2026-02-28 10:29:00 Sat ET

stock market paypal facebook apple microsoft google amazon tesla smart beta stock investment vitae proprietary alpha stock signals leaderboards ebooks analytic reports research articles alphabet personal finance meta nvidia self-help self improvement stock market simulation freemium stock search

As of March 2026, we have updated all of the cloud databases available on our AYA fintech network platform. The latest update spans our proprietary alpha stock signals, stock pages, descriptions, keywords, news feeds, key financial ratios, and financial statements. At both annual and quarterly frequencies, these up-to-date financial statements include the balance sheets, cash flow statements, and income statements for almost 6,000+ U.S. stocks, ADRs, and equity market funds on NYSE, NASDAQ, and AMEX. With U.S. patent accreditation and protection for 20 years, our AYA fintech network platform provides proprietary alpha stock signals and personal finance tools for stock market investors, traders, fund managers, and many more. We continue to publish new analytic reports, ebooks, essays, research articles, business book summaries, and blog posts. Through this continual content curation, we delve into topical issues in global macro finance, trade, both fiscal and monetary stimulus, financial stability, and technological advancement around the world. We can help empower stock market investors through technology, education, and social integration.

We apply an eclectic style in our written work. In economics, we integrate new classical monetarism, new Keynesianism, and supply-side structural reforms into our analysis. In politics, we combine realism, liberalism, and constructivism into our analysis. Each school of thought provides different but complementary insights, viewpoints, and perspectives. This eclectic style empowers stock market investors worldwide to mull over multiple fundamental forces, economic factors, and political considerations in light of global peace and prosperity. Our written work includes regular analytic reports, ebooks, essays, book reviews, research surveys, and many other long-form blog articles. With these efforts, we attempt to establish our own industry authority in global macro asset management.

As of January 2023, the U.S. Patent and Trademark Office (USPTO) has approved our U.S. fintech utility patent application: Algorithmic system for dynamic conditional asset return prediction and fintech network platform automation.

On 4 March 2021, we filed a U.S. patent continuation application (Application Number: #17192059; Publication Number: US20210192628) with a new set of claims in accordance with the April 2017 initial application (Application Number: #15480765; Publication Number: US20180293656).

We went through many USPTO office actions, rejections, failures, setbacks, and other technical obstacles. Eventually, our patent efforts came to fruition in time. We paid the USPTO maintenance fees to secure our patent protection and accreditation for 20 years.

With U.S. fintech patent accreditation and protection for 20 years, our AYA fintech network platform provides proprietary alpha stock signals and personal finance tools for stock market investors worldwide.

In recent times, we have completed our fresh website update: https://ayafintech.network

This update includes new product features such as the personal stock investment vitae, free access to our social network platform, virtual stock market game with real-time stock prices, several leaderboards for our virtual investors, and a rich library of ebooks, analytic reports, research articles, and many more.

Each freemium member trades top 6,000+ U.S. stocks with $1 million virtual token talents, updates his or her personal stock investment vitae with the most profitable stock positions, and pays some small annual fee to access our premium electronic resources.

Our homepage now offers a new freemium AI-driven stock search engine for the top tech titans Meta, Apple, Microsoft, Google, Amazon, Nvidia, and Tesla (MAMGANT or Magnificent 7).

The premium membership classes offer all kinds of features and benefits such as top 6,000+ U.S. proprietary alpha stock signals, personal finance tools, ebooks, analytic reports, and research articles etc.

You can check out our freemium pricing plan with different product features and benefits here: https://ayafintech.network/freemium.php

Each alpha stock signal represents an excess return to a smart beta stock investment portfolio strategy.

For instance, a 13% alpha suggests that we would predict the excess return to be about 13% relative to the smart beta market portfolio for a given stock with zero beta exposure to the 6 Fama-French fundamental factors such as size, value, momentum, asset growth, operating profitability, and market risk exposure.

Each prospective premium member can make his or her credit card payment via the secure PayPal payment gateway.

With U.S. fintech patent approval, accreditation, and protection for 20 years, our AYA fintech network platform provides proprietary alpha stock signals and personal finance tools for stock market investors worldwide.

