2020-06-24 09:32:00 Wed ET

lean startup lifelong learners distinctive capabilities principal owners best practices value creation competitive advantages team leaders iterative continuous improvements perseverance resilience founders senior managers purpose vision mission product differentiation cost leadership meritocracies critical success factors barbara corcoran

Several business founders and entrepreneurs take low risks with high potential rewards to buck the conventional wisdom.

Renee Martin and Don Martin (2010)

Several business founders and entrepreneurs manage to take relatively low risks in return for high potential rewards with clairvoyant calculus. These entrepreneurs trust their gut instincts to make difficult and high-pressure decisions at short notice, especially when nobody else believes in their entrepreneurial ideas and ventures. Successful entrepreneurs exhibit a positive attitude in large part because they veer away from the conventional wisdom with rigid rules and old schools of thought. In practice, these entrepreneurs refrain from following the crowd and thus dissect and triangulate topical issues in order to contemplate different what-if scenarios. Good entrepreneurs never let adversity, failure, or disappointment defeat them along the journey. These entrepreneurs cannot accept limitations and restrictions that others place on their team members and other contributors under normal circumstances or in rare times of financial stress.

Most founders venture out and start their lean enterprises and so often experience stressful moments that help test their faith. From time to time the best antidotes to doubt are persistence and resilience. These entrepreneurs find specific new niche market segments that everyone else fails to serve. Lean enterprises and also small agile and independent organizations may have their competitive advantages over large multinational corporations because lean enterprises can afford to serve those specific market niches that big business entities consider too small to be profitable.

Many business owners and entrepreneurs can spot structural shifts in cultural and economic market trends, and these new market trends often create fresh business opportunities. Smart and successful business owners and entrepreneurs study the competitive landscape to better understand the primary gaps for new products and services. Lean enterprises often close these gaps by offering new solutions to the specific jobs-to-be-done to meet the vast majority of customer demands. From time to time, most co-founders and entrepreneurs just start their business ventures and trust their gut instincts that their business ideas can turn out to be prevalent winners. These business owners and entrepreneurs understand the time value of money in the sense that the perfect time for new product launch may never present itself. In reality, most entrepreneurs seize the chance to garner first-mover advantages over their main competitors.

Most co-founders and entrepreneurs prefer to save money on ads but strive to get ubiquitous brand recognition within stringent budget constraints. To the extent that most entrepreneurs are smart and resourceful, they tend to believe that there can be many ways to attract customer attention. Successful business marketers make their business ventures well-known in creative and even unconventional manners. Successful founders and entrepreneurs exploit their core competitive advantages in response to customer demands, needs, wants, habits, and lifestyles. This deep industry analysis empowers business owners and entrepreneurs to view the world from alternative perspectives. Some lean enterprises therefore implement specific policies and practices because their prescient entrepreneurs can identify the major vulnerabilities of the dominant competitors out there.

Most co-founders and entrepreneurs learn to sharpen the saw on a regular basis. These business owners and entrepreneurs never stop reinventing their business ventures. Instead of becoming complacent over time, top-notch business men and women are not afraid to continue to take chances for exponential growth or service diversification. In this fashion, many lean enterprises strive to keep pace with the marketplace through both iterative continuous improvements and product feature enhancements. Within these lean and agile enterprises, disruptive innovators help team members learn valuable institutional lessons from mistakes and setbacks to move forward in incremental steps.

Barbara Corcoran built the Corcoran Group as a real estate conglomerate.

Barbara Corcoran built her Corcoran Group as a core real estate conglomerate in the hyper-competitive world of New York City real estate. At a young age, she was unfortunately diagnosed as dyslexic and so earned straight Ds in school. Corcoran always listened to the basic words of wisdom and encouragement from her mother and never let adversity, failure, or disappointment defeat her.

