2023-07-07 10:29:00 Fri ET

treasury deficit debt employment inflation interest rate macrofinance fiscal stimulus economic growth fiscal budget public finance treasury bond treasury yield sovereign debt sovereign wealth fund tax cuts government expenditures

Louis Kaplow (2010)

The theory of taxation and public economics

Harvard law and economics professor Louis Kaplow designs a 2-step methodology for normative policy analysis and then illustrates this method with numerous policy reforms. The first step helps identify efficiency gains when hypothetical lump-sum taxes can contribute to better redistributive results. The second step evaluates the redistributive effects of a standard social welfare function. Kaplow focuses on how most policymakers should approach redistributive taxes, social transfers, and core government expenditures (instead of what specific policies must be in due course). The central argument revolves around some basic normative principles rather than moral motives. As a result, the Kaplow 2-step methodology is persuasive in its own right for better economic policy evaluation.

Kaplow proposes a general methodology for dealing with the fundamental problem of public policy evaluation when both efficiency and redistribution are at stake. For practical relevance, Kaplow applies this 2-step methodology to many policy issues in progressive taxes, social transfers, and government expenditures on health care, education, global trade, finance, and research and development. From a normative viewpoint, economic policy prescriptions should substantively help enhance social welfare. This welfarism is the doctrine that the economic utility of individual agents should constitute the aggregate social welfare function. In this fresh light, the social welfare function should conform to individual preferences, should include all major sources of economic utility, and should be at least cardinally measurable and also comparable among economic actors. Aggregation of economic utility for individual economic actors should add strict concavity to the social welfare function. From a fundamental viewpoint, the legitimate policy outcome arises from the social choice of Pareto optimal economic results. In the domain of public policy, the median voter determinates the ultimate economic policy outcome via proportional representation. The Kaplow 2-step method can help better align socially desirable economic policy outcomes with common constituent interests across the political spectrum of liberal, conservative, and moderate-to-progressive reforms. In a nutshell, Kaplow provides his 2-step method for normative public policy evaluation in terms of both efficiency and equity.

The social welfare function helps determine the direction and extent of optimal tax redistribution. In the Kaplow normative architecture, fiscal deficits and government expenditures inevitably involve some redistributive results when key policymakers take the broader view of both taxes and government expenditures. However, most economists and politicians can set aside redistributive results when core economic policy evaluation focuses on efficiency gains as the central priority. In principle, the redistribution issues can often be left to the tax and transfer system with non-linear income tax curves by Nobel Laureate James Mirrlees (1971).

Anthony Atkinson and Joseph Stiglitz (1976) show that if individual economic utility is a weakly separable function of leisure with Mirrlees non-linear income tax curves, there should be no differential commodity taxes. Kaplow exploits this specific result and then applies this result to the conventional policy cases where the income tax payers can change their consumption, employment, and investment choices at will (subject to the usual resource and incentive constraints). The government can shift structurally from uniform commodity taxes to multiple commodity taxes with some increases in individual income taxes. In this instance, there would be no or minimal changes in labor supply and personal utility. The additional tax revenue represents a reduction in the deadweight loss of the commodity tax system. The redistributive result helps engineer a Pareto improvement over time.

In a similar vein, many fiscal reforms whose intrinsic elements involve zero or little redistribution can be efficient in the conventional economic sense. In principle, any redistributive results that support these fiscal reforms can cause appropriate lump-sum income tax adjustments. As a consequence, the separate social policy choice of a non-linear income tax transfer system can help address the redistribution issue. This general principle forms the core Kaplow 2-step method, which can often help analyze fiscal deficits, commodity taxes, Pigouvian corrective taxes, social transfer payments, public goods, capital income taxes, person-to-person transfers, social security reforms, and the special treatment of capital wealth and income taxes on billionaires and multinational corporations. When push comes to shove, the basic law of inadvertent consequences counsels caution. The prescient Kaplow analysis decomposes efficiency and equity effects in the baseline evaluation of government policy.