We build, design, and delve into our new and non-obvious proprietary algorithmic system for smart asset return prediction and fintech network platform automation. Unlike our fintech rivals and competitors who chose to keep their proprietary algorithms in a black box, we open the black box by providing the free and complete disclosure of our U.S. fintech patent publication. In this rare unique fashion, we help stock market investors ferret out informative alpha stock signals in order to enrich their own stock market investment portfolios. With no need to crunch data over an extensive period of time, our freemium members pick and choose their own alpha stock signals for profitable investment opportunities in the U.S. stock market.

Smart investors can consult our proprietary alpha stock signals to ferret out rare opportunities for transient stock market undervaluation. Our analytic reports help many stock market investors better understand global macro trends in trade, finance, technology, and so forth. Most investors can combine our proprietary alpha stock signals with broader and deeper macro financial knowledge to win in the stock market.

Through our proprietary alpha stock signals and personal finance tools, we can help stock market investors achieve their near-term and longer-term financial goals. High-quality stock market investment decisions can help investors attain the near-term goals of buying a smartphone, a car, a house, good health care, and many more. Also, these high-quality stock market investment decisions can further help investors attain the longer-term goals of saving for travel, passive income, retirement, self-employment, and college education for children. Our AYA fintech network platform empowers stock market investors through better social integration, education, and technology.

We implement our proprietary alpha investment model for positive U.S. stock signals.

We track the stock prices and returns for the recent 6-year period from early-February 2017 to early-February 2026.

This data span allows us to conduct an out-of-sample test to assess our proprietary alpha investment model performance in comparison to the major stock market benchmarks such as S&P 500, MSCI, Dow Jones, and Nasdaq etc.

S&P 500 yields an 12% net overall return per annum (NORPA) while Dow Jones and Nasdaq generate 13%-17% NORPAs.

MSCI stock market benchmarks deliver 5%-13% NORPAs (MSCI USA, MSCI World, MSCI Europe, and MSCI Asia).

With our proprietary alpha investment model, all of our virtual stock market portfolios outperform the S&P 500 and MSCI stock market benchmarks with 19%-21% NORPAs.

In fact, all of the 17 virtual stock portfolios deliver higher NORPAs than Dow Jones, Nasdaq, S&P 500, and MSCI stock market index returns.

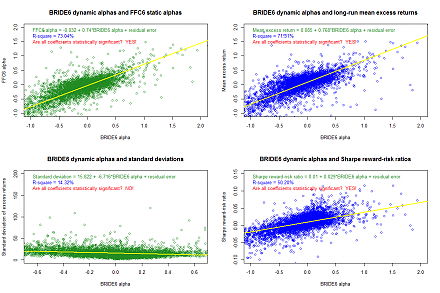

The signal-to-noise ratio or Sharpe ratio of average asset return to standard deviation in most market indices and benchmark portfolios (such as S&P 500, Nasdaq, Dow Jones, MSCI World, MSCI USA, MSCI Europe, and MSCI Asia etc) is 0.35 to 0.55 with 10% average returns and 18%-30% standard deviations; the vast majority of static Fama-French asset return models produce maximum Sharpe ratios in the range of 0.65 to 0.75; whereas, our algorithmic alpha investment system produces the Sharpe ratio of at least 1.675 with 20%-30% average returns and 12%-16% standard deviations.

Our U.S. utility patent specification provides more technical details on both the competitive advantages and distinctive capabilities of our algorithmic cloud system for dynamic conditional asset return prediction and fintech network platform automation.

The recent double-digits model performance corroborates the scientific fact that our proprietary alpha investment model outperforms the major stock market benchmarks: https://ayafintech.network/blog/our-proprietary-alpha-investment-model-outperforms-most-stock-market-indexes-february-2026/

In recent times, we wrote and published more than 200 long-form blog articles on a wide variety of global economic themes, trends, topics, and worldviews. Specifically, we provide fresh economic insights into world growth, inflation, trade, finance, technology, climate change, environmental biodiversity protection, labor-led social harmonization, corporate governance, ESG woke capitalism, government intervention, financial innovation, and fiscal-monetary policy coordination etc. With USPTO fintech patent approval, accreditation, and protection for 20 years, we provide proprietary alpha stock signals and personal finance tools for stock market investors worldwide. We create, curate, edit, refine, and improve our AYA fun podcasts, reports, stock synopses, surveys, self-improvement book reviews, ebooks, macro-financial research articles, and many more.

