2024-04-30 08:28:00 Tue ET

stock market paypal facebook apple microsoft google amazon tesla smart beta stock investment vitae virtual stock market simulation free stock search tool personal finance tool top tech titans proprietary alpha stock signals leaderboards ebooks analytic reports research articles investors

Andy Yeh Alpha (AYA) fintech network platform provides proprietary alpha stock signals and personal finance tools for stock market investors. Our AYA fintech network platform serves as a new online social community for long-term stock market investors (who should time the market more aggressively with healthy cash dividends and capital gains than myopic short-run traders). Specifically, the main platform features include AYA-exclusive proprietary alpha stock signals, CAPM alphas, Fama-French alphas, real-time stock prices, historical returns, interactive charts, social media messages, value and momentum portfolio strategies, analytic reports, blog articles, ebooks, and many other personal finance tools for stock market investors and traders both in America and around the world.

With U.S. fintech patent approval, accreditation, and protection for 20 years, our AYA fintech network platform provides proprietary alpha stock signals and personal finance tools for stock market investors worldwide.

We build, design, and delve into our new and non-obvious proprietary algorithmic system for smart asset return prediction and fintech network platform automation. Unlike our fintech rivals and competitors who chose to keep their proprietary algorithms in a black box, we open the black box by providing the free and complete disclosure of our U.S. fintech patent publication. In this rare unique fashion, we help stock market investors ferret out informative alpha stock signals in order to enrich their own stock market investment portfolios. With no need to crunch data over an extensive period of time, our freemium members pick and choose their own alpha stock signals for profitable investment opportunities in the U.S. stock market.

Smart investors can consult our proprietary alpha stock signals to ferret out rare opportunities for transient stock market undervaluation. Our analytic reports help many stock market investors better understand global macro trends in trade, finance, technology, and so forth. Most investors can combine our proprietary alpha stock signals with broader and deeper macro financial knowledge to win in the stock market.

Through our proprietary alpha stock signals and personal finance tools, we can help stock market investors achieve their near-term and longer-term financial goals. High-quality stock market investment decisions can help investors attain the near-term goals of buying a smartphone, a car, a house, good health care, and many more. Also, these high-quality stock market investment decisions can further help investors attain the longer-term goals of saving for travel, passive income, retirement, self-employment, and college education for children. Our AYA fintech network platform empowers stock market investors through better social integration, education, and technology.

As of early-January 2023, the U.S. Patent and Trademark Office (USPTO) has approved our U.S. fintech patent application: Algorithmic system for dynamic conditional asset return prediction and fintech network platform automation. On 4 March 2021, we filed a U.S. patent continuation application (Application Number: #17192059; Publication Number: US20210192628) with a new set of claims in accordance with the April 2017 initial application (Application Number: #15480765; Publication Number: US20180293656). We went through many USPTO office actions, rejections, failures, setbacks, and other technical obstacles. Eventually our fintech patent efforts came to fruition in time. We paid the USPTO maintenance fees to secure our patent protection and accreditation for 20 years.

AYA fintech network platform provides proprietary alpha stock signals and personal finance tools for stock market investors. The latest platform update includes new product features such as the personal stock investment vitae, free access to our online social community for stock market posts and discussions, virtual stock market game with real-time stock prices, several leaderboards for our virtual investors, and a rich library of ebooks, analytic reports, research articles, and many more.

Each freemium member trades top 6,000+ U.S. stocks, equity market funds, and ADRs with $1 million virtual token talents, updates his or her personal stock investment vitae with the most profitable stock positions, and pays some small annual fee to access our premium electronic resources (specifically, AYA-exclusive ebooks on the current macroeconomic and technological trends in smart-beta stock market investment and portfolio optimization).

Our homepage now offers a free stock search tool for the top tech titans Meta, Apple, Microsoft, Google, and Amazon (MAMGA). The premium membership classes offer all kinds of features and benefits such as top 6,000+ U.S. proprietary alpha stock signals, ebooks, analytic reports, and research articles, and other personal finance tools etc. Our AYA fintech network platform freemium pricing plan differentiates various online product features and benefits.

