2019-06-19 09:27:00 Wed ET

federal reserve monetary policy treasury dollar employment inflation interest rate exchange rate macrofinance recession systemic risk economic growth central bank fomc greenback forward guidance euro capital global financial cycle credit cycle yield curve

San Francisco Fed CEO Mary Daly suggests that trade escalation is not the only risk in the global economy. Due to the current Sino-U.S. trade tension, the global economy seems to slow down quite a bit. Some other global economic issues call for resolution too. For instance, Brexit may result in negative consequences for Eurozone trade and financial capital exodus. Daly indicates that the U.S. economy may experience unforeseen challenges if business sentiment and economic data get out of sync. If business sentiment turns out to be negative, this negativity may become a self-fulfilling prophecy that may inadvertently lead to major fluctuations in real economic output.

Nevertheless, Daly reiterates that the U.S. economy operates near the long-term efficient level with 3.6% unemployment as inflation rises toward the 2% target. In the current macroeconomic scenario, the federal funds rate remains neutral. This outcome accords with the Federal Reserve dual mandate of both price stability and maximum sustainable employment.

The recent interest rate hikes help dampen extreme asset price gyrations and so contribute to financial market stabilization. At any rate, Daly emphasizes that it is important for the Federal Reserve to remain patient before the FOMC members consider the next interest rate adjustments.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-11-19 09:38:00 Monday ET

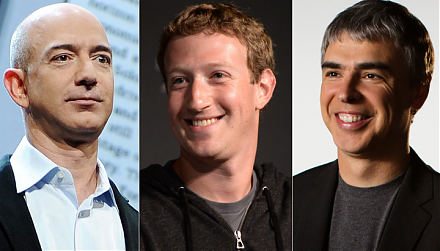

The Trump administration mulls over antitrust actions against Amazon, Facebook, and Google. President Trump indicates that the $5 billion fine against Googl

2019-09-11 09:31:00 Wednesday ET

Central banks in India, Thailand, and New Zealand lower their interest rates in a defensive response to the Federal Reserve recent rate cut. The central ban

2018-03-11 08:27:00 Sunday ET

At 89 years old, Hong Kong billionaire Li Ka-Shing announces his retirement in March 2018. With a personal net worth of $35 billion, Li has an incredible ra

2019-07-21 09:37:00 Sunday ET

Facebook introduces a new cryptocurrency Libra as a fresh medium of exchange for e-commerce. Libra will be available to all the 2 billion active users on Fa

2017-09-25 09:42:00 Monday ET

President Trump has allowed most JFK files to be released to the general public. This batch of documents reveals many details of the assassination of Presid

2019-02-17 14:40:00 Sunday ET

U.S. economic inequality increases to pre-Great-Depression levels. U.C. Berkeley economics professor Gabriel Zucman empirically finds that the top 0.1% rich