2019-08-07 08:32:00 Wed ET

stock market federal reserve monetary policy treasury fiscal policy deficit debt dollar technology employment inflation global macro outlook china trade brexit tariff interest rate exchange rate gold oil

Our fintech finbuzz analytic report shines fresh light on the current global economic outlook. As of Summer-Fall 2019, the current analytic report focuses on the recent hawkish-to-dovish Federal Reserve interest rate adjustments in the global context of trade, capital mobility, and stock market integration. The primary financial topics are the Federal Reserve dual mandate of price stability and maximum sustainable employment for better economic growth, Sino-American trade escalation and tech supremacy, Brexit trade economic policy uncertainty, and asset price stabilization for gold, oil, and the greenback.

We provide a soft PDF version of this analytic report in the cloud: https://bit.ly/2jY8dsI

This analytic report cannot constitute any form of financial advice, analyst opinion, recommendation, or endorsement. We refrain from engaging in financial advisory services, and we seek to offer our analytic insights into the latest economic trends, stock market topics, investment memes, and other financial issues. Our proprietary alpha investment algorithmic system helps enrich our AYA fintech network platform as a new social community for stock market investors: https://ayafintech.network.

In American economic history, the Federal Reserve needs to fulfill the legislative mandate of promoting long-run steady economic growth, price stability, maximum sustainable employment, production, and purchasing power. The key problem for Federal Reserve has become stopping disinflation from becoming a debt-deflation bust. In the current decade, most Federal Reserve interest rate adjustments help constrain money supply growth and hence prevent inflation from becoming a major source of economic turbulence. In recent years, the Federal Reserve has gradually formalized FOMC communication channels and operational procedures to foster transparency and public acceptance of central bank independence and power over the U.S. economy.

Meanwhile, the Federal Reserve learns from its prior interest rate cycles with fiat-money, legal tender, and monetary policy research that the best policy prescription aims to anchor long-run inflation expectations at a low level if the Federal Reserve intends to achieve the congressional dual mandate of price stability and maximum sustainable employment. The current adoption of a specific 2% inflation target is the end result of decades of learning from this experience with fiat money and core monetary policy research (from Volcker and Greenspan to Bernanke and Yellen).

In mid-2019, U.S. core CPI inflation continues to hover in the reasonable range of 1.5% to 2% or still below 2% monetary policy target. In order to sustain the current U.S. economic expansion, Federal Reserve Chair Jerome Powell and most FOMC members approve an interim federal funds rate cut from 2.25%-2.5% to 2%-2.25%. Powell reiterates the best FOMC intention that financial market participants cannot misconstrue this interest rate cut as a one-time rate cut or the first in a series. This emphasis better balances the current interest rate cycle in light of the first rate cut since the global financial crisis back in 2008.

However, many stock market analysts regard the interim interest rate reduction as the likely surrender of central bank independence in response to a vocal president. In Summer-Fall 2019, the recent rate cut represents dovish accommodation amid Sino-American trade conflict, Brexit trade exodus and Eurozone economic policy uncertainty, and geopolitical risks in Iran, North Korea, and the South China Sea. In due course, the law of inadvertent consequences counsels caution.

MIT PhD macro economist Jordi Gali and his thesis advisor and former IMF chief economist Olivier Blanchard empirically show that the core Taylor interest rate rule of solo price stabilization would be equivalent to minimizing the deviations of both inflation and the economic output gap from their respective target levels. Blanchard and Gali refer to this macroeconomic stabilization policy as the divine coincidence.

Nevertheless, the divine coincidence vanishes when the econometrician takes into account wage rigidities and financial market imperfections. In this alternative case, the econometrician can readily identify a clear trade-off between wage inflation and unemployment at least in the cross-section of key OECD and emerging-economies. This canonical trade-off between wage inflation and unemployment is the Phillips curve, and the Phillips curve serves as a crucial foundation for the New Keynesian school of macroeconomists such as Olivier Blanchard, Jordi Gali, Gregory Mankiw, and so forth.

In stark contrast, several real business cycle (RBC) macro economists dismiss this narrow focus on the New Keynesian Phillips Curve (NKPC) for a pair of reasons. First, there is no clear trade-off between core CPI inflation and unemployment, and the Phillips curve becomes the Phillips cloud. In other words, the Phillips curve has become too flat to be true. This empirical result holds even when we consider some alternative metrics of inflation such as the personal consumption expenditure (PCE) deflator and core consumer price index (CPI) inflation less food and energy. Hence, there is no conclusive evidence in support of the downward Phillips curve.

