2025-10-03 10:31:00 Fri ET

stock market technology facebook apple microsoft google amazon artificial intelligence tesla trade competitive advantages blue ocean alphabet personal finance asset management investment finance meta nvidia stock synopsis fundamental analysis taxation disruptive innovations fundamental forces economics politics

As of October 2025, we ask each of the state-of-the-art mainstream Google Gen AI models to complete our comprehensive fundamental analysis of Netflix (U.S. stock symbol: $NFLX) from the top financial economist’s perspective. These mainstream models include Gemini 2.5 Pro, Gemini 2.5 Flash, and Gemini 2.5 Flash Lite. In time, we write, refine, use, adapt, apply, and leverage a new Python program to conduct this comprehensive fundamental analysis of Netflix (U.S. stock symbol: $NFLX). For this purpose, we specify the same prompt for each of the Gen AI mainstream models:

Suppose you are the top-notch financial economist. Can you provide some comprehensive fundamental analysis of Netflix (U.S. stock symbol: $NFLX)? Please use only complete sentences with no hallucinations. Please search the web for the company’s most recent public announcements, key developments, new capital investments, new strategic initiatives, annual sales, gross margins, operating profit margins, net profit margins, and debt-to-equity ratios as part of this analysis. Please ensure this analysis to be between 4,500 words and 8,500 words.

We apply our rare unique lean-startup growth mindset with iterative continuous improvements to this comprehensive stock-specific fundamental analysis. With the Python program, we take the Gen AI long-form output as our minimum viable product (MVP). At this stage, we manually curate, edit, refine, adapt, and improve the long-form response. With this manual human content curation, we remake, reshape, and reinforce the final version to be our comprehensive stock-specific fundamental analysis. From the top-notch financial economist’s perspective, this manual human content curation adds our rare unique insights, worldviews, expert views, opinions, judgments, and even personal experiences to this comprehensive stock-specific fundamental analysis in due course.

On our AYA fintech network platform, we post, polish, and publish this new comprehensive fundamental analysis for social media circulation with the unique stock cashtag, the company description, the AYA-exclusive proprietary stock market alpha estimates, and several hyperlinks to the relevant stock pages, key financial statistics, financial statements, and external financial news articles etc.

With U.S. fintech patent approval, accreditation, and protection for 20 years, our AYA fintech network platform provides proprietary alpha stock signals and personal finance tools for stock market investors worldwide.

We build, design, and delve into our new and non-obvious proprietary algorithmic system for smart asset return prediction and fintech network platform automation. Unlike our fintech rivals and competitors who chose to keep their proprietary algorithms in a black box, we open the black box by providing the free and complete disclosure of our U.S. fintech patent publication. In this rare unique fashion, we help stock market investors ferret out informative alpha stock signals in order to enrich their own stock market investment portfolios. With no need to crunch data over an extensive period of time, our freemium members pick and choose their own alpha stock signals for profitable investment opportunities in the U.S. stock market.

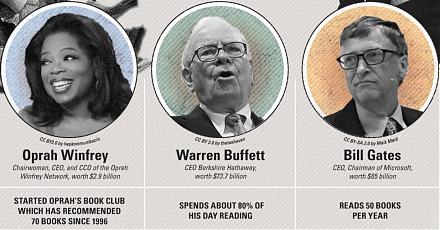

Smart investors can consult our proprietary alpha stock signals to ferret out rare opportunities for transient stock market undervaluation. Our analytic reports help many stock market investors better understand global macro trends in trade, finance, technology, and so forth. Most investors can combine our proprietary alpha stock signals with broader and deeper macro financial knowledge to win in the stock market.

Through our proprietary alpha stock signals and personal finance tools, we can help stock market investors achieve their near-term and longer-term financial goals. High-quality stock market investment decisions can help investors attain the near-term goals of buying a smartphone, a car, a house, good health care, and many more. Also, these high-quality stock market investment decisions can further help investors attain the longer-term goals of saving for travel, passive income, retirement, self-employment, and college education for children. Our AYA fintech network platform empowers stock market investors through better social integration, education, and technology.

Netflix ($NFLX) company description:

Today, Netflix serves as a new pioneer in the online video-streaming space. The company evolved from a small DVD-rental provider to a dominant video-streaming service provider due to its broad original content portfolio, global footprint, and vast user selection worldwide. In recent years, Netflix has been spending aggressively on building out its original show portfolio. This portfolio helps Netflix sustain its dominant global market position despite the recent launch of new cloud services such as Disney+, Apple TV, Amazon Prime Video. Netflix streams movies, drama series, television shows, and documentaries across a wide variety of genres and languages. Both American and international subscribers can watch these movies, films, and animations on several Internet-connective mobile devices such as television sets, personal computers, smartphones, tablets, and other mobile devices. In America, Netflix continues to deliver domestic DVDs via the U.S. Postal Service from distribution centers in the major U.S. cities, regions, and metropolitan areas.

Here we provide our AYA proprietary alpha stock signals for all premium members on our AYA fintech network platform. Specifically, a high Fama-French multi-factor dynamic conditional alpha suggests that the stock is likely to consistently outperform the broader stock market benchmarks such as S&P 500, Dow Jones, Nasdaq, Russell 3000, MSCI USA, and MSCI World etc. Since March 2023, our proprietary alpha stock signals retain U.S. Patent and Trademark Office (USPTO) fintech patent protection, approval, and accreditation for 20 years. Our homepage and blog articles provide more details on this proprietary alpha stock market investment model with robust long-term historical backtest evidence.

Sharpe-Lintner-Black CAPM alpha: 3.27%

Fama-French (1993) 3-factor alpha: 4.06%

Fama-French-Carhart 4-factor alpha: 4.87%

Fama-French (2015) 5-factor alpha: 5.90%

Fama-French-Carhart 6-factor alpha: 6.70%

Dynamic conditional 6-factor alpha: 11.49% (as of October 2025)

As of October 2025, we have updated all of the cloud databases available on our AYA fintech network platform. The latest update spans our proprietary alpha stock signals, stock pages, descriptions, keywords, news feeds, key financial ratios, and financial statements. At both annual and quarterly frequencies, these up-to-date financial statements include the balance sheets, cash flow statements, and income statements for almost 6,000+ U.S. stocks, ADRs, and equity market funds on NYSE, NASDAQ, and AMEX. With U.S. patent accreditation and protection for 20 years, our AYA fintech network platform provides proprietary alpha stock signals and personal finance tools for stock market investors, traders, fund managers, and many more. We continue to publish new analytic reports, ebooks, essays, research articles, business book summaries, and blog posts. Through this continual content curation, we delve into topical issues in global macro finance, trade, both fiscal and monetary stimulus, financial stability, and technological advancement around the world. We can help empower stock market investors through technology, education, and social integration.

We apply an eclectic style in our written work. In economics, we integrate new classical monetarism, new Keynesianism, and supply-side structural reforms into our analysis. In politics, we combine realism, liberalism, and constructivism into our analysis. Each school of thought provides different but complementary insights, viewpoints, and perspectives. This eclectic style empowers stock market investors worldwide to mull over multiple fundamental forces, economic factors, and political considerations in light of global peace and prosperity. Our written work includes regular analytic reports, ebooks, essays, book reviews, research surveys, and many other long-form blog articles. With these efforts, we attempt to establish our own industry authority in global macro asset management.

What is our asset management strategy?

https://ayafintech.network/blog/ayafintech-network-platform-update-notification/

What are our most recent blog posts, podcasts, ebooks, research articles, analytic reports, and other online resources?

What are our primary product features and social media services?

https://ayafintech.network/blog/ayafintech-network-platform-seo-transformation-notification/

Our proprietary alpha stock investment model outperforms the mainstream stock market indexes such as S&P 500, Dow Jones, Nasdaq, NYSE, MSCI USA, and MSCI World etc in recent years.

