2023-11-30 08:29:00 Thu ET

stock market technology facebook covid-19 apple microsoft google amazon data platform network scale artificial intelligence antitrust alpha patent model tech titan tesla global macro outlook machine software algorithm

The arrival of digital platforms for world payments promises to create new kings of the highly lucrative global payments system. In recent years, the global payments system generates total sales revenues worth more than $2 trillion each year. The new system of moving money worldwide now undergoes massive transformation. As the share of cash transactions continues to plummet by about 25% in the OECD club of rich countries, global digitization is part of this fundamental shift from cash. In light of these global technological developments, digital finance serves as a core revolutionary transformation of business models from food delivery and transport to mobile pay and e-commerce. The fresh business models differ dramatically from the conventional bank-card business model of world payments settlement.

In light of recent digitization worldwide, there are important policy implications for the technical relations between money and the state. Some governments may use the recent global digitization of cashless finance to help regulate their own citizens. Within the OECD club of rich countries, the government loses some financial clout to worldwide digital payments platforms. The frictionless movement of money may lead to greater efficiency. However, new financial stability concerns can arise from the fact that it is now easier for customers to withdraw bank deposits. Unforeseen mass cash withdrawals may inevitably cause bank runs. This rare event is a critical lesson learned from the recent failures of Silicon Valley Bank, Signature Bank, and First Republic Bank.

Just as with any new technology, the recent global digitization of cashless finance has already had its fair share of hype. However, modern digital payments platforms now challenge the old world order of cash. Traditionally, banks were the entry point for formal finance. Nowadays, online platforms facilitate mobile payments through mobile apps and QR codes. Fast online payment networks and high-speed Internet connections have become the gateway for many consumers worldwide. As users begin sending and receiving money, the data that these online platforms collect in due course can help unlock other financial services such as retail loans and asset investment recommendations.

A good example is Alipay in China. Alipay is the signature online payments service by Ant Financial Group (initially an online escrow service for Alibaba’s e-commerce platform). Similar to PayPal for e-commerce on eBay in America, Alipay boosts e-commerce on Alibaba through smartphones and QR codes to scale up fast online payments in China. In addition to WeChat Pay, Alipay now processes almost 90% of Chinese online payments. In combination, Alipay and WeChat Pay now service more than 1 billion users worldwide. As mobile pay becomes so prevalent in China, cash is no longer the most popular method of both payments and wire transfers.

In recent years, Ant Financial Group began gearing up for a blockbuster IPO at an asset market valuation of more than $300 billion. As a Chinese subsidiary fintech firm of Alibaba, Ant Group dominated in the domestic market for mobile payments and consumer loans. In comparison, the U.S. biggest bank, JPMorgan Chase, and the U.S. largest credit card network, Visa, were worth $450 billion and $520 billion respectively as of early-2022.

In the past year, the recent asset market turmoil from global interest rate hikes and the surprise Russian invasion of Ukraine has humbled many digital challengers in cashless finance. Despite these asset market ructions, we can draw 3 key lessons from the upsurge in online payments platforms for better cashless finance. First, it is unclear whether fintech firms, cryptocurrencies, or central bank digital currencies (CBDC) can likely end the reign of banks and credit cards. Cryptocurrencies such as Bitcoin and Ethereum etc still struggle to demonstrate their practical usefulness (as a widespread store of value as well as a medium of exchange). Whizzy fintech firms are likely to keep growing, but the conventional bank-card model has adapted well to the recent digitization of cashless finance. In mobile applications, Apple Pay and Google Pay continue to grow fast, but still play only a less important niche role in online payments.

Second, non-OECD markets have already helped develop open payment systems. From India and Brazil, these additional open payment systems offer an alternative to both the traditional bank-card model in the rich world and the fresh fintech model in China. Through open bank account-to-account transfer systems in Europe, and the rollout of the Federal Reserve’s FedNow instant-payments services in America, the rich world may come to copy the best open payment systems from non-OECD markets (e.g. UPI in India and Pix in Brazil).

