2025-09-18 08:03:32 Thu ET

stock market technology facebook apple microsoft google amazon artificial intelligence tesla trade competitive advantages blue ocean alphabet personal finance asset management investment finance meta nvidia stock synopsis fundamental analysis taxation disruptive innovations fundamental forces economics politics

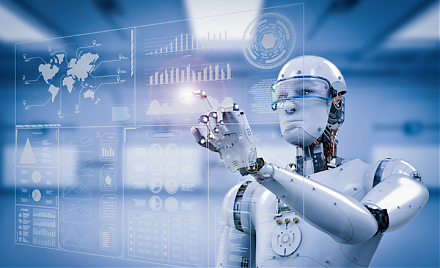

As of September 2025, we ask each of the state-of-the-art mainstream Google Gen AI models to complete our comprehensive fundamental analysis of (U.S. stock symbol: $GOOG) from the financial economist’s perspective. These mainstream models include Gemini 2.5 Pro, Gemini 2.5 Flash, and Gemini 2.5 Flash Lite. We write, refine, use, adapt, apply, and leverage a new Python program to conduct this comprehensive fundamental analysis of Google (U.S. stock symbol: $GOOG) as part of the Magnificent 7 tech titans. For this purpose, we specify the same prompt for each of the mainstream models:

Suppose you are the top-notch financial economist. Can you provide some comprehensive fundamental analysis of Alphabet Google (U.S. stock symbol: $GOOG)? Please use only complete sentences with no hallucinations. Please ensure this comprehensive fundamental analysis to be between 4,500 words and 8,500 words.

We apply our rare unique lean-startup growth mindset with iterative continuous improvements to this comprehensive stock-specific fundamental analysis. With the Python program, we take the Gen AI long-form output as our minimum viable product (MVP). At this stage, we manually curate, edit, refine, adapt, and improve the long-form response. With this manual human content curation, we remake, reshape, and reinforce the final version to be our comprehensive stock-specific fundamental analysis. From the financial economist’s perspective, this manual human content curation adds our rare unique insights, worldviews, expert views, opinions, judgments, and even personal experiences to this comprehensive stock-specific fundamental analysis in due course.

On our AYA fintech network platform, we post, polish, and publish this new comprehensive fundamental analysis for social media circulation with the unique stock cashtag, the company description, the AYA-exclusive proprietary stock market alpha estimates, and several hyperlinks to the relevant stock pages, key financial statistics, financial statements, and external financial news articles etc.

With U.S. fintech patent approval, accreditation, and protection for 20 years, our AYA fintech network platform provides proprietary alpha stock signals and personal finance tools for stock market investors worldwide.

We build, design, and delve into our new and non-obvious proprietary algorithmic system for smart asset return prediction and fintech network platform automation. Unlike our fintech rivals and competitors who chose to keep their proprietary algorithms in a black box, we open the black box by providing the free and complete disclosure of our U.S. fintech patent publication. In this rare unique fashion, we help stock market investors ferret out informative alpha stock signals in order to enrich their own stock market investment portfolios. With no need to crunch data over an extensive period of time, our freemium members pick and choose their own alpha stock signals for profitable investment opportunities in the U.S. stock market.

Smart investors can consult our proprietary alpha stock signals to ferret out rare opportunities for transient stock market undervaluation. Our analytic reports help many stock market investors better understand global macro trends in trade, finance, technology, and so forth. Most investors can combine our proprietary alpha stock signals with broader and deeper macro financial knowledge to win in the stock market.

Through our proprietary alpha stock signals and personal finance tools, we can help stock market investors achieve their near-term and longer-term financial goals. High-quality stock market investment decisions can help investors attain the near-term goals of buying a smartphone, a car, a house, good health care, and many more. Also, these high-quality stock market investment decisions can further help investors attain the longer-term goals of saving for travel, passive income, retirement, self-employment, and college education for children. Our AYA fintech network platform empowers stock market investors through better social integration, education, and technology.

Google ($GOOG) company description:

Alphabet Google provides many smart software products, cloud services, and online platforms in North America, Europe, Asia, and many other parts and regions of the world. As one of the Magnificent 7 tech titans in America, the high-tech conglomerate operates through Google Services, Google Cloud, and Other Bets segments. The Google Services segment provides smart software products and cloud services. This core business segment spans Online Search, Android, Chrome, Gmail, Google Play, Google Drive, YouTube, Google Maps, Google Photos, mobile devices, and online ads. This core business segment further involves smart freemium apps sales, in-app purchases, and online assets in Google Play and YouTube. Also, this core business segment provides mobile devices and YouTube consumer subscription services. The Google Cloud segment provides AI infrastructure, AI Studio, Vertex AI, cybersecurity, big data analytics, and other cloud services. This core business segment spans Google Workspace with smart tools for cloud communication, console control, and collaboration for business clients (Calendar, Gmail, Docs, Drive, and Google Meet etc). The Other Bets business segment sells healthcare and other Internet services. The Stanford co-founders, Larry Page and Sergey Brin, launched the new Google search online as part of the high-tech parent company Alphabet in September 1998 in Mountain View, California.