Industry Analysis

AYA ebook hyperlink: https://bit.ly/4hxvrwy

AYA ebook length: 283 pages (21 chapters and 122,241 words).

Bidenomics

AYA ebook hyperlink: https://bit.ly/44CdDu7

AYA ebook length: 206 pages (18 chapters and 90,405 words)

Trump Economic Reforms

AYA ebook hyperlink: https://bit.ly/2ZwYfiE

AYA ebook length: 507 pages (21 chapters and 97,854 words)

Modern management macro themes, insights, and worldviews

AYA ebook hyperlink: https://bit.ly/2IezdQh

AYA ebook length: 225 pages (top 40 recent management book reviews)

Economic science macro themes, insights, and worldviews

AYA ebook hyperlink: https://bit.ly/3FaegyI

AYA ebook length: 220 pages (top 40 recent economic science book reviews).

Wharton e-commerce professor Karl Ulrich explains that many elite universities now provide many massive open online courses (MOOCs) for lifelong learners to achieve their medium-term goals, tasks, and missions for better intellectual focus, personal growth, self-efficacy, self-improvement, and social engagement in modern life, business, innovation, and entrepreneurship.

Podcast: https://bit.ly/3URUam1

UCLA organizational psychology expert Dr Chip Espinoza et al explain, propose, and emphasize the 9 new core competences for better managing millennials in the modern workplace.

Podcast: https://bit.ly/3H0svMH

Article: https://ayafintech.network/blog/self-improvement-book-review-managing-millennials-by-chip-espinoza/

Consumer psychology experts Nir Eyal and Ryan Hoover explain why keystone habits often lead us to purchase products, goods, and services in our daily lives.

Podcast: https://bit.ly/3H5Ne1v

Article: https://ayafintech.network/blog/self-improvement-book-review-hooked-by-nir-eyal/

Mitch Anthony explains why it is often important for sales leaders to apply sound social skills and emotional competences to fulfill various customer needs, wants, demands, desires, and other preferences.

Podcast: https://bit.ly/44nPsST

Former New York Times science author and Harvard social psychologist Daniel Goleman explains why working with emotional intelligence can help hone social skills for smarter, better, and more effective leaders, teams, and organizations in modern life, business, innovation, and entrepreneurship.

Podcast: https://bit.ly/4khouAU

Former New York Times science author and Harvard social psychologist Daniel Goleman explains why greater mental focus serves as a vital mainstream driver of personal growth, success, virtue, happiness, and fulfillment in life, business, innovation, and entrepreneurship.

Podcast: https://bit.ly/44z2ZH5

Article: https://ayafintech.network/blog/self-improvement-book-review-focus-by-daniel-goleman/

Former New York Times science author and Harvard social psychologist Daniel Goleman explains why emotional intelligence often serves as a more important critical success factor than high IQ for our success, virtue, and happiness in life, business, innovation, and entrepreneurship.

Podcast: https://bit.ly/43O7TzP

Former New York Times prolific team author, and Pulitzer Prize winner Charles Duhigg delves into how we can change our lives for the better by mastering our habits from day to day.

Podcast: https://bit.ly/3FUTSHs

Article: https://ayafintech.network/blog/self-improvement-book-review-the-power-of-habit-by-charles-duhigg/

Serial venture capitalist Ben Horowitz describes many hard truths, lessons, and insights from his rare unique entrepreneurial journey of running LoudCloud from a Silicon Valley tech startup to a $1.65 billion sale to Hewlett-Packard.

Podcast: https://bit.ly/3FJ3fKl

Stanford psychology professor Carol Dweck describes, discusses, and delves into the reasons why the growth mindset helps motivate individuals, teams, and senior managers to accomplish more with greater grit, focus, and resilience.

Podcast: https://bit.ly/3HGF67P

Article: https://ayafintech.network/blog/self-improvement-book-review-mindset-by-carol-dweck/

President Trump refreshes American fiscal fears and sovereign debt concerns through the One Big Beautiful Bill Act.

Podcast: https://bit.ly/4eSEU1w

President Trump poses new threats to Fed Chair monetary policy independence again.