Netflix ($NFLX) stock page with proprietary alpha estimates:

https://ayafintech.network/stock/NFLX/

Netflix ($NFLX) stock page with financial statistics:

https://ayafintech.network/stock-ratio/NFLX/

Netflix ($NFLX) stock page with financial statements:

https://ayafintech.network/stock-statement/NFLX/

Netflix ($NFLX) financial news from Yahoo Finance:

https://finance.yahoo.com/quote/NFLX/news/?p=NFLX

Netflix ($NFLX) financial news from Google Finance:

https://www.google.com/search?q=NASDAQ:NFLX&tbm=nws

Netflix ($NFLX) financial news from MarketBeat:

https://www.marketbeat.com/stocks/NASDAQ/NFLX/news/

Netflix ($NFLX) financial news from Barchart:

https://www.barchart.com/stocks/quotes/NFLX/news

Netflix Inc (U.S. stock symbol: $NFLX) stands as a monumental force in the global entertainment sector, having profoundly reshaped content consumption worldwide. From its inception as a DVD-by-mail service to its current form as a diversified streaming titan, Netflix has consistently exhibited an adaptive and often disruptive business model. In the dynamic and intensely competitive realm of digital entertainment, a comprehensive fundamental analysis of Netflix necessitates an in-depth exploration of its financial performance, strategic maneuvers, capital allocation decisions, and market positioning. As of late 2025, the company continues to operate within a multifaceted environment characterized by fierce competition from both established media conglomerates and burgeoning digital platforms, alongside evolving consumer preferences and macroeconomic shifts. This analysis, conducted from the vantage point of a top-tier financial economist, will meticulously examine Netflix's most recent public announcements, key developments, new capital investments, strategic initiatives, and critical financial metrics, including annual sales, gross margins, operating profit margins, net profit margins, and debt-to-equity ratios. The overarching objective is to provide an expansive and insightful evaluation of Netflix’s current health, future prospects, and intrinsic value, adhering rigorously to a factual basis and robust economic principles.

In recent years, Netflix’s strategic trajectory has been particularly impressive, due to significant shifts away from its initial hyper-growth subscriber acquisition model toward a more delicate balance in support of diverse sales streams, profits, and shareholder returns. New challenges such as market saturation in developed economies, higher content costs, and a sectoral focus on profitability combine to compel Netflix to innovate vigorously. Its strategic responses, including the successful introduction of an ad-supported streaming tier, a global crackdown on account sharing, and a calculated diversification into gaming and live events, represent a pivotal evolution designed to sustain its competitive edge and unlock new avenues for growth in an increasingly maturing industry. These initiatives are not merely tactical adjustments but fundamental re-calibrations of its long-term strategy, reflecting a sophisticated understanding of both prevailing market dynamics and its own unique operational leverage.

This extensive report aims to dissect these intricate layers, providing a granular view of Netflix’s financial architecture and strategic foresight. By synthesizing a wealth of publicly available data, including the most recent earnings reports and investor disclosures, this analysis will illuminate the complex forces shaping Netflix’s present valuation and its potential future trajectory. Particular attention will be devoted to quantitative metrics, which will be presented with detailed context and analyzed for their implications on the company's operational efficiency, financial stability, and capacity for sustainable growth.

Netflix's recent public announcements and key developments vividly underscore a company actively adapting to a more mature and intricate streaming ecosystem. The period spanning from late 2024 through the second quarter of 2025 has been remarkably eventful, reflecting a concerted and strategic effort by management to optimize its business model for enhanced profitability and sustained long-term growth.

One of the most significant announcements pertains to Netflix’s robust financial performance in early to mid-2025. For the first quarter of 2025, Netflix reported impressive revenues of $10.54 billion, marking a substantial 12.5% increase year-over-year and comfortably surpassing analyst expectations. The net profit for Q1 2025 further demonstrated this strength, rising to $2.89 billion, or $6.61 per share, which significantly exceeded market forecasts. This strong financial momentum carried into the second quarter of 2025, with reported revenue reaching $11.08 billion, once again outperforming Wall Street expectations. The diluted earnings per share (EPS) for Q2 2025 landed at $7.19, aligning precisely with internal expectations and surpassing analyst estimates. These consistently strong results indicate a robust financial trajectory, strongly suggesting that the company’s recent strategic adjustments are yielding tangible and positive outcomes. Management’s initial guidance for Q2 2025 had projected revenue of $11.04 billion and an EPS of $7.03, both of which were either met or exceeded. Furthermore, the company reported an operating income of $3.34 billion and an operating margin of 31.7% in Q1 2025, with a forecast of an operating margin of 33.3% for Q2 2025, underscoring its commitment to profitability. This pattern of consistent outperformance against its own guidance serves as a compelling signal of effective operational management and a favorable market response to its sophisticated strategic pivots.

A pivotal development highlighted in recent announcements is the company’s evolving reporting strategy. Commencing in 2025, Netflix has deliberately ceased reporting quarterly subscriber numbers, opting instead to emphasize crucial financial and engagement metrics. This strategic shift is a direct response to the increasing complexities introduced by its burgeoning ad-supported tiers and the widespread global crackdown on account sharing, both of which render traditional subscriber counts less representative of the company’s true monetization potential and its overall market penetration. While this move might be perceived by some analysts as a reduction in transparency, Netflix articulates that it provides a more accurate and comprehensive picture of its business health, reflecting a heightened focus on revenue generation per user and overall profitability rather than merely top-line subscriber growth. As of the end of 2024, Netflix reported a substantial 302 million global memberships, indicating a robust 16% year-over-year increase and adding over 41 million new subscribers throughout 2024, which firmly underpins the strength and extensiveness of its underlying user base.

The highly anticipated crackdown on account sharing globally has been a key strategic initiative, and its positive impact is now being significantly realized. While initially met with some apprehension and potential user friction, this strategy has proven notably effective in converting former "borrowers" into legitimate paying subscribers, thus contributing materially to the healthy membership growth observed in late 2024 and early 2025. This initiative, when strategically coupled with judicious price increases for its standard and premium subscriptions across key markets such as North America and Europe in early 2025, has been instrumental in driving substantial revenue growth. These price adjustments, typically ranging from 5-7% depending on the specific region, represent a strategic lever designed to enhance average revenue per user (ARPU) and expand operating margins, although they inherently carry the risk of increased subscriber churn. However, management has confidently indicated that churn rates have remained effectively in check, a success bolstered by a stronger and more diverse content lineup and continuous product improvements.

Beyond its core streaming operations, Netflix has also made significant public announcements regarding its concerted diversification efforts. The company has significantly ramped up its content spending, committing approximately $18 billion for content in 2025, which marks a substantial 11% increase from the $16.2 billion spent in 2024. Notably, Chief Financial Officer Spencer Neumann has emphatically stated that this $18 billion figure is "not a ceiling," signaling a continued and aggressive investment posture in content to maintain its unparalleled competitive edge and drive sustained engagement across its platform. This extensive investment spans a wide and diverse array of content categories, including big-budget blockbusters, highly anticipated live sports, insightful documentaries, popular K-dramas, and engaging anime, all meticulously tailored to appeal to its vast and varied global audience. The remarkable success of major live events, such as the widely publicized Jake Paul vs. Mike Tyson fight and the streaming of NFL games, indicates a robust and strategic push into live content, which has traditionally served as a strong differentiator for linear television and other competing streaming services.

