2023-05-21 12:26:00 Sun ET

stock market federal reserve monetary policy treasury fiscal policy deficit debt technology covid-19 employment inflation global macro outlook interest rate fiscal stimulus economic growth central bank fomc capital global financial cycle gdp output

Amy Chua and Jed Rubenfeld (2015)

The triple package: how 3 unlikely traits explain the rise and fall of cultural groups in America

In the creation and persistence of racial and ethnic economic inequalities, the role of culture has been the main focus of substantial controversy in the social sciences. In their recent book The Triple Package, Yale Law School professor and tiger mom Amy Chua and her husband Jed Rubenfeld argue that relatively successful ethnic, religious, or national origin groups exhibit a common set of cultural traits in America. At least 3 cultural traits drive the economic success of these groups. Specifically, the 3 main cultural traits include a sense of group superiority, individual insecurity, and good impulse control. Through ethnic stereotypes and anecdotes of immigrant angst and anxiety, Chua and Rubenfeld insist on the essential need for the whole triple package of 3 main cultural traits to work well for economic success in practice. However, Chua and Rubenfeld raise serious issues in regard to the long prevalent research on non-cognitive skills. Core important interactions between cultural traits and environmental effects can determine economic success and prosperity among several ethnic groups in America and some other parts of the world.

This thesis precedes the subsequent Chua analysis of political tribalism in America. Across the political spectrum of Democrats and Republicans, some political tribes often choose to defend their own respective teams (just as in the Olympic Games). When some ethnic and religious groups feel persistent threats, these groups often retreat to political tribalism in support of greater social identity protection over time. However, the political tribes tend to make relatively irrational choices and decisions because these tribes voluntarily ignore the objective and even scientific facts. This unfortunate outcome reflects the inconvenient truth that many American tribes can no longer express their own angst and anxiety in regard to the broader social and economic issues such as free trade, immigration, health care, consumer protection, financial regulation, tech titan dominance, and asset market stabilization etc. The ultimate solution depends on how well the political tribes can find common ground from different perspectives to forge friendship and collaboration in due course.

Culture often serves as a major driver of racial and ethnic stratification in America. This basic notion has been a recurrent source of controversy in the social sciences. Ethnic differences in wealth and income can often emerge as a result of persistent group disparities in cultural capital such as social cohesion, perseverance, identity consistency, resilience, and so forth. Economically successful ethnic, religious, or national origin groups tend to possess a common set of cultural traits in the pursuit of money and status in America. Parents often impart a sense of group superiority, individual insecurity, and good impulse control from one generation to the next via cultural narrative stories, anecdotes, and social norms. The triple-package cultures often empower children to achieve better economic results in income, job prestige, and social status in adulthood (relative to non-triple-package children). Indeed, the American triple-package ethnic groups tend to range from the predictable Chinese and Jewish groups to the unforeseen Mormon and Nigerian groups. These cultural groups often emphasize the importance of both hard work and education. From a fundamental viewpoint, education serves as the surest ladder to economic success. The primary challenge for most Americans is to delve deeper into the cultural roots of this behavioral inclination.

Chua and Rubenfeld focus on cultural beliefs and traits such as group superiority and individual insecurity, as well as a specific skill of robust impulse control due to normative practices, as the main candidates for the cultural roots of core hard work, thrift, education, and family cohesion etc. In essence, these cultural roots are often characteristic of successful ethnic groups in terms of money and status. Empirical evidence suggests that non-cognitive skills such as impulse control, perseverance, grit, and conscientiousness are important determinants of educational attainment, income, and the avoidance of criminal behavior. Chua and Rubenfeld analyze and explain how the intergenerational transmission of both cultural beliefs and attitudes can contribute to persistent differences in social group behaviors. There is at least some merit in their insistence that the triple combination of traits (rather than single traits in isolation) help explain cross-ethnic group differences in economic success. Overall, cultural identity plays a core pivotal role in explaining social and economic inequalities in America and some other parts of the world.

