Search results : empathy

2017-08-01 09:40:00 Tuesday ET

2017-07-25 10:44:00 Tuesday ET

2017-07-19 11:35:00 Wednesday ET

2017-06-27 05:40:00 Tuesday ET

2017-06-21 05:36:00 Wednesday ET

2017-06-03 05:35:00 Saturday ET

2017-04-07 15:34:00 Friday ET

2017-03-15 08:46:00 Wednesday ET

2017-02-19 07:41:00 Sunday ET

2017-02-07 07:47:00 Tuesday ET

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-03-15 07:41:00 Thursday ET

The Trump administration's $1.5 trillion hefty tax cuts and $1 trillion infrastructure expenditures may speed up the Federal Reserve interest rate hike

2017-12-11 08:42:00 Monday ET

Fed Chair Janet Yellen says the current high stock market valuation does not mean overvaluation. A stock market quick fire sale would pose minimal risk to t

2022-03-15 10:32:00 Tuesday ET

Capital structure theory and practice The genesis of modern capital structure theory traces back to the seminal work of Modigliani and Miller (1958

2019-07-03 11:35:00 Wednesday ET

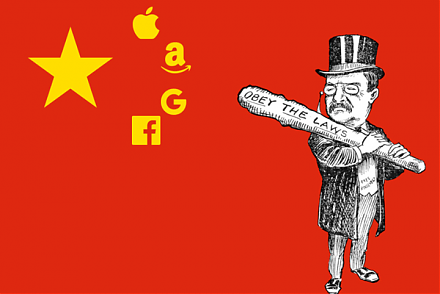

U.S. regulatory agencies may consider broader economic issues in their antitrust probe into tech titans such as Amazon, Apple, Facebook, and Google etc. Hou

2022-04-25 10:34:00 Monday ET

Corporate ownership governance theory and practice The genesis of modern corporate governance and ownership studies traces back to the seminal work

2018-12-23 13:39:00 Sunday ET

The House of Representatives considers a government expenditure bill with border wall finance and therefore sets up a shutdown stalemate with Senate. As fre