Furthermore, Netflix continues to proactively evolve its presence in the burgeoning gaming sector. In March 2025, the company unveiled a new and refined "four pillar" games strategy, strategically refocusing its development and publishing efforts on narrative games, multiplayer party games, games specifically designed for kids, and "mainstream" releases, which encompass licensed tie-ins and original titles with broad appeal. This refined strategic pivot came after a period of re-evaluation, which notably included the cancellation of plans for several larger, more ambitious games and the closure of a dedicated AAA game studio in late 2024. Despite these significant adjustments, Netflix co-CEO Greg Peters indicated during the Q2 2025 earnings calls that the company plans to "ramp up" its investment in gaming, emphasizing a disciplined and measured approach aimed primarily at translating this investment into demonstrable value for its members, rather than an immediate focus on direct monetization. However, future monetization models are not ruled out as the gaming segment achieves greater scale and market penetration. The long-term vision for this segment notably includes the development of cloud-streaming capabilities for games and the highly anticipated opening of physical "Netflix House" locations by late 2025, signaling a broader and more ambitious push into interactive and immersive entertainment experiences that extend beyond traditional video content.

Collectively, these meticulously planned announcements and pivotal developments paint a vivid picture of a company aggressively pursuing both sustainable growth and enhanced profitability through multiple, interconnected avenues. The strong financial performance observed in early 2025 strongly suggests that the strategic pivots centered around monetization innovation and content diversification are gaining significant traction, thereby allowing Netflix to not only maintain but also solidify its leadership position in a fiercely competitive and rapidly evolving market. The sustained emphasis on delivering high-quality, diverse content, combined with strategically innovative monetization strategies, effectively positions Netflix for continued resilience, robust expansion, and long-term value creation.

Netflix’s strategic direction for 2025 and beyond is fundamentally shaped by substantial capital investments and a series of interconnected initiatives meticulously designed to enhance subscriber value, diversify revenue streams, and fortify its competitive moats. These strategic thrusts represent a sophisticated and proactive adaptation to the evolving demands of the global entertainment market, signaling a clear shift beyond a singular focus on subscriber growth to embrace a more holistic approach encompassing engagement, effective monetization, and extensive ecosystem expansion.

A. Content Investment: The Core Differentiator and Sustained Competitive Advantage

At the very heart of Netflix’s capital allocation strategy remains its unwavering and profound commitment to content investment. For 2025, Netflix has committed approximately $18 billion in cash content spending, which represents a substantial 11% increase from the $16.2 billion spent in 2024. This monumental investment is not merely an increase in absolute spending but rather a highly strategic deployment of capital aimed at profoundly deepening its already expansive content library across an even wider array of genres, languages, and formats. Chief Financial Officer Spencer Neumann has emphatically underscored this commitment, stating unequivocally that the $18 billion figure is "not anywhere near a ceiling," thereby indicating that Netflix views superior content as a perpetual and escalating investment critically necessary to both attract and effectively retain its vast and diverse global audience.

This comprehensive content strategy is inherently multi-faceted and meticulously engineered. Firstly, there is a continued and pronounced emphasis on premium blockbusters and high-quality original series and films. This involves the aggressive production of big-budget action films, epic sci-fi sagas, and strategic collaborations with highly sought-after A-list talent, directly positioning Netflix to compete head-to-head with traditional Hollywood studios and other streaming giants such as Warner Bros. Discovery and Disney. The underlying rationale for this approach is unequivocally clear: tentpole productions are immensely powerful drivers of significant subscriber acquisition and enhanced engagement, generating widespread cultural buzz and providing compelling justification for ongoing subscription costs. Furthermore, successful original content inherently furnishes Netflix with invaluable intellectual property (IP) that can be strategically leveraged across a multitude of other verticals, including burgeoning segments like gaming and merchandise.

Secondly, Netflix is strategically doubling down on localized content and aggressive global expansion, with a particular focus on high-growth regions such as Asia-Pacific and Europe. The undeniable success of non-English language productions, exemplified by critically acclaimed series like Japan’s “Tokyo Ghoul” and India’s “Delhi Crime” transforming into bona fide global phenomena, powerfully illustrates the efficacy of this strategy. By proactively empowering local creators and investing substantially in culturally relevant programming across more than 50 countries, Netflix aims to profoundly deepen its market penetration in highly diverse international markets, cater precisely to nuanced regional tastes, and foster a strong sense of local ownership and affinity for its platform. This astute approach not only significantly strengthens Netflix’s competitive edge against both local and international rivals but also perfectly aligns with its overarching vision of establishing itself as a "global stage" for diverse and compelling storytelling.

Thirdly, a noteworthy new capital investment area is the strategic expansion into live content, particularly live sports and high-profile entertainment events. Historically, live sports programming has served as a resilient bulwark of traditional linear television, frequently cited as a primary reason for consumers to maintain their cable subscriptions. Netflix's deliberate entry into this highly coveted arena, vividly highlighted by successful ventures such as the streaming of the Jake Paul vs. Mike Tyson boxing match and key NFL games on Christmas Day, signifies a critical and transformative strategic shift. These particular events have reportedly become some of the most-streamed sporting events ever, unequivocally demonstrating Netflix's burgeoning capacity to attract and engage massive live audiences. The strategic implication of this move is profound: live content, with its inherent urgency, immediacy, and often shared communal viewing experience, possesses the unparalleled potential to drive significantly increased engagement, substantially reduce subscriber churn, and attract new and valuable demographics, particularly within sports-hungry markets. While the company is admittedly just beginning to build out its nascent live offering in the U.S., the projected long-term runway for this promising segment is unequivocally considerable. This initiative, by its very nature, necessitates substantial upfront investment in acquiring lucrative broadcasting rights and developing robust technical infrastructure, but the potential returns in terms of enhanced subscriber value and burgeoning advertising revenue are undeniably compelling.

B. Diverse Sales Streams with Online Advertisement and Better Pricing Power

Netflix’s strategic initiatives focused on diversifying its revenue streams are paramount to its long-term financial health and sustainability, representing a critical evolution beyond a sole and exclusive reliance on traditional subscription fees.

The ad-supported subscription tier, which was strategically introduced in late 2022, has rapidly and remarkably emerged as a cornerstone of Netflix’s comprehensive 2025 strategy. By mid-2025, this highly effective tier had successfully attracted over 15 million new subscribers globally, significantly exceeding initial internal projections and accounting for more than 50% of all new subscriber growth in the specific markets where it is actively available. The economically priced $7.99 plan in the U.S. and Canada has proven particularly resilient and attractive during periods of economic downturns, as consumers actively seek more affordable yet high-quality entertainment options. The undeniable success and accelerating momentum of the ad-supported tier are driving substantial new revenue growth, with advertising revenue itself projected to more than double in 2025. This impressive acceleration is further significantly bolstered by the strategic rollout of Netflix’s proprietary advertising technology platform, which robustly enables highly advanced targeting capabilities, efficient programmatic buying, and significantly improved measurement metrics for advertisers. This cutting-edge advertising platform, having been initially successfully launched in the U.S., is strategically slated for extensive expansion to ten additional key international markets by the close of 2025, signaling a strong and determined global push. From a shrewd financial economist's perspective, this groundbreaking initiative provides a crucial new and highly effective monetization lever, fundamentally reducing Netflix's historical reliance on continuous and potentially churn-inducing subscription price hikes and cultivating a more robust, diversified revenue base that possesses the inherent flexibility to scale effectively with both growing subscriber numbers and increasing advertising demand. It strategically allows Netflix to cater effectively to a broader demographic, including traditionally price-sensitive consumers, while simultaneously capturing a significant and growing share of the massive global digital advertising market.