By age 24, Corcoran had held 22 jobs. Her boyfriend piqued her active interest in real estate by relating many stories about his real estate development deals in New Jersey. Her boyfriend kept urging her to strike out on her own in New York City. At that time, Corcoran was still living with her parents in Edgewater, New Jersey, and her boyfriend sweetened the deal by offering to foot the bill for Corcoran to stay at the Barbizon Hotel for Women as she searched for an affordable apartment. She quickly found a job as a receptionist with a property management company.

Corcoran took the real estate exam and then began showing residential properties in Manhattan. In her first real estate weekend, she managed to rent 2 apartments with commissions of about $330 each, and so earned 3 times as much as she had in 3 weeks as a receptionist. Corcoran learned that real estate was a lot more fun than sitting behind a desk. She was never afraid to be different and so got to where she was by being herself.

After a few months, her boyfriend gave Corcoran $1,000 to start a small real estate company Corcoran-Simone in her apartment. Her former boss agreed to give her one-month rent as commission if she found a renter for one of his apartments. She picked the cheapest one-bedroom on the list, convinced her former boss to divide the lounge into separate rooms, and rented it as a one-bedroom plus den. She got her commission plus more apartments from her former boss to show as residential properties. Over time Corcoran continued to sharpen the saw with her real estate business acumen and knowledge.

Her real estate company continued to grow, and Corcoran soon realized that her greatest strength was her creativity. She began to focus on marketing residential properties with in-depth property descriptions and demographic details about most clients. In 1978, Corcoran decided to start her own company and divided Corcoran-Simone total assets and 14 staff members with her ex-boyfriend (only 5 years after she got into the real estate business). She rented a new office and then launched the Corcoran Group.

The Corcoran Group analyzed client data and real estate statistics. This analysis was one of the major competitive advantages that the Corcoran Group had in stark contrast to most other competitors. Market research became the backbone of the Corcoran Group. By analyzing demographic data from realtors, the company was able to predict a probable surge in the demand for apartments on the West side in 1979. Corcoran spotted this new market trend and then jumped on the bandwagon. The Corcoran Group opened a large office in the area to take full advantage of this new customer demand. In effect, Corcoran positioned her company to be in fresh blue-ocean markets where her competitors were not.

Corcoran started publishing a popular newsletter about New York residential real estate trends. This creative sales strategy empowered the Corcoran Group to build a high profile without substantial ad expenses. In the 1990s, Corcoran was one of the first to use the Internet to market real estate. After launching the new Corcoran Group website, Corcoran hired subject matter experts to offer both video clips and images online for better and quicker information exchange.

In 2001, Corcoran sold her company to the real estate conglomerate NRT for $66 million. At that time, the Corcoran Group had reached $5 billion annual sales with more than 2,000 staff members. Corcoran continued to serve as the chair of board of directors for a smooth transition. In 2005, she left the company for good. Barbara Corcoran found new niche market segments, took full advantage of the new market trends, and eventually defied the conventional wisdom to make a fortune through her entrepreneurial ventures in the real estate industry.

Paul Orfalea built Kinkos as a major photocopy service business in America.

As a child, Paul Orfalea was a perpetually poor student and was then unfortunately diagnosed with Attention Deficit Hyperactivity Disorder. He grew up in a Lebanese American family of entrepreneurs. His father ran an apparel company in downtown Los Angeles. His grandmother ran an apparel store in L.A. Fairfax District. Despite his struggles in school, his family expected Paul Orfalea to start his own business someday. Orfalea eventually graduated high school and went to college. He never let adversity and disappointment defeat him throughout the arduous journey.

In 1970, his senior year at the University of Southern California, Paul Orfalea was in a study group that had just completed a term paper. At that time, Orfalea had to make the photocopies. He went to the student copy center and was struck by the flurry of activity. Students were rushing to make photocopies for classes. Also, key professional members such as the executive assistants for a local law firm had to copy legal documents one page at a time.

