2023-05-31 03:15:40 Wed ET

stock market federal reserve monetary policy treasury technology inflation free trade capital investment interest rate risk corona virus crisis trade war covid global supply chain foreign direct investment cold war thucydides trap legitimacy world order hong kong taiwan

In recent times, the Biden administration launches further China investment curbs ahead of the upcoming G7 summit. Given many twists and turns in the Sino-American trade war, the recent rise in political and economic tensions is reasonably predictable. History has shown that hostile state-to-state relations inevitably occur when a rapidly rising power (China) starts to seriously threaten to displace a major ruling power (America). As Former Dean of Harvard Kennedy School of Government Graham Allison explains in detail, China and America might have fallen into this Thucydides trap in the form of a zero-sum trade war. The next U.S. trade executive order is likely to further restrict U.S. outbound investments to China in some areas of critical technology such as semiconductors and 5G telecom networks.

Semiconductors have been a key battleground for China-U.S. tensions because many U.S. policymakers are wary that Chinese advances in semiconductor technology may put the U.S. at a military disadvantage. In accordance with the recent U.S. CHIPS and Science Act, the main subsidies help revitalize the U.S. semiconductor manufacturing industry. These critical tech subsidies are only a drop in the bucket in stark comparison to what would be necessary to build out a domestic industry on the scale for U.S. high-tech consumption needs. Since the Trump administration, China-U.S. trade has tracked well below where this bilateral trade would have been in the absence of state-to-state trade war tensions. Bilateral foreign direct investment (FDI) flows should have increased dramatically in recent years. These FDI flows have instead declined as the Chinese Xi administration has already constrained outbound FDI in Mainland China, Hong Kong, and Macao etc. For these reasons, investor sentiment among many multinational corporations toward China has become more cautious in recent quarters.

Now the U.S. and Europe further derisk and decouple from China by substantially shortening the global supply chains for semiconductors, microchips, and 5G telecom networks across both continents. China’s distinct pro-cyclical economic environment shows relatively strong macro momentum and recovery from the recent rampant corona virus crisis of 2020-2022. In the meantime, many macro economists hail low inflation and interest rates in China. This growth combo for better asset market diversification seems more attractive than the current macro backstop in America and Europe. In light of recent geopolitical and economic tensions between the U.S. and China, the risk-reward trade-off has become more difficult, but China remains investable. From Alibaba (e-commerce), BYD (the biggest electric car rival to Tesla in East Asia), and Tencent (the biggest online company in East Asia) to Baidu (the dominant Chinese search engine) and ByteDance (the parent company of TikTok), Chinese tech titans continue to deliver relatively high and persistent returns well above the long prevalent stock market benchmarks such as S&P 500, Nasdaq, Dow Jones, MSCI USA, MSCI Europe, and MSCI World etc. Further, Huawei and ZTE still dominate the 5G telecommunication market worldwide. These Chinese tech giants still retain rare and unique competitive advantages in their specialty fields.

In Harvard Professor Graham Allison’s book Destined for War, he predicts the recent rise in state-to-state hostility between the U.S. and China. In recent years, the central thesis seems to perpetrate a self-fulfilling prophecy. Just as Athens challenged Sparta in Ancient Greece, both countries would become increasingly hostile toward each other when a rapidly rising power threatens to displace a ruling power. Human history shows 16 cases where a rising power threatened to displace a ruling power in the last 500 years. In 12 of these cases, the outcome was a full-blown military war. This classic Thucydidean rivalry now seems to prevail between the U.S. and China.