Complementing the success of the ad-supported tier are strategic and well-calibrated price increases for existing standard and premium subscription plans. In early 2025, Netflix proactively implemented price adjustments, typically in the range of approximately 5-7%, across key markets, including North America and Europe. These judicious price hikes are a direct and necessary response to the continuously rising content production costs and broader inflationary pressures impacting the entire industry. While such bold moves inherently carry the calculated risk of increased subscriber churn, Netflix has demonstrated a remarkable ability to manage this risk meticulously, leveraging its strong and continuously refreshed content slate and strategic product enhancements, such as a redesigned and more intuitive TV homepage, to effectively maintain high levels of subscriber loyalty and engagement. The proven ability to successfully implement these price increases while simultaneously controlling and minimizing churn rates powerfully highlights Netflix’s robust perceived value proposition and its strong, enduring brand equity. This dual strategy of offering both premium and value-oriented (ad-supported) tiers strategically enables Netflix to optimally maximize its revenue across disparate consumer segments with varying price sensitivities.

Another highly significant initiative driving both growth and substantial potential impact on overall revenue is the ongoing global crackdown on account sharing. This strategic implementation, which commenced its full rollout in 2024, has proven remarkably effective in converting numerous "borrowing" households into legitimate paying subscribers or prompting them to strategically opt for the lower-cost ad-supported tier. This bold move, while predictably unpopular with a segment of users, has undeniably contributed significantly to net membership growth and measurably increased the effective monetization of Netflix’s vast user base. It powerfully demonstrates Netflix’s unwavering commitment to comprehensively capturing the full economic value inherent in its premium content and extensive services.

C. Long-Term Strategic Bets on Video Games and Interactive Experiences

Netflix's deliberate and calculated push into gaming represents a strategic long-term bet on extensively diversifying its entertainment ecosystem and profoundly enhancing subscriber engagement beyond the confines of traditional linear video viewing. While its initial broad foray into gaming in 2021 was expansive, the company has since proactively and judiciously refined its strategy. In March 2025, Netflix announced a new and more focused "four pillar" approach to its burgeoning games business: a strategic emphasis on narrative games, engaging multiplayer party games, games specifically tailored for children, and widely appealing "mainstream" releases, which include licensed tie-ins and original titles with broad market appeal. This strategic pivot notably involved a deliberate scaling back from overly ambitious AAA and hardcore indie game development, and even saw the strategic cancellation of plans for several major titles and the closure of a dedicated AAA game studio in late 2024. This "disciplined" approach, as eloquently articulated by Co-CEO Greg Peters, aims to significantly maximize investment efficiency by focusing intently on game types that are best aligned with the existing Netflix subscriber base and offer unique, differentiated value, rather than directly attempting to compete with established gaming behemoths on their own terms.

Despite this meticulous strategic refocusing, Netflix plans to "ramp up" its investment in the gaming sector. The primary motivation behind this renewed push is to significantly increase active user engagement, meticulously create synergistic cross-media content loops, and ultimately reduce subscriber churn, rather than prioritizing immediate, direct revenue generation from the games themselves. Successful examples that validate this strategy include the highly engaging "Squid Game: Unleashed" and the popular "GTA's Netflix ports". While the vast majority of games are currently offered free of in-app purchases, Netflix has indicated it is "open" to strategically evolving its monetization model for games as this segment achieves greater scale and market penetration. The ambitious long-term vision for this segment notably includes developing advanced cloud-streaming capabilities for games and the planned launch of physical "Netflix House" locations by late 2025, signaling a broader and more immersive push into interactive and live entertainment experiences that extend far beyond traditional video content. The gaming initiative, therefore, is strategically positioned less for immediate revenue generation and more for profoundly enhancing the overall value proposition of a Netflix subscription, thereby significantly increasing subscriber retention and attracting new user segments in an increasingly crowded and competitive entertainment market. The total addressable market for gaming is considered "very, very large," suggesting significant potential upside in terms of long-term growth and revenue for Netflix in this expanding sector.

D. Technology and Product Innovation as New Foundations of Success

Beyond its compelling content and new business models, Netflix continues to make substantial and continuous investments in technology and product innovation. The strategic development and successful rollout of its proprietary ad tech stack serve as a prime illustration of this commitment, significantly enhancing its capabilities in a critical new revenue area. Furthermore, ongoing and systematic investments in its global streaming infrastructure, sophisticated data analytics capabilities, and continuously refined recommendation algorithms are absolutely critical to consistently improving the overall user experience, proactively driving heightened engagement, and effectively reducing subscriber churn. These continuous, albeit often less publicly celebrated, improvements represent vital capital investments that unequivocally reinforce Netflix’s technological leadership and diligently maintain its competitive advantage within a highly digital, fast-evolving entertainment space.

In summary, Netflix’s new capital investments and overarching strategic initiatives are meticulously designed to forge a more resilient and extensively diversified business entity. The substantial content budget steadfastly ensures a robust and continually refreshed offering, while the innovative ad-supported tier and judicious pricing strategies proactively unlock novel revenue streams and meticulously optimize monetization across various consumer segments. The carefully calculated expansion into nascent verticals such as gaming and live events aims to profoundly deepen subscriber engagement and strategically broaden the overarching entertainment ecosystem. Taken together, these comprehensive strategies are intended to secure Netflix’s long-term dominance by fostering sustainable and accelerated revenue growth, significant margin expansion, and enhanced shareholder value in an intensely competitive and rapidly evolving global market.

To comprehensively assess Netflix's financial health and operational efficiency, a detailed examination of its annual sales, profitability margins, and capital structure through the debt-to-equity ratio is absolutely essential. The period under review, particularly from 2022 through the second quarter of 2025, vividly showcases Netflix's strategic pivot from a prior pure growth-at-all-costs model to one that emphatically emphasizes profitable expansion and strategically diversified revenue streams.

A. Recent Sales Growth Trajectory and Strategic Diversification

Netflix has consistently demonstrated robust revenue generation, a powerful testament to its extensive global reach and its evolving, sophisticated monetization strategies. A meticulous analysis of the annual sales figures provides critical insights into the company's market penetration and its proven ability to consistently grow its top line.

2022 Annual Revenue: Netflix reported annual revenue of $31.616 billion in 2022, reflecting a 6.46% increase from the preceding year of 2021. This specific period notably marked a discernible moderation in the hyper-growth rates that had been observed during the earlier pandemic-driven surge, as the global streaming market began its inevitable maturation process and competitive pressures intensified across the industry.

2023 Annual Revenue: The company’s annual revenue for 2023 subsequently reached $33.723 billion, indicating a 6.67% increase from 2022. While these growth rates remained healthy and respectable, they clearly highlighted the pressing need for Netflix to develop and implement new and innovative revenue levers beyond merely relying on pure subscriber additions, particularly in already saturated and mature markets.

2024 Annual Revenue: A significant and impressive acceleration in revenue growth was unequivocally observed in 2024, with annual revenue climbing robustly to $39.001 billion, representing a substantial 15.65% increase from 2023. This impressive surge in revenue can be directly attributed to the highly successful and strategic implementation of new initiatives, primarily the widespread crackdown on account sharing and the initial, strong traction of the ad-supported tier, alongside carefully calculated strategic price adjustments across various markets. Streaming revenues alone constituted a staggering $39.0 billion of this total, driven by a 15% increase in average paying memberships to 277.7 million and a 1% rise in average monthly revenue per paying membership to $11.70. Netflix concluded 2024 with an impressive 302 million global memberships, showcasing a substantial 41.4 million net additions for the year, which powerfully underpins the effectiveness of its growth strategies. The regional breakdown for 2024 further illustrated strong performance across key geographical segments, with UCAN (United States and Canada) revenue increasing by 17% to $17.4 billion and EMEA (Europe, Middle East, and Africa) revenue growing by 17% to $12.4 billion.

2025 Quarterly Performance and Outlook:

Q1 2025 Revenue: Netflix reported an exceptionally strong $10.54 billion in revenue for the first quarter of 2025, comfortably exceeding analyst estimates and demonstrating a robust 12.5% year-over-year increase.

