2020-05-28 15:37:00 Thu ET

technology paypal alibaba tencent facebook apple microsoft google amazon platform flywheel reinvention megatrends digitization servitization network effects scale economies information cascades airbnb netflix zoom

Platform enterprises leverage network effects, scale economies, and information cascades to boost exponential business growth.

Laure Reillier and Benoit Reillier (2017)

Platform strategy: how to unlock the power of both communities and networks to grow the business

In this business book, Laure Reillier and Benoit Reillier explain the pervasive fact that many platform enterprises leverage positive network effects, scale economies, and information cascades to boost exponential user growth. Platform enterprises often serve several sides of the market for consumers, producers, and most other intermediaries. Business leaders should attract the attention of potential users and producers. During this gradual process, senior corporate decision-makers need to acquire prospective users as new customers to reach a critical mass of participants from each side of the market. As core platforms mature over time, business leaders must focus on developing self-sustainable networks with this critical mass of early technology adopters. Platform designers and business leaders should match both consumers and producers in an effective and efficient way that meets their specific needs. In a practical sense, platform designers should choose the critical mass of early technology adopters since most platform participants look for simple, reliable, convenient, and cost-effective products, services, and solutions.

Platform designers must provide efficient ways for both consumers and producers to connect with positive information cascades. Trust becomes an essential element in each fundamental transaction between platform users. Also, platform designers must help exchange the capital, information, and product and service provision in an effective manner that maximizes the intrinsic value of both user interactions and core transactions between buyers and sellers. Both business leaders and platform designers must work together to optimize the core functions of the broader network platform ecosystem. These corporate decision-makers collect, analyze, and learn from proprietary platform data to help enhance core user experiences with iterative continuous enhancements over time.

Platform enterprises often leverage positive network effects, scale economies, and information cascades over time.

Traditional business enterprises offer, deliver, and distribute products and services to their key customers with incremental feature enhancements over time, whereas, platform enterprises match and connect many users to facilitate online transactions. Most platform enterprises sustain business success and profitability by integrating unique niche strategies with retail commerce to help distribute both products and solutions on the Internet. Good examples of e-commerce include Amazon, Alibaba, eBay, and so forth. Other platform enterprises provide new products, services, and solutions to operate as intermediaries between input factors and output operations. Good examples of these platform intermediaries include Facebook (social media), Apple (mobile communication), Microsoft (software service provision), and Google (Internet search). Platform enterprises often operate as lean startups with positive network effects, scale economies, and information cascades. Since platform users tend to interact with one another within the network platform ecosystem, these lean platform enterprises can enjoy exponential premium user growth over time. These platform enterprises focus on sharing Internet information, digital content curation, software distribution, and ubiquitous social network transmission. As a result, this platform economy leads to new jobs, lower prices, and greater consumer choices.

A few economic factors can affect the sustainable success and profitability of most platform enterprises. First, positive or negative externalities can significantly cause platform business success or collapse. These externalities are positive or negative economic transactions that occur independently from either lean startups or large business organizations. Key platform business leaders can take into account these externalities to optimize core competitive advantages to add value to most platform participants when positive externalities arise; or conversely, key platform business leaders can choose to minimize their exposure to negative externalities.

Second, platform business leaders must consider scale economies that allow the average cost of production to decline when the business scale gradually increases over time. Platform enterprises can benefit from scale economies because the core business value rises exponentially for most platform participants with respect to an increase in the quadratic number of active user interactions. These network effects can help magnify the transactional value of most user interactions between buyers and sellers (or most senders and recipients in an information loop).

Third, most platform enterprises rely on a critical mass to sustain business success and profitability. A critical mass of platform participants refers to the inflection point at which the network platform ecosystem grows at a sustainable or even viral pace. In most platform enterprises, critical mass growth arises from the type and strength of all plausible network effects, customer tastes and preferences, user experiences, consumer behaviors, and information cascades. Some platforms that fail to reach a critical mass of early technology adopters may struggle to match platform users. Platform business leaders must learn to persevere during these rare hard times of severe financial stress for longer-term consumer value creation.

Most platform enterprises first attract and retain a critical mass of early technology adopters. Platform designers and high-growth hackers should hone this important process through the real business lifecycle. After attracting early technology users and customers on each side of the product-market fit, platform enterprises provide optimal consumer choices, match both buyers and sellers, and empower network participants to interact with one another. As platform designers match buyers and sellers (or senders and recipients), platform designers connect these users to core relevant information to reach the next stage of bilateral transactions. At this stage, platform participants transfer products, services, or electronic currencies. Platform designers must ensure that this robust process derives value for their exponential business growth amid maximum key interactions and transactions among platform participants. On balance, platform business leaders must optimize this information loop with iterative continual enhancements to help retain early technology adopters for better value creation. In this business value creation, platform designers collect, analyze, and learn from proprietary data to better match-and-connect new users.

With a sound proof of concept, platform enterprises need to scale up a critical mass of early technology adopters to optimize both user experiences and interactions.