Third, many governments worldwide take baby steps to reduce their dependence on western payment networks and on the U.S. dollar. These efforts seem to have accelerated a lot due to the western sanctions on Russia after its surprise invasion of Ukraine in early-2022. Several countries have built national alternatives to credit card networks such as Visa, Mastercard, American Express, and so on. China now deploys an alternative to the SWIFT international messaging system for banks.

In some countries, multilateral payment nodes permit citizens to use their domestic favorites abroad. UPI wallets from India are available for practical use in Singapore. Alipay wallets from China are now acceptable worldwide from Dubai to Washington DC. GrabPay of Malaysia is usable across much of South East Asia. China further leads the creation of an Asian payments system with the renminbi as the primary currency. As technology cheapens alternatives to the U.S. dollar, these alternative currencies may come to challenge the American tight grip on global finance.

Unified Payments Interface (UPI) is a fresh online-payments platform in India. This online platform permits free and fast account-to-account transfers with fintech apps such as PhonePe and Google Pay. Unlike Alipay and WeChat Pay in China, UPI is open, so its users can take their financial history to competitors with no exclusive contact to one single company. UPI users can scan QR codes and virtual IDs and passwords for account authentication. Today, UPI draws attention from the rest of the world. In recent times, UPI can process more than $1 trillion in online payments and cashless transactions per year (equivalent to one third of total GDP for India). In India, the government further bolstered UPI with the surprise demonetization in 2016, when the government discontinued multiple high-denomination bank notes. UPI benefited from the recent Covid-19 pandemic crisis as the novel corona virus left consumers with no choice not to use cash. In recent years, UPI has grown from 17% of 31 billion online payments in 2019 to 52% of 88 billion online payments in 2023. As of early-2023, India now leads the world in real-time digital payments by clocking almost 40% of all cashless transactions worldwide.

In addition to the open-payments platform UPI in India, Pix facilitates bank-to-bank payments with a small fee in Brazil. Pix now accounts for about 30% of electronic payments in Brazil, whereas, credit cards and debit cards take up about 20% each. This open instant-payment system serves as the third alternative to the bank-card model in the rich world and the exclusive fintech platforms in China. Insofar as the government designs well the open-payments networks, it costs quite little for users to move money worldwide. From these open-payments platforms UPI in India and Pix in Brazil, the resultant digital payments generate real-time data on both buyer and seller demographic attributes and purchase profiles etc. Potential lenders and insurers can reach customers who probably have neither the financial history nor enough assets to participate in traditional finance. The provision of bank credit can become more socially valuable with greater financial inclusion worldwide.

Non-U.S. tech giants include Alibaba and Tencent in China, Grab and Gojek ride-share services in Singapore and Indonesia, and Mercado Pago (the financial arm of MercadoLibre) e-commerce in Latin America. Their model of financial services starts by serving as a dominant service provider that customers use daily. In China, specifically, Alipay and WeChat Pay initially act as escrow accounts for customers to transfer money to sellers after buyers have received their goods or services via these mobile apps. Nowadays each shop owner only needs to display the QR code to accept mobile payments. As of early-2023, Alipay and WeChat Pay each attract more than 1.2 billion active users in China. In particular, Alipay handles more than $16 trillion in online payments each year in 2020-2023, nearly 25 times more than PayPal, the biggest online payment platform in America. Now Alipay and WeChat Pay settle and process more than 90% of mobile transactions in China.

Both tech giants earn as little as 0.1% of each transaction, less than banks do from debit cards. Around the world, mobile interchange fees have dramatically tumbled because of these tech firms. Online payment platforms may become a gateway for allowing tech titans to attract more active users worldwide. Using online payment data, Alibaba, Grab, and Tencent etc can determine borrower creditworthiness. In practice, this consumer credit assessment contributes to the internal mechanism for approving credit cards, mortgage loans, and small business retail loans etc.

Banks use many traditional ways such as credit history, current wealth, and income documentation etc to assess borrower creditworthiness. These banks then secure loans against collateral such as homes and cars to minimize the essential need to monitor each borrower. For many tech titans, online payment data can substitute for collateral. Online payment platforms collect a ton of information about borrower creditworthiness. This consumer reliance represents an inverse of the information asymmetry such that lenders know more about whether borrowers can repay loans (than borrowers themselves). Big tech and fintech firms have lent $450 per capita, or around 2% of total credit in China from 2018 to 2023.