Q2 2025 Revenue: The positive momentum unequivocally continued into the second quarter of 2025, with revenue reaching an impressive $11.08 billion, once again surpassing analyst expectations of $11.05 billion and marking a strong 15.90% year-over-year growth from Q2 2024's $9.56 billion.

Trailing Twelve Months (TTM) Revenue: As of June 30, 2025, Netflix’s TTM revenue stood at $41.693 billion, representing a solid 14.84% increase year-over-year. This figure further experienced a slight increase to $41.69 billion USD as of September 2025 (TTM).

Full-Year 2025 Outlook: Reflecting the ongoing strong business momentum, management has confidently lifted its full-year 2025 revenue outlook, now expecting a range between $44.8 billion and $45.2 billion. Earlier forecasts from January 2025 had initially projected 2025 revenue between $43.5 billion and $44.5 billion, which itself represented an upward revision of $500 million from previous guidance. This pattern of continuous upward revisions powerfully reflects solid business momentum and the favorable impact derived from its increasingly effective strategic initiatives, particularly the strategic price changes and the sustained growth in burgeoning advertising revenue.

From an economic perspective, this compelling sales growth trajectory highlights Netflix’s successful strategic transition. The discernible slowdown in revenue growth observed in 2022-2023 proactively prompted judicious strategic adjustments, which have evidently revitalized the company's top line performance. The significant acceleration in 2024 and the consistently strong performance demonstrated in 2025 unequivocally indicate that the company has effectively navigated the challenges of market saturation and intensified competition by intelligently leveraging its pricing power, creatively implementing innovative subscription models, and successfully converting previously non-paying users into revenue-generating customers. The strategic diversification of revenue streams, particularly the growing contribution from advertising, is adding a crucial layer of stability and a powerful new growth vector, thereby rendering the company less susceptible to the inherent ceiling of subscriber growth in its most established and mature markets.

B. Gross Margins for Content Cost Management and Operational Efficiency

Gross margin serves as a critical indicator of Netflix's inherent efficiency in managing its formidable content costs in direct relation to its revenue generation. Fluctuations observed in this crucial metric often provide insightful reflections of the dynamic interplay between content acquisition, meticulous production, and systematic amortization schedules.

2022 Average Gross Margin: Netflix’s average gross margin for the fiscal year 2022 was reported at 40.31%, experiencing a 4.16% decline from the previous year of 2021. This slight dip could logically be attributed to increased content spending and associated amortization schedules without a proportionally equivalent increase in revenue during that specific period.

2023 Average Gross Margin: A modest yet noticeable recovery was subsequently observed in 2023, with the average gross margin incrementally increasing to 39.53%, representing a 1.94% increase from 2022. This marginal but positive improvement suggests the initial and nascent efforts by the company to optimize its complex content costs or to begin realizing the incipient benefits derived from earlier implemented revenue-enhancing strategies.

2024 Average Gross Margin: Netflix impressively demonstrated a substantial and commendable improvement in its gross margin during 2024, with the average figure rising significantly to 44.55%, representing a remarkable 12.7% increase from 2023. The annual gross profit margin for the entirety of 2024 was recorded at a strong 46.1%. This robust expansion unequivocally indicates enhanced efficiency in the monetization of its extensive content library and potentially a more favorable mix of content costs relative to its accelerating revenue. It strongly suggests that strategic initiatives such as the ad-supported tier and the comprehensive password sharing crackdown are meaningfully contributing to positive revenue growth without a commensurate or disproportionate increase in the cost of goods sold (which primarily constitutes content amortization expenses).

Q2 2025 Gross Margin: The discernible positive trend resolutely continued into 2025, with the gross margin for the quarter ending June 30, 2025, reaching an impressive 48.49%. Other credible sources additionally indicate an even higher gross margin of 51.93% as of June 2025 for the latest twelve months period. This remarkable and sustained increase powerfully highlights a continuous improvement in the company's proven ability to generate revenue more efficiently and effectively from its continuously expanding content library. The latest twelve months gross profit margin is robustly reported at 48.5%.

From the top financial economist’s standpoint, the consistent and accelerating improvement in gross margins, particularly evident from 2024 and extending robustly into Q2 2025, represents a profoundly strong and positive signal. It unequivocally suggests that Netflix is systematically gaining better leverage and greater economic efficiency from its massive and ongoing content investments. This positive trend could be attributed to a confluence of factors, including more streamlined and efficient content production processes, judiciously renegotiated content licensing deals, or the increasingly significant contribution of higher-margin revenue streams, most notably the burgeoning advertising business. A consistently rising gross margin inherently provides greater financial flexibility for the company to comfortably cover its operating expenses and ultimately translates directly into enhanced overall profitability. The noteworthy and substantial increase observed from 2023 to 2024 and continuing into 2025 strongly suggests that the powerful scaling effects of its expansive global platform, meticulously coupled with its strategic and innovative monetization efforts, are becoming progressively and powerfully more effective.

C. Operating Profit Margins for Operational Leverage and Strategic Execution

Operating profit margin robustly reflects a company's profitability derived from its core operational activities after meticulously accounting for both the cost of goods sold and all associated operating expenses (which include critical categories such as marketing, technology development, and general and administrative costs). It serves as an absolutely key indicator of management’s effectiveness in controlling intrinsic costs and successfully generating profit directly from its sales revenue.

2022 Average Operating Margin: Netflix’s average operating margin for the fiscal year 2022 was reported at 18.88%, marking a 13.04% decline from the previous year, 2021. This specific period proved challenging for the company, largely characterized by a discernible slowdown in subscriber growth and intensified competition, factors which likely exerted pressure on both top-line revenue growth and simultaneously necessitated higher operating expenditures aimed at retaining existing users and actively attracting new ones. The operating margin notably hit a 5-year low of 17.8% in December 2022, underscoring the operational pressures of that time.

2023 Average Operating Margin: A modest yet welcome improvement was subsequently observed in 2023, with the average operating margin incrementally rising to 18.33%, representing a 2.91% increase from 2022. This indicates an initial and encouraging stabilization of operational efficiency following the prior year's challenges.

2024 Average Operating Margin: Netflix demonstrably achieved a significant and impressive expansion in its average operating margin in 2024, reaching a robust 24.68%, which signifies a substantial 34.64% increase from 2023. The full-year 2024 operating margin impressively expanded by 6 percentage points to reach 27%, with operating income surging a remarkable 50% year-over-year to $10.4 billion, notably exceeding the $10 billion mark for the very first time in the company's history. Some reports additionally indicate that the operating margin was a strong 25.55% at the close of 2024. This consistently robust performance powerfully highlights the unequivocal effectiveness of Netflix's cost management strategies and the undeniably positive impact derived from its new and diversifying revenue streams.

2025 Quarterly Performance and Outlook:

Q1 2025 Operating Margin: The company's operating margin rose impressively to approximately 32% in the first quarter of 2025, a significant increase from about 27% in the corresponding year-ago period. The reported operating income for this quarter was $3.34 billion, achieving an operating margin of 31.7%.

Q2 2025 Operating Margin: The operating margin for the quarter ending June 30, 2025, was reported at a solid 29.51%. Netflix had initially forecast an operating income of $3.67 billion and a highly ambitious operating margin of 33.3% for Q2 2025, which would have compared favorably to 27.2% in Q2 2024. Management guidance has also indicated that the operating margin in the second half of 2025 is expected to be somewhat lower than the first half, a strategic decision attributed to higher anticipated content amortization and increased sales and marketing costs associated with a significantly larger second-half content slate.

Trailing Twelve Months (TTM) Operating Margin: As of September 2025, the TTM operating margin was recorded at 25.55%. The latest twelve months operating income margin is a strong 29.5%.