An apt comparison might involve the recent proposal by Stephen Coate (2000). In essence, this recent proposal isolates the efficiency effects of policy changes in a second-best world. In accordance with the Coate efficiency approach, the probable policy change is efficient if there is no other feasible policy change that would be Pareto optimal. If the policy proposal is efficient in this sense, its social desirability depends on subjective judgments in terms of distributional consequences. In effect, the Coate approach differs from the Kaplow 2-step method as the former focuses on the comparisons of all feasible alternative policy proposals under consideration. Here feasibility reflects second-best constraints that manifest in all available policy choices. These second-best constraints can be restrictions on policy instruments. The Coate efficiency criterion thus helps economists and politicians avoid all sorts of distributional value judgments that may be open to controversy in light of median voter preferences and constituent interests. By contrast, the Kaplow 2-step method skillfully defends the use of a social welfare function for normative policy evaluation. For this purpose, both the role and design of non-linear optimal taxation can be as clear and intuitive as any other alternative wealth and income redistribution in most mainstream public finance topics. In the Kaplow policy analysis, the first step tends to focus on efficiency gains with regard to the social welfare function, and then the second step helps assess redistributive results around the social welfare function in terms of economic equality. In this Kaplow policy evaluation, alternative feasible policy proposals and second-best constraints are less important or even irrelevant. In a nutshell, the Coate and Kaplow policy assessments share the same efficiency and equity criteria, but such normative policy assessments differ substantively with respect to the high-level social welfare function, alternative feasible policy choices, and incentive constraints.

With optimal non-linear income taxes, the use of different income taxes relaxes the incentive constraints for optimal taxation to allow better redistribution to take place. Moving from uniform commodity taxes to progressive commodity taxes often leads to a Pareto improvement with no violation of the incentive constraints. This Pareto improvement accords with the efficiency criterion in the first element of the baseline Kaplow policy evaluation. The resultant increase in total tax revenue helps achieve better redistributive results through the social transfer and welfare system. In effect, this redistribution accords with the equity criterion in the second stage of the basic Kaplow public policy analysis. In essence, the 2-step Kaplow public policy analysis applies to the practical example of non-linear income taxation.

The same extension further applies to the practical case of public goods with non-separable preferences. If most government expenditures on health care, education, global trade, finance, and research and development etc are more complementary with leisure than private consumption, the state can use fiscal deficits to fund these public goods in due course. The practical application can often lead to some Pareto improvement. Again, this Pareto improvement accords with the efficiency criterion in the first stage of the baseline Kaplow policy evaluation. With progressive income taxes and social transfers, the government can better balance redistributive results. This redistribution accords with the second stage of the basic Kaplow public policy analysis. When push comes to shove, the basic law of inadvertent consequences counsels caution. In a nutshell, the 2-step Kaplow public policy analysis applies to the practical example of public goods. In this special case, the use of fiscal deficits for long-term government expenditures would require better fiscal-monetary policy coordination in due course.

Kaplow uses the 2 practical examples (income taxes and public goods) in order to support his argument for analyzing the efficiency consequences of policy changes independently from the redistributive results. With both progressive income taxes and social transfers, the government can attain better redistributive results around the social welfare function. The 2-step Kaplow public analysis hence helps achieve efficiency gains and redistributive results in a consistent and cost-effective manner. The same rationale can apply to capital income taxes, externalities, social security reforms, social transfers, other in-kind transfers, and so forth.

Kaplow raises some issues in his analysis of efficiency gains prior to redistribution. This analysis is quite novel and provocative in the public economics specialty. The issues revolve around an insistence that social welfarism should be the sole basis for public policy evaluation. In this context, individual economic utility can constitute the aggregation of cardinal median voter preferences and constituent interests etc. Subjective value judgments should be relevant for the government to characterize the aggregate social welfare function.