Second, NKPC evidence disappears in the time-series data for each of the OECD countries. This time-series data inconsistency also shows up in Japan, Hong Kong, Singapore, and South Korea. In the long run, the Phillips curve becomes so vertical that the natural rate of unemployment seems independent of inflation. In this rather skeptical light, price stabilization has no impact on real macro economic covariates such as real GDP, consumption, employment, capital investment, and so forth. In summary, the Phillips cloud echoes the RBC monetarist school of economists such as Robert Barro, John Cochrane, Roger Farmer, and Robert King etc.

Overall, the relentless NKPC monetary policy debate appears to be a moot issue. New Keynesian central bankers continue to consider a downward Phillips curve or a tentative trade-off between inflation and unemployment, whereas, real business cycle proponents view alternative macroeconomic behaviors and beliefs and even financial market imperfections as plausible sources of transitional dynamism in real macro economic covariates such as GDP growth, employment, capital investment, and financial intermediary capital. The Phillips curve remains an open controversy.

In mid-2019, Federal Reserve Chair Jerome Powell encounters a new question at the post-FOMC press conference: would the Federal Reserve consider raising the core inflation target from 2% to 4%? Powell offers a negative answer and reiterates that most central banks anchor inflation expectations at the extant 2% policy target. Major-currency exchange rates have become quite stable in recent years, and this currency market stability arises from the fact that most central banks tend to anchor inflation expectations at the universal 2% target worldwide. If inflation is so similar across countries, this monetary policy coordination helps anchor exchange rates through the long-term fundamental mechanism that competitive economic forces forge in order to sustain purchasing power parity. In the grand scheme of monetary policy coordination, the palpable Powell knee-jerk response indicates the essential need for central banks to maintain the status quo.

Most central bankers and macro economists settle on a low positive inflation target rate, for instance 2%, in contrast to the zero-inflation scenario and any other higher inflation target such as 3%-4%. The former may inadvertently induce the economy to the deflationary debt-driven liquidity trap. When borrowers regard deflation as a real possibility, they would be more likely to avoid excessive leverage. Further, the latter can cause more substantial generic gyrations in prices and wages etc. Even though the welfare cost of inflation often tends to be low (i.e. a small fraction of 1% U.S. real GDP growth), it is difficult for the Federal Reserve to depart too far from the 2% inflation target as most other central banks such as European Central Bank, Bank of England, and Bank of Japan etc anchor inflation expectations at this low positive threshold.

The optimal long-run stock market returns usually occur when inflation remains low and stable symmetrically around the 2% target. If U.S. real GDP growth is 2%-3%, U.S. nominal GDP growth with a 2% inflation rate would likely average 4%-5%. As a consequence, household consumption expenditures, retail sales, and corporate sales would grow at the reasonable range of 4% to 5%. Throughout U.S. economic history, this range is about the optimal growth rate in external capital flows through the economy to service U.S. national debt and any further fiscal deficit. In dynamic equilibrium, this optimal growth path helps better balance the economic output gap in the long run. In this logic, low and smooth real interest rate adjustments become a necessary conduit for the optimal macro mix of high and steady economic growth, high capital mobility, sustainable government debt, and low and stable inflation.

President Trump ramps up 25% tariffs on $250 billion Chinese imports soon after China backtracks on the Sino-U.S. trade agreement in early-May 2019. U.S. trade envoys express frustration that China reneges on prior commitments to the major resolution of persistent issues from bilateral trade deficit imbalance and currency misalignment to intellectual property protection and arbitrary technology transfer.

In recent times, the primary U.S.-China stock markets from S&P 500, Dow Jones, and NASDAQ to Hong Kong, Shanghai, and Shenzhen plunge 5%-6% in response to the current trade conflict between the U.S. and China. The Trump administration accuses China of breaking the fair trade deal across 7 chapters of the 150-page draft agreement, whereas, Chinese Vice Premier Liu He conveys his concern that the U.S. agribusiness export procurement figures should be realistic. Meanwhile, both sides need to better balance the substantive text of a major trade deal. In fact, the Chinese trade reps reiterate that this delicate balance must maintain the dignity and sovereignty of the country.