Full-Year 2025 Outlook: Reflecting its ongoing confidence, Netflix management has proactively lifted its full-year operating margin outlook for 2025, now expecting it to be approximately 30% on a reported basis, which is a commendable increase from 27% achieved in 2024. Earlier guidance had specifically targeted a 29% operating margin for 2025.

The observable and consistent upward trend in operating margins is particularly indicative of Netflix's burgeoning operational leverage and the efficacy of its strategic execution. The significant expansion achieved in 2024 and the projected healthy margins for 2025 powerfully demonstrate that the company is effectively translating its increased revenue into substantially higher operational profits. The successful launch and adoption of the ad-supported tier and the comprehensive account sharing crackdown are clearly contributing to this positive trend by boosting average revenue per user (ARPU) and total membership numbers without a directly proportional or excessive increase in core operating expenses. The slight and temporary dip in the Q2 2025 reported margin compared to Q1 2025, and the expectation of somewhat lower margins in the second half of 2025, can be logically attributed to the planned and strategic increase in content amortization and targeted marketing spend designed to support a stronger and more impactful content slate. This represents a prudent and strategic decision to invest for future growth, anticipating that these substantial content investments will drive further subscriber engagement, increased retention, and robust revenue generation in subsequent reporting periods.

D. Net Profit Margins: Shareholder Value Creation and Ultimate Profitability

Net profit margin serves as the ultimate metric, meticulously measuring the percentage of revenue that remains after all expenses, including critical items such as taxes and interest payments, have been comprehensively deducted. It is the definitive indicator of a company's overall profitability and its inherent ability to successfully generate long-term value for its discerning shareholders.

2022 Average Net Profit Margin: Netflix's average net profit margin for the fiscal year 2022 was reported at 15.78%, representing a 2.95% decline from 2021. This decline regrettably mirrored the broader pressures experienced across gross and operating margins during what proved to be a challenging operational period for the company.

2023 Average Net Profit Margin: The company subsequently experienced an encouraging increase in 2023, with the average net profit margin rising to 14.06%, demonstrating a 10.9% increase from 2022. This period notably marked the discernible beginning of a strong recovery in its overall profitability.

2024 Average Net Profit Margin: Netflix achieved a truly substantial and impressive increase in its average net profit margin in 2024, reaching a robust 20.25%, which represents a remarkable 44.03% increase from 2023. The full-year net income soared an extraordinary 61% to reach $8.7 billion. Some reports additionally indicate that the net margin was an even stronger 22.3% as of December 31, 2024. This profound and significant improvement unequivocally underscores the proven effectiveness of Netflix's strategic revenue growth and rigorous cost management strategies, which are now systematically flowing down to enhance the company's ultimate bottom line.

2025 Quarterly Performance and Outlook:

Q1 2025 Net Profit: Net profit for the first quarter of 2025 reached an impressive $2.89 billion, with an EPS of $6.61, comfortably exceeding market forecasts and demonstrating strong performance.

Q2 2025 Net Profit: Net income for the second quarter of 2025 was $3.1 billion, accompanied by an EPS of $7.19, once again beating analyst estimates. Netflix had previously expected net income of $3.05 billion for Q2 2025, which would have implied a strong 42% increase from Q2 2024.

Quarterly Net Profit Margin (Q2 2025): The net profit margin for the quarter ending June 30, 2025, was reported at a robust 24.58%. The latest twelve months net profit margin is also a strong 24.58%.

TTM Net Margin (September 2025): As of September 19, 2025, the Trailing Twelve Months (TTM) Net Margin was recorded at a solid 22.3%.

Full-Year 2025 Net Income Expectations: Net income is expected to reach an impressive $11.75 billion for the full fiscal year 2025. Analysts also project adjusted EPS to increase a substantial 24% year-over-year, from $19.83 in fiscal 2024 to $24.58 in fiscal 2025, underscoring strong earnings growth expectations.

The consistently robust growth observed in net profit margins from 2023 to 2024 and its continued strong trajectory into 2025 unequivocally signifies a highly successful strategic pivot towards profoundly enhanced overall profitability. This powerful trend indicates that Netflix is not only successfully growing its revenue base but is doing so with increasing efficiency, thereby allowing a significantly greater portion of each dollar of sales to ultimately convert into net income. This particular trend is extraordinarily attractive to discerning investors, as it strongly suggests increasing shareholder value and the establishment of a much stronger financial foundation necessary for future strategic investments and potential capital returns. The sustained and impressive improvement robustly demonstrates the power of operating leverage, where incremental revenues contribute disproportionately to the bottom line once critical fixed costs, particularly those associated with core content infrastructure and advanced platform development, are comfortably covered.

E. Debt-to-Equity Ratio: Capital Structure and Financial Risk Assessment

The debt-to-equity (D/E) ratio is an absolutely crucial financial leverage ratio that meticulously measures the proportion of equity capital relative to debt capital utilized to finance a company's total assets. From a financial perspective, a lower D/E ratio generally signifies a more stable and fiscally prudent financial position, whereas a consistently higher ratio suggests a greater reliance on borrowed funds and, consequently, an elevated level of inherent financial risk.

2024 Debt and Cash Position: As of December 31, 2024, Netflix reported total outstanding debt of $15.6 billion, which represented a 7% increase from the prior fiscal year. Critically, the company also held a substantial $9.6 billion in cash, cash equivalents, restricted cash, and short-term investments, marking a robust 34% increase year-over-year. The net debt position of the company stood at $6.1 billion at the close of 2024. Furthermore, the company reported $2.5 billion in debt maturities scheduled within the next 12 months, which it explicitly plans to refinance. Gross debt totaled $15.7 billion at the year-end 2024.

Q2 2024 Debt and Cash Position: At the end of the second quarter of 2024, gross debt was recorded at $14 billion, while cash, cash equivalents, and short-term investments collectively amounted to $6.7 billion. The company had $1.8 billion of debt maturities within the next twelve months from Q2 2024, which it also explicitly planned to refinance, indicating a proactive debt management strategy.

While a precise and directly calculated debt-to-equity ratio for 2024 or 2025 is not explicitly provided within the current search results, we can confidently infer a relatively healthy and prudently managed capital structure given the robust financial information available. With total debt around $15.6 billion and a substantial and liquid cash balance of $9.6 billion as of late 2024, Netflix indisputably maintains a strong and enviable liquidity position. The company generated an impressive $7.4 billion in cash from operations in 2024, and its free cash flow (FCF) robustly totaled $6.9 billion in both 2024 and 2023. For 2025, Netflix further expects to generate an even stronger FCF of approximately $8 billion to $8.5 billion. This consistently robust free cash flow generation provides the company with significant and critical flexibility for effective debt servicing, continuous strategic content investments, and substantial capital returns to its discerning shareholders (for instance, share repurchases, which notably amounted to $6.2 billion in 2024 and $1.6 billion in Q2 2025).

From the top financial economist’s viewpoint, Netflix appears to be managing its debt in a highly strategic and judicious manner. The observable increase in total debt is logically and intrinsically tied to its continuous and heavy investments in premium content, which are systematically amortized over time, effectively serving as a critical investment in future revenue-generating assets. However, the strong and consistently growing free cash flow generation powerfully mitigates the inherent financial risk typically associated with this level of debt. The company’s proven ability to generate substantial cash allows it to comfortably meet all its debt obligations, efficiently refinance upcoming maturities, and resolutely continue funding its ambitious growth strategies without imposing undue strain on its otherwise healthy balance sheet. While a precise D/E calculation would necessitate the explicit shareholder equity figure, which is not readily available in the current snippets, the overarching financial picture strongly suggests a company that is responsibly leveraged, with its debt serving as a proactive and instrumental tool to fuel strategic growth rather than indicating any underlying financial distress. The positive and sustained market reception of Netflix's financial health, robustly evidenced by its strong stock performance and consistent analyst upgrades, firmly reinforces the prevailing view that its capital structure is widely perceived as sustainable, well-managed, and highly supportive of its long-term strategic objectives.

