2021-11-22 11:29:00 Mon ET

stock market technology facebook covid-19 apple microsoft google amazon data platform network scale artificial intelligence antitrust alpha patent model tech titan tesla global macro outlook machine software algorithm

At a fundamental level, intense competition has been a major engine of economic growth and development in American economic history. This economic engine can result in tech pioneers in new industries that employ millions of knowledge workers to generate trillions of dollars in sales and profits in due course. This empirical fact is especially true in the digital economy. In most digital markets, fierce competition offers incentives for incumbent firms and new entrants to build fresh technological advances and business operations. This competition often helps spur new capital investments and disruptive innovations in mobile connectivity, e-commerce, online search, software, social media, and artificial intelligence etc. Also, this competition helps induce tech titans and unicorns to improve the quality of their products and services over time. Iterative continuous improvements help enhance the minimum viable products (MVP) as several disruptive innovations eventually come to fruition. In the absence of sufficient competition, incumbent tech titans often lack incentives to invest in research and development (R&D). The resultant shortage of R&D time and effort would slow the rate of high-tech innovation across the industry spectrum. Slow incremental alterations would replace disruptive new products and services in support of both incumbent tech titan profit entrenchment and market dominance. As a consequence of near absence of competition, venture capitalists would lose incentives to financially support fresh entrants to challenge the status quo market dominance of incumbent tech titans through direct competition.

In digital markets, the major benefits of robust competition move beyond innovation and productivity. Robust competition can further spur tech firms to compete against many other social dimensions such as data protection, consumer privacy, artificial intelligence, online security, and user convenience etc. Inadequate competition not only results in higher prices and fewer technological advances in many cases, but this insufficient competition also reduces the quality of both goods and services in due course. Given that online service providers cannot charge consumers directly for online services, most tech titans often compete on software quality. Along these lines, insufficient competition can lead to subpar consumer privacy, data protection, online security, and so on. Recent evidence suggests that insufficient competition goes hand in hand with both product and service quality degradation.

Many digital markets exhibit several rare unique features such as network effects, information cascades, and scale economies. Network effects refer to the fact that online platforms grow exponentially in terms of numbers of users and subscriptions as the marginal cost of acquiring each additional user is almost zero. Information cascades show that newsworthy information can transmit from Internet influencers to the global general public in a cost-effective and efficient manner. Both scale and scope economies suggest that the average costs of core business operations tend to decrease as online platforms grow exponentially in size. These central features empower online platforms to be the winners in most digital markets. These winners often attract billions of online users worldwide and then capture substantial market shares to reinforce their market power. This winner-takes-all phenomenon seems to be pervasive in mobile connectivity, social media, Internet search, e-commerce, software, and artificial intelligence etc. As a result, most digital markets tip in favor of a few tech titans such as Amazon, Apple, Facebook, and Google. The winner-takes-all economic trend therefore shifts the competitive equilibrium process from free and open competition in the market to oligopolistic competition for the market. In effect, high barriers to market entry limit the ability of new entrants to challenge incumbent tech titans. These high entry barriers further undermine the competitive process in support of persistent tech titan market dominance.

If potential competitors face substantial market entry barriers, some digital markets may be no longer properly contestable. High market shares can translate into core market power. This market power permits online platforms to increase prices well above marginal costs. Sometimes the resultant lack of intense competition reduces the quality of both online products and services. Tech titans can then leverage their current market power to further undermine market competition by buying disruptive innovations and potential tech rivals. For instance, Facebook acquires Instagram and WhatsApp in order to lock in more than 2 billion users worldwide. These major acquisitions help Facebook stifle lean startup competition (since new competitors cannot bring more innovative products and services specifically to the social media market). These antitrust concerns shine fresh light on misinformation, privacy, data security, and personal information protection.

In accordance with the winner-takes-all dynamism, the digital economy shows high market concentration. Only a few tech titans dominate several digital markets (from online search and social media to Internet advertisement and mobile connectivity). In some cases, this concentration results from a high volume of acquisitions by the dominant online platforms. Together, the top tech titans Amazon, Apple, Facebook, Google, Microsoft, Tesla, and Twitter etc have acquired hundreds of companies in the past decade. Antitrust enforcers choose not to block any of these acquisitions, many of which seem to have eliminated actual and potential rivals and competitors. In some cases, these acquisitions empower the dominant tech titans to neutralize some competitive threats. In other cases, the dominant tech titans shut down and discontinue the same products and services altogether. In these other cases, many antitrust enforcers refer to these tech transactions as killer acquisitions in American economic history. Whether these killer acquisitions serve as anticompetitive tactics remains open to controversy.