Chua and Rubenfeld identify 8 cultural groups as notably successful with the 3 key traits: Mormons, post-Castro Cubans, Nigerians, Indians, Chinese, Iranians, Jews, and Lebanese. Their markers of economic success include relatively high median household income in the U.S. Census, a large proportion of households with more than $100,000 annual income, and a variety of specific metrics such as the relative prominence of Mormon CEOs, Nigerian matriculation at Harvard Business School and prevalent economic success on Wall Street, post-Castro Cuban domination of Miami politics, Chinese overrepresentation at the Juilliard School of Music, Indian trophies in spelling bees and math and science competitions, and disproportionate success of American Jews by many economic measures such as entrepreneurship, high education, financial fortune in Wall Street, tech-savvy disruptive innovation in Silicon Valley, and so forth.

What do the diverse cultural groups have in common in accordance with the Chua-Rubenfeld triple-package thesis? First, each of these cultural groups tends to have a group superiority complex in terms of theology, history, or social hierarchy. Jews and Mormons both believe that they are the chosen people from God. These social groups often learn to believe (at least quietly) that they are intellectually, culturally, or morally superior to several other cultural groups (in accordance with quotes from Sigmund Freud, Justice Brandeis, and Philip Roth). Moreover, Chinese and Iranian Americans often take pride in the accomplishments of the ancient civilizations that serve as their unique heritage. The post-Castro Cuban migrants learn to represent the upper social strata of Cuban society and then arrive with a sense of entitlement in America. Indian Americans are predominantly from high-caste families, and this status represents an important and long prevalent aspect of their social identity in America. In sum, these group superiority complexes provide for minorities a useful defensive shield against racial discrimination and exclusion etc. In contrast, African Americans lack a unique group superiority complex due to a dark history of slavery and oppression. Many African Americans continue to suffer from ethnic exclusion and discrimination in the new era of equality. In this modern era, everyone learns to kowtow to the basic universal law that there is no or little fundamental difference between different racial groups. Most Americans learn to respect others who retain the basic human rights to life, liberty, and the pursuit of happiness.

Feeling innately superior is a good start on the path to exceptional accomplishment. In accordance with the unique Chua-Rubenfeld thesis, the 8 major cultural groups work hard in the hot pursuit of material success by fear and anxiety. For immigrants to America and their children, individual insecurity often emerges from racism and discrimination. Also, this insecurity can further arise from early economic losses in association with language transitions and inferior academic qualifications. Political refugees suffer from fear and violence. These immigrants often experience status shocks due to the expropriation of assets. The first-generation immigrant parents who incur these losses may put extreme pressure on their children to recoup their family fortunes. Many of the first-generation immigrant parents even attempt to set the unrealistic expectations and stereotypes for their children. For instance, many East Asian parents expect their children to become medical doctors in order to turn around their economic fate for money and status. Other first-generation immigrant parents expect their children to become disruptive innovators to lead lean business enterprises. For instance, David Ho and Terence Tao are typical examples of the former, and Elon Musk and Jeff Bezos are typical examples of the latter. The major cultural dimension shows family systems that allow this intergenerational pressure (such as the traditional Confucian notions of family honor and respect for elders in Chinese American families, rather than the transitory hardships of new arrivals). In practice, this individual insecurity generates a major drive for one to prove himself or herself. This drive leads to both extraordinary effort and a narrow focus on trying to achieve material success (rather than true love, happiness, or self-actualization). When push comes to shove, the basic law of inadvertent consequences counsels caution.

