2025-06-13 08:23:00 Fri ET

stock market federal reserve monetary policy treasury fiscal policy deficit debt technology employment inflation global macro outlook interest rate fiscal stimulus economic growth central bank fomc capital gdp output commitment discretion

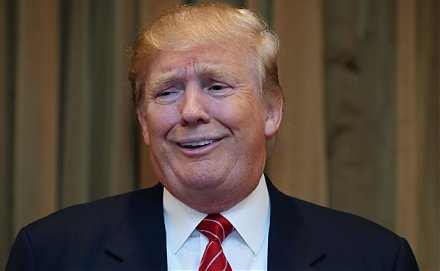

We delve into the mainstream legal origins of President Trump’s recent tariff policies as part of his second presidency. As a first step, we describe the recent developments of new Trump tariffs on China, Europe, Canada, Mexico, and other countries from April 2025 to June 2025. This chronology further provides some reasons for these new tariffs under the second Trump administration. Specifically, these reasons include economic incentives for better domestic manufacturing protectionism, as well as broader geopolitical risks, tensions, and frictions in relation to bilateral trade negotiations between America and China, Europe, Canada, Mexico, and other countries. We add rare unique value to these current themes, trends, topics, and discussions by shining fresh light on the mainstream legal origins of President Trump’s new tariff policies. In light of the broader U.S. domestic institutional arrangements for presidential executive orders, courts, and congressional laws, rules, and regulations, these legal origins, checks, balances, and provisions can cause complex, profound, and significant macro ripple effects across the American economic policy domain. In the meantime, the new aggressive trade policy stance emanates from the White House, as well as reshapes and reinforces fair trade treatments, geopolitical alliances, and even monetary policy interest rate adjustments.

In the best likelihood of success, President Trump regards hefty tariffs, comprehensive bans on strategic foreign investments in high technology, and even embargoes on China, Europe, and many other trade partners, as a strategic means to an end, but not an end in itself. For this reason, President Trump uses these trade measures to gain substantial leverage for the bilateral trade negotiations with China, Europe, Canada, Mexico, and many other countries. Although substantial economic policy uncertainty revolves around President Trump’s current tariff policy stance, we would probably expect to see sound, efficient, and reciprocal bilateral trade deals made between America and China, Europe, and most other countries in the next few quarters. In this positive light, President Trump seeks to achieve the best terms as part of his Make America Great Again (MAGA) campaign in the next bilateral trade negotiations worldwide. Tariffs emerge as the mainstream quid pro quo front and center, as the American economy suffers substantial bilateral trade deficits with its major trade partners, specifically China, Europe, Canada, and Mexico, among many other countries, in recent decades.

During his second term, President Donald Trump launched several steeper protective tariffs for almost all goods imports into America. Upon the second inauguration of President Trump in January 2025, the average effective U.S. tariff rate was less than 3%. This effective tariff rate rose substantially to 27%-30%, the highest level in more than one century in American history, due to Liberation Day tariffs as of Wednesday 2 April 2025. After President Trump’s recent tariff rollbacks in May-June 2025, the average effective U.S. tariff rate remained high, more than 15%, or a few percentage points above the baseline universal 10% tariff rate for all countries. Specifically, President Trump substantially escalated the China-U.S. trade war and once raised the tariffs on Chinese imports to 145%. In response to this aggressive tariff policy stance, China retaliated by imposing 125% tariffs on U.S. goods, as well as American export restrictions on rare earths, especially lithium, neodymium, cesium, dysprosium, and lanthanum etc. These key elements of rare earths would be critical to some strategic sectors such as electric vehicles (EV), autonomous robotaxis (AR), semiconductor microchips, new optical fibers for high-speed telecoms, cloud services, worldwide data centers for generative artificial intelligence (Gen AI) large language models (LLM), quantum computers, and so on. In recent times, China controlled more than 90% of global rare earths exports. At the same time, the Trump administration imposed comprehensive bans on foreign investments in high technology to target China as an aggressive unfair trade abuser in recent years.