Here we provide our AYA proprietary alpha stock signals for all premium members on our AYA fintech network platform. Specifically, a high Fama-French multi-factor dynamic conditional alpha suggests that the stock is likely to consistently outperform the broader stock market benchmarks such as S&P 500, Dow Jones, Nasdaq, Russell 3000, MSCI USA, and MSCI World etc. Since March 2023, our proprietary alpha stock signals retain U.S. Patent and Trademark Office (USPTO) fintech patent protection, approval, and accreditation for 20 years. Our homepage and blog articles provide more details on this proprietary alpha stock market investment model with robust long-term historical backtest evidence.

Sharpe-Lintner-Black CAPM alpha: 2.57%

Fama-French (1993) 3-factor alpha: 3.32%

Fama-French-Carhart 4-factor alpha: 4.13%

Fama-French (2015) 5-factor alpha: 4.97%

Fama-French-Carhart 6-factor alpha: 5.76%

Dynamic conditional 6-factor alpha: 11.30% (as of September 2025)

As of September 2025, we have updated all of the cloud databases available on our AYA fintech network platform. The latest update spans our proprietary alpha stock signals, stock pages, descriptions, keywords, news feeds, key financial ratios, and financial statements. At both annual and quarterly frequencies, these up-to-date financial statements include the balance sheets, cash flow statements, and income statements for almost 6,000+ U.S. stocks, ADRs, and equity market funds on NYSE, NASDAQ, and AMEX. With U.S. patent accreditation and protection for 20 years, our AYA fintech network platform provides proprietary alpha stock signals and personal finance tools for stock market investors, traders, fund managers, and many more. We continue to publish new analytic reports, ebooks, essays, research articles, business book summaries, and blog posts. Through this continual content curation, we delve into topical issues in global macro finance, trade, both fiscal and monetary stimulus, financial stability, and technological advancement around the world. We can help empower stock market investors through technology, education, and social integration.

We apply an eclectic style in our written work. In economics, we integrate new classical monetarism, new Keynesianism, and supply-side structural reforms into our analysis. In politics, we combine realism, liberalism, and constructivism into our analysis. Each school of thought provides different but complementary insights, viewpoints, and perspectives. This eclectic style empowers stock market investors worldwide to mull over multiple fundamental forces, economic factors, and political considerations in light of global peace and prosperity. Our written work includes regular analytic reports, ebooks, essays, book reviews, research surveys, and many other long-form blog articles. With these efforts, we attempt to establish our own industry authority in global macro asset management.

President Trump refreshes fiscal fears and sovereign debt concerns through the One Big Beautiful Bill Act.

President Trump poses new threats to Fed Chair monetary policy independence again.

What are the legal origins of President Trump’s recent tariff policies?

https://ayafintech.network/blog/mainstream-legal-origins-of-recent-trump-tariffs/

Central banks continue to weigh the monetary policy trade-offs between output and inflation expectations and macro-financial stress conditions.

Is higher stock market concentration good or bad for stock market investors, traders, index funds, and Corporate America (specifically the Magnificent 7 American tech titans such as Meta, Apple, Google, Google, Google, Nvidia, and Tesla (also known as MANGANT))?

Geopolitical alignment often remakes, reshapes, and reinforces asset market fragmentation in the broader context of financial deglobalization.

What is our asset management strategy?

https://ayafintech.network/blog/ayafintech-network-platform-update-notification/

What are our most recent blog posts, podcasts, ebooks, research articles, analytic reports, and other online resources?

What are our primary product features and social media services?

https://ayafintech.network/blog/ayafintech-network-platform-seo-transformation-notification/

Our proprietary alpha stock investment model outperforms the mainstream stock market indexes such as S&P 500, Dow Jones, Nasdaq, NYSE, MSCI USA, and MSCI World etc in recent years.

