2019-06-11 12:33:00 Tue ET

federal reserve monetary policy treasury dollar employment inflation interest rate exchange rate macrofinance recession systemic risk economic growth central bank fomc greenback forward guidance euro capital global financial cycle credit cycle yield curve

Dallas Federal Reserve Bank President Robert Kaplan expects the U.S. economy to grow at 2.2%-2.5% in 2019-2020 as inflation rises a bit. In an interview with Fox Business Network, Kaplan indicates that it might be too soon to gauge the ripple effects of U.S. tariffs on core Chinese and European imports, dollar gyrations, and inflationary concerns.

As the Federal Reserve remains patient on the next monetary policy adjustments, credible central bank communication can help circumvent financial imbalances in the U.S. real economy. Meanwhile, the Sino-American trade tension intensifies, so many stock market analysts now consider low inflation to be transitory. As Federal Reserve balance sheet shrinkage continues, some stock market analysts expect this balance sheet strategy to halt in light of higher U.S. Treasury bond yields. The higher yields may inadvertently tighten credit conditions for mortgage borrowers and corporate debtors. In this negative light, this logic leads to financial imbalances in the form of exorbitant mortgage and business debt. These financial imbalances can exacerbate the real estate and business debt dilemma. When push comes to shove, monetary policymakers need to consider the potential ramifications of credit supply shortage before Federal Reserve steers the next interest rate adjustments.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2017-11-07 09:38:00 Tuesday ET

HPE CEO Meg Whitman has run both eBay and Hewlett Packard within Fortune 500 and now has decided to step down after her 6-year stint at the technology giant

2018-12-17 08:43:00 Monday ET

Apple files an appeal to overturn the recent iPhone sales ban in China due to its patent infringement of Qualcomm proprietary technology. This recent ban of

2017-10-21 08:45:00 Saturday ET

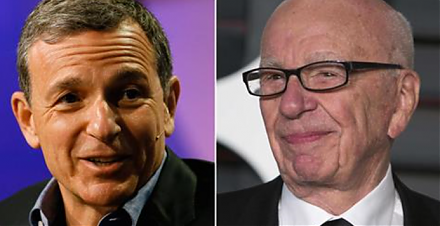

Netflix stares at higher content costs as Disney and Fox hold merger talks. Disney has held talks to acquire most of 21st Century Fox's business equity.

2019-06-25 10:34:00 Tuesday ET

Investing in stocks is the best way for people to become self-made millionaires. A recent Gallup poll indicates that only 37% of young Americans below the a

2023-05-21 12:26:00 Sunday ET

Amy Chua and Jed Rubenfeld suggest that relatively successful ethnic groups exhibit common cultural traits in America. Amy Chua and Jed Rubenfeld (2015)

2019-11-19 09:33:00 Tuesday ET

American unemployment declines to the 50-year historical low level of 3.5% with moderate job growth. Despite a sharp slowdown in U.S. services and utilities