Meta provides highly-targeted individual advertising and information services to corporations and other institutions. Meta's individual advertising targeting is based on information that they harvest from their users, who provide this information via their regular use of various Meta services that enable people to connect and share with friends and family through mobile devices, personal computers, virtual reality (VR) and mixed reality (MR) headsets, augmented reality (AR), and wearables. Meta services also help people discover and learn about what is going on in the world around them, enable people to share their experiences, ideas, photos, videos, and other content with audiences ranging from their closest family members and friends to the public at large, and stay connected everywhere by accessing their products....

+See MoreSharpe-Lintner-Black CAPM alpha (2.14%) Fama-French (1993) 3-factor alpha (2.92%) Fama-French-Carhart 4-factor alpha (3.72%) Fama-French (2015) 5-factor alpha (4.54%) Fama-French-Carhart 6-factor alpha (5.33%) Dynamic conditional 6-factor alpha (11.14%) Last update: Saturday 7 March 2026

2019-04-17 11:34:00 Wednesday ET

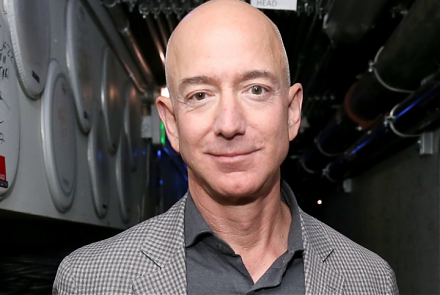

Amazon CEO Jeff Bezos admits the fact that antitrust scrutiny remains a primary imminent threat to his e-commerce business empire. In his annual letter to A

2022-11-30 09:26:00 Wednesday ET

Climate change and ESG woke capitalism In recent times, the Biden administration has signed into law a $375 billion program to better balance the economi

2022-05-05 09:34:00 Thursday ET

Corporate payout management This corporate payout literature review rests on the recent survey article by Farre-Mensa, Michaely, and Schmalz (2014). Out

2019-03-21 12:33:00 Thursday ET

Senator Elizabeth Warren proposes breaking up key tech titans such as Facebook, Apple, Microsoft, Google, and Amazon (FAMGA). These tech titans have become

2019-03-31 11:40:00 Sunday ET

AYA Analytica free finbuzz podcast channel on YouTube March 2019 In this podcast, we discuss several topical issues as of March 2019: (1) Sargent-Wallac

2025-05-21 04:27:10 Wednesday ET

Carol Dweck describes, discusses, and delves into the scientific reasons why the growth mindset often helps motivate individuals, teams, and managers to acc