President Trump further launched a new trade war against Canada and Mexico by imposing 25% tariffs on both countries. At a later stage, President Trump granted exemptions for all goods imports in accordance with the US-Mexico-Canada Agreement (USMCA). In addition to curbing U.S. trade deficits substantially, President Trump framed these new tariffs as key efforts to hold these countries accountable for American illegal immigration and contraband fentanyl abuse. At the same time, President Trump made his best conscious efforts to better support several American domestic manufacturing sectors. In this respect, President Trump added another 25% tariffs on all automobiles and 50% on steel and aluminum products from all countries. President Trump might further consider imposing hefty tariffs on semiconductor microchips, high-speed optical fibers for telecoms, quantum computers, and pharmaceutical medications.

On Liberation Day, President Trump announced the minimum baseline 10% tariffs on U.S. goods imports, as well as additional tailor-made tariffs for China, Europe, Canada, Mexico, and more than 70 other countries worldwide. In response, these reciprocal tariffs prompted tariff retaliation from many countries and then triggered a transient global stock market crash. The Trump administration regarded all sorts of trade deficits as harmful to the U.S. economy. For this reason, President Trump aimed to substantially reduce these U.S. trade deficits, as well as other unfair trade practices, with a new aggressive trade policy stance. In addition to tariffs, embargoes, and bans on foreign investments in high technology, the new aggressive trade policy stance further delved into potential currency manipulation for all the major global greenback reserve holders, specifically central banks and sovereign wealth funds worldwide, of U.S. Treasury bonds and several other dollar assets. President Trump reiterated that the second administration would close the de minimis exemption for China from May-June 2025, and possibly for all other countries at a future date.

From 11% to 50%, the higher reciprocal tariffs for each of more than 70 countries took effect in early-April 2025. Subsequently, the Trump administration halted these tariffs for 90 days for all countries except China. In response to a temporary trade truce between America and China, the Trump administration reduced tariffs to 30% for the vast majority of goods imports from China. However, the minimum baseline 10% tariff for all trade partners and some other additional 20% tariffs for China remained in effect for some strategic sectors. As a result of these hefty tariffs from the Trump administration, many stock markets worldwide depreciated substantially in market valuation, the major credit rating agencies downgraded U.S. Treasury bonds from the top notch, and many macro economists raised significantly the probabilistic expectations of a mild recession in America in the next 6 to 8 quarters.

The White House began bilateral trade negotiations in May 2025. The consequent transient trade truce between the U.S. and China led to substantially lower tariffs on almost all goods imports from China. The Trump administration reiterated the aggressive trade policy stance that the minimum baseline 10% tariff would remain for all countries in the long run. In addition, President Trump called for interest rate cuts from the Federal Reserve System, specifically Fed Chair Jerome Powell. Many macro economists interpreted this presidential influence as a new threat to Federal Reserve System’s long prevalent monetary policy independence.

Although the U.S. Constitution granted Congress the sole authority to levy taxes and tariffs, President Trump had the statutory power to impose tariffs unilaterally on foreign countries. In his second term, President Trump first imposed hefty tariffs on foreign steel and aluminum products and automobile parts and components for national security reasons under Section 232 of the Trade Expansion Act (TEA) of 1962. Moreover, President Trump directed the U.S. Trade Representative Office to start similar investigations of potentially unfair trade practices from foreign countries under Section 301 of the Trade Act of 1974. Further, President Trump invoked the new and rare presidential powers under the National Emergencies Act (NEA) of 1976 and the International Emergency Economic Powers Act (IEEPA) of 1977 by declaring multiple national emergencies in relation to border security, energy, and trade deficits.

In late-May 2025, the U.S. Court of International Trade vacated the fentanyl tariffs and many reciprocal tariffs, and therefore ruled that President Trump had overstepped his presidential authority to impose unilateral tariffs on foreign countries. On the next day, the U.S. Court of Appeals for the Federal Circuit in Washington D.C. temporarily reinstated President Trump’s tariffs. This federal appeals court paused the prior injunction to reconsider the government’s appeal. In the meantime, substantial economic policy uncertainty revolves around the legal, fiscal, and monetary policy implications of President Trump’s aggressive trade policy stance. In the bilateral trade negotiations between America and China, Europe, and Canada, among numerous other countries, Treasury Secretary Scott Bessent, Commerce Secretary Howard Lutnick, and Trade Representative Jamieson Greer would shepherd the trade talks.