In recent years, the U.S. and China might have fallen into the Thucydides trap in the form of a zero-sum trade war. Tariffs, quotas, and even embargoes have become the policy levers for economic sanctions in this Sino-American trade war. Americans have become so familiar with being at the top of the pecking order for more than a century. This mindset is now part of the American psyche. As we have seen in the case of other ruling powers, Americans can hardly tolerate the idea that China is not taking the place that the U.S. has already assigned to the Middle Kingdom in the American-led world order. In Mandarin, China serves as the connection between the earth and heaven. All other planets revolve around the sun. In the Chinese view, China shared a legitimate position at the center of the universe for thousands of years until Westerners showed up with new military technology at the dawn of the Xinhai bourgeois revolution against imperialism in 1911. As China has regained its new strength in the great rejuvenation of great Chinese people in recent decades, China returns to what key Chinese leaders view as its natural place of global power. As China becomes more powerful, China is now like other rising powers in history and then demands more say and sway in the world. These Thucydides storylines have already repeated many times in human history, so these storylines are now on display in the views and actions of both the U.S. and China. In this pragmatic view, China and America might have fallen into a Thucydides trap in the form of a zero-sum trade war in recent years.

Many Americans seem to fear that China is now the new Soviet Union in what may become a new Cold War. However, the Soviet Union was an expansive revolutionary power that was trying to pursue global transformation through communism. The Soviet Union believed that its key mission was to bring communist governments to power in every country. By contrast, China has no longer-term aspiration for other governments to follow the Chinese Communist Party (CCP). As Kissinger suggests, the Chinese people have a unique superiority complex that they cannot imagine other societies are good enough to imitate their form of government. One feature of the Cold War is an economic iron curtain that essentially separated the Soviet Union from the global economy. Today China is the second backbone of the global economy. As the Biden administration has already discovered in recent years, many nations refuse to choose between a U.S. in support of their essential peace and security, and a new China in support of their economic prosperity. In simple terms, the Cold War analogy misleads more than it clarifies geopolitical and economic tensions between the U.S. and China.

China has made reasonably clear that the CCP government aspires to displace the U.S. as the predominant power in Asia. The CCP aims to achieve this mandate not by attacking or occupying new territory. Just as the chess game of Go, China strategically surrounds nations and multinational corporations until they yield because they have no good alternative options. This status quo puts the U.S. and Mainland China directly at odds in the South China Sea, Taiwan, and the broader Asia-Pacific region. The U.S. believes strongly in its important role in the same Asia-Pacific region, as well as its long prevalent military and strategic alliances with Japan, South Korea, and Australia. For these reasons, America has no intention to walk away from Asia in the medium term. Thus, we can better understand the current geopolitical and economic tensions between China and the U.S. not in terms of the Cold War and global aspirations of each side, but in terms of a classic Thucydidean rivalry where East Asia now seems to be the most dangerous arena in the world.

The politics, populism, and nationalism in Washington and Beijing make it more difficult for both the U.S. and China to achieve a delicate balance in the current trade war. Geopolitical tensions between the U.S. and China render trade war resolution harder than the case for Athens and Sparta in Ancient Greece. Extraordinary efforts prevail only when the Biden and Xi administrations manage to find a robust way to trade war resolution. This alternative way needs to be robust enough for both sides to manage their domestic political demons. In fact, the U.S. and China fiercely compete for dominance in Asia. Each country further competes vigorously to be the next global leader in IT, AI, 5G, and many other critical tech advances. Each country now aspires to be an indispensable economy in global trade affairs via WTO governance mechanisms. In the Thucydides trap, the U.S. and China should learn to better balance the incentives for both to compete in trade affairs against the incentives for both to cooperate in non-trade affairs such as public health care, finance, climate change, education, crisis prevention, and disaster recovery.

We now live in the modern era of nuclear MAD: mutual assured destruction. Both the U.S. and China have nuclear arsenals. Any use of nuclear weapons against the other would lead to retaliation and, ultimately the destruction of both countries. We should be alert to remind ourselves of President Reagan’s wise doctrine: a nuclear war cannot be won and therefore must never be fought. Apart from military conflict resolution, there are substantial incentives for both the U.S. and China to cooperate on global climate risk management with less carbon footprint, asset market integration, and post-pandemic crisis prevention etc.

