climate change, corporate carbon-emission reductions often exceed national goals. This progress is a corporate response to wider social demands from consumers, employees, and potential hires. Alternatively, this progress may be a cynical effort to show that soft self-regulation obviates the need for additional government intervention.

Governments everywhere seem suddenly to have become much keener on ESG reformation. In addition to the best practices in corporate governance and climate risk management, many governments specifically focus on better labor protection. In America, the Biden administration seeks to raise the federal minimum wage. In Europe, the European Commission aims to achieve common rules and regulations on minimum pay. These labor rules and regulations further concern new platform workers who ferry passengers for Uber or meals for Deliveroo. In China, MeiTuan, the online platform for food delivery, is in hot water with Chinese state authorities for mistreating drivers. Moreover, free trade pacts encompass pro-labor standards too. In lieu of the North American Free Trade Agreement (NAFTA), the US-Mexico-Canada Agreement (USMCA) includes new rules and regulations for the protection of low-skill workers.

Since Dodd-Frank, financial regulators have become more intrusive. The Bank of England now requires macroprudential stress tests for rare events due to climate risk and extreme weather. The European Central Bank further considers requiring banks to disclose exposure to climate-driven high-impact operational events. This disclosure should include bank assets that may be subject to financial distress due to tougher climate risk legislation. The U.S. Securities and Exchange Commission (SEC) and Federal Reserve System expect to introduce these essential disclosure requirements for banks, insurers, investment houses, and other non-bank financial institutions in America. In due course, financial regulators may require the inclusion of ESG compliance in annual reports worldwide.

The SEC attempts to make it easier for investors to hold management to account. A new universal proxy helps ensure that board candidates appear on all ballots at annual general meetings. Dissident shareholders who seek to appoint directors no longer need to go through the hassle and expense of sending out rival ballots. Also, another new rule makes it harder for companies to block shareholder resolutions on climate change and human rights. These recent changes help empower activist shareholders such as Carl Icahn and Bill Ackman.

In America, Britain, Canada, and Europe, financial regulators seek to impose trade and investment restrictions as well as retaliatory sanctions on intellectual property rights. These penalties target infringement on patents, trademarks, and copyrights by foreign entities, especially HuaWei, SMIC, and ZTE etc from China and foreign companies from Russia, Iran, and North Korea. The blacklist includes over 1,600 offshore foreign entities in AI, 5G telecommunication, airspace, cloud computation, and semiconductor chip production. This additional red tape strengthens the long prevalent government intervention in high technology on national security grounds.

In world trade, finance, and technology, greater government involvement is unlikely to lead to better outcomes (than in the old days). Modern episodes of booms and busts often lead to a near-universal consensus on freer trade. By contrast, this new interventionism coincides with new barriers to global trade. These new barriers to free trade include tariffs, quotas, embargoes, and even fragile global supply chains (for semiconductor microchips and 5G telecom networks). Many governments now need to achieve a delicate balance between these trade frictions and the levers of business control. In an equilibrium interplay of economic reasons, national security concerns become part of the equation. Substantially more government intervention reflects not only economic motives but also geopolitical tensions these days.

Taxing profits in different places can be detrimental to trade and economic growth. Many bilateral tax treaties now enshrine this basic principle of tax policy pluralism. Governments can attract more capital investment with lower tax rates. From 1985 to 2023, the average corporate income tax rate has already declined from 49% to 25% worldwide. Many tax havens now charge zero to boost domestic employment. Multinational corporations have further learned to pay lower taxes by shifting gross income elsewhere with the recent rise of intangible assets (brands and copyrights). Although only 5% of U.S. multinational corporations’ foreign employees work in tax havens, these companies book almost 67% of foreign profits there. Today, around $1 trillion of world profits emerge in investment hubs and financial centers such as Cayman islands, Ireland, Singapore, Hong Kong, and so on. The average effective tax rate is only 5% in these well-known tax havens. A recent OECD study suggests that this common tax practice robs public coffers of $100 billion to $240 billion per year, or 4% to 10% of global corporate tax revenue.