Each alpha stock signal represents an excess return to a smart-beta stock investment portfolio strategy. For instance, a 15% alpha suggests that we would predict the excess return to be about 15% per annum relative to the smart-beta market portfolio for a given stock with zero beta exposure to the 6 Fama-French fundamental factors such as size, value, momentum, asset growth, operating profitability, and market risk. Each prospective premium member can make his or her credit card payment via the secure PayPal payment gateway. AYA fintech network platform uses the safe and secure online payment gateway through PayPal (the biggest online fund transfer platform in USA with 83%+ online market penetration).

With USPTO fintech patent protection and accreditation since early-January 2023, our proprietary alpha investment model consistently outperforms the major stock market benchmarks such as S&P 500, Dow Jones, Nasdaq, and MSCI USA, MSCI Europe, MSCI Asia, and MSCI World. We implement our proprietary alpha investment model for positive hefty U.S. stock signals. We track the stock prices and returns for the recent multi-year period from early-February 2017 to present. This data span allows us to conduct an out-of-sample test to assess our proprietary alpha investment model performance in comparison to the major stock market benchmarks.

In the long run, S&P 500 yields a 12% net overall return per annum (NORPA), and Dow Jones and Nasdaq generate 12% to 17% NORPAs. In the same time frame, MSCI stock market benchmarks deliver 5% to 13% NORPAs (MSCI USA, MSCI World, MSCI Europe, and MSCI Asia). With our proprietary alpha investment model, all of our virtual stock market portfolios outperform these major stock market benchmarks with 18% to 21% NORPAs. In practice, all of the 17 virtual stock portfolios deliver higher NORPAs than Dow Jones, Nasdaq, S&P 500, and MSCI stock market index returns over the long run.

For most market indexes and benchmark portfolios (such as S&P 500, Nasdaq, Dow Jones, MSCI World, MSCI USA, MSCI Europe, and MSCI Asia), the signal-to-noise ratio, or Sharpe ratio of average asset return to standard deviation, is 0.35 to 0.55 with 10% average returns and 18% to 30% standard deviations. The vast majority of static Fama-French asset return models produce maximum Sharpe ratios in the range of 0.65 to 0.75; whereas, our algorithmic alpha investment system produces the Sharpe ratio of at least 1.675 with 20% to 30% average returns and 12% to 16% standard deviations. Our US fintech patent specification provides more technical details on both the competitive advantages and distinctive capabilities of our algorithmic cloud system for dynamic conditional asset return prediction and fintech network platform automation. The recent double-digits model performance corroborates the scientific fact that our proprietary alpha investment model outperforms the major stock market benchmarks.

Our AYA-exclusive proprietary alpha investment model outperforms the major stock market indexes from early-February 2017 to present. These stock market indexes include S&P 500, Dow Jones, Nasdaq, and MSCI etc. We implement this proprietary alpha investment model for AYA-exclusive positive hefty U.S. stock signals. A complete non-technical model description is available on our AYA fintech network platform. Our long-run proprietary alpha investment model outperformance arises from the consistent analysis of both market niches and competitive advantages for the top 10 public corporations in each of the top 20 profitable U.S. industries. In a nutshell, our proprietary alpha stock investment model comprises smart-beta dynamic exposure to at least 6 fundamental factors such as size, value, momentum, operating profitability, asset growth, and market risk.

Our US Patent and Trademark Office (USPTO) online patent publication is available on the World Intellectual Property Office (WIPO) official website as well as Google Patents (Patent Publication Number: #US11599946B2). Every freemium member can sign up for free to check out our proprietary alpha signals on our AYA fintech network platform. In this new fashion, every freemium member can learn from these proprietary alpha stock signals to improve their stock market investments and portfolio strategies over time.

Our proprietary alpha investment model estimates long-term average supernormal returns for 6,000+ U.S. stocks, equity market funds, and ADRs, and then ranks these stocks in accordance with their dynamic conditional alpha stock signals. Several virtual members follow these dynamic conditional alpha stock signals to actively trade 6,000+ individual U.S. stocks on our AYA fintech network platform. These 17 virtual members focus on the 500 highest alpha stock signals for portfolio optimization. Our historical backtest evidence supports our AYA-exclusive proprietary alpha investment model outperformance over a sufficiently long-term data span.

