2018-10-23 12:36:00 Tue ET

federal reserve monetary policy treasury dollar employment inflation interest rate exchange rate macrofinance recession systemic risk economic growth central bank fomc greenback forward guidance euro capital global financial cycle credit cycle yield curve

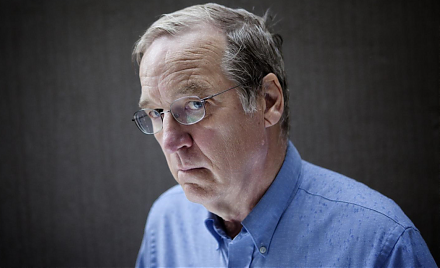

Former Fed Chair Paul Volcker releases his memoir, talks about American public governance, and worries about plutocracy in America. Volcker suggests that public governance entails running the government with few unproductive policy debates. As the U.S. central bank, the Federal Reserve need not adhere to an explicit 2% symmetric inflation target. The current neutral interest rate hike can continue even when inflation rises above the target range of 2%-2.5%. Volcker supports stronger supervisory powers for both the Federal Reserve and Treasury. Both regulatory agencies should continue to conduct regular macroprudential stress tests on the systemically-important financial institutions (SIFIs) once per year in the post-Dodd-Frank era. SIFIs should build up sufficient core capital buffers to safeguard against extreme losses that might arise in rare times of financial stress. Also, the Volcker rule separates commercial bank activities from proprietary investment transactions. This firewall serves as a safety valve between safe bank deposits and risky asset investments.

Volcker worries about the impact of money on the U.S. political system, and he expresses grave concerns about the recent trend that America seems to devolve into a plutocracy. In his view, U.S. democratic regulations should restrict the direct influence of crazy rich Americans over political affairs.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

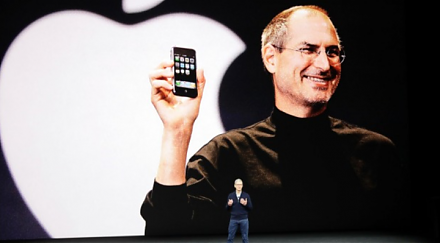

2018-06-25 12:43:00 Monday ET

Apple and Samsung are the archrivals for the title of the world's top smart phone maker. The recent patent lawsuit settlement between Apple and Samsung

2019-04-21 10:07:54 Sunday ET

Central bank independence remains important for core inflation containment in the current age of political populism. In accordance with the dual mandate of

2020-05-28 15:37:00 Thursday ET

Platform enterprises leverage network effects, scale economies, and information cascades to boost exponential business growth. Laure Reillier and Benoit

2018-05-04 06:29:00 Friday ET

Commerce Secretary Wilbur Ross suggests that 5G remains a U.S. top technology priority in light of the telecom merger proposal between Sprint and T-Mobile a

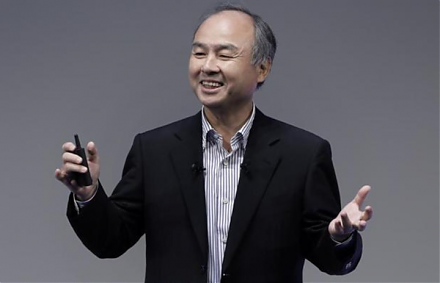

2018-12-21 11:39:00 Friday ET

The Internet and telecom conglomerate SoftBank Group raises $23 billion in the biggest IPO in Japan. Going public is part of the major corporate move away f

2023-11-28 11:35:00 Tuesday ET

David Colander and Craig Freedman argue that economics went wrong when there was no neoclassical firewall between economic theories and policy reforms. D