2023-11-21 11:32:00 Tue ET

treasury deficit debt employment inflation interest rate macrofinance fiscal stimulus economic growth fiscal budget public finance treasury bond treasury yield sovereign debt sovereign wealth fund tax cuts government expenditures

Paul Milgrom (2019)

Discovering prices: auction design in markets with complex constraints

Nobel Laureate Paul Milgrom delves into the economic theory and market design of the U.S. incentive auction for wireless spectrum allocation from TV broadcasters to telecoms. Designing new markets with complex constraints requires both novel economic theory and real-word practice. This new market design often draws upon ideas from computer science and game theory. Milgrom teaches us how economic designers and auctioneers grapple with complexity both in theory and in practice. Specifically, the American Medical Association (AMA) has used a game-theoretic economic algorithm to fairly and efficiently allocate residents to hospitals. In some subsequent practical applications, many U.S. universities have applied the same algorithm to allocate college and graduate school applicants to particular programs (Gale and Shapley, 1962; Roth, 1984, 2008). Economic theory has also informed the adoption of optimal reserve prices in online advertisement auctions (Myerson, 1981; Ostrovsky and Schwarz, 2011), as well as the eventual shift of ad auctions from practice-driven second price auctions (Aggarwal, Goel, and Motwani, 2006; Edelman, Ostrovsky, and Schwarz, 2007; Varian, 2009; Athey and Ellison, 2011) to Vickrey-Clarke-Groves auction-driven mechanisms (Athey and Nekipelov, 2010; Varian and Harris, 2014).

Nowadays, many markets have become extraordinarily complex both in theory and in practice. For Lyft and Uber, for instance, each company has to figure out client destinations, fair prices, dynamic driver locations, and reserve prices for ride-share services. Each company needs to match drivers to customers with fair and efficient journey prices. Overall, each company must raise revenue to cover its costs in the hot pursuit of shareholder wealth maximization. Each company has to encourage drivers and riders to remain on the mobile ride-share platform. Most of economic theory treats simple models of the economy where prices alone can guide efficient economic decisions, but this conclusion rarely applies to complex price discovery systems (Milgrom, 2017, pp.44). Milgrom offers his main theoretical auction-driven innovations of both near substitutability and approximate equilibrium solutions. His account of the design of the incentive auction serves as a specific sort of parable for the design of complex markets (such as the reallocation of wireless spectrum licenses from U.S. TV broadcasters to telecoms).

A market arises whenever economic agents interact and seek to transact subject to budget constraints and incentives. Markets are everywhere, and many of them are at least partially set through central marketplaces with rules, transactions, and infrastructure. In these central marketplaces, the rules help guide economic agents to make transactions, and the infrastructure facilitates transaction execution (Roth, 2018). The most plausible market design goal is long-term profitability. Additional market design goals include revenue optimization, transparency, speed, privacy, price discovery, new entry or competition, trust, simplicity (or ease of use), fairness, elimination of adverse selection, and operation within ethical bounds.

Radio spectrum is a rare and valuable resource. Only a narrow band is useful for wireless communication. Radio signals that TV broadcasters send on overlapping channels often interfere with each other. In America, the Federal Communications Commission (FCC) initially allocated some of the most desirable radio spectrum to TV broadcasters in the 1940s and 1950s. The signals would travel long distances to penetrate walls. Nowadays, however, fewer people watch broadcast television in America, whereas, more people access information through their mobile phones. The incentive auction helps buy back wireless spectrum licenses from hundreds of U.S. TV broadcasters. At the same time, the incentive auction helps sell those licenses to telecoms. The FCC hopes to clear the market as efficiently as possible. In principle, telecoms should sufficiently compensate TV broadcasters who choose to give up their wireless spectrum licenses. The government seeks to boost fiscal revenue to cover all the costs in association with the incentive auction.

By nature wireless spectrum licenses are heterogeneous, and these licenses cover different areas and wavelengths (Cramton, 2002). Most broadcasters owned local licenses that had to be aggregated into national networks for telecom use (Rosston, 2012; Leyton-Brown, Milgrom, and Segal, 2017). Any broadcaster who knew that his or her license was crucial for assembling a contiguous national network would have demanded compensation far above his or her true value (Kominers and Weyl, 2012; Rosston, 2012). Congress partially ameliorated this holdout risk by granting the FCC the authority to move broadcasters to different channels. In practice, this strategy helped ensure that the wireless spectrum was on the same wavelengths nationwide.