It is imperative for both the U.S. and China to learn how they should compete in some spaces and then should cooperate in others. This mutual adaptation is a hard but necessary aspect of our complex world today. We can borrow the coopetition analogy, rivalry partnership, from the business context. For instance, Apple and Samsung are fierce competitors in the world market for smartphones, but Samsung is the biggest supplier of parts and components for Apple as well. In a rivalry partnership, the U.S. and China should learn to compete in world trade affairs. At the same time, the U.S. and China should cooperate in non-trade activities such as post-pandemic public health care, finance, education, climate change, biodiversity risk management, crisis prevention, and disaster recovery etc. When push comes to shove, both countries should learn to adapt to a new equilibrium global order via legitimate means. Legitimacy here should not equate justice. Legitimacy means no more than an international agreement about the nature of workable arrangements, and about the permissible aims and methods of diplomacy. All of the major powers accept a new legitimate global order, whereas, any other world order is revolutionary and hence dangerous.

China’s economy caught up to the U.S. in purchasing-power terms after the Global Financial Crisis of 2008-2009 and now continues to grow at a faster pace. Recent erosion of the U.S. manufacturing base, emerging Chinese global competitors in critical tech industries, and the chronic U.S. trade deficits have all highlighted China’s growing economic clout. On the geo-political front, disputes over Chinese sovereignty flare up intermittently with various regional neighbors. In response, the U.S. often shows its allegiances via displays of force in the form of military exercises with allies or freedom-of-navigation operations in the South China Sea.

The Trump administration launched the trade war against China and so marked a sharp turn in the U.S. economic policy stance toward China. Tariffs reduced U.S. imports of particular Chinese products to some extent. However, these tariffs failed to produce a substantial shift in the bilateral trade imbalance given large differences in FDI flows between both countries. In recent talks, Chinese senior policymakers voice their concern and disappointment that the Biden administration would not seek to remove the 25% punitive tariffs in the China-U.S. trade war.

Both the U.K. and U.S. governments never try to dispute Mainland China’s sovereignty over Hong Kong after the post-colonial handover in 1997. However, these western countries often seem to rhetorically side with pro-democracy protests in Hong Kong in recent years. For this reason, Chinese policymakers often blame foreign forces for these protests. In response to these protests, China imposes a new national security law in Hong Kong. Due to ideological differences, American-led western allies criticize this monolith due to human rights concerns (such as the freedom of speech, freedom of expression, and freedom of assembly).

The global corona virus crisis has brought massive economic and human hardship. At least 3 years later, there is still no professional consensus on the natural origin of Covid-19. The WHO investigation remains incomplete as of mid-2023, and U.S. senior policymakers have expressed dissatisfaction with China’s cooperation in this investigation. In recent quarters, the Biden administration continues to blame China for net-zero Covid-19 lockdowns due to economic growth concerns, and the Chinese Xi administration criticizes the U.S. failure to control the corona virus spread worldwide. These cross-border interactions exacerbate geo-political and economic tensions between the U.S. and China.

China and Russia continue to proclaim a no-limits partnership more than a year after Russia instigated the first land war against Ukraine in Europe since World War II. Chinese political leaders have already emphasized strategic alignment with Russia multiple times in recent summits between the presidents and defense ministers. U.S. senior policymakers seem to have drawn the conclusion from Russia’s surprise invasion that it may be necessary for the U.S. to consider greater military efforts at deterring Mainland China to protect Taiwan along the Asia-Pacific first island chain. Recent U.S. arms sales and policymaker visits to Taiwan have sparked civil protests and military exercises from Mainland China. In combination, the China-U.S. trade war, Covid-19, Hong Kong protests, Russia-Ukraine conflict, and rock solid defense considerations for Taiwan seem to exacerbate geopolitical and economic tensions between the U.S. and China.

U.S. export controls continue to expand dramatically during the Biden administration in light of broad-brush anti-China sentiment. The U.S. Department of Commerce continues to add Chinese mega tech firms such as Huawei and ZTE in surveillance, aerospace, drone, cloud service provision, and other critical tech sectors to the Entity List with military and industrial economic sanctions. The basic intention is for the U.S. to avoid supplying U.S. critical tech advances to Chinese tech firms in association with China’s military surveillance policies etc. In response to U.S. tariffs and tech investment controls, China continues to dissuade other countries from joining U.S. efforts to introduce new economic sanctions against China. This response helps China build self-reliance with less dependence on foreign economies. China also seeks to use its own currency, the Renminbi, with key trade partners in the middle east, Brazil, Russia, and Turkey etc. On the margin, China has further shifted American dollar-led foreign reserves slightly toward gold in recent months. For now, no news may be good news for China-U.S. relations. Business contacts and fair trade talks may resume in the new post-Covid era. Official interactions are likely to step up further after a recent period of calm.