Both academic and career achievements often require diligent effort, persistence (even in the face of failure), and a rare inclination to defer gratification (or impulse control in the triple-package terms). Chua and Rubenfeld view impulse control as a unique and valuable skill that the 8 cultural groups often learn in terms of the key values and strategies of the first-generation immigrant parents who seek to impose strict regimens and expectations on their children. Here Chua and Rubenfeld focus on Chinese American families and then draw from the previous best-seller by Chua Battle Hymn of the Tiger Mother. Tiger Mother is a satirical and humorous memoir of their attempt to drive children to pinnacles of academic and music achievements with high-pressure work schedules, severely restrictive social and leisure pursuits, and relentless criticisms. Due to cultural stereotypes, unequal resources, and other difficult issues, social stratification often arises from genetic differences in cognitive ability. As social reproduction transmits from one generation to the next, social and economic (non-cognitive) barriers often play an important role in inhibiting upward mobility for many or most of the cultural groups without the triple package.

Chua and Rubenfeld present their triple-package narrative notion about economic success among specific cultural groups. This immigrant story focuses particularly on the key interactions between second-generation Americans and their immigrant parents. In a fundamental sense, immigrant parents serve as the conveyers of the 3 main cultural traits in the triple package. These chosen economically successful groups represent most model minorities with ethnic drive, grit, and persistence. For the most part, these chosen groups are immigrants and the children of immigrants. Migration is a highly selective process. People choose to move between countries when the likely benefits exceed the likely costs. Immigration rules, regulations, and institutions help determine the immigrants who are able to enter the land with milk and honey. Most U.S. immigrants are not representative of the non-immigrants left behind. Immigrant characteristics typically tend to depend on the economic, social, and political conditions that push the immigrants from the country of origin in order to pursue better opportunities in America. High-skill immigrants often expect to be successful in the new environment. Migrant selection tends to be generally positive because most immigrants are energetic and optimistic enough to work hard for life, liberty, and the pursuit of happiness.

This migrant selection relies on many observable characteristics such as income, education, and health status. The generic extent of positive migrant selection often varies substantially by the country of origin. Different immigrants often tend to enter the U.S. through different visa mechanisms that select on skillsets in different ways. Immigrants who first enter the U.S. on student visas or temporary work visas tend to earn higher wages than native Americans. Much of this competitive advantage arises from higher education and specialization. For instance, the U.S. Department of Homeland Security admits almost 55% of new permanent residents from India, and at least one quarter of new permanent residents from China, on the basis of employment preferences. In contrast, fewer than 7% of new residents from Mexico enter the U.S. for employment reasons. The broad admission criteria help ensure positive selection of high-skill immigrants from different countries.

Another practical way for economists to gauge the selectivity of immigrant groups entails comparing their observable characteristics to the respective distribution of characteristics in their country of origin. A pragmatic comparison of the educational distribution of new migrants with the educational distribution of home-country non-immigrants shows the U.S. immigrants from Asia exhibit greater positive selection than immigrants from Latin America and the Caribbean. If some other components of human capital positively correlate with education, the average person near the top of the educational distribution in a high-skill country such as Japan, Singapore, or Taiwan, is likely to carry specific innate attributes that lead to economic success in America. Further, the educational attainment of immigrants from Iran and India is high. Positive selection also seems substantial for immigrants from China, Japan, Singapore, South Korea, Taiwan, and so forth. The average Mexican immigrant is reasonably representative of the entire population of Mexico, whereas, the average immigrant from India, Nigeria, and Turkey has extraordinary privileges in his or her home country.

Because immigration is an investment with near-term costs and uncertain long-run benefits, this choice should be more attractive to people who are more adaptable, less risk-averse, and more patient. All of these attributes are economically valuable. McKenzie, Stillman, and Gibson (2010) focus on the random lottery for seats on a New Zealand quota for immigrants from Tonga. This empirical work tests positive migrant selection on the primary basis of unobservable characteristics. Applicants for this random lottery can earn almost twice the Tongan income of non-applicants. This evidence indicates substantial positive selection on the basis of unobservable characteristics with respect to the decision for Tongan immigrants to move to New Zealand.

