2019-07-05 09:32:00 Fri ET

technology social safety nets education infrastructure health insurance health care medical care medication vaccine social security pension deposit insurance

Warwick macroeconomic expert Roger Farmer proposes paying for social welfare programs with no tax hikes. The U.S. government pension and Medicare liabilities are $47 trillion in total. As Farmer suggests, national treasuries should establish social care funds, and these public funds borrow money at low interest rates and invest the proceeds in many international stock markets. A recent study analyzes data from OECD economies over a century and empirically shows that the average stock return is about 7% above the return on government bonds. Also, the average equity risk premium ranges from 3.8% in Denmark to 9.9% in Japan. Stock market idiosyncratic volatility may not fully accord with economic fundamental factors such as size, value, momentum, asset growth, operating profitability, and market risk etc. This volatility instead shows the animal spirits and sentiments of investors who often buy and sell shares on the basis of self-fulfilling prophecies of greed and fear.

When the government institutes social care funds, these public funds can smooth out short-term stock price gyrations to invest in the long-term fundamental health of the global economy. The key Farmer proposal may work well in practice as most public funds can then earn an average 4%-7% equity premium per annum.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2023-11-21 11:32:00 Tuesday ET

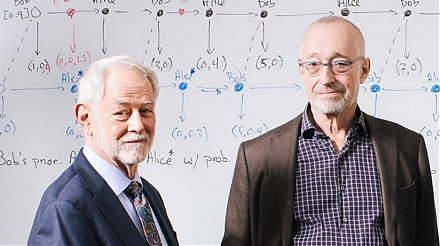

Nobel Laureate Paul Milgrom explains the U.S. incentive auction of wireless spectrum allocation from TV broadcasters to telecoms. Paul Milgrom (2019)

2018-03-21 06:32:00 Wednesday ET

Fed Chair Jerome Powell increases the neutral interest rate to a range of 1.5% to 1.75% in his debut post-FOMC press conference. The Federal Reserve raises

2019-07-30 15:33:00 Tuesday ET

All of the 18 systemically important banks pass the annual Federal Reserve stress tests. Many of the largest lenders announce higher cash payouts to shareho

2023-06-07 10:27:00 Wednesday ET

Anat Admati and Martin Hellwig raise broad critical issues about bank capital regulation and asset market stabilization. Anat Admati and Martin Hellwig (

2017-12-13 06:39:00 Wednesday ET

The Federal Communications Commission (FCC) has decided its majority vote to dismantle rules and regulations of most Internet service providers (ISPs) that

2020-09-10 08:31:00 Thursday ET

Most business organizations should continue to create new value in order to achieve long-run success and sustainable profitability. Todd Zenger (2016)