Paul Orfalea realized that he had stumbled onto a fresh market niche opportunity. After college graduation, he planned to launch his own photocopy business. Within a few months, Orfalea discovered the essential need for a photocopy center near the University of California at Santa Barbara, and so decided to just start his brand new photocopy business.

Paul Orfalea first rented a small storefront in Isla Vista more than 100 miles away from the UCSB campus, but he knew many students and faculty members had the essential need for his photocopy service. Orfalea leased a new photocopy machine from Xerox, and he named his photocopy business Kinkos, which was one of his nicknames that reflected his kinky blond hair.

When he started his photocopy business, Paul Orfalea was still a student at USC, and so he only worked at Kinkos twice a week. He created and handed out flyers on the UCSB campus and further stuffed them into faculty mailboxes. Orfalea even offered for sale pens and pencils in front of his small store to attract public attention. In this way, Orfalea saved money on expensive ads and therefore managed to get ubiquitous brand recognition within strict budget constraints. In the 1970s, college and municipal libraries had photocopy machines, but they were too expensive for students and faculty members to use in practice. Kinkos provided a cost-effective alternative. For this reason, Orfalea exploited his main competitive moats and first-mover advantages in this new blue-ocean market.

After the first store turned out to be profitable, Paul Orfalea opened a second store near the University of California at Irvine. Orfalea jumped on this bandwagon and then opened new Kinkos chain stores near prestigious universities where students and faculty members were likely use the photocopy service for both research and study. This business model became a major success in California.

By 1975, Kinkos had 24 stores throughout California, and further there were more than 80 stores near most major college campuses by 1980. By 1985, Kinkos began to attract small business customers. This new niche fringe market boosted a major business growth spurt for Kinkos.

At this point, Paul Orfalea wisely observed the essential need for computer usage. He added desktop computer services to the mix and so gave customers the option of using in-store Apple computers for a reasonable fee per hour. Orfalea developed a uniform professional look for the Kinkos chain stores. Kinkos workers started to wear more professional attire, and the Kinkos trademark logo got a facelift as well. In these creative ways, Orfalea continued to sharpen the saw with new innovations for his Kinkos photocopy service business. By 1990, there were 450 Kinkos chain stores in America. In 1995, the annual sales for Kinkos reached $1.5 billion across the country.

In 1996, Paul Orfalea sold a 30% board stock ownership interest to a major private equity investment firm. This firm reorganized Kinkos chain stores in America, and brought in a new CEO to take charge. In 2003, Orfalea sold all his residual Kinkos equity shares for $115 million. In 2004, FedEx strategically acquired all the Kinkos chain stores for $2.4 billion and then changed the brand name to FedEx Office.

This analytic essay cannot constitute any form of financial advice, analyst opinion, recommendation, or endorsement. We refrain from engaging in financial advisory services, and we seek to offer our analytic insights into the latest economic trends, stock market topics, investment memes, personal finance tools, and other self-help inspirations. Our proprietary alpha investment algorithmic system helps enrich our AYA fintech network platform as a new social community for stock market investors: https://ayafintech.network.

We share and circulate these informative posts and essays with hyperlinks through our blogs, podcasts, emails, social media channels, and patent specifications. Our goal is to help promote better financial literacy, inclusion, and freedom of the global general public. While we make a conscious effort to optimize our global reach, this optimization retains our current focus on the American stock market.

This free ebook, AYA Analytica, shares new economic insights, investment memes, and stock portfolio strategies through both blog posts and patent specifications on our AYA fintech network platform. AYA fintech network platform is every investor's social toolkit for profitable investment management. We can help empower stock market investors through technology, education, and social integration.

We hope you enjoy the substantive content of this essay! AYA!

Andy Yeh

Chief Financial Architect (CFA) and Financial Risk Manager (FRM)

Brass Ring International Density Enterprise (BRIDE) © 2013-2023

Do you find it difficult to beat the long-term average 11% stock market return?