Many artificial intelligence developers face the black box dilemma: they remain reluctant to disclose their proprietary algorithm because they would then lose their competitive advantage. Our competitors thus keep their proprietary machine-learning algorithm in a black box. We think outside the box, challenge the status quo, and so offer our U.S. fintech patent publication for free. We believe in the core conviction that we can carry out arduous quantitative work for the typical stock market investor who would otherwise spend too much time crunching data to generate economic insights into the fundamental prospects of U.S. stocks. Our proprietary alpha investment model estimates long-term average supernormal returns for more than 6,000+ U.S. stocks, equity market funds, and ADRs, and then ranks these stocks in accordance with their dynamic conditional alpha stock signals.

Our recent research shows that the proprietary alpha investment model captures dynamism in several fundamental factors such as size, value, momentum, asset growth, operating profitability, and market risk exposure (aka Fama-French fundamental factors). Also, the empirical evidence indicates econometrically significant mutual causation between macroeconomic innovations and dynamic conditional alphas. This causal relation serves as a core qualifying condition for fundamental factor selection in our unique asset return prediction model design and performance evaluation. In conclusion, we help demystify the pervasive misconception that it is often difficult for individual investors to beat the long-term average 11% to 12% stock market return.

This AYA-exclusive landmark ebook provides the fundamental analysis of each of the mainstream global macro markets, sectors, and industries in terms of competitive advantages, technological advances, and government interventions. This analysis spans global trade, finance, medicine, technology, electric vehicles (EV), autonomous robotaxis (AR), artificial intelligence (AI) large language models (LLM), graphics processing units (GPU), virtual reality (VR) headsets, high-speed broadband networks, cloud services, semiconductor microchips, video games, and China Internet stocks.

AYA ebook hyperlink: https://bit.ly/4hxvrwy

AYA ebook length: 283 pages (21 chapters and 122,241 words).

Table of Contents:

Government intervention remains a major influence over global trade, finance, and technology.

The current homeland industrial policy stance worldwide seems to embed the new notion of global resilience into economic statecraft.

The new world order of trade can help accomplish non-economic policy goals such as national security and technological dominance.

Central bank digital currencies (CBDC) can often help anchor public trust in money, especially in a new cashless society.

The global financial services industry now needs fewer banks worldwide.

The global asset management industry is central to modern capitalism.

In the global life insurance industry, many life insurers now prioritize profit margins over sales growth rates.

The American and European governments seek to impose new antitrust rules and regulations for tech titans such as Meta, Apple, Microsoft, Google, Amazon, Nvidia, and Tesla (MAMGANT or Magnificent 7).

With clean and green energy resources and electric vehicles (EV), the global auto industry now navigates at a newer and faster pace.

The new semiconductor microchip shortages and global supply chain bottlenecks remain severe for the U.S. tech titans and auto manufacturers.

Generative artificial intelligence (Gen AI) uses and applies large language models (LLM) to create numerous online contents and software solutions for better human productivity.

The global cloud services infrastructure helps expand what can be made digitally viable from clean and green electric vehicles (EV) and virtual reality (VR) headsets to artificial intelligence (AI) and the metaverse.

In the global market for high-speed broadband telecommunication, more efficient network management helps secure new competitive advantages.

Global video game publishers continue to enjoy double-digit sales growth.

Our AYA proprietary alpha stock signals and ESG scores help better capture both value and momentum gains in stock market portfolio optimization.

China Internet tech titans continue to grow amid greater competition.

Several pharmaceutical titans continue to enjoy their current post-pandemic patent development cycle.

With regard to wider weight loss and anti-obesity treatments, the global market for GLP-1 medications tends to grow substantially to benefit more than 1 billion people worldwide by 2030.

In the current global market for better biotech advances, medical innovations, and healthcare services, the new integration of artificial intelligence (AI) now reshapes the competitive landscape worldwide.

Today, tech titans, billionaires, pharmaceutical companies, and venture capitalists continue to reshape global pharmaceutical investments for both better healthspan and longer lifespan.

Is increasingly high stock market concentration good or bad for Corporate America and stock market investors?

