2023-09-07 11:30:00 Thu ET

stock market federal reserve monetary policy treasury fiscal policy deficit debt technology covid-19 employment inflation global macro outlook interest rate fiscal stimulus economic growth central bank fomc capital global financial cycle gdp output

Michael Woodford (2003)

Interest and prices: foundations of a theory of monetary policy

Columbia macroeconomist and professor Michael Woodford provides the theoretic foundations of monetary policy rules in global financial markets. Since the 1980s, most central banks have already abandoned money supply growth target rules as practical guidelines for monetary policy. Today effective monetary policy requires that central banks construct a conscious account of forward guidance on the future trajectories of both interest rates and macro indicators. This sound communication helps central banks better manage fiat money currencies to bolster confidence in the macro stability of real GDP national accounts. Woodford delves into the divine coincidence of both inflation and output gap stabilization over time. In due course, this macro stabilization strategy focuses on inflation target rules in the absence of either widespread commodity support or central bank control of monetary growth. This logic pervades the mainstream domain of the monetary economic science.

The Woodford monetary policy rules help central banks pursue both price stability and maximum sustainable employment in the Federal Reserve dual mandate. The explicit macroeconomic welfare analysis takes account of the new classical critique of traditional policy evaluation exercises. Monetary policy rules need not advocate adherence to a rigid New Keynesian framework with some trade-off between wage inflation and unemployment. At the same time, the consistent practical application of monetary policy rules often turns out to be better than central bank discretion in the broader business context.

In the Woodford monetary policy framework, credible and transparent core inflation targets help achieve the macroeconomic goal of price stability over time. This core implementation has the merit that the wide range of monetary policy decisions can be optimal under relatively plausible parametrizations. In this fresh light, Woodford provides a practically feasible method of quantitative monetary policy analysis. In response to the Lucas (1973) critique of key empirical relations between traditional Keynesian economic variables, the dynamic stochastic general equilibrium (DSGE) macroeconomic models offer new monetary policy prescriptions for central banks worldwide. Despite some statistical regularities such as the Phillips curve between wage inflation and unemployment, there is no scope for monetary policy (or fiscal stimulus policy) to dampen business cycle fluctuations with Pareto improvements. Expansionary monetary policy rules and interest rate adjustments may temporarily help reduce welfare losses in terms of both inflation and output gap deviations from their respective target rates. This monetary policy strategy works well if the general public cannot anticipate future interest rate adjustments. However, this strategy is likely to fail in due course when the general public comes to better anticipate future interest rates in accordance with some prescient monetary policy rules. In the long run, macroeconomic stabilization policy choices become ineffective in the form of small shocks to aggregate demand. This qualitative concept accords with the neo-classical synthesis. Monetary policy shocks are less significant than supply-driven technology shocks in terms of their cause-effect relations with aggregate business cycle fluctuations.

Even if central bankers can choose to steer monetary policy decisions and interest rate adjustments to smooth cyclical fluctuations with lower economic welfare costs, the resultant welfare gains would be relatively small in comparison to the efficiency gains from better macroeconomic stimulus programs. Long-run economic growth arises predominantly from capital investment accumulation, productivity growth, or population control. Sporadic discretionary fiscal and monetary policy adjustments often turn out to be counterproductive on the basis of statistical control optimization models. When push comes to shove from time to time, the basic law of inadvertent consequences counsels caution. There are different ways for macroeconomists to skin the cat, and all roads lead to Rome. However, no one can build Rome in one day.

In response to the neoclassic synthesis and Lucas critique, any successful rebuttal theory would have to satisfy several criteria. First, this theory must incorporate the conceptual advances of key dynamic competitive equilibrium rational expectations. Second, the theory must be as consonant with economic data overall as the long prevalent DSGE macro models. Third, the theory should preferably improve on the DSGE macro models in some respect. In regard to an economic welfare criterion, the theory should suggest that some form of macro stabilization policy dominates laissez-faire.