Kaplow applies this rationale to the economic analysis of cash donations. There is usually no differential taxation of cash donations from the basic viewpoint of donors. As some social transfer, each cash donation helps increase the economic utility of each donee whose disposable income rises. In effect, each cash donation provides economic utility benefits to both the donor (by direct preference) and the donee on social welfare grounds. Both utility benefits count as positive contributions to social welfare. At the same time, the cash receipt by the donee can generally result in an increase in labor supply. With progressive income taxes, the increase in labor force participation can lead to some first-order efficiency gain (or some reduction in the deadweight loss of non-linear labor income taxation). If the social welfare function exhibits aversion to economic inequality, the social transfer system would probably regard cash donations as some form of redistribution from the donor to the donee. When the donor is generally richer than the donee in most aspects of social welfare, the cash transfer leads to an efficient Pareto improvement with better redistribution over time. So social welfare considerations illustrate the economic consequences of the economic principle that utility often serves as an objective metric for socially desirable efficiency gains and redistributive results. In this decent example of cash donations, the 2-step Kaplow public policy analysis helps better align the efficiency gains with the equity considerations in the broader tax-transfer system.

The social welfare approach focuses on economic utility of family members as the main basis for the tax treatment of family fortunes. Many social considerations can influence proper policy choices. The policymaker faces the fact that family fortune redistribution may or may not respect the social welfare function. Also, there may be substantive economies of scale in consumption that affect family-income-driven individual utility. Within the family, altruism may motivate family fortune allocation and inheritance within the incentive constraints such as inter-generational transfer taxation. All family consumption and redistribution benefits should count for social welfare purposes. Due to altruistic utility, each household member may well benefit from the private consumption of all the other family members. The 2-step Kaplow public policy evaluation of inter-generational transfer taxation therefore has to take into consideration altruistic utility benefits in addition to direct family utility benefits. Kaplow further considers the implications of children whose economic utility should count for social welfare purposes. Having children can affect the overall utility costs and benefits for each family. Parents spend time and money looking after their own children in the lofty pursuit of both happiness and fulfillment. Children can often be better economic utility generators than parents, not necessarily because children have different preferences but because children need fewer resources to generate the same amount of consumption as adults. All of these factors influence both the level of utility per capita in the family and the average marginal utility for suboptimal redistribution. In this family context, the economic equality of marginal utility proves to be practically relevant and informative in due course.

The 2-step Kaplow policy analysis not only indicates individual preferences for core alternative outcomes, but the analysis also helps better reveal cardinal preferences by confronting economic actors with subjective value choices and judgments under uncertainty. Cardinal utility is only measurable up to an affine transformation. This affine transformation need not be the same for all economic actors. We often need some other sources of information to learn measurable individual utility functions. This information helps formulate the aggregate social welfare function. Sometimes it is almost impossible for economists to objectively compare the different levels of economic utility of people who have quite different preferences for goods, services, leisure, risk, and so forth. Kaplow admits the common fact that these preferences may or may not exist in sufficient strength to cause a meaningful first-order impact on the optimal income taxation problem.

As Kaplow indicates at the outset, if the social welfare function is strictly concave, this concavity shows some aversion to both risk and inequality. This social welfare function accords with the Pareto principle (i.e. 80% of the consequences can arise from 20% of the causes). In a positive light, incremental economic policy changes should focus on small steps that can lead to substantial increases in the aggregate social welfare function in terms of overall economic utility. Kaplow policy evaluation deals with incremental changes in population growth as well as structural shifts in intertemporal substitution between the private consumption patterns of current and future generations. At any rate, how the social welfare function reflects the general aversion to economic inequality remains an open question.

Kaplow draws a fine distinction between the concavity of individual utility functions as well as some concavity in the social welfare function. The latter can entail some value judgment, and the former represents measurable individual utility. Adopting the long prevalent view of individual utility functions as objective measures of social welfare for normative purposes is relatively innocuous if all economic actors have the same selfish preferences. However, there are some circumstances where the concavity concerns have deeper policy implications for redistributive results. First, people often differ in their ability to generate utility from consumption resources. If these differences result from differences in needs for expenditures, it is reasonable for economists to include these differences in needs as a multiplicative element of consumption in the social welfare utility function.