Platform business models can often work well with several other business models to establish substantial platform ecosystems. This key success factor helps ensure that the new platform ecosystems offer greater user value than the sum of the parts. For instance, Amazon taps into e-commerce and cloud service provision; Google focuses on Internet search and cloud software development; Apple specializes in the design and development of smart mobile devices such as iPhones and iPads; Microsoft fixates on the Windows operating system, Office software suite, and key cloud software service provision; and Facebook integrates Messenger, Instagram, WhatsApp, and Oculus VR into the broader social network platform ecosystem. In essence, these platform orchestrators scale up a critical mass of early technology adopters to optimize both user experiences and interactions in the broader context of substantial business network platform ecosystems.

As business leaders work through the first stage of the typical platform lifecycle, it is important for these platform orchestrators to understand how well their business models operate relative to external competitive forces. This institutional knowledge can empower platform trailblazers to identify core stakeholders, value propositions, new business opportunities, mergers and acquisitions, buyers and sellers, senders and recipients, and so on. These platform enterprises match and connect all users to conduct voluntary transactions on the basis of both trust and brand recognition.

In the second platform life stage, co-founders and entrepreneurs launch their fresh platform ecosystems, attract early technology users, and test their proof of concept. With a proper product-market fit, most platform orchestrators attract, retain, match, and connect both buyers and sellers to conduct core transactions and interactions. It is often essential for business leaders to go through multiple iterations to find the right and robust product-market fit at a brisk pace. Platform orchestrators offer their minimum viable product or service to a critical mass of early technology adopters. In order to keep their growth and momentum, these platform trailblazers must learn from past mistakes, pre-launch failures, and groupthink biases etc to optimize user experiences and interactions with iterative continuous enhancements.

After these platform designers find the proof of concept, they must shift their focus to scaling up the size of a prospective network platform ecosystem. During this key stage, platform orchestrators should apply prescient business insights into positive network effects, scale economies, and information cascades. In other words, most platform designers attempt to scale up a critical mass of early technology adopters, apply ubiquitous Internet ad levers, promote healthy and frequent user interactions, and help facilitate proper and robust transactions among premium members.

As platform enterprises become mature, key business leaders begin to respond to competitive threats, boost both engagements and transactions, deliver key feature enhancements, monetize new platform services and user acquisitions, build-and-scale frontline customer service teams with no R&D compromises, and consolidate new purpose brands and jobs-to-be-done. When key business leaders design and develop their network platform ecosystems, these corporate decision-makers must determine how their major platforms generate new leads, sales, and profits. These platform designers need to mull over premium membership fees and other prices:

Platform enterprises often need to promote trust and brand recognition in response to both external competitive forces and regulatory requirements.

Unlike traditional business organizations that establish trust between the company and its core consumers, platform enterprises need a more holistic approach where trust has to be built between the platform and its participants as well as among the end users themselves. Corporate decision-makers must ensure that their purpose brands convey trust in their ideas. Fresh ideas should foster trust among end users, buyers and sellers, and consumers and producers etc. As prosumer intermediaries, platform enterprises can better promote their purpose brands and jobs-to-be-done by helping encourage positive user experiences, interactions, and transactions.

Many platform enterprises strive to apply practical business insights into emergent customer needs and wants. From time to time, these platform enterprises enhance their core competencies, value propositions, competitive advantages, blue-ocean growth strategies, and disruptive innovations etc. As platform enterprises become large and popular with greater market power and dominance, regulatory agencies may preemptively set new rules as safety valves for several other competitors due to antitrust concerns and anti-competitive market behaviors. For instance, Amazon, Facebook, and Microsoft are 3 major examples of platform titans under substantial antitrust scrutiny. Other platform examples include Airbnb, Apple, eBay, and Uber. In this light, regulatory agencies either have to break up platform titans into smaller business units or impose stringent antitrust rules and supervisory reviews to deter anti-competitive market behaviors.

Platforms benefit from positive network effects, scale economies, and information cascades. There are at least 2 major types of highly valuable platforms: innovation platforms empower third-party firms to add complementary products and services to some core disruptive technology (e.g. Google Android, Apple iOS, and Amazon Web Services); and transaction platforms facilitate the positive exchange of goods and services (cf. Amazon Marketplace, Airbnb, and Uber). In the empirical analysis of 20-year Forbes Global 2000 data, the top 43 core platform enterprises generate about $4.5 billion annual sales with only half the number of employees at their non-platform counterparts. These platform enterprises generate twice operating profits, market values, and bottom-line growth rates.

There are some generic lessons for modern platform corporations. First, founders and managers need to learn fast from failures for better lean startup optimization. Despite huge upside platform opportunities, the mere pursuit of a platform strategy may not improve the odds of success as a long-term sustainable business. Second, most platforms boost exponential customer demand with network effects and scale economies, so platform enterprises can set prices near their relatively low marginal costs with appropriate buyer-or-seller subsidies. Google, Facebook, Twitter, Apple, Amazon, Alibaba, and Tencent start their lean corporations by subsidizing at least one side of the market before they maintain profitable platforms. In contrast, Netflix, Uber, Lyft, Slack, and Zoom still struggle to fine-tune their business models.