This AYA-exclusive landmark ebook provides the key motifs in the merry medley of Trump economic policy reforms 2016-2020:

AYA ebook hyperlink: https://bit.ly/2ZwYfiE

AYA ebook length: 507 pages (21 chapters and 97,854 words)

Table of Contents:

(1) Federal Reserve monetary policy decisions and interest rate adjustments in response to inflationary fluctuations, economic output gyrations, as well as technological advances such as artificial intelligence and robotic automation;

(2) Fiscal stimulus with massive tax cuts and national debt and deficit stockpiles;

(3) Deregulatory reforms on capital adequacy rules, leverage limits, macro-prudential stress tests, liquidity requirements, and deposit insurance constraints;

(4) Bilateral trade engagements (e.g. Sino-U.S. trade negotiations and steel-and-aluminum tariffs on Canada, Europe, and Mexico etc);

(5) Oil price gyrations due to global supply reductions by Saudi Arabia and United Arab Emirates as well as draconian economic sanctions on nuclear nations such as Iran and North Korea;

(6) Social safety nets such as infrastructure overhaul, health care, higher education, and residential property development etc;

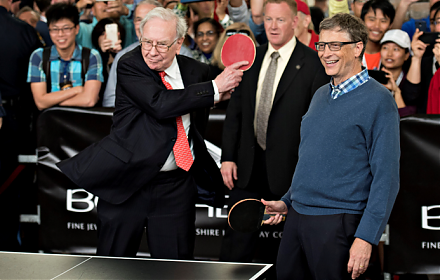

(7) Personal finance guidelines and recommendations from Warren Buffett stock market investment principles to rich habits, frugal lifestyles, and self-help life inspirations.

Length: 507 pages (97,854 words)

This AYA-exclusive landmark ebook delves into the macroeconomic and technological aspects of Bidenomics from mid-2020 to present. This ebook comprises 4 main parts. The first part explains the pre-Biden Trump economic policy reforms in trade, taxation, and technology in accordance with anti-China investor sentiment and neo-liberal public choice. The second, third, and fourth parts discuss the central foundations of Biden economic policy reforms in fiscal and monetary policy coordination, climate change, and the Inflation Reduction Act. Through these latter analytic reports, Bidenomics focuses on the recent technological advances and their broader policy implications for environmental, social, and governance (ESG) stock market investment strategies etc. This macro trend has profound public policy implications for U.S. tech titans Meta, Apple, Microsoft, Google, Amazon, Nvidia, and Tesla etc (MAMGANT).

AYA ebook hyperlink: https://bit.ly/44CdDu7

AYA ebook length: 206 pages (18 chapters and 90,405 words)

Table of Contents:

Part 1: pre-Biden Trump economic policy reforms in trade, taxation and technology.

The global economy faces a paradigm shift toward pervasive peculiar phenomena due to Sino-U.S. fair trade and Brexit deals.

Technological advances, geopolitical risks, and pandemic outbreaks cannot shake investor confidence in the American dollar as the global reserve currency.

U.S. tech titans Facebook, Apple, Microsoft, Google, and Amazon enjoy platform advantages, competitive moats, positive network effects, and scale economies.

Artificial intelligence continues to push boundaries for several tech titans to sustain their disruptive innovations, competitive moats, and first-mover advantages.

Part 2: Biden economic reforms in fiscal and monetary policy coordination, climate change, and the Inflation Reduction Act.

The corona virus crisis helps reshape global trade, taxation, and technology.

The Biden administration launches economic policy reforms in fiscal and monetary stimulus, global trade, finance, and technology.

The global asset management industry is central to modern capitalism.

Banks must now compete with central bank digital currencies (CBDC) and fintech payment platforms in processing inter-bank and cross-border payments worldwide.

Part 3: Biden tech advances and their broader policy implications for environmental, social, and governance (ESG) stock market investment strategies.

Artificial intelligence, 5G, and virtual reality can help transform global trade, finance, and technology.

There are several structural antitrust issues and concerns in U.S. digital markets.

What are the major demand-supply factors and concerns in light of semiconductor microchip shortages and financial services?

Electrification can help substantially reduce global carbon emissions worldwide in accordance with the Paris climate agreement.

Part 4: Biden tech advances and their broader policy implications for environmental, social, and governance (ESG) stock market investment strategies.

The Biden Inflation Reduction Act is central to modern world capitalism.

What are the top global macro tech risks (as of mid-2023)?

Government intervention remains a major influence over global trade, finance, and technology.

The bank-credit-card model and fintech platforms have adapted well to the recent digitization of cashless finance.

In recent decades, trade liberalization has promoted better economic growth and efficiency worldwide.