Netflix’s strategic vision for strengthening its current global market dominance has multiple facets due to its highly adaptive approach in support of video content leadership with stellar monetization and astute diversification strategies. As the global video-streaming industry inevitably matures and evolves in due course, the company focuses on profoundly deepening subscriber engagement, strategically expanding its total addressable market, and diligently fortifying its competitive advantages against a formidable and continuously growing array of rivals.

A. Content as the Key Growth Engine and Differentiator in the Global Market

Netflix’s core strategic approach fundamentally continues to revolve around its robust, diverse, and continuously expanding content library. The unwavering commitment to spend an astounding $18 billion on content in 2025, representing a significant 11% increase from the prior year, powerfully underscores the fundamental belief that truly compelling and high-quality content is the ultimate and most potent driver of both subscriber acquisition and sustained retention. This immense investment is meticulously and strategically allocated to achieve several critical, interlinked objectives:

Global Appeal and Local Relevance: Netflix's visionary strategy to invest heavily and broadly in localized content production across more than 50 countries, with a particular emphasis on high-growth regions such as Asia-Pacific and Europe, serves as a testament to its profound understanding of nuanced global consumer preferences. By actively producing and acquiring culturally relevant programming, Netflix not only significantly expands its international footprint but also proactively creates a virtuous cycle where local successes can organically evolve into global phenomena, thereby powerfully reinforcing its aspirational "global stage" positioning. This sophisticated approach also shrewdly acts as an effective hedge against potential content fatigue or overly narrow regional preferences, by providing an extensively diverse portfolio that resonates with an exceptionally wide array of tastes and cultural sensibilities.

Premium and Diverse Content Slate: The continuous strategic focus on big-budget blockbusters, high-profile A-list collaborations, and an extensive array of genres (ranging from critically acclaimed scripted dramas to insightful documentaries, massively popular K-dramas, and engaging anime) ensures that Netflix meticulously caters to a remarkably broad spectrum of entertainment demands across its global audience. This inherent diversification is absolutely crucial in a market environment where consumers are now presented with an overwhelming abundance of choice, positioning Netflix as a comprehensive and preferred entertainment destination. The consistent and reliable delivery of popular, high-quality titles is paramount to maintaining elevated levels of subscriber engagement and effectively minimizing undesirable churn rates.

Expansion into Live Events: The deliberate and strategic entry into the highly competitive arena of live sports and other major live entertainment events represents a profoundly significant move designed to capture a substantial segment of the audience that has historically remained loyal to traditional linear television. The proven success of streaming major sporting events, such as key NFL games and high-profile boxing matches, convincingly indicates Netflix’s burgeoning capacity to effectively execute and profitably monetize live programming on a grand scale. Live content intrinsically offers immediate and compelling engagement, actively fosters shared social viewing experiences, and possesses the potential to drive substantial advertising revenue, thereby adding yet another crucial layer to Netflix's already robust and competitive offerings. This strategic move also judiciously reduces the company's reliance on often costly traditional content licensing by providing unique, proprietary live experiences that direct competitors may find exceedingly difficult or cost-prohibitive to replicate effectively.

B. Product Innovation with Online Advertisement and Better Pricing Power

The continuous evolution of Netflix’s monetization strategy represents a critical and transformative aspect of its overarching strategic vision, marking a fundamental and decisive departure from its long-standing and historically exclusive ad-free, single-revenue-stream business model.

The Ad-Supported Tier (AVOD): The remarkable and rapid success of the ad-supported tier, which by mid-2025 had successfully attracted over 15 million new subscribers globally and contributed to an impressive over 50% of new subscriber growth in the relevant markets where it is available, is undeniably a game-changer for the company. This groundbreaking initiative has effectively and significantly broadened Netflix's total addressable market by offering a more affordable entry point, thereby strategically attracting price-sensitive consumers who might have otherwise opted out or never subscribed due to cost barriers. The projected doubling of advertising revenue in 2025, meticulously facilitated by Netflix’s proprietary and cutting-edge ad tech stack, robustly underscores the immense financial potential embedded within this innovative hybrid model. From a competitive vantage point, the ad-supported tier empowers Netflix to compete much more effectively with existing ad-supported streamers while simultaneously leveraging its unparalleled premium content library to command deservedly higher ad rates. Crucially, it also provides a vital new growth vector for revenue in mature markets where pure subscriber growth is inherently experiencing a natural slowdown.

Strategic Pricing Adjustments: The demonstrated ability to successfully implement targeted price increases for its standard and premium plans across key markets such as North America and Europe, while simultaneously managing subscriber churn rates effectively, powerfully highlights Netflix's deeply entrenched perceived value and its formidable pricing power within the market. These strategic price increases contribute directly and substantially to average revenue per user (ARPU) growth and robust margin expansion, unequivocally demonstrating that a significant segment of subscribers are willing to pay more for Netflix's superior content and consistently high platform quality. This sophisticated dual strategy of offering both premium and value-oriented (ad-supported) tiers strategically enables Netflix to optimally maximize its revenue generation across distinct consumer segments with varying levels of price sensitivity.

Account Sharing Crackdown: The global crackdown on unauthorized password sharing stands as another critical and impactful monetization initiative. By meticulously converting previous "borrowers" into legitimate paying subscribers, either through new individual subscriptions or by actively driving adoption of the more accessible ad-supported tier, Netflix is effectively and systematically expanding its paying customer base and ensuring that it fully captures the inherent economic value of its extensive service. This bold and decisive move, while predictably controversial among some users, has undeniably proven to be highly effective in driving significant membership growth and measurably increasing overall revenue.

C. Diversification into Video Games and Interactive Experiences

Netflix's strategic and calculated pivot into gaming, while admittedly still in its relatively nascent stages, fundamentally reflects a long-term strategic vision to profoundly expand its holistic entertainment ecosystem and substantially enhance subscriber engagement beyond the traditional confines of linear video viewing. The meticulously refined "four pillar" strategy, with its focused emphasis on narrative, party, kids, and mainstream/licensed tie-in games, strongly indicates a more disciplined and precisely targeted approach to this burgeoning vertical. The primary and overarching motivation behind this initiative is to significantly increase active user engagement, seamlessly create synergistic cross-media content loops, and ultimately effectively reduce subscriber churn, rather than prioritizing immediate, direct revenue generation from the games themselves.

The ongoing development of advanced cloud-streaming capabilities specifically for games and the planned establishment of physical "Netflix House" locations by late 2025 powerfully demonstrate a deep and enduring commitment to fostering interactive and immersive entertainment experiences that extend far beyond the parameters of traditional streaming. These forward-looking initiatives strategically tap into the broader and expanding market potential of gaming and live experiences, thereby positioning Netflix to capture a significant share of an increasingly diversified entertainment market by offering unique, integrated experiences that direct competitors may find exceedingly challenging to replicate. This visionary strategic move aims to fundamentally fortify Netflix's already strong position as a holistic and comprehensive entertainment provider, transcending its historical identity as merely a video streaming service.

D. Technology and Product Innovation as the New Foundations of Leadership

Underpinning all of these ambitious strategic initiatives is Netflix's continuous investment in operational excellence and relentless technological innovation. The successful development and widespread rollout of its proprietary ad tech stack serve as a prime and compelling example of this commitment, significantly enhancing its capabilities within a critical new revenue area. Furthermore, ongoing and systematic investments in its robust global streaming infrastructure, sophisticated data analytics capabilities, and continuously refined recommendation algorithms are absolutely vital to consistently improving the overall user experience, proactively driving heightened engagement, and effectively reducing subscriber churn in an intensely competitive market. Netflix’s unique and powerful ability to leverage its vast repository of user data to inform critical content decisions, personalize recommendations with unprecedented accuracy, and continually optimize its platform constitutes a significant and enduring competitive advantage.