Third, it is important for most public platform corporations to explain why they strive to accomplish a great deal for better customer trust and loyalty. Most platforms can cultivate customer rapport to inspire most users via positive information cascades. For instance, Alibaba Taobao and Tmall leverage Alipay as the fast and sleek third-party payment system to reduce the transactional frictions of e-commerce in China; whereas, eBay fails to attract customer trust and rapport there due to the absence of a credible and verifiable third-party payment mechanism.

Fourth, most platforms enjoy and maintain first-mover competitive advantages with formidable barriers to entry. A typical example is Microsoft: the software tech titan remains competitive with its Windows operating system, Office software suite, and Edge Internet browser. However, Microsoft gradually loses unique business niches to Apple iOS, Google Android, Chrome, Firefox, Safari, and Opera.

On balance, key platform enterprises deploy a reasonable mix of these competitive strategies for better network effects, scale economies, and information cascades.

This analytic essay cannot constitute any form of financial advice, analyst opinion, recommendation, or endorsement. We refrain from engaging in financial advisory services, and we seek to offer our analytic insights into the latest economic trends, stock market topics, investment memes, personal finance tools, and other self-help inspirations. Our proprietary alpha investment algorithmic system helps enrich our AYA fintech network platform as a new social community for stock market investors: https://ayafintech.network.

We share and circulate these informative posts and essays with hyperlinks through our blogs, podcasts, emails, social media channels, and patent specifications. Our goal is to help promote better financial literacy, inclusion, and freedom of the global general public. While we make a conscious effort to optimize our global reach, this optimization retains our current focus on the American stock market.

This free ebook, AYA Analytica, shares new economic insights, investment memes, and stock portfolio strategies through both blog posts and patent specifications on our AYA fintech network platform. AYA fintech network platform is every investor's social toolkit for profitable investment management. We can help empower stock market investors through technology, education, and social integration.

We hope you enjoy the substantive content of this essay! AYA!

Andy Yeh

Chief Financial Architect (CFA) and Financial Risk Manager (FRM)

Brass Ring International Density Enterprise (BRIDE) © 2013-2023

Do you find it difficult to beat the long-term average 11% stock market return?

It took us 20+ years to design a new profitable algorithmic asset investment model and its attendant proprietary software technology with fintech patent protection in 2+ years. AYA fintech network platform serves as everyone's first aid for his or her personal stock investment portfolio. Our proprietary software technology allows each investor to leverage fintech intelligence and information without exorbitant time commitment. Our dynamic conditional alpha analysis boosts the typical win rate from 70% to 90%+.

Our new alpha model empowers members to be a wiser stock market investor with profitable alpha signals! The proprietary quantitative analysis applies the collective wisdom of Warren Buffett, George Soros, Carl Icahn, Mark Cuban, Tony Robbins, and Nobel Laureates in finance such as Robert Engle, Eugene Fama, Lars Hansen, Robert Lucas, Robert Merton, Edward Prescott, Thomas Sargent, William Sharpe, Robert Shiller, and Christopher Sims.

Follow AYA Analytica financial health memo (FHM) podcast channel on YouTube: https://www.youtube.com/channel/UCvntmnacYyCmVyQ-c_qjyyQ

Follow our Brass Ring Facebook to learn more about the latest financial news and fantastic stock investment ideas: http://www.facebook.com/brassring2013.

Free signup for stock signals: https://ayafintech.network

Mission on profitable signals: https://ayafintech.network/mission.php

Model technical descriptions: https://ayafintech.network/model.php

Blog on stock alpha signals: https://ayafintech.network/blog.php

Freemium base pricing plans: https://ayafintech.network/freemium.php

Signup for periodic updates: https://ayafintech.network/signup.php

Login for freemium benefits: https://ayafintech.network/login.php

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-11-03 12:30:00 Sunday ET

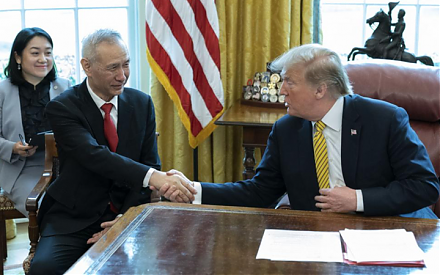

Chinese trade delegation offers to boost purchases of U.S. agricultural products to reach an interim trade deal with the Trump administration. Chinese Vice

2024-04-30 09:30:00 Tuesday ET

With clean and green energy resources and electric vehicles, the global auto industry now navigates at a newer and faster pace. Both BYD and Tesla have

2017-04-01 06:40:00 Saturday ET

With the current interest rate hike, large banks and insurance companies are likely to benefit from higher equity risk premiums and interest rate spreads.

2017-06-27 05:40:00 Tuesday ET

These famous quotes of self-made billionaires are inspirational words of wisdom on financial management, innovation, and entrepreneurship. For financial

2020-09-03 10:26:00 Thursday ET

Agile business firms beat the odds by building faster institutional reflexes to anticipate plausible economic scenarios. Christopher Worley, Thomas Willi

2017-04-19 17:37:00 Wednesday ET

Apple is now the world's biggest dividend payer with its $13 billion dividend payout and surpasses ExxonMobil's dividend payout record. Despite the