At the start of the Trump administration, the decision of imposing 25% tariffs on China was made primarily on economic grounds. The trade representative team focused on narrowing the bilateral trade deficit against China. In recent years, the Biden administration has kept these tariffs in place in light of anti-China investor sentiment. Also, the Biden administration has further defended these tariffs from legal challenges. In recent years, the U.S. Court of International Trade upheld the Section 301 tariffs on over $300 billion imports from China. Despite the fact that this case might ultimately flow to the U.S. Court of Appeals and even the U.S. Supreme Court, most economists expect to see no or minimal broad-brush changes to the tariffs in the medium term.

Near the end of the Trump administration, and then throughout the Biden administration, the U.S. policy stance toward China has already shifted to anti-China investor sentiment with a strategic focus (rather than a purely economic focus). We can borrow the Red Queen story-line from business administration to describe the current China-U.S. relations. The strategic U.S. policy stance toward China focuses on maintaining a relative competitive advantage in key critical tech advances with as large a lead as possible. This strategic focus can lead to at least 2 main consequences. First, the Biden administration now broadens and intensifies further export controls on Section 1758 new foundational tech advances. Second, the Biden administration imposes CFIUS outbound investment restrictions on China in order to reduce the transfer of U.S. technology (in the common form of trade secrets, patents, trademarks, and copyrights), rather than high-tech expertise and capital per se.

Recent data shows a stark divergence between China-U.S. bilateral trade and investment flows. Despite all of the focus on the trade war over the past 6 years, bilateral trade continues to remain at high levels. This trade arises from key supportive U.S. household consumption patterns. However, this bilateral trade is well below where it would have been in the absence of tariffs and other trade frictions.

On the investment side, foreign direct investment (FDI) into China built by U.S. corporations has sharply declined in recent years. In the past 3 years, specifically, more than 80% of all FDI flows into China originate from the top 10 U.S. tech titans and another top 10 European auto and chemical companies etc. In combination, the U.S. trade policy stance toward China has been tough with no or little withdrawal of the current status of Permanent Normal Trade Relations (PNTR). In the meantime, economists cannot rip out the basic tenets of free trade that has substantially benefited both the U.S. and China since the latter became part of the WTO in December 2001. The U.S. still needs to add some elements of fair trade, specifically in the form of Section 301 tariffs and Section 1758 tech investment restrictions, to ensure a delicate balance in the new normal China-U.S. bilateral trade relations.

How well the U.S. economically derisks and decouples from China depends on the daylight between their economic systems. The U.S. and Canada, for instance, have similar economic systems, so few limits exist to interoperability in trade, finance, investment, and technology between these North American neighbors. On both sides of the border, companies conduct the same of due diligence to get comfortable doing business with each other.

The U.S. and China, however, have increasingly dissimilar economic system. Since China entered the WTO in late-2001, China has worked earnestly to adjust its economic system in a free market direction. Western engagement with China continues to be ineffective both for governments and companies. This issue persists even when we take into account national security considerations. It is hence likely for the U.S. to further economically decouple from China. This gradual divergence may or may not be maximal. Many trade activities continue to be permissible and accretive to the joint economic welfare of the U.S. and China. In this broader context, the likely gradual divergence between the U.S. and China means that the U.S. may share a smaller fraction of the economic pie with China. When the U.S. and China both accept the new normal trade arrangements, this equilibrium becomes a legitimate world order.

This analytic essay cannot constitute any form of financial advice, analyst opinion, recommendation, or endorsement. We refrain from engaging in financial advisory services, and we seek to offer our analytic insights into the latest economic trends, stock market topics, investment memes, personal finance tools, and other self-help inspirations. Our proprietary alpha investment algorithmic system helps enrich our AYA fintech network platform as a new social community for stock market investors: https://ayafintech.network.