Podcast: https://bit.ly/4ebeoQH

What are the mainstream legal origins of President Trump’s tariff policies?

Podcast: https://bit.ly/3ZnNMG7

Article: https://ayafintech.network/blog/mainstream-legal-origins-of-recent-trump-tariffs/

American exceptionalism often turns out to be the heuristic rule of thumb for better economic growth, low and stable inflation, full employment, and macro-financial stability.

Podcast: https://bit.ly/4iuWuJ9

In the broader modern monetary policy context, central banks learn to weigh the trade-offs between output and inflation expectations and macro-financial stress conditions.

Podcast: https://bit.ly/42SwrXG

Today, tech titans continue to reshape and even disrupt global pharmaceutical investments for both better healthspan and longer lifespan.

Podcast: https://bit.ly/41KDNLp

Artificial intelligence continues to reshape the current global market for better biotech advances, medical innovations, and healthcare services.

Podcast: https://bit.ly/4hBVimM

The global market for GLP-1 anti-obesity weight-loss treatments now grows substantially to benefit more than 1 billion people worldwide by 2030.

Podcast: https://bit.ly/4bz6vmI

Is higher stock market concentration good or bad for Corporate America?

Podcast: https://bit.ly/3F1fpgN

As he moves into his second term, President Trump continues to blame China for the long prevalent U.S. trade deficits and several other social and economic deficiencies.

Podcast: https://bit.ly/42ucDKt

Geopolitical alignment often reshapes and reinforces asset market fragmentation in the broader context of financial deglobalization.

Podcast: https://bit.ly/3ZpGMcD

China poses new economic, technological, and military threats to the U.S. and many western allies.

Podcast: https://bit.ly/3XGWrD1

Geopolitical alignment often reshapes and reinforces asset market fragmentation in the broader context of financial deglobalization.

Podcast: https://bit.ly/3ZpGMcD

We delve into the fundamental analysis of each of the top 10 China Internet stocks with dual stock exchange status on NYSE and NASDAQ. These tech titans include Tencent (TME), Alibaba (BABA), Baidu (BIDU), NetEase (NTES), PinDuoDuo (PDD), JD.com (JD), iQiyi (IQ), Bilibili (BILI), and so forth. This analysis explains in detail the mainstream competitive advantages in support of both higher sales growth rates and profit margins for these Chinese tech titans.

Podcast: https://bit.ly/3Cv4T0f

Podcast collection online: https://ayafintech.network/blog/aya-fintech-network-platform-podcasts-on-global-trends-topics-and-issues-in-macro-finance/

We delve into the 5 major economic themes of the U.S. presidential election between Biden and Trump in November 2024.

https://ayafintech.network/blog/american-presidential-election-rematch-between-biden-and-trump/

The global cloud infrastructure helps expand what can be made digitally viable from electric vehicles (EV) and virtual reality (VR) headsets to artificial intelligence (AI) and the metaverse.

The current homeland industrial policy stance tends to tilt toward significantly improving the worldwide resilience of global supply chains for critical technological advancements such as AI, 5G, and VR.

Generative artificial intelligence (Gen AI) uses large language models (LLM) and content generation tools to help enhance human productivity.

Central banks should shape CBDC design features and functions to reduce any adverse impact on bank intermediation.

What are the mainstream technological advances in the global auto industry?

https://ayafintech.network/blog/mainstream-technological-advances-in-the-global-auto-industry/

The new world order of trade helps accomplish non-economic policy goals such as national security and technological dominance.

The bank credit card model and fintech platforms have adapted well to the recent digitization of cashless finance.

Government intervention continues to be a major influence over global trade, finance, and technology.

Trade liberalization has promoted better economic growth and efficiency worldwide.

The bank-credit-card model and fintech platforms have adapted well to the recent digitization of cashless finance.

What are the top global risks in trade, finance, and technology (as of mid-2023)?

https://ayafintech.network/blog/top-global-risks-in-trade-finance-and-technology-may-2023/

The Biden Inflation Reduction Act is central to modern world capitalism.