There are substantial synergies between loans and many other financial products and services such as asset management and insurance. Tech titans now use their online payment platforms to reverse-engineer most banking products and services. In America, credit card sweeteners attract and retain active users worldwide. For instance, PayPal provides the one-stop conglomeration of financial services from bank deposits and wire transfers to credit cards, mortgages, small business loans, insurance policies, and even stock market investment recommendations. PayPal has almost doubled in market value in 2020-2023 and serves as the most valuable online payment platform in the world. Another business payment provider, Stripe, now hits the market value of about $95 billion and thus serves as one of the largest private tech companies in America. Stripe offers both retail and wholesale banking services to small-to-medium-size enterprises (SMEs). Stripe wins favor with SMEs by making it easier to embed online payments in their respective websites. Further, Stripe has expanded into corporate payroll and cash management services.

Visa, Mastercard, and American Express continue to dominate in the rich world of credit cards. In China, Alipay and WeChat Pay dominate as the duopoly of online payments platforms. All these tech titans garner substantial market power. In India and Brazil, the open-payments platform orchestrators of UPI and Pix see their third alternative model as breaking this world trend to super-star firm concentration. This provision of online payment services is similar to a public utility. A public utility can be non-excludable and non-rivalrous. The provision of online payment services is non-excludable in the sense that one cannot exclude individuals from enjoying the benefits of these online payment services. This provision is non-rivalrous because someone’s use of these online payment services cannot prevent others from their separate use of the same services. For these reasons, the government has to fund the gap between the marginal social and private costs of online payment services, which would otherwise be below the optimal level in the absence of state subsidies and tax credits.

There are structural reasons for the long prevalent market power of the bank-card business model. Incumbent banks adopt fresh technological advances faster than upstarts can acquire customers. Specifically, credit card companies have become adept at retaining customers through juicy cash reward points for airline miles and beach holidays. Hefty transaction fees can help fund these cash reward points, but these fees are not high enough to persuade merchants and other retailers to refuse to accept credit cards.

The economics of credit cards helps explain the fundamental strength of the bank-card model. When a customer swipes his or her credit card, a complex flow of card information takes place. In America, retailers cough up about 1% to 3% of the total transaction value to the credit card company (exchange fee), the credit card issuer (bank interchange), and their payment processor (transaction processing fee). The interchange component is the largest of the 3 separate fees, as the bank takes the risk that the bill may not be paid. Credit cards with the most cash reward points are likely to charge the highest transaction fees. For a $100 transaction, $0.14 goes to the credit card company, $0.43 goes to the credit payment processor, and almost $1.68 goes to the card-issuing bank. Consumers receive $1.30 back through cash reward points. These cash reward points dent the bank’s credit card profits.

The bigger problem is that retailers pass on some of their card fees to consumers in higher prices. Many consumers do not have access to credit cards, so they end up paying for other people’s cash reward points. For every income bracket, higher prices tend to outweigh the cash reward points. Consumers who earn $25,000 to $50,000 per year pay 1.4% net credit card fees (after deductions from cash reward points). Consumers who earn over $150,000 face only 0.82% net credit card fees. This inequality shows that the price effect of credit cards can be detrimental to low-income earners.

Consumers face incentives to choose the credit cards with the most cash reward points. Retailers are willing to accept expensive credit cards because they would otherwise sacrifice too many sales. This bank-card model tends to concentrate the business, and Visa and Mastercard serve as overwhelmingly the dominant duopoly. In practice, these credit card giants sustain profit margins as high as 35% to 45%. The next front-runner, American Express, struggles to catch up with the duo these days.

In addition to Visa, Mastercard, and American Express, Target now seeks to build a fresh retail payment method for current consumers in America. Target launches RedCard to provide customers 5% discounts on all purchases at Target. RedCard encourages consumers to spend at Target over its retail competitors. Almost 20% of $100 billion annual sales for Target come through RedCard. For its debit cards, Target takes the money directly from each customer’s bank account and therefore sidesteps normal credit card fees altogether.