Repacking the TV broadcasters who would not sell back their licenses created the possibility of interference, whereby those broadcaster signals might partially or fully block each other. The incentive-compatible Vickrey mechanisms determine prices by comparing efficient allocations. In these Vickrey auction-like mechanisms, small errors can snowball into large errors in price and efficiency assessments (Milgrom, 2017, pp.168). The challenge for the FCC was therefore to design an auction that would be both approximately efficient and robust to imperfections in price efficiency assessments. At the same time, this auction would need to be simple enough for TV broadcasters to participate with fair price targets.

The reverse auction that Milgrom et al proposed would start by offering a high price for each TV broadcaster license. The auctioneer would gradually reduce the price offers in sequence. As soon as a broadcaster rejected the previous price offer, the broadcaster exited the auction permanently and thus remained on the air (Milgrom and Segal, 2020). To address concerns with interference, the auction would freeze the price of any broadcaster that would potentially create interference if it chose to leave the auction. The deferred-acceptance algorithm finds market-clearing prices when goods are near substitutes (Kelso and Crawford, 1982). If wireless spectrum licenses are instead complementary from the perspective of the FCC, then market-clearing prices might not exist in reality. If goods are near substitutes, the deferred-acceptance algorithm would reach approximately efficient prices (Milgrom, 2021, pp.190-194). In this special case, the resultant allocation would be close to efficient as well.

Milgrom considers the structure of the FCC preferences over broadcast licenses. The FCC wanted to buy back licenses in a way that would maximize the value of the broadcasters who kept their wireless spectrum licenses in the end. Those TV broadcasters who chose to remain on the air would retain the highest fair value of licenses for operating as stations. From an auction design perspective, it would be ideal if the FCC preferences were almost one-for-one substitutable. Given flexible repacking rules, the FCC had to make wireless spectrum licenses as substitutable as possible (Kominers and Weyl, 2012). In simulations, the deferred-acceptance auction achieved 95% efficiency (Leyton-Brown, Milgrom, and Segal, 2017).

With the incentive auction, Milgrom explains at least 3 different types of complexity in new markets (such as the respective new markets for wireless wavelengths and online ads). First, how should marketplace designers specify various design goals? Second, how can each market designer overcome technical difficulties of eliciting information from economic actors and many other market participants? Third, how should each market designer tackle fundamental computational constraints? All of these 3 different types of complexity often define and describe new markets in light of budge constraints, incentives, and design goals.

When design goals conflict, simply specifying what economists prioritize becomes a major market design challenge all of its own. Specification complexity often tends to reflect these market design decisions and tradeoffs. The FCC offers extremely abstract remarks on the multiple market design goals for repurposing the spectrum. For example, the 2010 National Broadband Plan recommended that the U.S. policy makers ensure greater transparency with respect to wireless spectrum allocation and utilization with better broadcast incentives (FCC, 2020, pp.75). The exercise of making the design goals more precise was the first principal complexity in better developing the incentive auction. The policymakers decided that the market design goals of the incentive auction would involve buying out hundreds of broadcasters with heterogeneous licenses. Moreover, the policy makers decided that the market design goals would help reallocate the wireless spectrum licenses to telecoms as efficiently as possible with a reasonable amount of revenue for the government.

The incentive auctioneers can help resolve this specification complexity in at least 2 fundamental ways. First, the FCC repacks the otherwise homogeneous wireless spectrum in order to increase competition between TV broadcasters and telecoms. Second, the market designers run the forward and reverse auctions sequentially to figure out how much wireless spectrum new markets can clear in due course. In practice, the resultant market design helps hit the fiscal revenue target for the U.S. government.

In terms of market design goals, economists often achieve efficient outcomes by maximizing allocative surplus in accordance with the Kaldor-Hicks criterion. From time to time, efficiency means maximizing social welfare. For this reason, our main interpretation of efficiency as a major market design goal often tends to depend on the social welfare function. If economists have some distributional preferences in favor of less economic inequality, efficiency might involve distorting the allocation of wireless spectrum for TV broadcasters and telecoms. This partial consideration can often help improve the socioeconomic outcomes of poor people in the market for wireless spectrum.