The U.S. further derisks and decouples from China.

https://ayafintech.network/blog/the-us-further-derisks-and-decouples-from-china/

Bank failure resolution and financial risk management: Silicon Valley Bank, Signature Bank, and First Republic Bank

American federalism and domestic institutional arrangements

https://ayafintech.network/blog/american-federalism-and-domestic-institutional-arrangements/

Economic policy incrementalism for better fiscal-monetary policy coordination

International trade, immigration, and elite-mass conflict

https://ayafintech.network/blog/international-trade-immigration-and-elite-mass-conflict/

Tax policy pluralism for addressing special interests

https://ayafintech.network/blog/tax-policy-pluralism-for-addressing-special-interests/

There is significant mutual causation between macroeconomic innovations and stock market alphas.

Bank leverage and capital bias adjustment through the macroeconomic cycle

https://ayafintech.network/blog/bank-capital-regulation-through-the-real-business-cycle/

Better corporate ownership governance through world convergence toward the Berle-Means stock ownership dispersion

https://ayafintech.network/blog/berle-means-corporate-ownership-governance/

In our new book, we summarize the top 40 titles in the modern economic science from 2000 to 2023. These 40 book summaries offer the collective wisdom of eminent economists for better stock market investment, macrofinancial asset return prediction, and economic policy coordination. In due course, we continue to update this macro knowledge reservoir from year to year.

Michel De Vroey delves into the global history of macroeconomic theories from real business cycles to persistent monetary effects.

Eric Posner and Glen Weyl propose radical reforms to resolve key market design problems for better democracy and globalization.

Mark Granovetter follows the key principles of modern economic sociology to analyze social relations and economic phenomena.

Basic income reforms can contribute to better health care, infrastructure, education, technology, and residential protection.

Former Bank of England Governor Mervyn King provides his deep substantive analysis of the Global Financial Crisis of 2008-2009.

Several feasible near-term reforms can substantially narrow the scope for global tax avoidance by closing information loopholes.

Barry Eichengreen compares the Great Depression of the 1930s and the Great Recession as historical episodes of economic woes.

The Federal Reserve System conducts monetary policy decisions, interest rate adjustments, and inter-bank payment operations.

Timothy Geithner shares his reflections on the post-crisis macro financial stress tests for U.S. banks.

Calomiris and Haber delve into the comparative analysis of bank crises and politics in America, Britain, Canada, Mexico, and Brazil.

Angus Deaton analyzes the correlation between health and wealth in light of the economic origins of inequality worldwide.

Peter Schuck analyzes U.S. government failures and structural problems in light of both institutions and incentives.

William Easterly critiques several economic development policies and then indicates that bottom-up solutions often result in macro policy success in spite of nation states.

Paul Samuelson defines the mathematical evolution of price theory and then influences many economists in business cycle theory and macro asset management.

Amy Chua and Jed Rubenfeld suggest that relatively successful ethnic groups exhibit common cultural traits in America.

Thomas Piketty connects the dots between economic growth and inequality worldwide with long-term global empirical evidence.

Anat Admati and Martin Hellwig raise broad critical issues about bank capital regulation and asset market stabilization.

Daron Acemoglu and James Robinson show that good inclusive institutions contribute to better long-run economic growth.

Michael Sandel analyzes what money cannot buy in stark contrast to the free market ideology of capitalism.

Carmen Reinhart and Kenneth Rogoff analyze long-run crisis data to find the root causes of financial crises for better bank capital regulation and asset market stabilization.

Louis Kaplow strives to find a delicate balance between efficiency gains and redistributive taxes in the social welfare function.

Ray Fair applies his macroeconometric model to study the central features of the U.S. macroeconomy such as price stability and full employment in the dual mandate.

Joseph Stiglitz and Andrew Charlton suggest that free trade helps promote better economic development worldwide.

Lucian Bebchuk and Jesse Fried critique that executive pay often cannot help explain the stock return and operational performance of most corporations.

Oxford macro professor Stephen Nickell and his co-authors delve into the trade-off between inflation and unemployment in the dual mandate of price stability and maximum employment.

Peter Isard analyzes the proper economic policy reforms and root causes of global financial crises of the 1990s and 2008-2009.

Steven Shavell presents his economic analysis of law in terms of the economic outcomes of both legal doctrines and institutions.

Jared Diamond delves into how some societies fail, succeed, and revive in global human history.

Michael Woodford provides the theoretical foundations of monetary policy rules in ever more efficient financial markets.