We describe and analyze in detail the potential off-ramps to the recent hefty tariffs and their economic ripple effects from the White House, Congress, and federal and district courts in America. In our best conscious efforts, we describe, discuss, and delve into the mainstream legal origins of President Trump’s tariff policies. The most straightforward off-ramp would be for the White House itself to reduce-and-even-reverse the tariff hikes. However, a significant pullback seems unlikely for the foreseeable future due to the second Trump administration’s broader goal for trade negotiators to substantially reduce the U.S. trade deficits.

President Trump would likely seek to reach multiple bilateral trade deals in support of further foreign commitments to purchasing American goods and energy resources, especially shale oil and natural gas resources. These bilateral trade deals would be similar to the provisions as part of the China-U.S. Phase One trade agreement during the first Trump administration. In effect, these foreign commitments would reduce substantially U.S. bilateral trade deficits. However, one size would not fit all. It would not be feasible for all of more than 70 countries to increase substantially their foreign purchases of American goods and energy resources. In practice, the second Trump administration would make best conscious efforts to prioritize at least some of the new bilateral trade deals by the end of the 90-day pause.

Near-term macro-financial pains, setbacks, obstacles, and difficulties could further force the White House to reverse course on these hefty tariffs. In recent times, the 90-day pause on country-specific tariffs arose from the Trump administration’s concerns about dysfunction in American financial markets, specifically the foreign institutional demand for Treasury bonds. President Trump would probably need to make the threat of additional tariffs seem real again to maintain significant leverage in the next bilateral trade negotiations before the end of the 90-day pause. A negative macro-financial market reaction might limit the potential for further tariff hikes. However, this broader market reaction would not force Trump tariff reductions at this stage.

Even if tariffs remained at the current levels, product-specific exemptions could be another off-ramp. The recent tariff exemptions on smartphones, tablets, computers, and many other electronic products would likely show President Trump’s tendency to move into that direction. The second Trump administration could continue to push for country-specific tariffs with key exemptions on some strategically, economically, and even geopolitically sensitive products and technological transfers. In due course, these market forces would constrain the ultimate impact of additional tariffs from the White House.

Congress would respond to tariff hikes from the White House, but congressional oversight would only be symbolic in the best likelihood of success. The most straight-forward off-ramp with greater congressional oversight would result from a majority vote to terminate President Trump’s national emergency declaration on Liberation Day. This simple majority vote would require further support from only a few Republicans, and this majority vote would require all Democrats to vote in favor. These congressional resolutions would have a good chance of passage. Some of these resolutions had been through both chambers of Congress. Senate would likely vote on these resolutions in the next few weeks. The House of Representatives would probably refrain from reaching a simple majority vote. Indeed, any vote would only be symbolic because any congressional legislation would still require a presidential signature. President Trump would almost always veto any legislation that Congress passed to limit his presidential authority to impose tariffs on foreign countries. Congress could override such a presidential veto, but Republican dissatisfaction with tariffs would not seem deep and broad enough to reach the supermajority vote, or more than 67% of all congressional seats, in both Senate and House. Nevertheless, even if one chamber of Congress voted against additional tariffs, this result would send an important political signal to the White House and could limit any further tariff escalation from the Trump administration. On the margin, this signal could further reduce the odds that President Trump insisted on imposing the country-specific tariffs, especially those new tariffs on some strategic sectors against China and Europe.

In practice, Congress could pass new legislation to constrain President Trump’s authority to impose unilateral tariffs on foreign countries. This new congressional oversight would likely face an even more difficult road ahead. Unlike the national emergency resolution, such new legislation would not serve as a guarantee for consideration in either chamber of Congress. At least the House would not appear likely to allow such legislation to come up for a vote, or alternatively, would require an almost impossible supermajority vote. The new congressional oversight would seem less likely in light of the current sentiment among Republicans. Even if such new legislation eventually passed through Congress, such legislation would still have to contend with a presidential veto. Even if Democrats might win control of the House in the next midterm elections in 2026, Democrats would still require substantial Republican support to override a presidential veto. In light of these hurdles for further Republican support and a presidential veto, any new additional congressional oversight would only serve as a symbolic vote of confidence in President Trump’s recent tariff policies, country-specific tariffs, and his broader aggressive trade policy stance.