When U.S. trade envoy Robert Lighthizer and Treasury Secretary Steven Mnuchin return from bilateral trade negotiations in Shanghai, President Trump announces a new 10% tariff on all the additional $300 billion Chinese imports prior to the next round of Sino-American trade negotiations in September 2019. This new tariff may seem small at first glance, but the extra unilateral tariff poses a key economic threat to the Chinese economy with subpar economic performance in recent years. In the broader context of Sino-American trade escalation, the Trump administration may leverage not only tariffs but also quotas and even embargoes to further constrain Chinese economic growth, technology transfer, and intellectual property theft. Due to these considerations, China continues to trudge on a long road with unbearably heavy trade barriers toward the next U.S. presidential election in late-2020.

China tries to modernize its economy by moving up the manufacturing value chain to invest in 5G telecoms and semiconductors to be the next global powerhouse of scientific and technological innovation by mid-century. The government has set an explicit target for total R&D expenditures to surge to 2.5%-5% of total real GDP by 2025. In fact, the Chinese share of global R&D expenditures has risen from about 5% in 2000 to 25% in 2019, whereas, the U.S.-equivalent share has declined from double digits over the same time frame.

In addition to supportive government policies, many factors contribute to the recent rise of China as a tech-savvy R&D superpower. These important factors include a massive consumer market; a large pool of high-skill labor; a robust and solid global supply chain of modern manufacturing capabilities for smart phones, tablets, and other artificially intelligent mobile devices. In the current age of Chinese astronauts landing on the dark side of the moon, China is well on its way to becoming a tech leader in global e-commerce transactions (Alibaba, Taobao, and Tmall), third-party payments (Alipay and WeChat Pay), key industrial robots (Foxconn, Pegatron, and Quanta), 5G telecom capabilities (HuaWei), autonomous cars (Didi and Ucar), and artificial intelligence applications such as digital music and instant messenger apps (Baidu, ByteDance, and Tencent etc).

As the Trump administration blacklists the Chinese 5G telecom giant HuaWei, U.S. top tech firms such as Google, Intel, and Qualcomm suspend Android services to the Chinese company. HuaWei cannot license the Android operating system with tech services from these U.S. tech titans. Several stock market analysts indicate that this new obstacle hits more than 50% of HuaWei mobile devices worldwide. The Trump executive order blocks HuaWei from Android software apps and other updates that normally preload on HuaWei smartphone shipments. This ban hence specifies digital isolation for HuaWei as the second largest handset manufacturer. If the current Sino-U.S. trade conflict morphs into a tech cold war in recent times, the HuaWei ban can best be regarded as the dawn of a digital iron curtain. In the broad context of bilateral relations and public affairs, China and the U.S. seem to have fallen into the proverbial Thucydides trap (or an aggressive clash of Chinese and American civilizations in accordance with the famous thesis of Harvard political scientist Samuel Huntington).

From early-2018 to mid-2019, China substantially offloads its U.S. Treasury bond positions by almost $21 billion to $1.1 trillion. These Treasury bond positions reach their lowest level, or 5% of U.S. government debt, in almost 2 years. The Chinese Xi administration may thus leverage its current status as top Treasury debtholder in the next round of bilateral trade negotiations. As a result, the Chinese renminbi depreciates to almost 6.7x to 7x per U.S. dollar in recent times. This Treasury bond operation triggers Treasury bond yield hikes that lead to U.S. yield curve inversion. This yield curve inversion seems to precede each of the U.S. economic recessions since the 1970s. In this light, the Treasury bond operation may inadvertently cause collateral damage to U.S. economic growth, financial intermediary capital, liquidity creation, credit supply, and capital investment etc. The Trump administration has to contemplate whether it is opportune to further diversify the foreign ownership of U.S. Treasury bonds as these government bonds now concentrate in the hands of Chinese and Japanese quasi-sovereign wealth fund managers.

This economic thread reverberates with the prior theme of long-term U.S. real GDP growth. The optimal long-run stock market returns often occur when inflation is low and stable symmetrically around the 2% policy target. If U.S. real GDP growth is 2%-3%, U.S. nominal GDP growth with 2% inflation would likely average 4%-5%. As a result, household consumption expenditures, retail sales, and corporate sales etc would grow at 4%-5%. In U.S. economic history, this optimal economic growth rate coincides with the optimal growth rate in foreign capital flows. China, Japan, and other foreign owners of Treasury bonds therefore service the majority of U.S. national debt and any further fiscal deficit. In equilibrium, this optimal growth path helps the U.S. government achieve the macro mix of high and steady GDP growth, sustainable government debt, and low and stable inflation through smooth interest rate cycles.