Positive migrant selection on productive traits suggests that the economic success of first-generation triple-package migrants can be quite predictable. This selectivity has clear and obvious implications for the economic success and prosperity of the second generation. Through social reproduction, high-skill immigrant parents often transmit their social and economic privileges to the second generation. In this main mechanism, positive selection can help accumulate higher levels of human capital in addition to several other positive traits and advantages for the immigrant children. The educational attainment of the second generation often tends to be higher for immigrant groups due to greater positive migrant selection.

The triple-package traits per se serve as ethnic class-driven characteristics. High-skill immigrant parents often tend to have rare unique group superiority complexes and high expectations for their children. Most of the immigrants experience some status shock and even discrimination in their early years in America. This common experience generates transitional insecurity and so a major focus on rebuilding the family status via the academic and career achievements of the second-generation children. In light of parental authority, insecurity, and discipline etc, these second-generation children learn impulse control. To the extent that culture matters most, the culture of status generates this persistent comparative advantage over time. In the triple-package view, economic mobility accords with the key rationale that what children need to succeed is a rare set of cultural traits (group superiority, individual insecurity, and impulse control). These cultural traits help mold second-generation children, either purposefully or inadvertently, through immigrant parents, schools, and communities.

Chua and Rubenfeld invoke the famous marshmallow test to demonstrate the core fundamental importance of impulse control. The smart psychologist Walter Mischel and his co-authors empirically report a significant positive correlation between the ability for a 4-year-old child to delay gratification and his or her own academic and career accomplishments later in life (in terms of both test scores and first job wages) (e.g. Mischel, Ebbesen, and Zeiss (1972)). Self-control, grit, and persistence tend to be the major traits in association with the personal ability to master desires and temptations. These cultural traits are the stars in the constellation of non-cognitive skills that psychologists regard as important determinants of economic success in adulthood. In recent years, the economic science contributes significantly to some empirical studies of the positive effects of core traits on socio-economic disparities at adult ages. These studies focus on how human capital accumulation helps build character and perseverance over time. This gradual transition molds toddlers into young adults with good impulse control. Chua and Rubenfeld argue that the early life experiences help develop impulse control in the triple package. Environmental influences further contribute to the personal development of good impulse control in many immigrant families.

Nobel Laureate James Heckman and his co-authors empirically show that several intensive enrichment interventions for young children such as the Perry Preschool and Abecedarian programs cause significant positive effects on economic results, substantially reduce criminal behaviors, and boost both wealth and wage income in adulthood. Since these programs have only transitory effects on cognitive tests, Heckman and his collaborators conclude that these programs help enhance what most economists regard as non-cognitive skills. Further, early life experiences can combine with environmental influences to help train better executive functions (or a set of mental regulatory skills in relation to impulse control and problem analysis). We can think of impulse control as some specific type of human capital, or a stable and augmentable capability for people to perform high-skill tasks with patience and resistance to temptation. Overall, all of these subtle traits can contribute to positive economic outcomes in adulthood.

Chua and Rubenfeld have chosen the triple package of traits and beliefs in relation to subsequent economic success in adulthood. Their immigrant story is informal in nature and then draws heavily from recent empirical work on the technology of skill formation (Heckman and Mosso, 2014). The whole triple package is quite essential and necessary for both economic success and prosperity in adulthood. There are important interactions between the 3 key traits in the generation of material returns. In triple-package terms, good impulse control can be quite valuable in the specific context of American immigrant households with high group superiority and intense parental approval and individual insecurity. In sum, Chua and Rubenfeld advocate that relatively successful ethnic groups exhibit these common cultural traits (good impulse control, group superiority, and individual insecurity) in America and some other parts of the world.

This analytic essay cannot constitute any form of financial advice, analyst opinion, recommendation, or endorsement. We refrain from engaging in financial advisory services, and we seek to offer our analytic insights into the latest economic trends, stock market topics, investment memes, personal finance tools, and other self-help inspirations. Our proprietary alpha investment algorithmic system helps enrich our AYA fintech network platform as a new social community for stock market investors: https://ayafintech.network.