The odds would be substantially higher that some of the courts might intervene the new tariff policies from the White House. At any pace, it would be far from a guarantee for the courts to block President Trump’s tariffs, further tariff hikes, and baseline and country-specific tariffs in time. Some of the courts, specifically the U.S. Court of International Trade, could enforce a preliminary injunction to pause the new baseline and country-specific tariffs from the White House. In response, the Court of Appeals for the Federal Circuit temporarily reinstated tariffs under the second Trump administration. This federal appeals court paused the injunction to reconsider the government’s appeal. In the special case of an injunction from a district court, the federal appeals court, or both, the Trump administration could theoretically appeal to the Supreme Court. Any potential court confirmation of an injunction for President Trump’s tariffs would require substantial evidence of irreparable harm. Even in this special case, financial losses from tariffs might not quality because the American government could refund all these tariff revenues if the higher court eventually overturned the Trump tariffs in due time. In terms of the legal battle, the argument of irreparable harm would become substantially stronger if the Trump administration pushed for higher tariffs. Any successful injunction would require a good chance that the plaintiffs might ultimately win the case with a high bar.

Although a successful injunction might look less likely, a favorable court confirmation against Trump tariffs would still be possible. Several court cases would fall into this new territory. A recent case in Florida against President Trump’s reciprocal tariffs on Chinese imports would further apply to the broader baseline and country-specific tariffs on Liberation Day under the International Emergency Economic Powers Act (IEEPA). Specifically, this lawsuit makes 3 major claims. First, IEEPA does not give the president the legal authority to impose unilateral tariffs on foreign countries. Notably, the law makes no reference to the specific jargon, tariffs, as part of the American global trade engagements. Second, these tariffs violate the Supreme Court’s major questions doctrine (MQD). This doctrine holds that Congress should explicitly grant the president the legal power to impose policies with this level of economic and political significance. Congress has not done so thus far. This same argument would block President Biden’s student loan forgiveness program, and this program served as only a fraction of the size of President’s Trump tariff policies. Third, this presidential power would run afoul of the non-delegation doctrine even if Congress had granted President Trump such legal authority to impose unilateral tariffs. The non-delegation doctrine limits the extent that Congress can delegate its legislative power to the other branches of government. However, trade lawyers are generally skeptical that such court challenges could succeed, as courts have traditionally deferred to the executive branch on the broader questions of foreign policy affairs.

Even if the courts intervene to block these IEEPA-driven tariffs, President Trump could use many other legal authorities to impose tariffs on foreign countries. Specifically, Section 122 of the Trade Act of 1974 allows the president to impose additional 15% tariffs on imports for up to 5 months. Section 338 of the Tariff Act of 1930 allows up to 50% tariffs on some foreign countries that discriminate against American manufacturers. Section 301 of the Trade Act of 1974 places no limits on the dollar amount and duration of new tariffs. In fact, Section 301 served as the mainstream legal basis for the first Trump administration’s tariffs on Chinese imports as part of the Sino-American trade war back in 2018-2019. In addition, Section 232 of the Trade Expansion Act (TEA) of 1962 allows the president to impose tariffs, restrictions on foreign technological transfers, and other trade restrictions for national security reasons, concerns, purposes, and considerations. In practice, Section 232 served as the mainstream legal basis for President Trump’s new tariffs on steel and aluminum products and automobile parts and components worldwide. For the foreseeable future, however, any court injunction would limit President Trump’s legal power to use IEEPA as the mainstream legal basis for new baseline and country-specific tariffs, restrictions on foreign technological transfers, and other trade sanctions. Any such court injunction would be meaningful and economically and geopolitically significant, because this injunction could provide a transient reprieve for global financial markets. In effect, any such court injunction might make the Trump administration more cautious in pursuing several other legal authorities under the relevant trade statutes.

In the best likelihood of success, President Trump regards hefty tariffs, comprehensive bans on strategic foreign investments in high technology, and even embargoes on China, Europe, and many other trade partners, as a strategic means to an end, but not an end in itself. For this reason, President Trump uses these trade measures to gain substantial leverage for the bilateral trade negotiations with China, Europe, Canada, Mexico, and many other countries. Although substantial economic policy uncertainty revolves around President Trump’s current tariff policy stance, we would probably expect to see sound, efficient, and reciprocal bilateral trade deals made between America and China, Europe, and most other countries in the next few quarters. In this positive light, President Trump seeks to achieve the best terms as part of his Make America Great Again (MAGA) campaign in the next bilateral trade negotiations worldwide. Tariffs emerge as the mainstream quid pro quo front and center, as the American economy suffers substantial bilateral trade deficits with its major trade partners, specifically China, Europe, Canada, and Mexico, among many other countries, in recent decades.

