2017-06-03 05:35:00 Sat ET

trust perseverance resilience empathy compassion passion purpose vision mission life metaphors seamless integration critical success factors personal finance entrepreneur inspiration grit

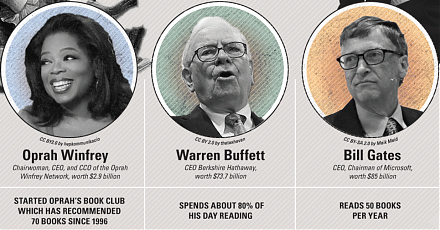

Fundamental value investors, who intend to manage their stock portfolios like Warren Buffett and Peter Lynch, now find it more difficult to ferret out individual stocks that currently experience substantial market undervaluation. During the current economic boom, a rising tide lifts all boats, especially for tech firms, banks, and energy companies. Written by Parnassus equity portfolio managers, this article seems to emphasize the general observation that most health care and biotech stocks seem reasonably cheap relative to most market benchmarks.

However, we believe it is not likely for these health care and biotech stocks to bounce back during the current Trump administration. President Trump seeks to cut medical costs and drug prices substantially in the next few years to make health care more affordable for the American middle class without Obamacare.

The resultant competitive landscape for these health care and biotech firms becomes a unique one with fewer moats across the pharmaceutical industry spectrum. This key motif serves as part of the broader mantra of Trumponomics.

This analysis draws investor attention to big banks with minimal financial stress (after they pass the Federal Reserve's macroprudential stress test), tech stocks with average P/E ratios well above 25x (especially for FAMGA aka Facebook, Apple, Microsoft, Google, and Amazon), and energy companies (such as PSX or Phillips 66 that Warren Buffett has included as a new value stock in Berkshire Hathaway's portfolio in recent times).

The law of inadvertent consequences counsels caution.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-05-15 08:40:00 Tuesday ET

Net neutrality rules continue to revolve around the Trump administration's current IT agenda of 5G telecom transformation. Republican Senate passes the

2019-09-07 17:37:00 Saturday ET

Federal Reserve Chair Jerome Powell announces the monetary policy decision to lower the federal funds rate by a quarter point to 2%-2.25%. This interest rat

2017-01-17 12:42:00 Tuesday ET

Former Treasury Secretary and Harvard President Larry Summers critiques that the Trump administration's generous tax holiday for American multinational

2019-04-30 07:15:00 Tuesday ET

Through our AYA fintech network platform, we share numerous insightful posts on personal finance, stock investment, and wealth management. Our AYA finte

2019-06-19 09:27:00 Wednesday ET

San Francisco Fed CEO Mary Daly suggests that trade escalation is not the only risk in the global economy. Due to the current Sino-U.S. trade tension, the g

2019-12-10 09:30:00 Tuesday ET

Federal Reserve institutes the third interest rate cut with a rare pause signal. The Federal Open Market Committee (FOMC) reduces the benchmark interest rat