Some stock market analysts estimate that the current Sino-American trade conflict may curtail global GDP by about $600 billion. If the Trump administration imposes tariffs on all the other $325 billion Chinese imports and then China retaliates with tit-for-tat countermeasures, the global stock market may shrink by 9% by mid-2021. Both U.S. and Chinese real GDP may decline by at least one percentage point. In addition, several other trade blocs such as Australia, Canada, and Europe etc rely heavily on U.S.-China cross-border commerce and so may suffer as a result.

To the extent that the Trump administration seeks to better balance bilateral trade deficits against China, each successive trade deficit declines to no more than $80 billion per quarter from early-2018 to mid-2019. As the prevalent U.S. CPI inflation persists in the reasonable range of 1.7% to 1.9% or still below the 2% policy target, the evidence defies the conventional wisdom that Trump tariffs may substantially boost Chinese import prices with undue inflationary pressure. Nevertheless, it may be too soon to gauge the negative effects of U.S. tariffs on Chinese and European import prices, greenback fluctuations, and inflationary gyrations as several central bankers and stock market analysts prefer to view a mutually beneficial Sino-U.S. trade deal as the global macro economic baseline.

Britain appoints former London mayor and Foreign Secretary Boris Johnson as the new prime minister and successor to Theresa May to set the stage for fresh Brexit negotiations with the European Commission. This leadership change causes the British pound to fluctuate much, and some stock market analysts even speculate pound-dollar parity by late-2020.

Johnson advocates that he would be keen to force Brexit with no deal on October 31, 2019, which is the final deadline for Britain to depart the European Union, after the House of Commons thrice rejects Brexit proposals from the May administration. To secure better economic arrangements with European Union, Jeremy Corbyn now encourages Labour legislators to back a second referendum on Brexit. Labour Party now has a strategic advantage if Corbyn and his fellow MPs pivot in favor of a second Brexit referendum. As the European Union remains the largest trade bloc to Britain, Britons must reconsider the economic pros and cons of closer trade ties with the Eurozone. The Brexit withdrawal agreement may involve a gross amount of €100 billion. Net of some U.K. assets, the final bill would involve about €65 billion. The withdrawal transfer funds can contribute to better British health care, welfare, infrastructure, taxation, and other aspects of public finance.

In the prior Brexit referendum, supportive sentiments arise from a wide variety of socioeconomic factors such as the European sovereign debt crisis, immigration, terrorism, and E.U. bureaucracy.

However, Britons primarily use the British pound but not the Euro, thereby the U.K. has never been part of the E.U. monetary union. Many British millennials prefer to remain in the E.U. for closer trade ties and better economic arrangements. Britons may consider a second referendum on Brexit with the backstop agreement for free flows of goods between Northern Ireland and the Irish Republic.

Most stock market analysts predict that leaving the European Union with no proper deal would plunge the U.K. into a deep economic recession due to Eurozone trade constraints and capital outflows. U.K. stock markets would fall 5% in light of a 2% decrease in economic output, and the pound would likely plummet 10%-13%. This prediction accords with what the U.K. Office for Budget Responsibility suggests in its recent report on the British economic outlook.

Gold prices surge to the peak of $1447 per ounce in mid-2019 in light of Sino-U.S. trade tension, Brexit economic policy uncertainty, and other geopolitical risks. The Federal Reserve switches to a dovish tone with an interim interest rate cut, and so the greenback depreciates quite a bit. European Central Bank, Bank of England, and Bank of Japan may consider expanding extra monetary stimulus if the global economy weakens in the next few quarters. Stock market investor sentiments tend to prevail in the negative correlation between the U.S. dollar and gold appreciation. The precious yellow metal accrues no interest as a stable store of value over time, and hence gold prices serve as a countercyclical negative-beta indicator of global economic stability.

The recent accidental drone collision between Iran and America adds to the current global trade escalation. Iran-specific oil production cuts may boost energy prices. As a consequence, both gold and oil prices surge as stock market investors seek capital safety.