Even when the design goals are clear, information frictions often stand in the way. The market has to somehow discover the specific preferences of economic agents. Economic agents acquire and process information in order to access the market with clear and identifiable preferences. Informational complexity reflects difficulties that arise in aggregating information from economic agents and many other market participants. Fortunately, the FCC was able to repack TV stations to create enough competition in the market for wireless spectrum. This new market turned out to be approximately competitive. In principle, the forward auction rules would build on previous package auctions for wireless spectrum. Running the reverse auction to clear TV stations off the air was no trivial matter. The clever deferred-acceptance algorithm elegantly tackled this informational complexity. Milgrom applied the core deferred-acceptance algorithm in the presence of complementarities. His practical application gave substantive assurance about how closely the economic outcome might approximate efficiency in accordance with the Kaldor-Hicks criterion.

Informational complexity might further arise when the market designer has to elicit combinatorial preferences over a large set of economic objects. In some specific contexts such as online ad auctions (Lahaie, Parkes, and Pennock, 2008), public electricity markets (Schnizler and Neumann, 2007), and business school courses (Budish and Cantillon, 2012), some goods might be substitutes, whereas, others might be complements. Rank-order lists would not suffice to characterize the main preferences of economic agents. It might often be infeasible for economic agents to submit high-dimensional combinatorial preferences for a large set of economic objects. In this special case, informational complexity necessitates the new market design of simpler bids in the incentive auction (Milgrom, 2009).

With computational complexity, the central computational constraints often impede the FCC ability to achieve specific design goals such as long-term profitability etc. The problem of determining which sets of TV broadcasters would be left on the air with minimal interference was computationally intractable. This complexity tended to constrain the market design of the incentive auction substantially. In particular, this complexity made it impractical for the FCC to compute efficient allocations of wireless spectrum for TV broadcasters and telecoms. In the Vickrey auction-driven mechanisms, price interdependence often adds to this computational complexity, and any errors would exacerbate the computational problem of efficient allocations. By gradually adjusting prices, the deferred-acceptance auction was less sensitive to imperfections in market design feasibility. As a result, it would be more likely for the FCC to determine market-clearing prices and efficient reallocations of wireless spectrum for TV broadcasters and telecoms.

The U.S. Federal Communications Commission (FCC) is responsible for allocating licenses for the use of electromagnetic spectrum to television broadcasters, mobile wireless services providers, satellite service providers, and others. The FCC must give bidders sufficient information and flexibility to pursue strategies for promoting a reasonably efficient assignment of wireless spectrum licenses. In reality, the FCC has to successfully implement the incentive auction without too much complexity that bidders might not understand the incentive auction itself. In the end, the FCC has chosen an ascending bid mechanism because it would increase efficiency to provide all the bidders with more information (Milgrom and Weber, 1982). In this key context, the FCC can avoid the winner’s curse for all the bidders in accordance with the linkage principle. The linkage principle states that all auction houses have an incentive to pre-commit to revealing all available information about each lot. In the art market specifically, for example, each auctioneer typically hires art experts to examine each lot, and hence the auctioneer pre-commits to revealing the truthful estimate of the fair value of art. Positive publicity arises from the linkage principle. In the particular case of wireless spectrum reallocation, the linkage principle serves as the theoretical foundation for the market design choice by the FCC between an ascending bid auction and a sealed-bid auction.

Milgrom teaches us how economists can map different forms of complexity to pin down the standard economic toolkit for the incentive auction. Milgrom proves that market design can work in increasingly complex contexts such as the new market for wireless spectrum reallocation. For Lyft and Uber, ride-share marketplaces face specification complexity in figuring out how economists can trade off efficiency and fiscal revenue design goals. These economists should elicit information about the multiple preferences of both riders and drivers over cost, speed, and direction. In practice, computational complexity plays an important role too as each online ride-share platform must offer travel schedules and optimal allocations in real time. All of these different forms of complexity become approachable both in theory and in practice. The incentive auction signals that the ideal future market designer might no longer be able to act as a humble economic engineer or a competent technocrat, but he or she would have to become a craftsman and a technologist who designs, creates, conceives, and implements the additional inventive features and elements of the incentive auction. The clever future market designer should not lose sight of the essential need for the FCC to maintain public trust in the incentive auction for wireless spectrum allocation.

This analytic essay cannot constitute any form of financial advice, analyst opinion, recommendation, or endorsement. We refrain from engaging in financial advisory services, and we seek to offer our analytic insights into the latest economic trends, stock market topics, investment memes, personal finance tools, and other self-help inspirations. Our proprietary alpha investment algorithmic system helps enrich our AYA fintech network platform as a new social community for stock market investors: https://ayafintech.network.