The potential gains are large. Target would save around $2 billion each year if all customers used RedCard rather than their normal credit cards. Other companies might follow suit. Already many firms that bill customers frequently, such as public utilities and telecoms, encourage consumers to link their bank accounts to cheaper direct debits. Ride-hailers such as Uber and Lyft that need to pay 7 million drivers often use debit networks to transact quickly at low costs.

Big tech is getting in on the act. Apple launches a new credit card to join the buy-now-pay-later business with 7 million users. In collaboration with Goldman Sachs, Apple further launches a deposit account with a 4% interest rate. Already around 75% of iPhone users have Apple Pay accounts. Also, Meta seeks to launch similar credit cards for its 2.2 billion active users across Facebook, Messenger, Instagram, and WhatsApp worldwide. The massive user bases of Apple and Meta may likely turn both tech titans into global payment giants.

Many other fintech firms now go after different bits of the online-payments stack. These fintech firms include Stripe, Adyen, Checkout, and Payoneer. The newfound complexity of accepting online payments has grown with the recent rise of global payment systems. Online payment processors must deal with different currencies, rules and regulations, and sources of funds. All of these fundamental factors give these online payment processors sustainable niche pricing power.

From Bitcoin to Ethereum, cryptocurrencies may play a role in worldwide payments. However, some recent developments shed skeptical light on this subsidiary role of cryptocurrencies for better online payments settlement. Some tech traders tend to hope that cryptocurrencies help reduce dependence on SWIFT and the greenback. Some economists expect cryptocurrencies to serve as useful hedges against high inflation. There are at least 3 major reasons why cryptocurrencies may or may not help attain these goals. First, cryptocurrencies have shown unreasonably volatile price fluctuations in recent times. Specifically, Bitcoin has depreciated substantially from more than $60,000 to the broad range of $25,000 to $30,000. Ethereum and other cryptocurrencies further exhibit a similar kind of extreme price volatility within a relatively short time frame. For this reason, the vast majority of cryptocurrencies serve neither as an acceptable store of value nor as a useful medium of exchange. Meanwhile, cryptocurrencies have no legal tender status in any jurisdictions except El Salvador. Hence, cryptocurrencies cannot qualify as real fiat currencies, but only as mark-to-market assets subject to the relevant tax laws for capital gains.

Second, there are substantial legal issues around the recent investigations of most prominent crypto exchanges such as FTX, Binance, and Coinbase etc. These legal issues pertain to anti-money-laundering compliance, tax evasion, terrorist finance, fraud, and online safety and privacy protection due to a lack of user authentication. When these crypto exchanges process online transactions with opaque rules and regulations, antitrust concerns may inevitably arise from this specific context. Such legal developments therefore prevent the widespread adoption of cryptocurrencies such as Bitcoin, Litecoin, and Ethereum. Institutional investors and fund managers often choose to avoid trading cryptocurrencies altogether even though some crypto assets may prove to be useful hedges against inflation.

Third, there is still a lack of worldwide crypto adoption because there are cheaper alternative payment gateways. Why must institutional investors pay additional fees to transact on the Bitcoin Ethereum blockchain when it is much more cost-effective to transfer money through India’s UPI and Brazil’s Pix? As governments establish stricter rules and regulations for crypto exchanges, cross-country crypto payments would be comparatively more expensive. The vast majority of key costs of financial transactions arise from complying with standard prudential regulations like know-your-customer (KYC) and anti-money-laundering (AML) laws. If cryptocurrencies face the same array of prudential rules and regulations as fintech firms, can Bitcoin, Litecoin, Ethereum, and so forth offer any additional unique value beyond the token blockchain ledger?