Early researchers attempt to accomplish some elements of this research program (i.e. John Taylor (1979), Oliver Hart (1982), Julio Rotemberg (1982), and Guillermo Calvo (1983)). Some common economic threads and insights run through this long prevalent macroeconomic research. First, the early DSGE macro models consider infinite-horizon open economies where the representative economic agent exhibits rational expectations in dynamic equilibrium. Second, these DSGE macro models tend to depart from perfect competition. In particular, monopolistically competitive firms differentiate their products and services in order to adjust optimal prices well above market equilibrium wages and marginal costs. As a result, these early macro models clear the product, labor, and capital markets in equilibrium as long as the optimal producer and consumer quantity decisions turn out to be equal on average. Third, these DSGE macro models analytically focus on demand shocks rather than supply shocks. Fourth, demands shock serve as perturbations of the nominal stock of outside fiat money. Real money balances are part of consumer utility functions. Nominal money shocks are demand shocks, and these demand shocks cause both economic output, income, household consumption, labor, and capital investment accumulation etc to fluctuate through the real business cycle. Fifth, the early DSGE macro models provide welfare analysis through the quadratic loss function of the probability distributions of both output growth and price inflation. Alternatively, the potential consumption gains and losses can serve as another measure of changes in economic welfare as Nobel Laureate Robert Lucas recommends as part of the macroeconomic policy research agenda. Sixth, it can often be optimal for the social planner to adjust macroeconomic policy instruments (interest rates, bank reserves, and large-scale asset purchases) to design fiscal and monetary stimulus programs for better macroeconomic stabilization through the business cycle. The latter policy prescription is a major conceptual difference of opinion between the new classical and New Keynesian schools of macroeconomic thought.

In almost 2 decades, Michael Woodford and his co-authors design several DSGE macro models that broadly share the central features of monopolistic competition in order to achieve the economic stabilization goal. Woodford et al further advance beyond demand shocks, nominal money balances, and quadratic welfare losses. Modelling money balances as some argument of the consumer utility function is a theoretical artifice for the macroeconomist to graft money balances onto a dynamic equilibrium model of real economic output. This central feature omits the analysis of both the private and social costs and benefits of fiat money. Money-in-the-utility-function models confront the Lucas (1976) puzzle of econometric policy evaluation in spades. When the central bank changes its monetary policy, these changes alter the fundamental nature of fiat money as an asset. There is no reason for the macro economist to think that the money-inclusive utility function remains approximately constant over time. A better economic welfare analysis of monetary policy changes should apply the envelope theorem to focus on the partial derivative of the money-inclusive utility function with respect to some marginal change in monetary policy. Specifically, the macroeconometrician gauges the quantitative impact of a round-yard interest rate change on real economic output, labor, capital, consumption, and so forth. In practice, fiat money serves as both the store of value as well as medium of exchange. Some marginal change in real money balances should cause no first-order effect on economic welfare per se.

Woodford advances the different justification for real money balances. Analytically, Woodford considers how the inclusion of real money balances as an argument of utility would affect the stochastic calibration analysis. Specifically, Woodford cites the real monetary effect as one major reason why complete macro stabilization of the price level may not be optimal. The Woodford baseline theory bolsters the core monetary policy prescription of alternative stabilization for lower welfare losses due to monetary non-neutrality.

The Sargent-Wallace unpleasant monetarist arithmetic analysis demonstrates that the central bank cannot contain money supply growth (or high inflation) if the fiscal authority engages in endless government bond issuance to fund public investment projects for better economic growth and employment. In this case, the central bank loses its monetary policy independence due to a lack of fiscal prudence. As a result, the central bank would eventually tolerate higher inflation sooner or later as money supply growth (or so inflation) accelerates due to the gradual accumulation of fiscal deficits over time. In effect, national debt caps constrain the positive fruits of macro policy coordination between the central bank and the fiscal authority.