We share and circulate these informative posts and essays with hyperlinks through our blogs, podcasts, emails, social media channels, and patent specifications. Our goal is to help promote better financial literacy, inclusion, and freedom of the global general public. While we make a conscious effort to optimize our global reach, this optimization retains our current focus on the American stock market.

This free ebook, AYA Analytica, shares new economic insights, investment memes, and stock portfolio strategies through both blog posts and patent specifications on our AYA fintech network platform. AYA fintech network platform is every investor's social toolkit for profitable investment management. We can help empower stock market investors through technology, education, and social integration.

We hope you enjoy the substantive content of this essay! AYA!

Andy Yeh

Chief Financial Architect (CFA) and Financial Risk Manager (FRM)

Brass Ring International Density Enterprise (BRIDE) ©

Do you find it difficult to beat the long-term average 11% stock market return?

It took us 20+ years to design a new profitable algorithmic asset investment model and its attendant proprietary software technology with fintech patent protection in 2+ years. AYA fintech network platform serves as everyone's first aid for his or her personal stock investment portfolio. Our proprietary software technology allows each investor to leverage fintech intelligence and information without exorbitant time commitment. Our dynamic conditional alpha analysis boosts the typical win rate from 70% to 90%+.

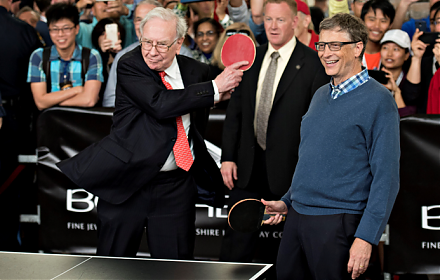

Our new alpha model empowers members to be a wiser stock market investor with profitable alpha signals! The proprietary quantitative analysis applies the collective wisdom of Warren Buffett, George Soros, Carl Icahn, Mark Cuban, Tony Robbins, and Nobel Laureates in finance such as Robert Engle, Eugene Fama, Lars Hansen, Robert Lucas, Robert Merton, Edward Prescott, Thomas Sargent, William Sharpe, Robert Shiller, and Christopher Sims.

Follow our Brass Ring Facebook to learn more about the latest financial news and fantastic stock investment ideas: http://www.facebook.com/brassring2013.

Follow AYA Analytica financial health memo (FHM) podcast channel on YouTube: https://www.youtube.com/channel/UCvntmnacYyCmVyQ-c_qjyyQ

Free signup for stock signals: https://ayafintech.network

Mission on profitable signals: https://ayafintech.network/mission.php

Model technical descriptions: https://ayafintech.network/model.php

Blog on stock alpha signals: https://ayafintech.network/blog.php

Freemium base pricing plans: https://ayafintech.network/freemium.php

Signup for periodic updates: https://ayafintech.network/signup.php

Login for freemium benefits: https://ayafintech.network/login.php

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2017-03-09 05:32:00 Thursday ET

From 1927 to 2017, the U.S. stock market has delivered a hefty average return of about 11% per annum. The U.S. average stock market return is high in stark

2019-08-03 09:28:00 Saturday ET

U.S. inflation has become sustainably less than the 2% policy target in recent years. As Harvard macro economist Robert Barro indicates, U.S. inflation has

2019-06-23 08:30:00 Sunday ET

The financial crisis of 2008-2009 affects many millennials as they bear the primary costs of college tuition, residential demand, health care, and childcare

2018-08-21 11:40:00 Tuesday ET

President Trump criticizes his new Fed Chair Jerome Powell for accelerating the current interest rate hike with greenback strength. This criticism overshado

2019-11-03 12:30:00 Sunday ET

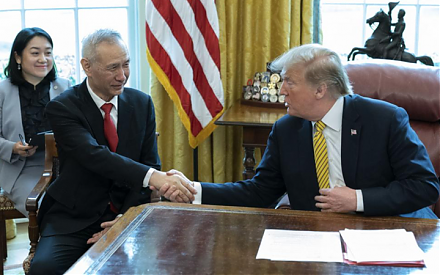

Chinese trade delegation offers to boost purchases of U.S. agricultural products to reach an interim trade deal with the Trump administration. Chinese Vice

2018-10-30 10:41:00 Tuesday ET

Personal finance author Ramit Sethi suggests that it is important to invest in long-term gains instead of paying attention to daily dips and trends. It