As Amazon, Apple, Facebook, and Google capture control over the major channels of distribution, these tech titans have now come to function as online gatekeepers. These dominant online platforms exploit this gatekeeper power to dictate terms of use to extract concessions that third parties would not endorse in more competitive markets. These concessions and demands carry significant economic harms and damages. In practice, these concessions have gradually become the costs of core business operations for small-to-medium enterprises and even public corporations due to a lack of options in America, Britain, Canada, Europe, and many other parts of the world.

Several major U.S. public corporations that rely heavily on these dominant online platforms indicate in investor statements and financial reports that this dependent relation creates an inherent risk to their business operations. For example, the ride-sharing companies Uber and Lyft cite their separate use of Amazon Web Services (AWS) and Google Maps as a potential risk to their business operations in America. In some cases, technology partners may take actions to disrupt the interoperability of software platforms with many products and services. In a similar vein, Pinterest states that several structural changes in the Google search engine algorithms may inadvertently harm the Pinterest photo-sharing social media services. Specifically, Pinterest directors and senior executive managers cannot control organic search traffic and user retention from several search engines such as Google, Yahoo, and Microsoft Bing etc. This common reliance on tech titans Amazon, Apple, Facebook, and Google etc poses an anti-competitive threat across many online industries in America, Britain, Canada, Europe, and several other parts of the world.

Since sometimes these dominant online platforms integrate into adjacent business lines with iterative continuous improvements, these tech titans operate both as key intermediaries for third-party firms as well as direct competitors to these third-party service providers. The dominant online platforms leverage this dual transformation through user data exploitation, self-preference, core tech appropriation, and abrupt changes to terms of online platform usage. For instance, Amazon now faces both U.S. and E.U. antitrust scrutiny over the current e-commerce use of merchant data. Under the European General Data Protection Regulation (GDPR), the European Commission specifically probes into whether Amazon uses and collects third-party seller data to promote its products to the detriment of other retailers. This antitrust investigation serves as a core structural step toward better characterizing Amazon cross-border e-commerce business practices. The current inquiry can help reveal how tech titans such as Amazon, Apple, and Facebook etc may inadvertently use customer information to reinforce their market power and dominance.

This concern reflects negative feedback from both U.S. and E.U. third-party sellers, retailers, and manufacturers that Amazon has been trying to abuse its dual role as a direct e-commerce competitor and also as an online marketplace for merchants. Under the current Amazon terms of use for America and Europe, most third-party sellers and most other merchants grant Amazon royalty-free rights to use their own product information, content, technology, and even trademark logo design. Global e-commerce platforms should not eliminate retail consumer benefits such as better product prices and wider options through anti-competitive business practices. Both American and European regulators can impose fines and penalties of 10% to 15% of worldwide sales. However, antitrust experts indicate the essential need for both U.S. and E.U. regulators to design some new precedent of both keystone industry standards and business practices for online platforms such as Amazon, Apple, and Facebook.

Strong network effects often tend to empower several tech titans such as Amazon, Apple, Facebook, and Google to grow exponentially in terms of global user bases. This long prevalent and pervasive tendency thus makes these tech titans prone to market concentration and monopolization. From time to time, the marginal cost of acquiring each additional user is almost zero, whereas, both sales and profits tend to increase exponentially in line with the number of users worldwide. Some indirect network effects arise when the greater use of online products and services forms some new standards to enhance incentives for third parties to invest in compatible tech design and development. In turn, the third-party new tech usage can reinforce the ubiquitous popularity of both original online products and services for those top tech titans. For instance, numerous mobile app developers rely on the Android and iOS mobile systems built by Google and Apple respectively. These third-party app developers such as Amazon, Facebook, Instagram, Netflix, Pokémon Go, Spotify, TikTok, Uber, and YouTube create online games, photos, video clips, social media newsfeeds, music podcasts, and e-commerce tools for better mobile app utilization and user convenience. As a consequence, these third-party apps further reinforce the dominant market concentration and monopolization of both Android and iOS in top mobile app design and development worldwide.

