Ginkgo Bioworks platform is enabling biotechnology applications across diverse markets, from food and agriculture to industrial chemicals to pharmaceuticals. Ginkgo Bioworks, formerly known as Soaring Eagle Acquisition Corp., is based in NEW YORK....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 14 February 2026

2025-07-01 13:35:00 Tuesday ET

In recent times, financial deglobalization and asset market fragmentation can cause profound public policy implications for trade, finance, and technology w

2019-07-19 18:40:00 Friday ET

We can decipher valuable lessons from the annual letters to shareholders written by Amazon CEO Jeff Bezos. Amazon is highly customer-centric because the wor

2023-11-21 11:32:00 Tuesday ET

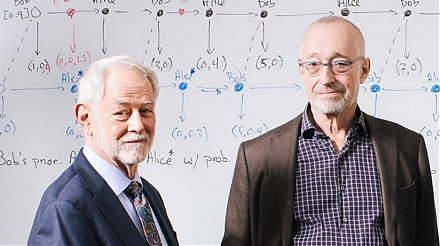

Nobel Laureate Paul Milgrom explains the U.S. incentive auction of wireless spectrum allocation from TV broadcasters to telecoms. Paul Milgrom (2019)

2017-06-09 06:37:00 Friday ET

To complement President Trump's pro-business economic policies such as low taxation, new infrastructure, greater job creation, and technological in

2019-01-31 08:40:00 Thursday ET

We offer a free ebook on the latest stock market news, economic trends, and investment memes as of January 2019: https://www.dropbox.com/s/4d8z

2018-09-11 18:36:00 Tuesday ET

President Trump tweets that Apple can avoid tariff consequences by shifting its primary supply chain from China to America. These Trump tariffs on another $