Woodford builds DSGE macro models to support the new classic Sargent-Wallace monetarist arithmetic analysis. As Thomas Sargent and Neil Wallace (1975) show, the price level is indeterminate in equilibrium when the central bank follows some sort of interest rate rule. However, Woodford argues that the macroeconomist does not necessarily have to take this point of view. The central bank announcement of a stochastic price process can accord with rational expectations under the broader monetary policy framework. This announcement would suffice to anchor primarily rational expectations to the interest rate and inflation paths built by monetary policy decision-makers. Woodford strives to reconcile favorable central bank experiences of interest rate rules with the Sargent-Wallace adverse theoretical assessments in due course. Moreover, McCallum (1981) shows that the Sargent-Wallace analysis confines attention to some specific class of monetary policy decisions that depend on some interest rate rules. However, this class of monetary policy decisions may not depend on the equilibrium parameters of interest rate rules.

Woodford amends the standard McCallum analysis in at least 2 particular respects. First, Woodford considers the target to be the price path per se or the inflation path, instead of the money stock. Woodford further shows that this change in core target specification cannot affect the McCallum analysis. Second, Woodford presents his analysis as a log-linear local approximation (rather than an exact analysis for some class of log-linear market economies). Woodford regards the approximation as a valid and reasonable quantitative assessment for a broader class of differentiable economies subject to sufficiently small random shocks. If monetary policy serves as a function of the deviations of actual prices from the time series of target prices, only one equilibrium stochastic price process would move in tandem with interest rate adjustments under the optimal monetary policy. Woodford further presents his analogous result for inflation target rules. In this inflation target case, the sufficient condition for determinacy of equilibrium is that the elasticity of the interest rate with respect to the ratio of actual to target inflation must be greater than unity. This idea accords with the Taylor interest rate rule that the central bank should increase the interest rate when inflation is high (or when actual employment far exceeds the full employment level). When both inflation and employment levels are low, the Taylor rule suggests that the central bank should reduce the interest rate in order to help boost both monetary momentum and stimulus for the real economy. In this fashion, monetary policy decisions and interest rate adjustments can help reduce economic welfare losses through the real business cycle.

In most cases, the central bank makes a firm commitment to follow some specific monetary policy. This commitment has to be credible to representative economic agents in the real economy. As Robert Barro and David Gordon (1983) advocate, the feasible and credible monetary policy commitment can be tantamount to some determinacy of equilibrium in an extensive game where the central bank decisions represent a cumulative strategic response to real business cycle fluctuations. From a fundamental viewpoint, Michael Woodford thinks that monetary policy can affect the alignment between relative prices and marginal rates of transformation. If most producers are price setters but each has an opportunity to adjust the price only at intervals, and if the price reset occasions for producers are not synchronous, then relative prices cannot equate marginal rates of transformation. As a result, there is some sort of allocative inefficiency due to the misalignment between relative prices and marginal rates of transformation.

Woodford further considers strategic complementarity in most retail price decisions. Referring to impulse-response results of Lawrence Christiano, Martin Eichenbaum, and Charles Evans (2001), Woodford indicates that an actual unforeseen reduction in the U.S. nominal interest rate has virtually no effect on real GDP until 2 quarters later. In fact, the peak effect does not happen until 6 quarters after the interest rate shock, and a significant real effect persists 2 to 3 years after the interest rate shock. In terms of strategic complementarity in retail price adjustments, the real effect of the interest rate reduction can be spread across many rounds of price adjustments. This economic logic helps explain the 2-year to 3-year persistent effects of interest rate cuts on real GDP output gains in due course.

Eric Leeper, Christopher Sims, and Tao Zha (2001) explain that many identification problems are pervasive in the macroeconomic science. As cyclical variables, most interest rates tend to rise before NBER recessions. To better control inflation, the central bank must choose gradual interest rate hikes systematically in response to real business cycle fluctuations in the general state of the economy. Further, David Romer and Christina Romer (2000) find evidence in support of the notion that the central bank measures business cycle data more accurately than the private sector. As a result, the central bank can forecast the real business cycle more accurately than the private sector (especially when business cycle fluctuations often tend to be autoregressive in nature). In light of the ample consistent evidence, Woodford suggests that monetary policy should focus most heavily on reducing the adverse effects of price inertia in some particular markets and industries where retail prices change least often. Retail prices often cannot move sufficiently to support relative prices in the standard Arrow-Debreu market exchange economy. Sticky prices thus only move by occasional discrete jumps. Slow partial price adjustments may be a deliberate contractual arrangement for trade partners to share risk in commerce.