Online platforms connect disparate market niche segments in order to benefit from strong network effects. Online e-commerce platforms such as Amazon and Alibaba connect global buyers and sellers. Just as several social media networks such as Facebook, Instagram, Pinterest, Snapchat, Tencent, WeChat, and WhatsApp, the intrinsic value of Amazon Marketplace or Alibaba Taobao Tmall rises exponentially as more global users (both buyers and sellers) engage with the online e-commerce platform. In a similar vein, the value of online platforms with Internet advertisement (such as Facebook and Google) increases exponentially with the number of users worldwide. These online advertisers can acquire access to billions of users and so mega troves of consumer data profiles. Positive network effects serve as powerful barriers to market entry for new tech firms. These network effects can prove to be so strong that lean startups cannot easily challenge these incumbent tech titans in specific market niche segments. In combination with many other barriers to market entry such as higher switching costs and business restrictions, network effects all but ensure not only high market concentration but also durable market power for top tech titans Amazon, Apple, Facebook, and Google. In a nutshell, these market entry obstacles often raise antitrust concerns in light of anti-competitive business practices and standards.

High switching costs present another main barrier for potential market entrants. In many cases, the major tech titans can maintain market power partly because it is not easy for many users to switch away from incumbent technology. Some market exhibits this lock-in when switching costs are sufficiently high such that most users stay with the incumbent tech titans (rather than switch to some other tech unicorns whose online products and services would serve as close substitutes). Over time, this lock-in reduces competition, deters market entry, and may even inadvertently worsen user data privacy.

High switching costs represent a central feature of social media and online search platforms (such as Facebook and Google respectively). Here users contribute their data to each platform, but these users may not be able to readily migrate their data to an alternative online platform. Likewise, numerous third-party online sellers who have generated hundreds of product reviews, details, and descriptions on Amazon may face a similar challenge. These online sellers cannot readily migrate their data from Amazon to an alternative e-commerce platform in a cost-effective manner. In fact, many other significant factors can contribute to high switching costs in several digital markets. These other factors include anti-competitive terms and conditions, online default configurations, product design variations, and user-specific personal details. In combination, all these factors favor the dominant online platforms such as Apple, Amazon, and Facebook etc.

Big data accumulation serves as another powerful barrier to market entry for new tech entrants and unicorns in the digital economy. This big data accumulation can allow tech titans to target online advertisement with scalpel-like precision. In effect, social media outlets and Internet advertisers such as Facebook and Twitter often improve their online products and services by better deciphering user preferences and interactions. In this fundamental way, these online tech titans identify and then exploit new business opportunities through efficient monetization on the Internet.

Tech titans acquire better access to big data and then use this data accumulation to better target new and current users for product and service improvements. This virtuous circle attracts more users and more personal data profiles in due course. In this positive feedback loop, greater engagement brings in big data accumulation. Social media platforms Facebook, Pinterest, Snapchat, and Twitter etc tweak, fine-tune, and so improve user experiences and experiments with new online products and services. These tech titans often exclude rivals and competitors from acquiring access to their proprietary user data through many technical restrictions, paywalls, and legal contracts. These exclusionary tactics can close off some digital markets to shield incumbent tech titans from fierce competition. In effect, data accumulation may inadvertently exacerbate anti-competitive conduct in these digital markets for social media, e-commerce, and mobile connectivity.

Personal data collection can often further create information asymmetries. These information asymmetries grant tech titans special access to private information. In effect, this access provides these tech titans a significant competitive advantage. These rich economic insights shine fresh light on user tastes and behaviors as well as broader market usage trends. In this fundamental way, tech titans can leverage their dominant online platforms to track nascent competitive threats. Specifically, Facebook and Twitter build and design their online ad tech infrastructure with many apps and other mobile browser extensions etc. In combination, these apps, emails, and mobile extensions provide protective modes and levels in support of user lock-in. Most ordinary users cannot readily switch away from these dominant platforms in the near absence of close substitutes for online data accumulation.

This significant data advantage empowers dominant platforms to acquire rivals and competitors early in their respective lifecycles. The resultant serial acquisitions of nascent rivals by tech titans stifle free market competition and disruptive innovation. This acquisition strategy exploits the big data advantages, and so most tech titans acquire tech unicorns just before these new tech bellwethers become true threats. From time to time antitrust enforcers may fail to identify these killer acquisitions as anti-competitive business practices. Beyond antitrust scrutiny, several data-driven killer acquisitions of both nascent and potential tech rivals significantly undermine competition in a systematic manner. Lean startup and upstart competitors are often data-rich but cash-poor. The rare unique combination is not likely to trigger antitrust scrutiny in a price-centric framework (especially if those tech titans price their killer acquisitions well below the relevant threshold for merger review). In U.S. economic history, monopolistic conduct triggers antitrust enforcement only when many killer acquisitions tip new digital markets in favor of tech titans in the same way Microsoft tactically acquired Netscape to stave off intense competition in the Internet browser market back in the 1990s.