This AYA-exclusive landmark ebook sheds new light on the top 40 fundamental themes and insights in the modern economic science from 2000 to present. This ebook provides fresh insights into the mainstream schools of economic thoughts from the neoclassical synthesis and monetarism to the New Keynesian framework and Keynesian search theory. Furthermore, this ebook focuses on the competitive advantages, opportunities, risks, and threats of both tech titans and mega banks in the modern age of technological advancement, diffusion, and proliferation. Fresh opportunities arise in the broader context of Internet search, consumer technology, e-communication, social media, software, e-commerce, and cloud service provision etc. In contrast, the primary threat is closer antitrust scrutiny on the sheer size, power, and product market dominance of both tech titans and banks as several regulatory institutions mistrust these corporations in global economic history.

AYA ebook hyperlink: https://bit.ly/3FaegyI

AYA ebook length: 220 pages (top 40 recent economic science book reviews).

This AYA-exclusive landmark ebook focuses on the recent top 40 modern strategic business management principles and case studies from 2000 to present. The primary topics include lean startup entrepreneurship, long-term sustainable business management, fundamental factor investment, and dual digital transformation etc. This topical ebook draws key life lessons from the best business minds of Warren Buffett, Jeff Bezos, Larry Page, Steve Jobs, Bill Gates, Mark Zuckerberg, Gordon Moore, Andrew Grove, Jim Collins, Clayton Christensen, and so forth.

AYA ebook hyperlink: https://bit.ly/2IezdQh

AYA ebook length: 225 pages (top 40 recent management book reviews)

This AYA-exclusive landmark research article delves into mutual causation between stock market alphas and macroeconomic innovations. The online appendix provides complete econometric details and algorithms for empirical analysis. This empirical analysis includes the recursive multivariate filtration of Fama-French dynamic conditional alphas, ARMA-GARCH representation of both dynamic conditional alphas and betas, and vector autoregression analysis of mutual causation between alpha spreads and macro surprises. The particularly careful implementation of canonical vector autoregressions (VAR) and autoregressive conditional heteroskedasticity (ARCH) models relies on the seminal contributions of Nobel Laureates Robert Engle, Clive Granger, and Christopher Sims. From a technical perspective, this work provides the solid research methodology and practical application of complex econometric tools for macrofinancial research.

We extract dynamic conditional factor premiums from the Fama-French factor model and find that most anomalies disappear after we account for time variation in these premiums. New vector autoregression evidence shows that mutual causation between dynamic conditional alphas and macroeconomic surprises serves as a core qualifying condition for fundamental factor selection. This economic insight is an incremental step toward drawing a distinction between rational risk and behavioral mispricing models. As dynamic conditional alphas often reveal the marginal investor’s fundamental news and expectations about the cross-section of average asset returns, our economic insight helps enrich macroeconomic asset return prediction.

This AYA-exclusive landmark research article provides both the theory and evidence in support of the new permanent capital hypothesis in macrofinance. We design a dynamic stochastic general equilibrium (DSGE) structural model with Epstein-Zin recursive preferences to gauge the marginal investor’s stochastic discount factor with financial intermediary capital. This model embeds and enriches the cash-flow and discount-rate channels of both the q-theory and intertemporal CAPM. GMM dynamic panel data analysis shows that there is a significant trade-off between cash payout and intertemporal debt substitution in the form of foregone tax shields with higher equity capital ratios. We design a new fundamental factor with better-minus-worse (BMW) capital strength to modify the Fama-French (2018) 6-factor model for asset return prediction. The resultant 7-factor model helps explain some additional recent asset return anomalies.

This AYA-exclusive landmark research article provides a quantitative assessment of bank capital adequacy. In this study, we carry out the Monte Carlo simulation analysis of large-scale synthetic data on bank capital. This analysis lends credence to the recent policy proposal for banks to hold substantially higher equity capital buffers in order to safeguard against extreme losses that might arise in rare but plausible times of severe financial stress (such as the Global Financial Crisis of 2008-2009 and the recent rampant corona virus crisis of 2020-2022). In this study, we apply the recent advances in financial data science and Monte Carlo simulation. This research has profound policy implications for macrofinancial asset market stabilization.