Most monetary policy rules ensure that the inflation rate is close to zero at all times. This core notion relates to the Wicksellian natural rate of interest for the economy. Over some period of time, sequential changes in the natural rate of interest affect real business cycle fluctuations in real GDP economic output growth, employment, industrial production, and capital investment accumulation. As Woodford proves in mathematical terms, the optimal monetary policy with zero inflation at all times sets the interest rate equal to the natural rate of interest. A by-product of this proof is a result that the deviation of inflation from zero is a fundamental function of an output gap. This economic output gap is the ratio between current output and initial output in the optimal resource allocation of the counterfactual optimization problem.

Columbia macroeconomist and professor Michael Woodford provides the theoretic foundations of monetary policy rules in global financial markets. Since the 1980s, most central banks have already abandoned money supply growth target rules as practical guidelines for monetary policy. Today effective monetary policy requires that central banks construct a conscious account of forward guidance on the future trajectories of both interest rates and macro indicators. This sound communication helps central banks better manage fiat money currencies to bolster confidence in the macro stability of real GDP national accounts. Woodford delves into the divine coincidence of both inflation and output gap stabilization over time. In due course, this macro stabilization strategy focuses on inflation target rules in the absence of either widespread commodity support or central bank control of monetary growth. This logic pervades the mainstream domain of the monetary economic science.

The Woodford monetary policy rules help central banks pursue both price stability and maximum sustainable employment in the Federal Reserve dual mandate. The explicit macroeconomic welfare analysis takes account of the new classical critique of traditional policy evaluation exercises. Monetary policy rules need not advocate adherence to a rigid New Keynesian framework with some trade-off between wage inflation and unemployment. At the same time, the consistent practical application of monetary policy rules often turns out to be better than central bank discretion in the broader business context.

In the Woodford monetary policy framework, credible and transparent core inflation targets help achieve the macroeconomic goal of price stability over time. This core implementation has the merit that the wide range of monetary policy decisions can be optimal under relatively plausible parametrizations. In this fresh light, Woodford provides a practically feasible method of quantitative monetary policy analysis. In response to the Lucas (1973) critique of key empirical relations between traditional Keynesian economic variables, the dynamic stochastic general equilibrium (DSGE) macroeconomic models offer new monetary policy prescriptions for central banks worldwide. Despite some statistical regularities such as the Phillips curve between wage inflation and unemployment, there is no scope for monetary policy (or fiscal stimulus policy) to dampen business cycle fluctuations with Pareto improvements. Expansionary monetary policy rules and interest rate adjustments may temporarily help reduce welfare losses in terms of both inflation and output gap deviations from their respective target rates. This monetary policy strategy works well if the general public cannot anticipate future interest rate adjustments. However, this strategy is likely to fail in due course when the general public comes to better anticipate future interest rates in accordance with some prescient monetary policy rules. In the long run, macroeconomic stabilization policy choices become ineffective in the form of small shocks to aggregate demand. This qualitative concept accords with the neo-classical synthesis. Monetary policy shocks are less significant than supply-driven technology shocks in terms of their cause-effect relations with aggregate business cycle fluctuations.

Even if central bankers can choose to steer monetary policy decisions and interest rate adjustments to smooth cyclical fluctuations with lower economic welfare costs, the resultant welfare gains would be relatively small in comparison to the efficiency gains from better macroeconomic stimulus programs. Long-run economic growth arises predominantly from capital investment accumulation, productivity growth, or population control. Sporadic discretionary fiscal and monetary policy adjustments often turn out to be counterproductive on the basis of statistical control optimization models. When push comes to shove from time to time, the basic law of inadvertent consequences counsels caution. There are different ways for macroeconomists to skin the cat, and all roads lead to Rome. However, no one can build Rome in one day.

This analytic essay cannot constitute any form of financial advice, analyst opinion, recommendation, or endorsement. We refrain from engaging in financial advisory services, and we seek to offer our analytic insights into the latest economic trends, stock market topics, investment memes, personal finance tools, and other self-help inspirations. Our proprietary alpha investment algorithmic system helps enrich our AYA fintech network platform as a new social community for stock market investors: https://ayafintech.network.