Scale economies are another central feature of tech titan market dominance. This feature makes some tech titans prone to market concentration and monopolization. Scale economies arise when the average costs of key business operations decline as tech titans grow exponentially in operational size. Because new entry requires high upfront costs, most digital markets often favor incumbent tech titans. This key economic reason makes it difficult for new tech bellwethers to challenge incumbent tech titans in the digital markets for mobile connectivity, online search, social media, software, e-commerce, and artificial intelligence etc.

In a similar vein, dominant tech titans that enjoy scale economies can extend their reach across some adjacent markets through some expansive platform ecosystem of both the current online products and services. Entering these adjacent markets often incurs low costs for most dominant tech titans. When a mega online platform has sufficient technological expertise and access to user data, the cost of applying these rare unique business resources into some new adjacent market is relatively low. In exchange for free products and services, users provide valuable social data on the Internet. This big data accumulation further helps shine fresh light on many consumer behaviors and preferences (in addition to their own user profiles, tastes, and online interactions etc). Specifically, personal location history helps inform the common traffic patterns, buyer choices, consumer incentives and responses, and many other data-driven externalities. For online platforms such as Amazon, Apple, Facebook, Instagram, Netflix, Tencent, Twitter, WeChat, and WhatsApp, the cost of acquiring user data can be substantially below the value of personal information within the broader global online platform ecosystem.

In recent times, the U.S. Judiciary convenes a subcommittee to re-assess the free and open market dominance of Amazon, Apple, Facebook, and Google (Alphabet) in the broad context of the antitrust, commercial, and administrative law in America. On the basis of testimony from the Chief Executive Officers (CEO) of these 4 major tech titans (Jeff Bezos, Tim Cook, Mark Zuckerberg, and Sundar Pichai), the U.S. judiciary subcommittee reveals common antitrust problems by studying the broad business practices (although these tech titans somewhat differ in important ways). First, each online platform now serves as a major gatekeeper over some channel of distribution for billions of users worldwide. By controlling online access to digital markets, these tech titans can pick winners and losers in the U.S. economy. These tech titans not only wield tremendous power, but they also abuse this market power by imposing oppressive contract terms, charging exorbitant fees, or acquiring data from people and businesses. In many cases, these people and businesses rely on the online products and services that these 4 major tech titans offer on a continual basis. Second, each online platform uses its gatekeeper role and position to keep its market power. By controlling the digital tech infrastructure, the tech titans seem to have surveilled many other businesses to identify potential rivals. In some cases, these top tech titans buy out, copy, or cut off their competitive threats in time. Third, these tech titans abuse their dual role as both intermediaries and rent-seekers to further entrench their free market dominance. Through self-preference, predatory pricing power, and exclusionary business conduct, the dominant online platforms can potentially exploit their market power in order to become even more dominant with exponentially higher sales and profits over time.

Consumer Reports publishes a recent survey on Platform perceptions: consumer attitudes on competition and fairness in online platforms. This survey indicates that at least 85% of Americans are skeptical about their personal data available on core online platforms such as Amazon, Apple, Facebook, and Google etc. Also, at least 81% of Americans convey their concerns that these online tech platforms continue to collect personal data in order to develop more comprehensive consumer profiles. Moreover, the same survey suggests that almost 80% of Americans view big tech killer acquisitions as detrimental to free market competition and consumer choice. About 60% of Americans support more government regulation of online platforms with mandatory interoperability features. The regulation helps make it easier for all global users to switch from one online platform to another without losing important data profiles and connections.

Amazon has significant and durable market power in the U.S. online retail market. Many third-party sellers, brand manufacturers, and publishers share this concern. Although Amazon controls only about 40% of U.S. online retail sales, this market share may inadvertently comprise a substantial underestimation bias. Through key global channels of retail distribution, Amazon garners control of more than 65% of online retail sales in America, Britain, Canada, Europe, and several other parts of the world. As an online retail platform, Amazon retains monopoly power over many small-to-medium enterprises that cannot find a comparable alternative to Amazon for reaching online consumers worldwide. Amazon attracts almost 3 million active third-party sellers on its e-commerce marketplace worldwide. About 35% of these third-party sellers (more than 1 million sellers) rely on Amazon as their sole source of income.

Amazon maintains its current dominant market position by acquiring its rivals and competitors such as Diapers.com, PillPack, and Zappos. Amazon further acquires smaller retailers in adjacent markets. In turn, these killer acquisitions add customer data profiles and buyer behaviors etc to the extant competitive moats. This strategy expands and entrenches Amazon market power in e-commerce and cloud service provision. The resultant corporate control over many business lines empower the online retail platform to disadvantage rivals and competitors in important ways. In effect, these important ways often undermine free market competition.