In addition to cryptocurrencies, central bank digital currencies (CBDC) can play an important role in global payments settlement. As a recent BIS survey shows, fully 114 countries have already launched, or are exploring CBDCs, and these countries represent more than 95% of world GDP. Central banks are the ultimate settlement institution of any financial system. A wholesale CBDC can be made accessible to some financial institutions across the same financial system. This wholesale CBDC can make online payments systems more competitive by granting particular fintech firms access to central banks directly (rather than through banks). CBDCs can help upgrade cross-border payments by making possible real-time payment settlement across several pairs of currencies. Even for countries with highly complex payment systems, a wholesale CBDC can help influence prudential standards in governing the new design of virtual currencies.

To the extent that cryptocurrencies exhibit extreme price volatility in recent years, there are better alternative hedges against inflation: passive and active index funds, stocks, bonds, currencies, futures, residential real estate investments, and so forth. Nowadays, most investors can buy beta exposure to the stock market return (such as S&P 500) for only a few basis points. These investors tend to focus on passive index funds from BlackRock and Vanguard. These passive index funds track only the closest U.S. stock market returns and alternative benchmarks for some specific sectors such as technology and disruptive innovation (e.g. Meta, Apple, Microsoft, Google, Amazon, Nvidia, and Tesla (aka MAMGANT)). Technology can allow cost-effective access to global stock markets. BlackRock, State Street, and Vanguard owe their growing heft to matching stock market indices worldwide. In reality, these asset management firms benefit from a virtuous circle. Lower costs translate into lower fees, more fund flows, and even lower costs for the passive asset managers. Their dominance is the most salient sign of recent consolidation in the global asset management industry. The biggest asset management firms become bigger in light of simple passive stock investment portfolios. Global elites emerge from the asset management firms that each manage more than one trillion dollars in assets under management. These asset management companies include BlackRock, Vanguard, State Street, Fidelity, Allianz, Capital Group, BNY Mellon, PIMCO, Northern Trust, Goldman, JPMorgan Chase, Morgan Stanley, UBS, AXA, BNP Paribas, Invesco, Wellington Management, Prudential Financial Group, and so forth. Size has hence become a core competitive advantage in the global asset management industry.

Passive index funds hold stocks in proportion to their market capitalization. Trading costs are tiny. Each mutual fund buys a stock when it qualifies for the passive index, and then sells a constituent stock if it drops out of the index. The free open market for large-cap stocks is liquid enough to absorb sales or purchases whenever index funds need to match inflows or redemptions.

Beta passive stock investment strategies are not the only game in town. Most asset managers design billions-of-dollars smart-beta factor strategies in search of higher alphas. These alphas represent excess returns that mutual funds earn in response to multi-factor exposure to size, value, momentum, cash profitability, asset growth, market risk, and so forth. In the global history of asset management, value stocks with higher book-to-market equity ratios often tend to cyclically outperform growth stocks with lower book-to-market equity ratios; small-cap stocks often outperform large-cap stocks; momentum stocks tend to beat the broader stock market; and it is often profitable to invest in stocks with high operating cash profitability, low asset growth (or low capital investment), and low to medium market risk exposure. Also, stocks often offer substantially higher average long-term returns in the reasonable range of 11% to 15% in stark contrast to bonds, currencies, futures, and residential real estate trusts (REIT). Many financial economists expect these mega trends to persist in the next few decades. Better financial development can help breed better economic growth and employment in the presence of inclusive institutions.

The social impact of CBDCs fundamentally depends on their technical design. All virtual currencies are liabilities of a central bank. These token currencies may often be free from the risk of deposit runs on commercial banks. Some token currencies use high-tech blockchains, and others do not. Nevertheless, the full-blown CBDCs and pilots, from China to Bahamas and Nigeria, have already converged on some common principles. Typically, commercial banks help intermediate these CBDCs and then work with private wallet-providers. It would be reasonable for the central bank to impose caps on how much each CBDC user can hold in practice. In limiting the complexity of day-to-day CBDC operational management, China’s e-CNY, the largest-scale CBDC pilot, is quite similar to the Bahamian sand dollar and Nigeria’s e-naira. All of these CBDCs incur zero transaction fees, and none of these CBDCs bear any interest. The technical reason for zero interest and usage caps is for each central bank to avert large outflows of deposits from commercial banks into CBDCs. Thus far, these fresh CBDCs have seen little uptake despite high-profile launches. As the People’s Bank of China (PBOC) suggests, only about $2 billion worth of the CBDC was in circulation in early-2023. Indeed, this new CBDC has already created more than 250 million digital wallets. However, the vast majority of Chinese users believe both Alipay and WeChat Pay already work well in Mainland China, so many merchants and retailers cannot generate more sales with e-CNY. At this stage, it is not clear how a retail CBDC can contribute to better and more secure access to global payments.