It took us 20+ years to design a new profitable algorithmic asset investment model and its attendant proprietary software technology with fintech patent protection in 2+ years. AYA fintech network platform serves as everyone's first aid for his or her personal stock investment portfolio. Our proprietary software technology allows each investor to leverage fintech intelligence and information without exorbitant time commitment. Our dynamic conditional alpha analysis boosts the typical win rate from 70% to 90%+.

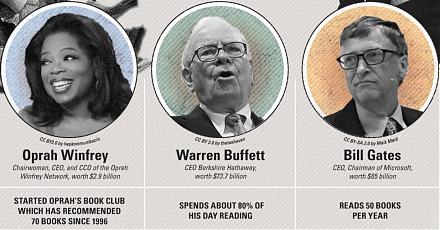

Our new alpha model empowers members to be a wiser stock market investor with profitable alpha signals! The proprietary quantitative analysis applies the collective wisdom of Warren Buffett, George Soros, Carl Icahn, Mark Cuban, Tony Robbins, and Nobel Laureates in finance such as Robert Engle, Eugene Fama, Lars Hansen, Robert Lucas, Robert Merton, Edward Prescott, Thomas Sargent, William Sharpe, Robert Shiller, and Christopher Sims.

Follow AYA Analytica financial health memo (FHM) podcast channel on YouTube: https://www.youtube.com/channel/UCvntmnacYyCmVyQ-c_qjyyQ

Follow our Brass Ring Facebook to learn more about the latest financial news and fantastic stock investment ideas: http://www.facebook.com/brassring2013.

Free signup for stock signals: https://ayafintech.network

Mission on profitable signals: https://ayafintech.network/mission.php

Model technical descriptions: https://ayafintech.network/model.php

Blog on stock alpha signals: https://ayafintech.network/blog.php

Freemium base pricing plans: https://ayafintech.network/freemium.php

Signup for periodic updates: https://ayafintech.network/signup.php

Login for freemium benefits: https://ayafintech.network/login.php

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2023-07-14 10:32:00 Friday ET

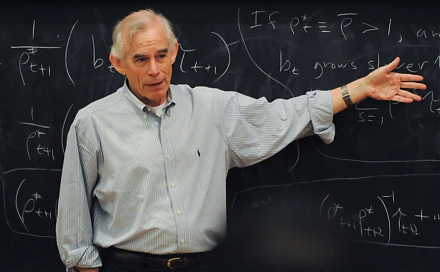

Ray Fair applies his macroeconometric model to study the central features of the U.S. macroeconomy such as price stability and full employment in the dual m

2018-11-03 11:36:00 Saturday ET

Apple adds fresh features to its new iPad Pro and MacBook Air in addition to its prior suite of iPhone XS, iPhone XS Max, and iPhone XR back in September 20

2018-07-27 10:35:00 Friday ET

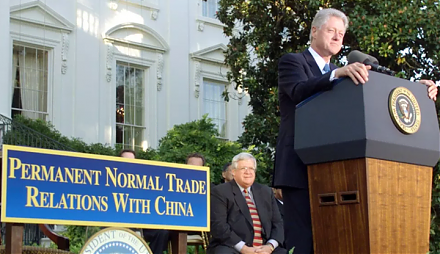

Admitting China to the World Trade Organization (WTO) and other international activities seems ineffective in imparting economic freedom and democracy to th

2019-11-11 09:36:00 Monday ET

Apple upstream semiconductor chipmaker TSMC boosts capital expenditures to $15 billion with almost 10% revenue growth by December 2019. Due to high global d

2018-03-15 07:41:00 Thursday ET

The Trump administration's $1.5 trillion hefty tax cuts and $1 trillion infrastructure expenditures may speed up the Federal Reserve interest rate hike

2022-02-02 10:33:00 Wednesday ET

Our proprietary alpha investment model outperforms most stock market indices from 2017 to 2022. As of early-January 2023, the U.S. Patent and Trademark O