Google ($GOOG) stock page with proprietary alpha estimates:

https://ayafintech.network/stock/GOOG/

Google ($GOOG) stock page with financial statistics:

https://ayafintech.network/stock-ratio/GOOG/

Google ($GOOG) stock page with financial statements:

https://ayafintech.network/stock-statement/GOOG/

Google ($GOOG) financial news from Yahoo Finance:

https://finance.yahoo.com/quote/GOOG/news/?p=GOOG

Google ($GOOG) financial news from Google Finance:

https://www.google.com/search?q=NASDAQ:GOOG

Google ($GOOG) financial news from MarketBeat:

https://www.marketbeat.com/stocks/NASDAQ/GOOG/news/

Google ($GOOG) financial news from Barchart:

https://www.barchart.com/stocks/quotes/GOOG/news

As the top-notch financial economist, we make our best efforts to conduct this comprehensive fundamental analysis of Alphabet Google (U.S. stock symbol: $GOOG) as one of the Magnificent 7 tech titans in America.

Alphabet Inc (U.S. stock symbol: $GOOG) serves as the parent company for Google and various Other Bets. As one of the Magnificent 7 tech titans, this high-tech conglomerate represents a colossal force in the global technology landscape primarily due to its pervasive influence in online advertisement, cloud computation, and a broad spectrum of new technological innovations. For our practical purposes, we refer to the tech titan as both Alphabet and Google. Our comprehensive fundamental analysis posits that Google retains exceptionally robust economic moats primarily from its unique data-driven competitive advantages, network effects, and new strategic assets in Artificial Intelligence (AI) multi-modal models such as Gemini, Imagen, Veo, Vertex, NotebookLM, AlphaFold, GNoME, TensorFlow, and Google AI Studio etc. The company demonstrates formidable financial health and operational performance with vast cash stockpiles and stable, robust, and recurrent free cash flows from the dominant Google search and online advertisement business segments. This unique cash capacity supports Google’s strategic investments in new, nascent, and high-growth areas such as Google Cloud Platform (GCP) and its broader portfolio of Other Bets.

However, Alphabet is not without significant risks, trade tensions, and new challenges for the foreseeable future. In North America and Europe, some recent regulatory antitrust investigations probe into Google’s market dominance, particularly in online search and digital advertisement, and this intense regulatory scrutiny may lead to fines, penalties, structural changes in anti-competitive business practices, and even regulatory remedies in terms of new stringent laws, rules, and regulations such as the Digital Markets Act (DMA) and General Data Protection Regulation (GDPR) in Europe as well as the California Consumer Privacy Act (CCPA) in America. While the core Google cloud services and smart software solutions remain highly profitable, the long-term investments in Other Bets often require substantial capital expenditures (CapEx), R&D outlays, and potential mergers and acquisitions (M&A). Although these new strategic moves provide significant optionality for future value creation, these investments sometimes dilute both profits and free cash flows for the parent company.

Our comprehensive fundamental analysis deep-dives into Google’s core business segments, competitive pressures, financial performance, stock market valuation, and a thorough assessment of the tech titan’s medium-term risks, threats, strengths, and opportunities. Our analysis suggests that Google represents a high-quality tech titan with robust competitive advantages and substantial long-term growth options. Google’s current stock market valuation reflects a complex interplay of (1) core profitability from the core online search and online ad business segments, (2) the high growth trajectory of the AI-driven business segments, and (3) the speculative but potentially transformative value of Other Bets. In light of all of these fundamental forces, Google continues to face fierce competitive pressures and regulatory headwinds in some strategic sectors. Serious stock market investors who weigh the trade-offs, pros, and cons of the tech titan should better understand Google’s core competitive advantages against the external risks, threats, trade tensions, regulatory pressures, and competitive dynamics. Our comprehensive fundamental analysis now appreciates the strategic long-term vision in support of Google’s core business operations, AI-driven next-generation technological advances, and disruptive innovations in the next decade.

The parent company, Alphabet, officially started as a major corporate reorganization of Google in October 2015. Today, Alphabet stands as one of the biggest, most profitable, and most influential high-tech conglomerates North America, Europe, Asia, and many other parts and regions of the world. In support of Google’s core business operations outside online search, advertisement, and AI-driven cloud computation, this major reorganization provides greater transparency, autonomy, and financial flexibility to the tech titan’s diverse range of core business segments. As Google continues to secure its dominant market leadership in online search, advertisement, and AI-driven cloud computation, the other business segments focus on their primary missions to pursue high-risk, high-reward, and long-run ventures in Other Bets. More broadly, the parent company, Alphabet, seeks to organize the world’s online information in useful, practical, and universally accessible forms such as web text, audio, video, imagery, animation, and virtual reality (VR). The Google co-founders Larry Page and Sergey Brin continue to drive the tech titan’s strategic position, vision, and product development today.