We share and circulate these informative posts and essays with hyperlinks through our blogs, podcasts, emails, social media channels, and patent specifications. Our goal is to help promote better financial literacy, inclusion, and freedom of the global general public. While we make a conscious effort to optimize our global reach, this optimization retains our current focus on the American stock market.

This free ebook, AYA Analytica, shares new economic insights, investment memes, and stock portfolio strategies through both blog posts and patent specifications on our AYA fintech network platform. AYA fintech network platform is every investor's social toolkit for profitable investment management. We can help empower stock market investors through technology, education, and social integration.

We hope you enjoy the substantive content of this essay! AYA!

Andy Yeh

Chief Financial Architect (CFA) and Financial Risk Manager (FRM)

Brass Ring International Density Enterprise (BRIDE) ©

Do you find it difficult to beat the long-term average 11% stock market return?

It took us 20+ years to design a new profitable algorithmic asset investment model and its attendant proprietary software technology with fintech patent protection in 2+ years. AYA fintech network platform serves as everyone's first aid for his or her personal stock investment portfolio. Our proprietary software technology allows each investor to leverage fintech intelligence and information without exorbitant time commitment. Our dynamic conditional alpha analysis boosts the typical win rate from 70% to 90%+.

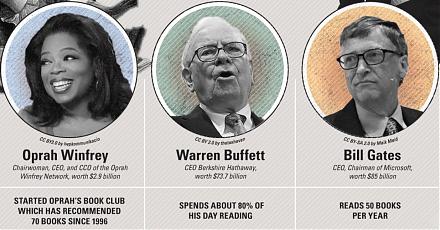

Our new alpha model empowers members to be a wiser stock market investor with profitable alpha signals! The proprietary quantitative analysis applies the collective wisdom of Warren Buffett, George Soros, Carl Icahn, Mark Cuban, Tony Robbins, and Nobel Laureates in finance such as Robert Engle, Eugene Fama, Lars Hansen, Robert Lucas, Robert Merton, Edward Prescott, Thomas Sargent, William Sharpe, Robert Shiller, and Christopher Sims.

Follow our Brass Ring Facebook to learn more about the latest financial news and fantastic stock investment ideas: http://www.facebook.com/brassring2013.

Follow AYA Analytica financial health memo (FHM) podcast channel on YouTube: https://www.youtube.com/channel/UCvntmnacYyCmVyQ-c_qjyyQ

Free signup for stock signals: https://ayafintech.network

Mission on profitable signals: https://ayafintech.network/mission.php

Model technical descriptions: https://ayafintech.network/model.php

Blog on stock alpha signals: https://ayafintech.network/blog.php

Freemium base pricing plans: https://ayafintech.network/freemium.php

Signup for periodic updates: https://ayafintech.network/signup.php

Login for freemium benefits: https://ayafintech.network/login.php

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-09-25 15:33:00 Wednesday ET

Product market competition and online e-commerce help constrain money supply growth with low inflation. Key e-commerce retailers such as Amazon, Alibaba, an

2018-06-14 10:35:00 Thursday ET

The Federal Reserve's current interest rate hike may lead to the next economic recession as credit supply growth ebbs and flows through the business cyc

2021-02-02 14:24:00 Tuesday ET

Our proprietary alpha investment model outperforms the major stock market benchmarks such as S&P 500, MSCI, Dow Jones, and Nasdaq. We implement

2019-02-01 15:35:00 Friday ET

Our proprietary alpha investment model outperforms the major stock market benchmarks such as S&P 500, MSCI, Dow Jones, and Nasdaq. We implem

2018-05-19 09:29:00 Saturday ET

Treasury Secretary Steve Mnuchin indicates that the Trump team puts the trade war with China on hold. The interim suspension of U.S. tariffs should offer in

2025-06-20 08:27:00 Friday ET

President Trump poses new threats to Fed Chair monetary policy independence again. We describe, discuss, and delve into the mainstream reasons, conc