Although Amazon regards third-party sellers as business partners, Amazon plays its dual role as an online gatekeeper for the e-commerce marketplace and also as an online retail seller in the same marketplace. This dual role creates an inherent conflict of interest. In practice, Amazon competes for higher online retail sales and profits along with many third-party sellers worldwide. The likely conflict of interest provides incentives for Amazon to exploit its rare unique access to third-party seller profiles, product details, brand names, trademark logos, and many other troves of online data. Amazon identifies, copies, and cuts off third-party competition through anti-competitive behaviors and business practices in both e-commerce and cloud service provision.

Amazon Web Services (AWS) offers the critical high-tech infrastructure for online businesses. Because AWS provides Software-as-a-Service (SaaS) and Platform-as-a-Service (PaaS) to many online business clients, Amazon has another conflict of interest in terms of high switching costs and barriers to market entry. Most AWS business clients cannot readily migrate their cloud data to some other cloud service provider (e.g. Microsoft Azure, Google Cloud, Alibaba Cloud, Oracle, and IBM etc). These cloud customers often must weigh the trade-offs between patronizing some other competitor and selecting the best cloud technology for their central business operations. Also, artificially intelligent voice assistant ecosystems serve as another nascent market with a high propensity for lock-in and self-preference. Amazon now expands the Alexa ecosystem rapidly through many killer acquisitions of rivalrous technological advances in natural language and human speech recognition. In the meantime, Amazon strives to sell Alexa-driven smart speakers at deep discounts in order to attain sufficiently high market shares in adjacent market niche segments. Amazon continues to retain early leadership in artificial intelligence, and this early leadership leads to the inevitable collection of highly sensitive consumer data. This data-driven competitive advantage allows Amazon to entrench market dominance in e-commerce (Amazon Marketplace), multi-media entertainment (Prime Video), and cloud service provision (AWS Marketplace).

Apple retains significant and durable market power in the mobile operating system market. Apple controls the iOS mobile operating system, and this system runs on Apple mobile devices such as iPhones and iPads. Apple further controls all mobile software distribution to iOS mobile devices. As a result, Apple has monopoly power in the mobile app store market. Apple now controls access to more than 100 million iPhones and iPads in America.

The Apple flagship channel of software distribution, App Store, revolutionizes app design and development on mobile devices. In effect, App Store reduces barriers to iOS market entry for app developers with a broader range of choices for mobile app consumers. However, Apple leverages its control of both iOS and App Store to enforce significant barriers to competition. In this rare unique fashion, Apple can discriminate against rivals and competitors with self-preference and exclusionary anti-competitive conduct. Also, Apple applies this market power to exploit iOS app developers through broader misappropriation of competitive sensitive information. Through App Store, Apple charges iOS app developers supra-competitive prices well above marginal costs (i.e. Apple charges 30% taxes on all premium apps and in-app purchases via App Store). Apple maintains its durable market power in light of network effects, high barriers to market entry, and significant switching costs in the mobile operating system market.

As the hardware market for mobile devices matures over time, Apple pivots to rely increasingly more on sales of both mobile software apps and services. Moreover, Apple collects fees and commissions in App Store (which serves as the mobile iOS gatekeeper). In the absence of intense competition, Apple retains monopoly power over software distribution to iOS mobile devices. This monopoly power potentially harms rivals and competitors (such as Android users and app developers), leads to software quality degradation and innovation among mobile app developers, and results in higher prices and fewer consumer choices over time.

Facebook keeps and entrenches its monopoly power in the market for social media. Facebook acquires its potential competitive threats (e.g. Instagram and WhatsApp) to shore up its social media market position. In addition to these killer acquisitions, Facebook tips the social media market toward durable tech monopolization. Some recent internal documents show that the main Facebook family of online products and services (such as Instagram, WhatsApp, Messenger, and Oculus etc) seems to experience more considerable internal competition for global users than external competition in response to most other social media outlets (such as LINE, Pinterest, Reddit, Snapchat, WeChat, and so forth). It is probable for these internal products and services to shore up one another through collusion. Facebook applies a variety of anti-competitive business practices to sustain its durable market power. In effect, Facebook leverages data-driven competitive moats and market insights to identify nascent high-tech potential threats, and so Facebook acquires, copies, or cuts off these competitive threats through killer acquisitions or social media embargoes. In these important ways, Facebook weakens many other social networks, especially if Facebook perceives these social media outlets as real, nascent, or even potential competitive threats. In the absence of intense competition, several Facebook anti-competitive business practices lead to mobile software quality deterioration, result in worse privacy protection for global social network users, and may further cause misinformation and data breach (e.g. the Cambridge Analytica data debacle).

