2018-01-13 08:39:00 Sat ET

treasury deficit debt employment inflation interest rate macrofinance fiscal stimulus economic growth fiscal budget public finance treasury bond treasury yield sovereign debt sovereign wealth fund tax cuts government expenditures

The Economist digs deep into the political economy of U.S. government shutdown over 3 days in January 2018. In more than 4 years since 2014, U.S. government shutdown looks likely to end within a specific time frame. Government shutdowns cost a great deal, dampen stock market investor sentiments and expectations, and embarrass congressional members on the Senate and House of Representatives. Democrats now exacerbate procedural uncertainty and hence put pressure on the Republican Senate majority leader over DACA and Obamacare legislative issues. Both DACA and Obamacare are controversial milestones, and Democrats require reasonable solutions to carefully crafting better health care and immigration bills.

President Trump urges Congress to pass a *bill of love* for DACA recipients to stay with legal residency (but not citizenship) in exchange for better border security finance and stronger enforcement of immigration laws. Also, both Republicans and Democrats seek to present their alternative cases for health care reforms in lieu of Obamacare or the Affordable Care Act.

These legislative issues matter because an increase in U.S. government debt and deficit may trigger greater seigniorage in light of robust money supply growth and Treasury bond issuance. The resultant seigniorage discrepancy can translate into inflation that manifests in higher general prices for the typical American consumer. In accordance with its dual mandate of maximum employment and price stability, the Federal Reserve would need to accelerate the current neutral interest rate hike to contain inflation near full employment. These ripple effects may dampen stock and bond prices, investor sentiments, and macroeconomic expectations.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-07-13 07:17:00 Saturday ET

Japanese prime minister Shinzo Abe outlines the main economic priorities for the G20 summit in Osaka, Japan. First, Asian countries need to forge the key Re

2018-11-23 09:39:00 Friday ET

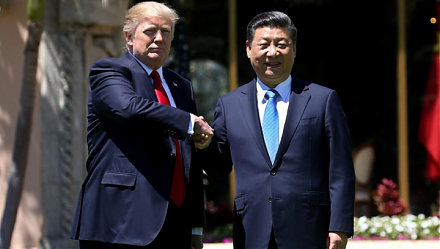

Former White House chief economic advisor Gary Cohn points out that there is no instant cure for the Sino-U.S. trade dilemma. After the U.S. midterm electio

2018-11-03 11:36:00 Saturday ET

Apple adds fresh features to its new iPad Pro and MacBook Air in addition to its prior suite of iPhone XS, iPhone XS Max, and iPhone XR back in September 20

2019-06-01 10:33:00 Saturday ET

Top tech firms such as Google, Intel, and Qualcomm suspend Android services to HuaWei as the Trump administration blacklists the Chinese company. HuaWei can

2019-06-11 12:33:00 Tuesday ET

Dallas Federal Reserve Bank President Robert Kaplan expects the U.S. economy to grow at 2.2%-2.5% in 2019-2020 as inflation rises a bit. In an interview wit

2019-01-04 11:41:00 Friday ET

Chinese President Xi JingPing calls President Trump to reach Sino-American trade conflict resolution. Xi sends a congratulatory message to mark 40 years sin