With U.S. fintech patent approval, accreditation, and protection for 20 years, our AYA fintech network platform provides proprietary alpha stock signals and personal finance tools for stock market investors worldwide.

We build, design, and delve into our new and non-obvious proprietary algorithmic system for smart asset return prediction and fintech network platform automation. Unlike our fintech rivals and competitors who chose to keep their proprietary algorithms in a black box, we open the black box by providing the free and complete disclosure of our U.S. fintech patent publication. In this rare unique fashion, we help stock market investors ferret out informative alpha stock signals in order to enrich their own stock market investment portfolios. With no need to crunch data over an extensive period of time, our freemium members pick and choose their own alpha stock signals for profitable investment opportunities in the U.S. stock market.

Smart investors can consult our proprietary alpha stock signals to ferret out rare opportunities for transient stock market undervaluation. Our analytic reports help many stock market investors better understand global macro trends in trade, finance, technology, and so forth. Most investors can combine our proprietary alpha stock signals with broader and deeper macro financial knowledge to win in the stock market.

Through our proprietary alpha stock signals and personal finance tools, we can help stock market investors achieve their near-term and longer-term financial goals. High-quality stock market investment decisions can help investors attain the near-term goals of buying a smartphone, a car, a house, good health care, and many more. Also, these high-quality stock market investment decisions can further help investors attain the longer-term goals of saving for travel, passive income, retirement, self-employment, and college education for children. Our AYA fintech network platform empowers stock market investors through better social integration, education, and technology.

Andy Yeh (online brief biography)

Co-Chair

AYA fintech network platform

Brass Ring International Density Enterprise ©

Do you find it difficult to beat the long-term average 11% stock market return?

It took us 20+ years to design a new profitable algorithmic asset investment model and its attendant proprietary software technology with fintech patent protection in 2+ years. AYA fintech network platform serves as everyone’s first aid for his or her personal stock investment portfolio. Our proprietary software technology allows each investor to leverage fintech intelligence and information without exorbitant time commitment. Our dynamic conditional alpha analysis boosts the typical win rate from 70% to 90%+.

Our new alpha model empowers members to be a wiser stock market investor with profitable alpha signals! The proprietary quantitative analysis applies the collective wisdom of Warren Buffett, George Soros, Carl Icahn, Mark Cuban, Tony Robbins, and Nobel Laureates in finance such as Robert Engle, Eugene Fama, Lars Hansen, Robert Lucas, Robert Merton, Edward Prescott, Thomas Sargent, William Sharpe, Robert Shiller, and Christopher Sims.

Free signup for stock signals: https://ayafintech.network

Mission on profitable signals: https://ayafintech.network/mission.php

Model technical descriptions: https://ayafintech.network/model.php

Blog on stock alpha signals: https://ayafintech.network/blog.php

Freemium base pricing plans: https://ayafintech.network/freemium.php

Signup for periodic updates: https://ayafintech.network/signup.php

Login for freemium benefits: https://ayafintech.network/login.php

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2023-04-14 13:32:00 Friday ET

Calomiris and Haber delve into the comparative analysis of bank crises and politics in America, Britain, Canada, Mexico, and Brazil. Charles Calomiris an

2019-03-25 17:30:00 Monday ET

America seeks to advance the global energy dominance agenda by toppling Saudi Arabia as the top oil exporter by 2024. The International Energy Agency (IEA)

2018-07-11 09:39:00 Wednesday ET

In recent times, the Trump administration sees the sweet state of U.S. economic expansion as of early-July 2018. The latest CNBC All-America Economic Survey

2020-03-26 10:31:00 Thursday ET

The unique controversial management style of Steve Jobs helps translate his business acumen into smart product development. Jay Elliot (2012) Leading

2019-04-25 09:35:00 Thursday ET

Bridgewater hedge fund founder Ray Dalio suggests that the current state of U.S. capitalism poses an existential threat for many Americans. Dalio deems the

2018-08-27 09:35:00 Monday ET

President Trump and his Republican senators and supporters praise the recent economic revival of most American counties. The Economist highlights a trifecta