2019-05-30 16:44:00 Thu ET

stock market competition macrofinance stock return s&p 500 financial crisis financial deregulation bank oligarchy systemic risk asset market stabilization asset price fluctuations regulation capital financial stability dodd-frank

AYA Analytica finbuzz podcast channel on YouTube May 2019

In this podcast, we discuss several topical issues as of May 2019:

(1) Our proprietary alpha investment model beats S&P 500, Dow, Nasdaq, and MSCI;

(2) Federal Reserve halts the next interest rate hike in early-2019;

(3) Trump ramps up tariffs on Chinese imports with no trade deal;

(4) Oil prices hike after Trump stops waiving economic sanctions on Iran;

(5) Tech unicorns blitzscale business niches for scale economies and network effects.

AYA Analytica is our online regular podcast and newsletter about key financial news, market insights, economic issues, and stock investment strategies on our Andy Yeh Alpha (AYA) fintech network platform. With both American focus and international reach, our primary and ultimate corporate mission aims to help enhance financial literacy, inclusion, and freedom of the open and diverse global general public. We apply our unique dynamic conditional alpha investment model as the first aid for every investor with profitable asset investment signals and portfolio strategies. In fact, our AYA freemium fintech network platform curates, orchestrates, and provides proprietary software technology and algorithmic cloud service to most members who can interact with one another on our AYA fintech network platform. Multiple blogs, posts, ebooks, analytical reports, stock alpha signals, and asset omega estimates offer proprietary solutions and substantive benefits to empower each financial market investor through technology, education, and social integration. Please feel free to sign up or login to enjoy our new and unique cloud software services on AYA fintech network platform now!

Please feel free to follow our AYA Analytica financial health memo (FHM) podcast channel on YouTube: https://www.youtube.com/channel/UCvntmnacYyCmVyQ-c_qjyyQ

Please feel free to follow our Brass Ring Facebook to learn more about the latest financial news and stock investment ideas: https://www.facebook.com/brassring2013

Free signup for stock signals: https://ayafintech.network

Mission on profitable signals: https://ayafintech.network/mission.php

Model technical descriptions: https://ayafintech.network/model.php

Blog on stock alpha signals: https://ayafintech.network/blog.php

Freemium base pricing plans: https://ayafintech.network/freemium.php

Signup for periodic updates: https://ayafintech.network/signup.php

Login for freemium benefits: https://ayafintech.network/login.php

We create each free finbuzz (or free financial buzz) as a blog post on the latest financial news and asset investment ideas. Our finbuzz collection demonstrates our unique American focus with global reach. Each free finbuzz provides deep insights into numerous topical issues in global finance, stock market investment, portfolio optimization, and dynamic asset management. We strive to help enrich the economic lives of most investors who would otherwise engage in financial data analysis with inordinate time commitment.

Please feel free to forward our finbuzz to family and friends, peers, colleagues, classmates, and others who might be keen and abuzz to learn more about asset investment strategies and modern policy reforms with macroeconomic insights.

Do you find it difficult to beat the long-term average 11% stock market return?

It took us 20+ years to design a new profitable algorithmic asset investment model and its attendant proprietary software technology with fintech patent protection in 2+ years. AYA fintech network platform serves as everyone's first aid for his or her personal stock investment portfolio. Our proprietary software technology allows each investor to leverage fintech intelligence and information without exorbitant time commitment. Our dynamic conditional alpha analysis boosts the typical win rate from 70% to 90%+.

Our new alpha model empowers members to be a wiser stock market investor with profitable alpha signals!! This proprietary quantitative analysis applies the collective wisdom of Warren Buffett, George Soros, Carl Icahn, Mark Cuban, Tony Robbins, and Nobel Laureates in finance such as Robert Engle, Eugene Fama, Lars Hansen, Robert Lucas, Robert Merton, Edward Prescott, Thomas Sargent, William Sharpe, Robert Shiller, and Christopher Sims.

Andy Yeh Alpha (AYA) fintech network platform serves as each investor's social toolkit for profitable investment management. AYA fintech network platform helps promote better financial literacy, inclusion, and freedom of the global general public. We empower investors through technology, education, and social integration.

Andy Yeh

AYA fintech network platform founder

Brass Ring International Density Enterprise (BRIDE)

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2017-06-15 07:32:00 Thursday ET

President Donald Trump has discussed with the CEOs of large multinational corporations such as Apple, Microsoft, Google, and Amazon. This discussion include

2020-06-10 10:35:00 Wednesday ET

Most lean enterprises should facilitate the dual transformation of both core assets with fresh cash flows and new growth options. Scott Anthony, Clark Gi

2024-05-05 10:31:00 Sunday ET

Stock Synopsis: Pharmaceutical post-pandemic patent development cycle In terms of stock market valuation, the major pharmaceutical sector remains at its

2021-08-01 07:26:00 Sunday ET

The Biden administration launches economic reforms in fiscal and monetary stimulus, global trade, finance, and technology. President Joe Biden proposes s

2018-09-09 13:42:00 Sunday ET

Warren Buffett shares his key insights into life, success, money, and interpersonal communication. Institutional money managers and retail investors ca

2017-10-03 18:39:00 Tuesday ET

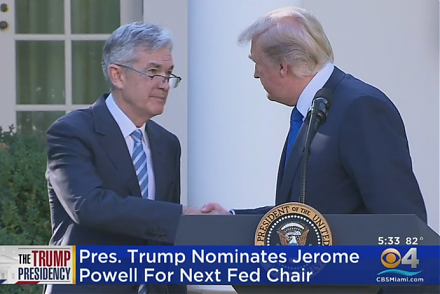

President Trump has nominated Jerome Powell to run the Federal Reserve once Fed Chair Janet Yellen's current term expires in February 2018. Trump's