2019-08-20 07:33:00 Tue ET

federal reserve monetary policy treasury dollar employment inflation interest rate exchange rate macrofinance recession systemic risk economic growth central bank fomc greenback forward guidance euro capital global financial cycle credit cycle yield curve

The recent British pound depreciation is a big Brexit barometer. Britain appoints former London mayor and Foreign Secretary Boris Johnson as the prime minister. The Conservative Party selects Johnson as the successor to Theresa May to set the stage for fresh Brexit negotiations with the European Commission. This change hits the pound with volatile exchange rate gyrations. The British pound sinks to the new lowest level of US$1.24 in 2017-2019. Johnson advocates that he would be keen to force Brexit with or without a post-May deal on October 31, 2019, which is the latest deadline for Britain to depart the European Union. Alternatively, Britons might consider a second referendum on Brexit with the backstop agreement for free flows of goods between Northern Ireland and the Irish Republic.

Most stock market analysts predict that leaving the European Union with no proper deal would plunge the U.K. into a deep economic recession due to Eurozone trade constraints and capital outflows. U.K. stock markets would fall 5% in light of a 2% decrease in economic output, and the pound would likely plummet 10%-13%. This prediction accords with what the U.K. Office for Budget Responsibility suggests in its recent report on the British economic outlook.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

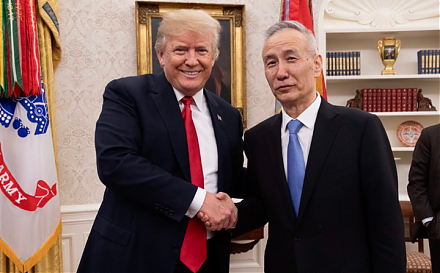

2018-10-17 12:33:00 Wednesday ET

The Trump administration blames China for egregious currency misalignment, but this criticism cannot confirm *currency manipulation* on the part of the Chin

2026-04-30 08:28:00 Thursday ET

In the current global market for better biotech advances, medical innovations, and healthcare services, the new integration of artificial intelligence (AI)

2017-08-07 09:39:00 Monday ET

Global financial markets suffer as President Trump promises *fire and fury* in response to the recent report that North Korea has successfully miniaturized

2017-12-21 12:45:00 Thursday ET

Tony Robbins summarizes several personal finance and investment lessons for the typical layperson: We cannot beat the stock market very often, so it w

2018-03-11 08:27:00 Sunday ET

At 89 years old, Hong Kong billionaire Li Ka-Shing announces his retirement in March 2018. With a personal net worth of $35 billion, Li has an incredible ra

2018-01-01 06:30:00 Monday ET

As former chairman of the British Financial Services Authority and former director of the London School of Economics, Howard Davies shares his ingenious ins