We share and circulate these informative posts and essays with hyperlinks through our blogs, podcasts, emails, social media channels, and patent specifications. Our goal is to help promote better financial literacy, inclusion, and freedom of the global general public. While we make a conscious effort to optimize our global reach, this optimization retains our current focus on the American stock market.

This free ebook, AYA Analytica, shares new economic insights, investment memes, and stock portfolio strategies through both blog posts and patent specifications on our AYA fintech network platform. AYA fintech network platform is every investor's social toolkit for profitable investment management. We can help empower stock market investors through technology, education, and social integration.

We hope you enjoy the substantive content of this essay! AYA!

Andy Yeh

Chief Financial Architect (CFA) and Financial Risk Manager (FRM)

Brass Ring International Density Enterprise (BRIDE) ©

Do you find it difficult to beat the long-term average 11% stock market return?

It took us 20+ years to design a new profitable algorithmic asset investment model and its attendant proprietary software technology with fintech patent protection in 2+ years. AYA fintech network platform serves as everyone's first aid for his or her personal stock investment portfolio. Our proprietary software technology allows each investor to leverage fintech intelligence and information without exorbitant time commitment. Our dynamic conditional alpha analysis boosts the typical win rate from 70% to 90%+.

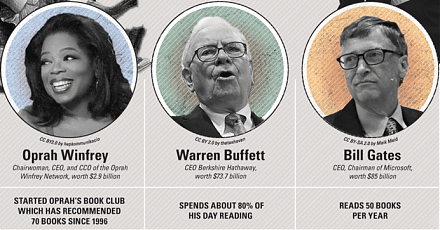

Our new alpha model empowers members to be a wiser stock market investor with profitable alpha signals! The proprietary quantitative analysis applies the collective wisdom of Warren Buffett, George Soros, Carl Icahn, Mark Cuban, Tony Robbins, and Nobel Laureates in finance such as Robert Engle, Eugene Fama, Lars Hansen, Robert Lucas, Robert Merton, Edward Prescott, Thomas Sargent, William Sharpe, Robert Shiller, and Christopher Sims.

Follow our Brass Ring Facebook to learn more about the latest financial news and fantastic stock investment ideas: http://www.facebook.com/brassring2013.

Follow AYA Analytica financial health memo (FHM) podcast channel on YouTube: https://www.youtube.com/channel/UCvntmnacYyCmVyQ-c_qjyyQ

Free signup for stock signals: https://ayafintech.network

Mission on profitable signals: https://ayafintech.network/mission.php

Model technical descriptions: https://ayafintech.network/model.php

Blog on stock alpha signals: https://ayafintech.network/blog.php

Freemium base pricing plans: https://ayafintech.network/freemium.php

Signup for periodic updates: https://ayafintech.network/signup.php

Login for freemium benefits: https://ayafintech.network/login.php

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2023-02-21 08:27:00 Tuesday ET

Mark Granovetter follows the key principles of modern economic sociology to analyze social relations and economic phenomena. Mark Granovetter (2017) &

2025-06-21 10:25:00 Saturday ET

Former New York Times science author and Harvard psychologist Daniel Goleman explains why emotional intelligence can serve as a more important critical succ

2019-03-11 10:32:00 Monday ET

Lyft seeks to go public with a dual-class stock ownership structure that allows the co-founders to retain significant influence over the rideshare tech unic

2019-01-17 10:41:00 Thursday ET

Sino-American trade talks make positive progress over 3 consecutive days as S&P 500 and global stock market indices post 3-day win streaks. Asian and Eu

2019-09-19 15:30:00 Thursday ET

U.S. yield curve inversion can be a sign but not a root cause of the next economic recession. Treasury yield curve inversion helps predict each of the U.S.

2019-10-31 13:38:00 Thursday ET

AYA Analytica finbuzz podcast channel on YouTube October 2019 In this podcast, we discuss several topical issues as of October 2019: (1)