Second, similar issues arise from the case where inter-dependent utility functions are practically relevant for normative policy purposes. Personal choices can reveal many sources of pleasure or displeasure. It would be impossible for economists to detect all or most instances of utility interdependency. This utility interdependence can often lead to inconsistencies in most alternative policy choices. If policymakers remain ready to take into account altruism in charitable donations and bequests as policy-relevant considerations, these policymakers should include interdependent utility functions for normative policy purposes.

Third, people sometimes have different ordinal preferences, and this feature often becomes quite problematic for inter-personal comparisons of social welfare. From time to time, heterogeneous preferences are a fact of life. People choose different bundles of goods or services, save different dollar amounts, supply different levels of hard labor, give different donations to their heirs and charities, choose different family structures, and so forth. To apply the 2-step Kaplow methodology, we would often need to measure the interpersonal comparisons of individual utility functions with diverse preferences. In practice, it would seem insurmountable for economists to attempt to apply the social welfare approach when most economic actors exhibit heterogeneous preferences. For instance, non-linear progressive income taxation would differ substantially due to these diverse preferences and utility functions etc. Heterogenous economic actors can further differ in their innate ability, health status, their date and place of birth, risk aversion, and taste for leisure etc. In most cases, redistributive policies should compensate many economic actors for their rare and unique disadvantages that can arise from characteristics beyond personal control. At the same time, redistributive policies should not compensate for any outcomes that result from the free and responsible choices of most economic actors. In this view, different personal choices made by economic actors from similar opportunity sets should not be relevant for redistributive policies.

Harvard law and economics professor Louis Kaplow designs a 2-step methodology for normative policy analysis and then illustrates this method with numerous policy reforms. The first step helps identify efficiency gains when hypothetical lump-sum taxes can contribute to better redistributive results. The second step evaluates the redistributive effects of a standard social welfare function. Kaplow focuses on how most policymakers should approach redistributive taxes, social transfers, and core government expenditures (instead of what specific policies must be in due course). The central argument revolves around some basic normative principles rather than moral motives. As a result, the Kaplow 2-step methodology is persuasive in its own right for better economic policy evaluation.

Kaplow proposes a general methodology for dealing with the fundamental problem of public policy evaluation when both efficiency and redistribution are at stake. For practical relevance, Kaplow applies this 2-step methodology to many policy issues in progressive taxes, social transfers, and government expenditures on health care, education, global trade, finance, and research and development. From a normative viewpoint, economic policy prescriptions should substantively help enhance social welfare. This welfarism is the doctrine that the economic utility of individual agents should constitute the aggregate social welfare function. In this fresh light, the social welfare function should conform to individual preferences, should include all major sources of economic utility, and should be at least cardinally measurable and also comparable among economic actors. Aggregation of economic utility for individual economic actors should add strict concavity to the social welfare function. From a fundamental viewpoint, the legitimate policy outcome arises from the social choice of Pareto optimal economic results. In the domain of public policy, the median voter determinates the ultimate economic policy outcome via proportional representation. The Kaplow 2-step method can help better align socially desirable economic policy outcomes with common constituent interests across the political spectrum of liberal, conservative, and moderate-to-progressive reforms. In a nutshell, Kaplow provides his 2-step method for normative public policy evaluation in terms of both efficiency and equity.

This analytic essay cannot constitute any form of financial advice, analyst opinion, recommendation, or endorsement. We refrain from engaging in financial advisory services, and we seek to offer our analytic insights into the latest economic trends, stock market topics, investment memes, personal finance tools, and other self-help inspirations. Our proprietary alpha investment algorithmic system helps enrich our AYA fintech network platform as a new social community for stock market investors: https://ayafintech.network.