Google maintains its monopoly power in the markets for general online search and Internet advertisement. Google leverages its rare unique click-and-query data and extensive default online search results across most mobile devices and browsers worldwide. Many large public corporations, small-to-medium enterprises, and lean startups depend on the Google search engine for organic search traffic. Almost no alternative search engines (such as Microsoft Bing, DuckDuckGo, and Yahoo) can serve as competitive close substitutes.

Several anti-competitive tactics include aggressive campaigns for vertical search integration, misappropriate content curation from third parties, and Internet search discrimination against third-party vertical search providers. Google can continue to steadily proliferate search results with Pay-Per-Click (PPC) ads and webpages in favor of the Google search engine, the Chrome browser, Gmail, and several other online products and services. As a result of these tactics, Google seems to siphon off organic search traffic from the rest of the online web. In important ways, Google serves as an online search gatekeeper for ready access to some critical channels of distribution of relevant results. Since purchasing the Android operating system in 2005, Google has applied many contractual restrictions and exclusive provisions to extend its online search monopoly from desktop to mobile. Google requires key smartphone manufacturers to install default status to Google apps such as Chrome and Google Maps etc. These impediments help Google entrench its online search dominance as well as market power in adjacent mobile app market niche segments. Google continues such tactical impediments to extend online search market power from desktop and mobile to voice as artificial intelligence now serves as the natural language processor for most mobile devices worldwide.

Today Google is quite ubiquitous across the digital economy and hence serves as the PPC ad tech infrastructure for many key online products and services. Through Chrome, Google now owns the most popular browser as a critical gateway to the Internet. The Chrome browser protects and promotes many of Google other online products and services. Through Google Maps, Google captures more than 80% of the market for mobile navigation services in America. This major input helps secure control through several killer acquisitions of smaller mobile map service providers. Through Google Cloud, Google has another core cloud platform where the parent company Alphabet invests in many new killer acquisitions to dominate the Internet of Everything in the next wave of artificially intelligent surveillance technology.

Google exploits information asymmetries to track real-time consumer data across many market niche segments. Each of its online services provides Google with a rich trove of user data. This data-driven competitive advantage helps reinforce the current search engine dominance with Google-specific online products. All of these online search and mobile app products and services effectively help drive greater monetization through PPC ads available on the Google search engine. By linking these online products and services altogether, Google increasingly functions as a monopolistic platform ecosystem with higher switching costs, network effects, and scale economies.

The U.S. judiciary subcommittee proposes several reforms for potential legislation. For better big tech regulation, Congress has the responsibility to conduct oversight of both the relevant U.S. antitrust law and competition system. New proper antitrust rules, regulations, and institutions should be commensurate with tech advances in mobile connectivity, software, social media, online search, e-commerce, and cloud service provision. First, some of these reforms address anti-competitive business practices in digital markets. Second, antitrust enforcers should strive to better ring-fence merger reviews of future killer acquisitions (which may inadvertently lead to online market dominance or even monopolization). Third, U.S. and E.U. regulators should work together to improve the sound administration of the antitrust rules and regulations through other reforms with vigorous antitrust scrutiny and enforcement. When push comes to shove, the basic law of inadvertent consequences counsels caution.

Antitrust enforcers should strive to restore competition in the digital economy. From time to time, these antitrust enforcers structurally separate and prohibit tech titans from operating in adjacent business lines. Some non-discriminatory requirements help prohibit online platforms from engaging in self-preferential treatments. These dominant online platforms should offer equal terms and conditions for equal online products and services. These platforms should further make their online products and services compatible with various networks in terms of high interoperability and data portability. Most global users should be able to readily migrate their personal data from these online platforms to some alternative platform ecosystems. Antitrust enforcers should strive to prohibit future killer acquisitions by the dominant online platforms Amazon, Apple, Facebook, and Google for better competitive equilibrium. Antitrust enforcers should secure some safe harbor for most news publishers and journalists in order to safeguard the free and diverse press worldwide. In essence, antitrust enforcers should proscribe the dominant online platforms from engaging in anti-competitive contractual practices in support of collusion and digital market dominance. In due course, antitrust enforcers help ensure due process protection for lean startup enterprises whose profitability relies on several online products and services from the dominant online platforms.