Another primary root cause of gold appreciation can be geopolitical tension on the Korean peninsula. Several stock market analysts maintain the view that there are irreconciliable differences between the U.S. and North Korea on both the pace and breadth of complete, verifiable, and irreversible denuclearization by mid-2020. This elusive policy target seems out of sync with the North Korean long-run commitment to its nuclear program. A logical prediction suggests that the U.S. may reluctantly revert to an aggressive containment strategy. In this scenario, North Korea poses a regional security threat that can devastate South Korea, Japan, and even China, Taiwan, and the Philippines. This threat may disrupt the key global supply chains.

In its national congress of Chinese Communist Party, the Xi administration seeks to deploy first-class military forces to broaden territorial and maritime claims in the South China Sea. In the South China Sea, the sovereignty and state control of key islands and reefs remain in dispute. In recent years, China intends to place military hardware on the South China Sea territories for new maritime defense capabilities. A partial abdication of U.S. leadership of global public affairs can embolden China to exert its historical rights and territorial claims in the region. Also, the Chinese Xi administration aims to resolve cross-strait issues with Taiwan in the next decades. These regional security issues may disrupt global supply networks and major sea lanes with negative economic consequences.

Overall, these geopolitical risks contribute to the recent gold appreciation. A major Sino-U.S. fair trade deal can be the new headwind for the precious metal.

In mid-2019, the Trump administration decides to stop waiving economic sanctions on Iranian oil exports. U.S. State Secretary Mike Pompeo asserts that the U.S. no longer grants these waivers to China, India, Japan, South Korea, Turkey, and so forth. Also, America plans to raise oil exports to 9 million barrels per day by 2024. This U.S. oil production is likely to surpass Russian shipments and may eventually overtake Saudi oil exports.

In contrast to greater U.S. oil production, Saudi Arabia and United Arab Emirates seek to drain global supply glut to support higher oil prices by cutting oil exports to 7 million barrels per day. As a consequence, the crude oil price appreciation helps improve the economic prospects of Saudi Aramco in the next biggest IPO lock-up period. In the grand scheme of geopolitical risk balance, the U.S. national security strategists need to trade off interim oil price fluctuations with draconian economic sanctions on the nuclear nation Iran. This aggressive containment strategy helps isolate Iran to the detriment of oil-dependent economies worldwide.

If the U.S. efficiently cracks down on Iranian ghost tankers and also strikes deals with other oil importers (such as China, India, Japan, South Korea, and Turkey) to switch their crude oil supply bases away from Iran, Iranian oil exports may decline well below 1 million barrels per day that most stock market analysts expect in mid-2019 to late-2020. To cope with the global oil shortfall, Saudi Arabia, Russia, and United Arab Emirates may have residual capacity to ramp up crude oil supply; and U.S. shale production can further fill the gap. However, a sudden and sizeable oil supply cut may not be feasible in volatile countries such as Libya and Venezuela. On balance, oil prices may soar well above the current target levels as most other OPEC producers cannot expand oil output sufficiently to put a lid on oil prices.

In the worst-case scenario, oil appreciation can cause higher inflation with subpar economic growth worldwide.

Do you find it difficult to beat the long-term average 11% stock market return?

It took us 20+ years to design a new profitable algorithmic asset investment model and its attendant proprietary software technology with fintech patent protection in 2+ years. AYA fintech network platform serves as everyone’s first aid for his or her personal stock investment portfolio. Our proprietary software technology allows each investor to leverage fintech intelligence and information without exorbitant time commitment. Our dynamic conditional alpha analysis boosts the typical win rate from 70% to 90%+.

Our new alpha model empowers members to be a wiser stock market investor with profitable alpha signals! The proprietary quantitative analysis applies the collective wisdom of Warren Buffett, George Soros, Carl Icahn, Mark Cuban, Tony Robbins, and Nobel Laureates in finance such as Robert Engle, Eugene Fama, Lars Hansen, Robert Lucas, Robert Merton, Edward Prescott, Thomas Sargent, William Sharpe, Robert Shiller, and Christopher Sims.

Follow AYA Analytica financial health memo (FHM) podcast channel on YouTube:

https://www.youtube.com/channel/UCvntmnacYyCmVyQ-c_qjyyQ

Follow our Brass Ring Facebook to learn more about the latest financial news and fantastic stock investment ideas:

http://www.facebook.com/brassring2013.