In response to this world trend of legal tax avoidance, many governments attempt to improve corporate taxation for social fairness. In Britain, the government raises the corporate income tax rate from 19% to 25% in recent times. Several European governments follow suit to boost the corporate income tax rate to 23%. In Canada, the business tax rate is 26.5%. In the vast majority of these countries, governments simplify corporate taxation in search of bigger total tax revenue from big business. In America, moderate Democrats seem to have already convinced President Biden to keep the corporate tax cuts from 35% to 21% by the Trump administration. But the recent legislation introduces new taxes in the form of a share buyback tax and an excise tax of 95% on net sales of medications outside the Medicare system.

U.S. multinational corporations now need to pay 15% global minimum taxes. This new minimum taxation helps Treasury increase its total tax revenue by $30 billion per year. Through the OECD, 136 countries have already signed up to the new tax pact of a similar 15% global minimum tax rate. This new tax pact allocates greater corporate tax rights from where companies book profits to where these companies make sales. The reallocation of corporate tax rights applies only to companies with global turnover above $24 billion and pre-tax net income over 10% of total revenue. This global minimum taxation helps generate an additional 5% tax revenue on top of current corporate taxation, or almost $100 billion per annum. For the OECD club of rich countries, multinational corporations are likely to end up paying up to 3% of total GDP. In the new equilibrium, greater government intervention becomes much less favorable to these corporations in world trade, finance, and technology.

Modern tax policy pluralism praises the virtues of an interest group system. In this system, public policy represents the equilibrium in the group struggle and the best approximation of the public interest. However, it is clear that special interest groups often put broad segments of the American public at a disadvantage. Tax laws treat different types of income differently. These different tax laws penalize work and investment and so divert capital investment into non-productive tax shelters and an illegal underground economy. The social unfairness and inefficiency of complex tax laws emerge from special interest groups. Political considerations sometimes may or may not adequately reflect these special interests in tax policy pluralism. Incremental U.S. tax regime changes often serve as a natural response to the long prevalent special interests and ideological differences.

The new classic Sargent-Wallace unpleasant monetarist arithmetic analysis shows that the central bank often cannot curtail money supply growth with higher inflation if the fiscal authority engages in endless government bond issuance to fund public investment projects for better economic growth and employment. In this case, the central bank temporarily loses monetary policy independence due to a lack of fiscal prudence. As a consequence, the central bank would have to tolerate much higher inflation sooner or later as money supply growth (higher inflation) accelerates due to the gradual accumulation of fiscal deficits on the top of national debt. In effect, national debt caps would probably help constrain the positive fruits of macro policy coordination between the central bank and the fiscal authority.

In world trade, finance, and technology, greater government involvement is unlikely to lead to better outcomes (than in the old days). Modern episodes of booms and busts often lead to a near-universal consensus on freer trade. By contrast, this new interventionism coincides with new barriers to global trade. These new barriers to free trade include tariffs, quotas, embargoes, and even fragile global supply chains (for semiconductor microchips and 5G telecom networks). Many governments now need to achieve a delicate balance between these trade frictions and the levers of business control. In an equilibrium interplay of economic reasons, national security concerns become part of the equation. Substantially more government intervention reflects not only economic motives but also geopolitical tensions these days.

As of mid-2023, we provide our proprietary dynamic conditional alphas for the U.S. top tech titans Meta, Apple, Microsoft, Google, and Amazon (MAMGA). Our unique proprietary alpha stock signals enable both institutional investors and retail traders to better balance their key stock portfolios. This delicate balance helps gauge each alpha, or the supernormal excess stock return to the smart beta stock investment portfolio strategy. This proprietary strategy minimizes beta exposure to size, value, momentum, asset growth, cash operating profitability, and the market risk premium. Our unique proprietary algorithmic system for asset return prediction relies on U.S. trademark and patent protection and enforcement.