E. Competitive Landscape and Future Outlook for Market Leadership

Netflix operates within an exceptionally intense and continuously evolving competitive environment, facing formidable rivals such as Disney+, Max (Warner Bros. Discovery), Peacock (Comcast), Paramount+, and Amazon Prime Video, alongside a myriad of regional and niche streaming services. Each competitor brings its own distinctive strengths to the table, whether it be vast content libraries, exclusive live sports rights, or compelling bundled offerings. However, Netflix's proactive and well-executed strategic moves position it exceptionally favorably. Its unparalleled global scale, formidable content budget, and increasingly diversified monetization strategies (including the highly successful ad-supported tier, demonstrated pricing power, and the impactful account sharing crackdown) are systematically creating more resilient and robust revenue streams and an expanded total addressable market.

The company's deliberate decision to cease reporting quarterly subscriber numbers and instead pivot its focus towards key financial and engagement metrics profoundly reflects a mature and confident understanding of its business dynamics, prioritizing sustainable and profitable growth over mere volume. This significant shift in reporting unequivocally signals confidence in its proven ability to consistently generate substantial value from its existing and growing user base through multiple, synergistic avenues. The decidedly positive outlook for 2025, which includes elevated revenue and operating margin guidance, strongly suggests that these sophisticated strategies are indeed working effectively and yielding measurable results.

In conclusion, Netflix is no longer merely a pioneering streaming service but has decisively evolved into a diversified and dynamic global entertainment powerhouse. Its forward-looking strategic vision, meticulously executed with increasing financial discipline, encompasses leveraging its unmatched content leadership, innovatively transforming monetization models through advertising and dynamic pricing, and strategically expanding into complementary entertainment verticals. This comprehensive and integrated approach, robustly supported by strong financial performance and a clear, actionable operational roadmap, uniquely positions Netflix to deftly navigate the complex and continuously evolving market dynamics and to capitalize effectively on long-term growth opportunities. The company's impressive trajectory robustly suggests that it is exceptionally well-equipped to navigate future market shifts, thereby presenting a compelling investment thesis for those seeking exposure to a resilient, innovative, and market-leading entity within the global digital media landscape.

Netflix Inc (U.S. stock symbol: $NFLX) has unequivocally demonstrated remarkable resilience and strategic acumen in profoundly transforming its business model to meet the formidable challenges and capitalize on the immense opportunities within a maturing global streaming market. From the shrewd financial economist’s viewpoint, the company is not merely navigating a complex environment characterized by intense competition, escalating content costs, and evolving consumer behaviors, but is doing so with increasing effectiveness and foresight. The comprehensive fundamental analysis meticulously presented herein reveals a company that, as of late 2025, is not merely surviving but demonstrably thriving through strategic innovation and disciplined execution.

The financial performance of Netflix in 2024 and through the first half of 2025 powerfully underscores a highly successful strategic pivot towards profitable growth. The significant acceleration in annual sales, with 2024 revenue reaching an impressive $39.001 billion (representing a robust 15.65% increase year-over-year) and a strong outlook for 2025 revenue projected between $44.8 billion and $45.2 billion, clearly demonstrates the efficacy of its diversified revenue streams. This robust top-line growth is largely attributable to the highly successful implementation of the ad-supported tier, which has significantly expanded its total addressable market and is strategically projected to double its advertising revenue in 2025. Concurrently, the global crackdown on account sharing has proven to be an exceptionally potent mechanism for converting previously unmonetized viewership into legitimate paying subscribers, thereby further bolstering the company's revenue streams.

Crucially, this accelerated revenue growth has been accompanied by a substantial and encouraging expansion in profitability margins. Gross margins have witnessed a remarkable improvement, with the average gross margin for 2024 standing at 44.55% and reaching an impressive 48.49% by Q2 2025. This consistent upward trend clearly indicates a heightened and continuous efficiency in managing its vast and strategic content investments. Operating profit margins have similarly surged, with the average for 2024 at 24.68% and a robust operating margin of 29.51% in Q2 2025, with management confidently targeting approximately 30% for the full fiscal year 2025. Net profit margins have consistently followed suit, with the average reaching 20.25% in 2024 and an impressive 24.58% in Q2 2025, translating directly into robust and sustainable net income growth. These expanding margins serve as a powerful indicator of increasing operational leverage, effectively reflecting Netflix's enhanced ability to scale its global platform and monetize its extensive user base more efficiently without a directly proportional or excessive increase in its underlying cost structure. The judicious and strategically implemented price increases in early 2025 across key markets further contribute positively to average revenue per user (ARPU) growth and overall margin expansion, unequivocally demonstrating the company's strong pricing power within the market.

Netflix's capital structure appears strategically and prudently managed. While total debt stood at $15.6 billion in 2024, the company's strong and liquid cash position of $9.6 billion and consistently robust free cash flow generation (projected between $8.0 billion and $8.5 billion for 2025) provide ample liquidity and critical financial flexibility for efficient debt servicing, continuous strategic content investments, and proactive capital returns to its shareholders. The continuous, substantial investment in content—an impressive $18 billion planned for 2025—is a strategic and calculated capital allocation decision fundamentally aimed at maintaining its formidable competitive edge and proactively driving future growth, rather than being a signal of underlying financial strain.

The strategic initiatives in gaming and live events, while still in their evolving stages, represent forward-looking and calculated bets on extensively diversifying its entertainment ecosystem and profoundly deepening subscriber engagement beyond the traditional confines of video streaming. The refined "four pillar" gaming strategy, with its disciplined focus on engagement over immediate monetization, strategically positions Netflix to effectively tap into a broader total addressable market for holistic entertainment experiences. The planned opening of physical "Netflix House" locations further signals a strong and innovative commitment to immersive, interactive experiences that extend the brand's reach.

In sum, Netflix is no longer merely a pioneering video-streaming service but has decisively transformed into a diverse, dynamic, and robust global entertainment powerhouse. Its visionary strategic direction, executed with increasing financial discipline and precision, encompasses leveraging its unparalleled content leadership, innovatively transforming its monetization models through the successful integration of advertising and dynamic pricing, and strategically expanding into complementary entertainment verticals. The significant shift in reporting focus from mere subscriber counts to more meaningful financial and engagement metrics profoundly reflects a mature, confident, and strategically agile company that emphatically prioritizes sustainable, profitable growth. While the competitive landscape remains exceptionally fierce, Netflix's proactive adaptations, consistently strong financial performance, and clearly articulated strategic roadmap position it exceptionally favorably for continued leadership and long-term value creation in the ever-evolving global entertainment industry. The company's impressive and strategic trajectory strongly suggests that it is exceptionally well-equipped to skillfully navigate future market dynamics, thereby presenting a compelling investment thesis for those seeking exposure to a resilient, innovative, and unequivocally market-leading entity within the global digital media landscape.

Disclaimer: This analysis is for illustrative purposes and does not constitute investment advice. Investors should conduct their own due diligence, and these investors should consult with professional financial advisors before these investors make any stock investment decisions. Financial data changes rapidly, and this comprehensive fundamental analysis relies on the recent complete assessment of the public company’s key competitive advantages, fundamental forces, technological advancements, and even external government interventions.

With U.S. fintech patent approval, accreditation, and protection for 20 years, our AYA fintech network platform provides proprietary alpha stock signals and personal finance tools for stock market investors worldwide.