2019-02-13 11:00:00 Wed ET

treasury deficit debt employment inflation interest rate macrofinance fiscal stimulus economic growth fiscal budget public finance treasury bond treasury yield sovereign debt sovereign wealth fund tax cuts government expenditures

President Trump may reluctantly sign the congressional border wall deal in order to avert another U.S. government shutdown. With his executive power to declare a national emergency, President Trump expresses his displeasure with this House-Senate compromise, but he has to accept the $1.4 billion border wall deal. House and Senate negotiators tentatively reach a border security agreement in principle to avoid another partial government shutdown.

Several commentators view this presidential ploy as a risky maneuver that may open the Pandora box of future challenges both in court and in Congress. Trump seeks alternative public finance to fund the $5 billion southern border wall. The key immigration reform reflects the fact that President Trump faces political opposition from House Democrats with respect to public finance.

This public finance standoff may exacerbate the current U.S. fiscal budget deficit. In accordance with the Sargent-Wallace unpleasant monetarist arithmetic principle, the monetary authority would need to allow higher money supply growth or inflation in the form of higher seigniorage taxes if the fiscal authority continues to fund the budget deficit with incessant public bond issuance. In this light, the congressional border wall deal has profound policy implications for fiscal equilibrium as well as monetary price stability.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2020-03-05 08:28:00 Thursday ET

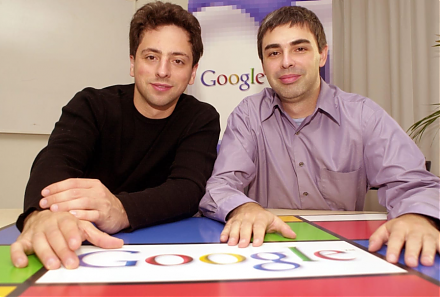

The Stanford computer science overlords Larry Page and Sergey Brin design and develop Google as an Internet search company. Janet Lowe (2009) Google s

2017-11-23 10:42:00 Thursday ET

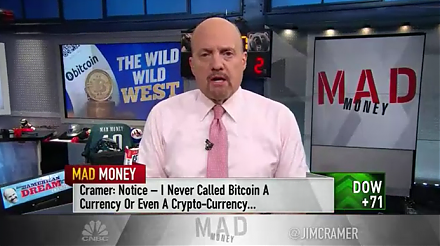

As the TV host of Mad Money, Jim Cramer provides 5 key reasons against the purchase and use of cryptocurrencies such as Bitcoin. First, no one knows the ano

2018-06-02 09:35:00 Saturday ET

The finance ministers of Britain, Canada, France, Germany, Italy, and Japan team up against U.S. President Donald Trump and Treasury Secretary Steven Mnuchi

2023-04-14 13:32:00 Friday ET

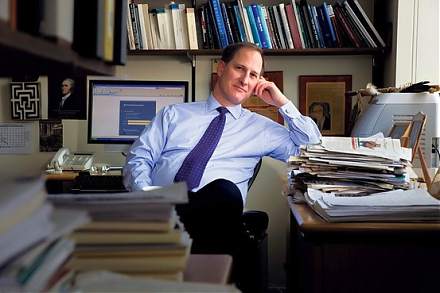

Calomiris and Haber delve into the comparative analysis of bank crises and politics in America, Britain, Canada, Mexico, and Brazil. Charles Calomiris an

2018-05-19 09:29:00 Saturday ET

Treasury Secretary Steve Mnuchin indicates that the Trump team puts the trade war with China on hold. The interim suspension of U.S. tariffs should offer in

2018-12-18 10:38:00 Tuesday ET

President Trump threatens to shut down the U.S. government in 2019 if Democrats refuse to help approve $5 billion public finance for the southern border wal