U.S. and E.U. regulators should strengthen many antitrust rules and institutions for tech titans such as Apple, Amazon, Facebook, and Google. These regulators must reiterate the core anti-monopoly goals of both antitrust rules and their centrality to ensuring the vibrant and robust democracy in America, Europe, and several other parts of the world. Antitrust regulators should strengthen presumptions and bright-line rules in support of nascent lean startup tech competitors. Moreover, antitrust regulators should clarify legal restrictions on vertical mergers and acquisitions (and their resemblance to tech killer acquisitions) due to anti-competitive concerns. In a nutshell, antitrust regulators should deter anti-competitive business practices such as monopoly leverage, self-preference, predatory price markup on top of near-zero marginal costs, both refusal and denial of essential online products and services, and collusive product design. Both U.S. and E.U. regulators should take additional policy measures to strengthen overall antitrust enforcement by overriding several problematic precedents in the case law.

American and European regulators should revive antitrust enforcement for big tech. Both U.S. and E.U. regulators must restore robust congressional oversight as well as enforcement of antitrust rules worldwide. In collaboration with the Federal Trade Commission, U.S. and E.U. antitrust regulators should trigger civil penalties as well as other relief measures in response to the practical application of unfair business methods of competition by those online platforms Amazon, Apple, Facebook, and Google. American and European antitrust regulators should strengthen the private enforcement of antitrust rules by eliminating obstacles such as arbitration clauses, limits on class action formation, judicial constraints on antitrust injury, and unduly high standards for tech titans to plead guilty to anti-competitive business practices. Overall, the U.S. judiciary subcommittee proposes these antitrust reforms for new legislation. For better big tech regulation, Congress is responsible for the oversight of both the relevant U.S. antitrust law and competition system.

As of late-2021, we list our proprietary dynamic conditional alphas for the U.S. top tech titans Facebook, Apple, Microsoft, Google, and Amazon (FAMGA). Our core proprietary alpha stock signals enable both institutional investors and retail traders to better balance their key stock portfolios. This delicate balance helps gauge each alpha, or the supernormal excess stock return to the smart beta stock investment portfolio strategy. This proprietary strategy minimizes beta exposure to size, value, momentum, asset growth, cash operating profitability, and the market risk premium. Our unique proprietary algorithmic system for asset return prediction relies on U.S. trademark and patent protection and enforcement.

Our unique algorithmic system for asset return prediction includes 6 fundamental factors such as size, value, momentum, asset growth, profitability, and market risk exposure.

Our proprietary alpha stock investment model outperforms the major stock market benchmarks such as S&P 500, MSCI, Dow Jones, and Nasdaq. We implement our proprietary alpha investment model for U.S. stock signals. A comprehensive model description is available on our AYA fintech network platform. Our U.S. Patent and Trademark Office (USPTO) patent publication is available on the World Intellectual Property Office (WIPO) official website.

Our core proprietary algorithmic alpha stock investment model estimates long-term abnormal returns for U.S. individual stocks and then ranks these individual stocks in accordance with their dynamic conditional alphas. Most virtual members follow these dynamic conditional alphas or proprietary stock signals to trade U.S. stocks on our AYA fintech network platform. For the recent period from February 2017 to February 2021, our algorithmic alpha stock investment model outperforms the vast majority of global stock market benchmarks such as S&P 500, MSCI USA, MSCI Europe, MSCI World, Dow Jones, and Nasdaq etc.

This analytic essay cannot constitute any form of financial advice, analyst opinion, recommendation, or endorsement. We refrain from engaging in financial advisory services, and we seek to offer our analytic insights into the latest economic trends, stock market topics, investment memes, personal finance tools, and other self-help inspirations. Our proprietary alpha investment algorithmic system helps enrich our AYA fintech network platform as a new social community for stock market investors: https://ayafintech.network.

We share and circulate these informative posts and essays with hyperlinks through our blogs, podcasts, emails, social media channels, and patent specifications. Our goal is to help promote better financial literacy, inclusion, and freedom of the global general public. While we make a conscious effort to optimize our global reach, this optimization retains our current focus on the American stock market.

This free ebook, AYA Analytica, shares new economic insights, investment memes, and stock portfolio strategies through both blog posts and patent specifications on our AYA fintech network platform. AYA fintech network platform is every investor's social toolkit for profitable investment management. We can help empower stock market investors through technology, education, and social integration.

We hope you enjoy the substantive content of this essay! AYA!

Andy Yeh

Chief Financial Architect (CFA) and Financial Risk Manager (FRM)

Brass Ring International Density Enterprise (BRIDE) ©

Do you find it difficult to beat the long-term average 11% stock market return?

It took us 20+ years to design a new profitable algorithmic asset investment model and its attendant proprietary software technology with fintech patent protection in 2+ years. AYA fintech network platform serves as everyone's first aid for his or her personal stock investment portfolio. Our proprietary software technology allows each investor to leverage fintech intelligence and information without exorbitant time commitment. Our dynamic conditional alpha analysis boosts the typical win rate from 70% to 90%+.