Free signup for stock signals: https://ayafintech.network

Mission on profitable signals: https://ayafintech.network/mission.php

Model technical descriptions: https://ayafintech.network/model.php

Blog on stock alpha signals: https://ayafintech.network/blog.php

Freemium base pricing plans: https://ayafintech.network/freemium.php

Signup for periodic updates: https://ayafintech.network/signup.php

Login for freemium benefits: https://ayafintech.network/login.php

We update and refresh part of memetic financial information on a sporadic basis. We aim to facilitate this information exchange only for illustrative purposes. Some information may be stale and incomplete. Therefore, we recommend each member to consult the respective external website(s) for more up-to-date information.

This analytic report cannot constitute any form of financial advice, analyst opinion, recommendation, or endorsement. We refrain from engaging in financial advisory services, and we seek to offer our analytic insights into the latest economic trends, stock market topics, investment memes, and other financial issues. Our proprietary alpha investment algorithmic system helps enrich our AYA fintech network platform as a new social community for stock market investors: https://ayafintech.network.

The conventional disclaimers apply to this key case where each freemium member bewares, understands, and acknowledges the service terms and conditions for our courteous fintech network platform. Any omissions, errors, or other blemishes do not necessarily reflect the official views and opinions of our AYA fintech platform orchestrator. We make a conscious effort to keep most major omissions to 1% to 5% of the fintech information for about 6,000 U.S. stocks on NYSE, NASDAQ, and AMEX. These omissions tend to concentrate around some rare corporate events (e.g. IPO, delisting occurrence and recurrence, abrupt trading suspension, and M&A initiation etc). Overall, these disclaimers, terms, and conditions of our service should be viewed as baseline house rules for fintech network platform usage and development.

Under pending subsequent patent-law confirmation, the relevant legal text protects our proprietary alpha software technology for ubiquitous knowledge transfer. Each freemium member enjoys his or her interactive usage and information exchange on our AYA algorithmic fintech network platform with sound and efficient dynamic conditional asset return prediction.

Our AYA fintech network platform helps promote better financial literacy, inclusion, and freedom of the global general public with an abiding interest in core economic reforms, financial markets, and stock market investments. In this broader context, each freemium member can consult our mission statement that provides more in-depth explanatory details on our long-term aspiration.

Andy Yeh Alpha (AYA)

AYA fintech network platform founder

Brass Ring International Density Enterprise (BRIDE)

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2017-03-09 05:32:00 Thursday ET

From 1927 to 2017, the U.S. stock market has delivered a hefty average return of about 11% per annum. The U.S. average stock market return is high in stark

2018-11-11 13:42:00 Sunday ET

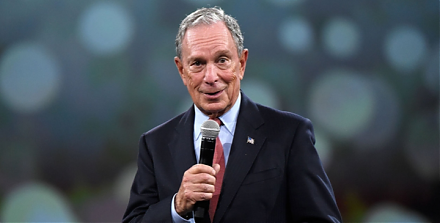

Michael Bloomberg provides $80 million as campaign finance for Democrats to flip the House of Representatives in the November 2018 midterm elections, gears

2022-03-25 09:34:00 Friday ET

Corporate cash management The empirical corporate finance literature suggests four primary motives for firms to hold cash. These motives include the tra

2023-05-28 10:24:00 Sunday ET

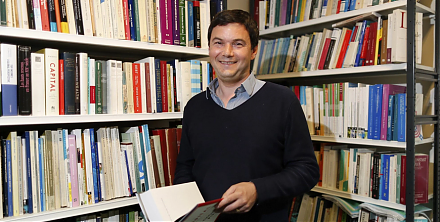

Thomas Piketty connects the dots between economic growth and inequality worldwide with long-term global empirical evidence. Thomas Piketty (2017) &nbs

2020-09-15 08:38:00 Tuesday ET

Macro eigenvalue volatility helps predict some recent episodes of high economic policy uncertainty, recession risk, or rare events such as the recent rampan

2019-05-05 10:34:00 Sunday ET

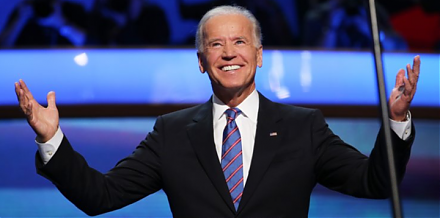

Former Vice President Joe Biden enters the next U.S. presidential race with many moderate-to-progressive policy proposals. At the age of 76, Biden stands ou