This AYA-exclusive landmark research article delves into whether the long prevalent global divergence from broad Berle-Means stock ownership dispersion is optimal from the social planner’s perspective. We design a model of corporate ownership and control to assess Berle-Means convergence toward diffuse incumbent stock ownership. Berle-Means convergence occurs when legal institutions for investor protection outweigh in relative importance the firm-specific protection of shareholder rights. While these arrangements are complementary sources of investor protection, Berle-Means convergence draws the corporate outcome to the socially optimal quality of corporate governance. High ownership concentration creates perverse incentives for inside blockholders to steer major business decisions to the detriment of both minority shareholders and outside blockholders. Our analysis sheds skeptical light on high insider stock ownership with managerial entrenchment and rent protection.

The fintech founder, Andy Yeh, implements the lean startup approach to incubating our AYA fintech network platform through iterative continuous improvements and feature enhancements. Andy is responsible for ensuring maximum sustainable member growth within our AYA fintech network platform ecosystem. Andy supports the core mission of promoting greater financial literacy, inclusion, and freedom of the global general public. Andy integrates multiple team efforts and endeavors to help enrich the economic lives of others. AYA fintech network platform provides fresh economic insights into stock market news, investment themes, business practices, personal finance tools, as well as generic life inspirations. Andy serves as a financial economist, founder, as well as inventor of an algorithmic system for dynamic conditional asset return prediction and fintech network platform automation (USPTO Patent Publication Number: US20210192628). On behalf of his fintech firm, Brass Ring International Density Enterprise (BRIDE), Andy retains fintech patent protection, approval, and accreditation from the U.S. Patent and Trademark Office (USPTO) for 20 years.

Andy has rich extensive international experiences in monetary, fiscal, and financial stability policies. His research publications appear in a reasonable range of both academic and professional journals in macro finance, asset return prediction, algorithmic factor quantification, cash capital structure, financial risk management, and corporate ownership governance. Andy maintains a rich library of PhD-level literature reviews, study notes, mathematical exercises in investment theory and evidence, econometric theory, macroeconomic theory and evidence, empirical corporate finance, and both English and Chinese bible verses for Christian faith. Prior to orchestrating our AYA fintech network platform as a new online social community for stock market investors, Andy has served as financial economist at several international organizations in America, New Zealand, and Taiwan. These organizations include Academia Sinica, Bank of America, Federal Reserve Bank of San Francisco, Reserve Bank of New Zealand, Institute for Information Industry, Moody’s Analytics, and so forth.

Andy was born and bred in Taiwan; spent 12 years from high school to his first full-time job in New Zealand; studied and worked another 5 years from graduate school to a Vice President appointment in San Francisco, California, USA; and then spent PhD and lean startup years in Taipei, Taiwan.

His lean enterprise, Brass Ring International Density Enterprise (BRIDE), received first incorporation and registration in Hong Kong.

Andy holds several academic degrees and qualifications with scholarship support such as Doctor of Philosophy (PhD) in macro finance from National Taiwan University, Master of Financial Engineering (MFE) from the University of California at Berkeley, Master of Management Studies (MMS) and Bachelor of Management Studies (BMS) both with first-class honors from the University of Waikato, and Financial Risk Manager (FRM) global risk industry accreditation.

Andy Yeh

Postdoc Co-Chair

Brass Ring International Density Enterprise (BRIDE) ©

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2017-12-09 08:37:00 Saturday ET

Michael Bloomberg, former NYC mayor and media entrepreneur, criticizes that the Trump administration's tax reform is a trillion dollar blunder because i

2018-10-30 10:41:00 Tuesday ET

Personal finance author Ramit Sethi suggests that it is important to invest in long-term gains instead of paying attention to daily dips and trends. It

2019-02-21 12:37:00 Thursday ET

Apple shakes up senior leadership to initiate a new transition from iPhone revenue reliance to media and software services. These changes include the key pr

2023-03-07 11:29:00 Tuesday ET

Former Bank of England Governor Mervyn King provides his deep substantive analysis of the Global Financial Crisis of 2008-2009. Mervyn King (2017) &nb

2019-01-07 18:42:00 Monday ET

Neoliberal public choice continues to spin national taxation and several other forms of government intervention. The key post-crisis consensus focuses on go

2018-12-17 08:43:00 Monday ET

Apple files an appeal to overturn the recent iPhone sales ban in China due to its patent infringement of Qualcomm proprietary technology. This recent ban of