Our new alpha model empowers members to be a wiser stock market investor with profitable alpha signals! The proprietary quantitative analysis applies the collective wisdom of Warren Buffett, George Soros, Carl Icahn, Mark Cuban, Tony Robbins, and Nobel Laureates in finance such as Robert Engle, Eugene Fama, Lars Hansen, Robert Lucas, Robert Merton, Edward Prescott, Thomas Sargent, William Sharpe, Robert Shiller, and Christopher Sims.

Follow AYA Analytica financial health memo (FHM) podcast channel on YouTube: https://www.youtube.com/channel/UCvntmnacYyCmVyQ-c_qjyyQ

Follow our Brass Ring Facebook to learn more about the latest financial news and fantastic stock investment ideas: http://www.facebook.com/brassring2013.

Free signup for stock signals: https://ayafintech.network

Mission on profitable signals: https://ayafintech.network/mission.php

Model technical descriptions: https://ayafintech.network/model.php

Blog on stock alpha signals: https://ayafintech.network/blog.php

Freemium base pricing plans: https://ayafintech.network/freemium.php

Signup for periodic updates: https://ayafintech.network/signup.php

Login for freemium benefits: https://ayafintech.network/login.php

We update and refresh part of memetic financial information on a sporadic basis. We aim to facilitate this information exchange only for illustrative purposes. Some information may be stale and incomplete. Therefore, we recommend each member to consult the respective external website(s) for more up-to-date information.

This analytic report cannot constitute any form of financial advice, analyst opinion, recommendation, or endorsement. We refrain from engaging in financial advisory services, and we seek to offer our analytic insights into the latest economic trends, stock market topics, investment memes, and other financial issues. Our proprietary alpha investment algorithmic system helps enrich our AYA fintech network platform as a new social community for stock market investors: https://ayafintech.network.

The conventional disclaimers apply to this key case where each freemium member bewares, understands, and acknowledges the service terms and conditions for our courteous fintech network platform. Any omissions, errors, or other blemishes do not necessarily reflect the official views and opinions of our AYA fintech platform orchestrator. We make a conscious effort to keep most major omissions to 1% to 5% of the fintech information for about 6,000 U.S. stocks on NYSE, NASDAQ, and AMEX. These omissions tend to concentrate around some rare corporate events (e.g. IPO, delisting occurrence and recurrence, abrupt trading suspension, and M&A initiation etc). Overall, these disclaimers, terms, and conditions of our service should be viewed as baseline house rules for fintech network platform usage and development.

Under pending subsequent patent-law confirmation, the relevant legal text protects our proprietary alpha software technology for ubiquitous knowledge transfer. Each freemium member enjoys his or her interactive usage and information exchange on our AYA algorithmic fintech network platform with sound and efficient dynamic conditional asset return prediction.

Our AYA fintech network platform helps promote better financial literacy, inclusion, and freedom of the global general public with an abiding interest in core economic reforms, financial markets, and stock market investments. In this broader context, each freemium member can consult our mission statement that provides more in-depth explanatory details on our long-term aspiration.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2026-04-30 08:28:00 Thursday ET

In the current global market for better biotech advances, medical innovations, and healthcare services, the new integration of artificial intelligence (AI)

2021-11-22 11:29:00 Monday ET

U.S. judiciary subcommittee delves into the market dominance of online platforms in terms of the antitrust, commercial, and administrative law in America.

2020-05-05 09:31:00 Tuesday ET

Our fintech finbuzz analytic report shines fresh light on the fundamental prospects of U.S. tech titans Facebook, Apple, Microsoft, Google, and Amazon (F.A.

2019-06-01 10:33:00 Saturday ET

Top tech firms such as Google, Intel, and Qualcomm suspend Android services to HuaWei as the Trump administration blacklists the Chinese company. HuaWei can

2018-11-11 13:42:00 Sunday ET

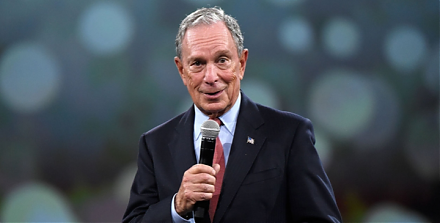

Michael Bloomberg provides $80 million as campaign finance for Democrats to flip the House of Representatives in the November 2018 midterm elections, gears

2025-07-01 13:35:00 Tuesday ET

In recent times, financial deglobalization and asset market fragmentation can cause profound public policy implications for trade, finance, and technology w