Colin Camerer, George Loewenstein, and Matthew Rabin assess the recent advances in the behavioral economic science.

Jordi Gali delves into the science of the New Keynesian monetary policy framework with economic output and inflation stabilization.

https://ayafintech.network/blog/new-keynesian-monetary-policy-framework/

Daron Acemoglu and James Robinson show a constant economic tussle between society and the state in the hot pursuit of liberty.

https://ayafintech.network/blog/state-society-and-the-narrow-corridor-of-liberty/

Thomas Philippon draws attention to greater antitrust scrutiny in light of the rise of market power and its economic ripple effects.

https://ayafintech.network/blog/the-great-reversal-of-antitrust-merger-review-in-america/

Jonathan Baker frames the current debate over antitrust merger review and enforcement in America.

https://ayafintech.network/blog/the-new-antitrust-enforcement-paradigm/

Walter Scheidel indicates that persistent European fragmentation after the collapse of the Roman Empire leads to modern economic growth and development.

Paul Morland suggests that demographic changes lead to modern economic growth in the current world.

Joel Mokyr suggests that economic growth arises from a change in cultural beliefs toward technological progress.

Thomas Sowell argues that some economic reforms inadvertently exacerbate economic disparities.

Nobel Laureate Paul Milgrom explains the U.S. incentive auction of wireless spectrum allocation from TV broadcasters to telecoms.

David Colander and Craig Freedman argue that economics went wrong when there was no neoclassical firewall between economic theories and policy reforms.

This analytic essay cannot constitute any form of financial advice, analyst opinion, recommendation, or endorsement. We refrain from engaging in financial advisory services, and we seek to offer our analytic insights into the latest economic trends, stock market topics, investment memes, personal finance tools, and other self-help inspirations. Our proprietary alpha investment algorithmic system helps enrich our AYA fintech network platform as a new social community for stock market investors: https://ayafintech.network.

We share and circulate these informative posts and essays with hyperlinks through our blogs, podcasts, emails, social media channels, and patent specifications. Our goal is to help promote better financial literacy, inclusion, and freedom of the global general public. While we make a conscious effort to optimize our global reach, this optimization retains our current focus on the American stock market.

This free ebook, AYA Analytica, shares new economic insights, investment memes, and stock portfolio strategies through both blog posts and patent specifications on our AYA fintech network platform. AYA fintech network platform is every investor's social toolkit for profitable investment management. We can help empower stock market investors through technology, education, and social integration.

We hope you enjoy the substantive content of this essay! AYA!

Andy Yeh (online brief biography)

Co-Chair

AYA fintech network platform

Brass Ring International Density Enterprise ©

Our Brass Ring Facebook fan page: http://www.facebook.com/brassring2013.

Free signup for stock signals: https://ayafintech.network

Mission on profitable signals: https://ayafintech.network/mission.php

Model technical descriptions: https://ayafintech.network/model.php

Blog on stock alpha signals: https://ayafintech.network/blog.php

Freemium base pricing plans: https://ayafintech.network/freemium.php

Signup for periodic updates: https://ayafintech.network/signup.php

Login for freemium benefits: https://ayafintech.network/login.php

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-12-07 11:30:00 Saturday ET

China turns on its 5G telecom networks in the hot pursuit of global tech supremacy. China Telecom, China Unicom, and China Mobile disclose 5G fees of $18-$2

2020-08-01 07:28:00 Saturday ET

Technological advances, geopolitical risks, and pandemic outbreaks cannot shake investor confidence in the American dollar as the global reserve currency.

2019-01-05 11:39:00 Saturday ET

Reuters polls show that most Americans blame President Trump for the recent U.S. government shutdown. President Trump remains adamant about having to shut d

2023-01-11 09:26:00 Wednesday ET

Addendum on USPTO fintech patent protection and accreditation As of early-January 2023, the U.S. Patent and Trademark Office (USPTO) has approved our U.S

2020-07-05 11:31:00 Sunday ET

Business entrepreneurs dare to dream, remain true and authentic to themselves, and try to make a great social impact in the world. Alex Malley (2014)

2019-08-07 12:33:00 Wednesday ET

Conor McGregor learns a major money lesson from LeBron James. This lesson suggests that James spends about $1.5 million on his own body each year. The $1.5