We share and circulate these informative posts and essays with hyperlinks through our blogs, podcasts, emails, social media channels, and patent specifications. Our goal is to help promote better financial literacy, inclusion, and freedom of the global general public. While we make a conscious effort to optimize our global reach, this optimization retains our current focus on the American stock market.

This free ebook, AYA Analytica, shares new economic insights, investment memes, and stock portfolio strategies through both blog posts and patent specifications on our AYA fintech network platform. AYA fintech network platform is every investor's social toolkit for profitable investment management. We can help empower stock market investors through technology, education, and social integration.

We hope you enjoy the substantive content of this essay! AYA!

Andy Yeh

Chief Financial Architect (CFA) and Financial Risk Manager (FRM)

Brass Ring International Density Enterprise (BRIDE) ©

Do you find it difficult to beat the long-term average 11% stock market return?

It took us 20+ years to design a new profitable algorithmic asset investment model and its attendant proprietary software technology with fintech patent protection in 2+ years. AYA fintech network platform serves as everyone's first aid for his or her personal stock investment portfolio. Our proprietary software technology allows each investor to leverage fintech intelligence and information without exorbitant time commitment. Our dynamic conditional alpha analysis boosts the typical win rate from 70% to 90%+.

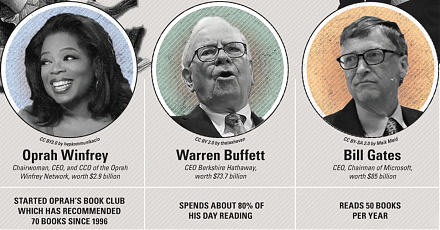

Our new alpha model empowers members to be a wiser stock market investor with profitable alpha signals! The proprietary quantitative analysis applies the collective wisdom of Warren Buffett, George Soros, Carl Icahn, Mark Cuban, Tony Robbins, and Nobel Laureates in finance such as Robert Engle, Eugene Fama, Lars Hansen, Robert Lucas, Robert Merton, Edward Prescott, Thomas Sargent, William Sharpe, Robert Shiller, and Christopher Sims.

Follow our Brass Ring Facebook to learn more about the latest financial news and fantastic stock investment ideas: http://www.facebook.com/brassring2013.

Follow AYA Analytica financial health memo (FHM) podcast channel on YouTube: https://www.youtube.com/channel/UCvntmnacYyCmVyQ-c_qjyyQ

Free signup for stock signals: https://ayafintech.network

Mission on profitable signals: https://ayafintech.network/mission.php

Model technical descriptions: https://ayafintech.network/model.php

Blog on stock alpha signals: https://ayafintech.network/blog.php

Freemium base pricing plans: https://ayafintech.network/freemium.php

Signup for periodic updates: https://ayafintech.network/signup.php

Login for freemium benefits: https://ayafintech.network/login.php

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-01-05 11:39:00 Saturday ET

Reuters polls show that most Americans blame President Trump for the recent U.S. government shutdown. President Trump remains adamant about having to shut d

2019-10-07 12:35:00 Monday ET

Federal Reserve reduces the interest rate by another key quarter point to the target range of 1.75%-2% in September 2019. In accordance with the Federal Res

2023-05-28 10:24:00 Sunday ET

Thomas Piketty connects the dots between economic growth and inequality worldwide with long-term global empirical evidence. Thomas Piketty (2017) &nbs

2019-07-17 12:37:00 Wednesday ET

Gold prices surge above $1400 per ounce amid global trade tension and economic policy uncertainty. Both European Central Bank and Bank of Japan may consider

2019-12-30 11:28:00 Monday ET

AYA Analytica finbuzz podcast channel on YouTube December 2019 In this podcast, we discuss several topical issues as of December 2019: (1) The Trump adm

2019-03-21 12:33:00 Thursday ET

Senator Elizabeth Warren proposes breaking up key tech titans such as Facebook, Apple, Microsoft, Google, and Amazon (FAMGA). These tech titans have become