We share and circulate these informative posts and essays with hyperlinks through our blogs, podcasts, emails, social media channels, and patent specifications. Our goal is to help promote better financial literacy, inclusion, and freedom of the global general public. While we make a conscious effort to optimize our global reach, this optimization retains our current focus on the American stock market.

This free ebook, AYA Analytica, shares new economic insights, investment memes, and stock portfolio strategies through both blog posts and patent specifications on our AYA fintech network platform. AYA fintech network platform is every investor's social toolkit for profitable investment management. We can help empower stock market investors through technology, education, and social integration.

We hope you enjoy the substantive content of this essay! AYA!

Andy Yeh

Chief Financial Architect (CFA) and Financial Risk Manager (FRM)

Brass Ring International Density Enterprise (BRIDE) ©

Do you find it difficult to beat the long-term average 11% stock market return?

It took us 20+ years to design a new profitable algorithmic asset investment model and its attendant proprietary software technology with fintech patent protection in 2+ years. AYA fintech network platform serves as everyone's first aid for his or her personal stock investment portfolio. Our proprietary software technology allows each investor to leverage fintech intelligence and information without exorbitant time commitment. Our dynamic conditional alpha analysis boosts the typical win rate from 70% to 90%+.

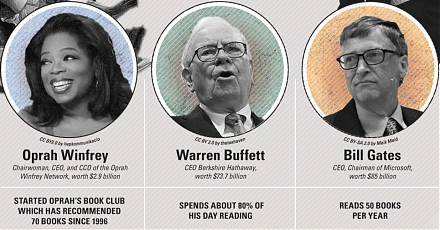

Our new alpha model empowers members to be a wiser stock market investor with profitable alpha signals! The proprietary quantitative analysis applies the collective wisdom of Warren Buffett, George Soros, Carl Icahn, Mark Cuban, Tony Robbins, and Nobel Laureates in finance such as Robert Engle, Eugene Fama, Lars Hansen, Robert Lucas, Robert Merton, Edward Prescott, Thomas Sargent, William Sharpe, Robert Shiller, and Christopher Sims.

Follow our Brass Ring Facebook to learn more about the latest financial news and fantastic stock investment ideas: http://www.facebook.com/brassring2013.

Follow AYA Analytica financial health memo (FHM) podcast channel on YouTube: https://www.youtube.com/channel/UCvntmnacYyCmVyQ-c_qjyyQ

Free signup for stock signals: https://ayafintech.network

Mission on profitable signals: https://ayafintech.network/mission.php

Model technical descriptions: https://ayafintech.network/model.php

Blog on stock alpha signals: https://ayafintech.network/blog.php

Freemium base pricing plans: https://ayafintech.network/freemium.php

Signup for periodic updates: https://ayafintech.network/signup.php

Login for freemium benefits: https://ayafintech.network/login.php

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-12-21 11:39:00 Friday ET

The Internet and telecom conglomerate SoftBank Group raises $23 billion in the biggest IPO in Japan. Going public is part of the major corporate move away f

2019-04-07 13:39:00 Sunday ET

CNBC news anchor Becky Quick interviews Warren Buffett in early-2019. Buffett explains the fact that book value fluctuations are a metric that has lost rele

2019-08-31 14:39:00 Saturday ET

AYA Analytica finbuzz podcast channel on YouTube August 2019 In this podcast, we discuss several topical issues as of August 2019: (1) Warren B

2018-04-02 07:33:00 Monday ET

China President Xi JinPing tries to ease trade tension between America and China in his presidential address at the annual Boao forum. In his vulnerable att

2018-03-02 12:34:00 Friday ET

White House top economic advisor Gary Cohn resigns due to his opposition to President Trump's recent protectionist decision on steel and aluminum tariff

2018-10-21 14:40:00 Sunday ET

President Trump floats generous 10% tax cuts for the U.S. middle class ahead of the November 2018 mid-term elections. Republican senators, congressmen, and