In America, a CBDC is a new digital form of central bank money that can be broadly available to the general public. Central bank money includes physical greenback currency in circulation by the Federal Reserve System, as well as digital balances held by commercial banks. Even though the vast majority of Americans have long held money predominantly in digital form, for instance, bank deposits, payments, wire transfers, and e-commerce transactions through mobile apps and QR codes, a CBDC would differ dramatically from extant digital money available to the general public as a CBDC would be a new separate liability of the Federal Reserve System (not of U.S. commercial banks). The Federal Reserve System continues to commit to ensuring the continual safety and availability of cash in America. For this reason, the Federal Reserve System now weighs the pros and cons of a CBDC, and further views a CBDC as a means to broaden secure online payment options, even though the prevalence of a CBDC can possibly reduce-or-even-replace cash.

Meanwhile, the Federal Reserve System has made no decision on issuing a CBDC. The Federal Reserve System would only proceed with the brand-new issuance of a CBDC with proper legislation and congressional approval. The Federal Reserve System seeks to promote monetary and financial stability with a sound and efficient payment system. With technological advances ushering in a new wave of private-sector financial products and services such as digital wallets, mobile payment apps, and cryptocurrencies, the Federal Reserve System and other central banks around the world now explore the potential benefits and risks of CBDCs.

The Federal Reserve System should follow several principles to better regulate the recent digitization of CBDCs in support of cashless finance:

Any CBDC should provide real benefits to households, businesses, and the overall economy beyond any costs and risks;

Any CBDC should yield these benefits more effectively than alternative methods;

Any CBDC should complement the current forms of cash and central bank money, as well as alternative methods for providing financial products and services;

Any CBDC should protect consumer privacy with proper authentication; and

Any CBDC should protect against all criminal activities with anti-money-laundering compliance and broad support from key stakeholders.

Overall, cryptocurrencies and central bank digital currencies (CBDC) may or may not revolutionize global payments. As global payment gateways, the conventional OECD bank-card model and Chinese fintech payment platforms remain resilient in light of intense competition from recent digitization. The alternative open payment systems UPI from India as well as Pix from Brazil now serve as the third generation of cashless finance in addition to the Visa-Mastercard bank-card model and fintech platforms Alipay and WeChat Pay in China. In combination, these prevalent online-payment models help improve consumer welfare with both lower prices and better technological options for online payments worldwide. In this wider context, central banks need to better regulate the recent digitization of cashless finance.

As of mid-2023, we provide our proprietary dynamic conditional alphas for the U.S. top tech titans Meta, Apple, Microsoft, Google, and Amazon (MAMGA). Our unique proprietary alpha stock signals enable both institutional investors and retail traders to better balance their key stock portfolios. This delicate balance helps gauge each alpha, or the supernormal excess stock return to the smart beta stock investment portfolio strategy. This proprietary strategy minimizes beta exposure to size, value, momentum, asset growth, cash operating profitability, and the market risk premium. Our unique proprietary algorithmic system for asset return prediction relies on U.S. trademark and patent protection and enforcement.

Our unique algorithmic system for asset return prediction includes 6 fundamental factors such as size, value, momentum, asset growth, profitability, and market risk exposure.

Our proprietary alpha stock investment model outperforms the major stock market benchmarks such as S&P 500, MSCI, Dow Jones, and Nasdaq. We implement our proprietary alpha investment model for U.S. stock signals. A comprehensive model description is available on our AYA fintech network platform. Our U.S. Patent and Trademark Office (USPTO) patent publication is available on the World Intellectual Property Office (WIPO) official website.