Our unique algorithmic system for asset return prediction includes 6 fundamental factors such as size, value, momentum, asset growth, profitability, and market risk exposure.

Our proprietary alpha stock investment model outperforms the major stock market benchmarks such as S&P 500, MSCI, Dow Jones, and Nasdaq. We implement our proprietary alpha investment model for U.S. stock signals. A comprehensive model description is available on our AYA fintech network platform. Our U.S. Patent and Trademark Office (USPTO) patent publication is available on the World Intellectual Property Office (WIPO) official website.

Our core proprietary algorithmic alpha stock investment model estimates long-term abnormal returns for U.S. individual stocks and then ranks these individual stocks in accordance with their dynamic conditional alphas. Most virtual members follow these dynamic conditional alphas or proprietary stock signals to trade U.S. stocks on our AYA fintech network platform. For the recent period from February 2017 to February 2022, our algorithmic alpha stock investment model outperforms the vast majority of global stock market benchmarks such as S&P 500, MSCI USA, MSCI Europe, MSCI World, Dow Jones, and Nasdaq etc.

Do you find it difficult to beat the long-term average 11% stock market return?

It took us 20+ years to design a new profitable algorithmic asset investment model and its attendant proprietary software technology with fintech patent protection in 2+ years. AYA fintech network platform serves as everyone’s first aid for his or her personal stock investment portfolio. Our proprietary software technology allows each investor to leverage fintech intelligence and information without exorbitant time commitment. Our dynamic conditional alpha analysis boosts the typical win rate from 70% to 90%+.

Our new alpha model empowers members to be a wiser stock market investor with profitable alpha signals! The proprietary quantitative analysis applies the collective wisdom of Warren Buffett, George Soros, Carl Icahn, Mark Cuban, Tony Robbins, and Nobel Laureates in finance such as Robert Engle, Eugene Fama, Lars Hansen, Robert Lucas, Robert Merton, Edward Prescott, Thomas Sargent, William Sharpe, Robert Shiller, and Christopher Sims.

Follow AYA Analytica financial health memo (FHM) podcast channel on YouTube: https://www.youtube.com/channel/UCvntmnacYyCmVyQ-c_qjyyQ

Follow our Brass Ring Facebook to learn more about the latest financial news and fantastic stock investment ideas: http://www.facebook.com/brassring2013.

Free signup for stock signals: https://ayafintech.network

Mission on profitable signals: https://ayafintech.network/mission.php

Model technical descriptions: https://ayafintech.network/model.php

Blog on stock alpha signals: https://ayafintech.network/blog.php

Freemium base pricing plans: https://ayafintech.network/freemium.php

Signup for periodic updates: https://ayafintech.network/signup.php

Login for freemium benefits: https://ayafintech.network/login.php

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-01-04 07:36:00 Thursday ET

The world now faces an economic inequality crisis with few policy options. Some recent U.S. Federal Reserve data suggest that both income and wealth inequal

2019-07-01 12:35:00 Monday ET

Apple releases the new iOS 13 smartphone features. These features include Dark Mode, Audio Share, Memoji, better privacy protection, smart photo collection,

2018-07-15 11:35:00 Sunday ET

Facebook, Google, and Twitter attend a U.S. House testimony on whether these social media titans filter web content for political reasons. These network pla

2022-04-25 10:34:00 Monday ET

Corporate ownership governance theory and practice The genesis of modern corporate governance and ownership studies traces back to the seminal work

2017-05-13 07:28:00 Saturday ET

America's Top 5 tech firms, Apple, Alphabet, Microsoft, Amazon, and Facebook have become the most valuable publicly listed companies in the world. These

2019-01-31 08:40:00 Thursday ET

We offer a free ebook on the latest stock market news, economic trends, and investment memes as of January 2019: https://www.dropbox.com/s/4d8z