2017-04-07 15:34:00 Fri ET

trust perseverance resilience empathy compassion passion purpose vision mission life metaphors seamless integration critical success factors personal finance entrepreneur inspiration grit

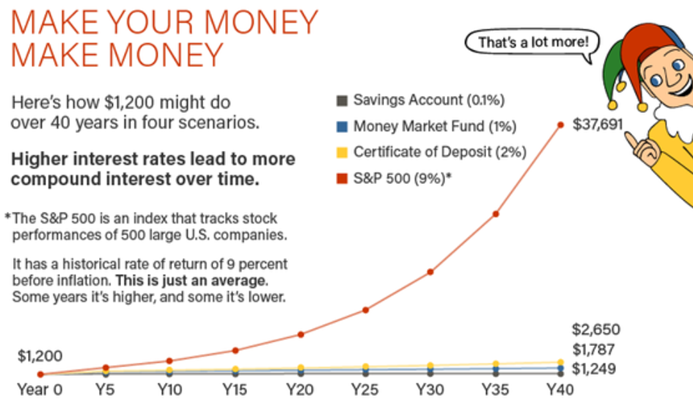

Would you rather receive $1,000 each day for one month or a magic penny that doubles each day over the same month?

At first glance, this counterintuitive question defies the conventional wisdom because compound interest can readily outweigh arithmetic interest over an equivalent time horizon.

Indeed, the magic penny would become $10,737,418, or equivalently 346 times more than $31,000 over the same one-month period.

Successful long-term sustainable value investment focuses on the magic power of compound interest, which Albert Einstein characterizes as the most powerful mathematical tool for exponential growth.

Exponential compound interest is thus the key to unlocking long-run sustainable wealth creation.

Each investor should reinvest his or her disposable income from cash dividend payout and share buyback to yield interest on both principal and interest income.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-12-13 08:30:00 Thursday ET

The recent arrest of HuaWei senior executive manager may upend the trade truce between America and China. At the request of several U.S. authorities, Canadi

2020-10-13 08:27:00 Tuesday ET

Agile lean enterprises strive to design radical business models to remain competitive in the face of nimble startups and megatrends. Carsten Linz, Gunter

2018-08-17 11:45:00 Friday ET

In accordance with the extant corporate disclosure rules and requirements, all U.S. public corporations have to report their balance sheets, income statemen

2019-09-03 14:29:00 Tuesday ET

Due to U.S. tariffs and other cloudy causes of economic policy uncertainty, Apple, Nintendo, and Samsung start to consider making tech products in Vietnam i

2018-09-07 07:33:00 Friday ET

The Economist re-evaluates the realistic scenario that the world has learned few lessons of the global financial crisis from 2008 to 2009 over the past deca

2020-02-02 11:32:00 Sunday ET

Our fintech finbuzz analytic report shines fresh light on the current global economic outlook. As of Winter-Spring 2020, the analytical report delves into t