Our core proprietary algorithmic alpha stock investment model estimates long-term abnormal returns for U.S. individual stocks and then ranks these individual stocks in accordance with their dynamic conditional alphas. Most virtual members follow these dynamic conditional alphas or proprietary stock signals to trade U.S. stocks on our AYA fintech network platform. For the recent period from February 2017 to February 2022, our algorithmic alpha stock investment model outperforms the vast majority of global stock market benchmarks such as S&P 500, MSCI USA, MSCI Europe, MSCI World, Dow Jones, and Nasdaq etc.

Do you find it difficult to beat the long-term average 11% stock market return?

It took us 20+ years to design a new profitable algorithmic asset investment model and its attendant proprietary software technology with fintech patent protection in 2+ years. AYA fintech network platform serves as everyone’s first aid for his or her personal stock investment portfolio. Our proprietary software technology allows each investor to leverage fintech intelligence and information without exorbitant time commitment. Our dynamic conditional alpha analysis boosts the typical win rate from 70% to 90%+.

Our new alpha model empowers members to be a wiser stock market investor with profitable alpha signals! The proprietary quantitative analysis applies the collective wisdom of Warren Buffett, George Soros, Carl Icahn, Mark Cuban, Tony Robbins, and Nobel Laureates in finance such as Robert Engle, Eugene Fama, Lars Hansen, Robert Lucas, Robert Merton, Edward Prescott, Thomas Sargent, William Sharpe, Robert Shiller, and Christopher Sims.

Follow AYA Analytica financial health memo (FHM) podcast channel on YouTube: https://www.youtube.com/channel/UCvntmnacYyCmVyQ-c_qjyyQ

Follow our Brass Ring Facebook to learn more about the latest financial news and fantastic stock investment ideas: http://www.facebook.com/brassring2013.

Free signup for stock signals: https://ayafintech.network

Mission on profitable signals: https://ayafintech.network/mission.php

Model technical descriptions: https://ayafintech.network/model.php

Blog on stock alpha signals: https://ayafintech.network/blog.php

Freemium base pricing plans: https://ayafintech.network/freemium.php

Signup for periodic updates: https://ayafintech.network/signup.php

Login for freemium benefits: https://ayafintech.network/login.php

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

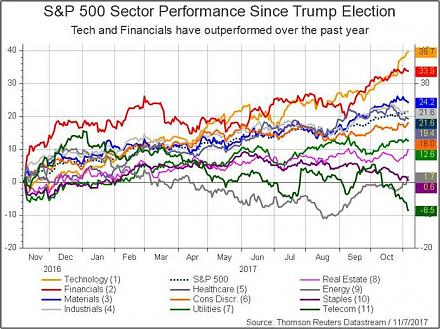

2017-10-09 09:34:00 Monday ET

The current Trump stock market rally has been impressive from November 2016 to October 2017. S&P 500 has risen by 21.1% since the 2016 presidential elec

2018-09-05 08:34:00 Wednesday ET

Citron Research short-sellers initiate a class-action lawsuit against Tesla and its executive chairman Elon Musk because he might have deliberately orchestr

2018-01-23 06:38:00 Tuesday ET

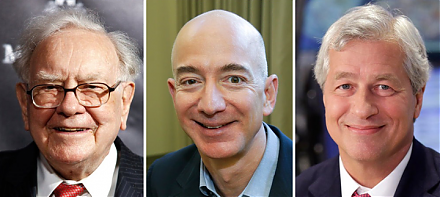

Amazon, Berkshire Hathaway, and JPMorgan Chase establish a new company to reduce U.S. employee health care costs in negotiations with drugmakers, doctors, a

2019-04-07 13:39:00 Sunday ET

CNBC news anchor Becky Quick interviews Warren Buffett in early-2019. Buffett explains the fact that book value fluctuations are a metric that has lost rele

2019-03-09 12:43:00 Saturday ET

Pinterest files a $12 billion IPO due in mid-2019. This tech unicorn allows users to pin-and-browse images through its social media app and website. Pintere

2019-02-28 20:44:00 Thursday ET

AYA Analytica finbuzz podcast channel on YouTube February 2019 In this podcast, we discuss several topical issues as of February 2019: (1) our proprieta