Alphabet's organizational structure bifurcates into 2 primary business segments: Google and Other Bets. The former spans the vast majority of the tech titan’s multiple sales streams, profits, and free cash flows, and this first primary business segment includes strategic assets such as Google Search, Advertisement, Android, Chrome, Google Play, YouTube, Google Cloud, Google Maps, and Google's hardware products. These hardware products span Google Pixel (smartphones, laptops, tablets, and earbuds etc), Google Nest (smart home devices such as speakers, displays, thermostats, and cameras), Fitbit human-health-and-fitness trackers, Chromebooks, and Chromecasts.

The second segment for Other Bets spans a diverse range of early-stage, high-risk, high-reward, and long-term audacious ventures such as Waymo (autonomous robotaxi technology), Verily and Calico (healthcare), DeepMind (state-of-the-art AI research), and many other experimental technological advances. These new advances help address significant global challenges with new niche market paradigms. This strategic separation underscores Alphabet's unique approach to tapping into disruptive innovations. As a result, this approach balances the formidable scale, cost efficiency, and profitability of Google’s core business operations with a Silicon Valley approach to incubating numerous next-generation disruptive innovations, technological advancements, and blue-ocean market strategies.

As of its recent disclosures, Alphabet commands a hefty and impressive multi-trillion-dollar stock market capitalization. This fact places Alphabet among the most valuable public corporations worldwide. The American stock trades under the dual stock symbols $GOOG (Class C capital stock with no shareholder votes) and $GOOGL (Class A common stock with shareholder votes). This dual class stock structure reflects Alphabet’s current cash capacity, financial stability, and systemic importance in the new global data economy. Also, this dual class stock structure serves as a major cornerstone for many institutional investors and retail investors. Investor perceptions typically oscillate between broader admiration for the tech titan’s innovative prowess and market dominance as well as apprehension with respect its exposure to regulatory investigations, antitrust concerns, and speculative Other Bets. Hence, our comprehensive fundamental analysis of the tech titan necessitates a more granular assessment of these complex components.

Alphabet's sales streams overwhelmingly concentrate in the current Google search engine and its adjacent AI-driven cloud services and smart software solutions. We can disaggregate Google into several key pillars of sales streams. We seek to better understand each of these core components in support of Google’s strategic position, vision, competitive dynamism, and growth trajectory for the foreseeable future.

A. Google Search

This core business segment serves as the bedrock of both Google’s financial success and competitive moat. Google Search holds an extremely high global market share of 85% to 95% in most countries. Hence, Google is the de facto gateway to the Internet for billions of users worldwide. For Google Search, the other core component primarily refers to online sales streams from non-search assets such as Android, Google Play, Google Maps, and many other websites for better Google search user experiences in accordance with the gold standards: E-E-A-T (experience, expertise, authority, and trustworthiness).

1. Dominance and Monetization Model:

Google's dominance arises from a virtuous cycle: superior search results attract more users; more usage generates more data; more data allows for the further refinement of search algorithms; and this refinement leads to even better search results. This network effect is immensely powerful. Monetization primarily occurs through Google Ads (formerly AdWords and AdSense), where online advertisers bid on keywords to display highly relevant ads alongside search results (Search Ads) or across a vast cloud network of both third-party websites and mobile apps (Display Ads). The pay-per-click (PPC) model ensures that online advertisers pay only when users click on the respective online ads. This PPC monetization model constantly aligns almost real-time incentives with measurable returns on capital investments (ROI).

2. Competitive Landscape:

As Google's search dominance is almost monopolistic, several new market entrants, rivals, and competitors still struggle to attract more users worldwide. These alternative search engines include Microsoft Bing, DuckDuckGo, and Brave Search. Each of these search engines typically holds low single-digit market shares. For Google, the true competition often arises from indirect search engines such as Amazon for product search, Yelp for local business search, and TikTok for youth culture search. In recent years, some new competition stems from social media platforms such as Facebook, Instagram, Snapchat, Reddit, Pinterest, and LinkedIn etc. However, none replicate the breadth, depth, and ubiquity of Google's general-purpose search engine.

3. Technological Moat:

Google continues to be a major global market leader in AI cloud services, smart software solutions, and machine-learning (ML) algorithms. These technological advances serve as powerful strategic assets, and these strategic assets combine to comprise a core component of the Google search engine’s superiority. In recent years, Google has successfully embedded new neural networks and many other state-of-the-art ML algorithms such as Rank Brain, BERT, MUM, and Passage Rank etc. All of these algorithms empower the Google search engine to better understand natural languages, user intents, and contextual backgrounds. In turn, these new features further provide increasingly helpful, useful, and accurate search results. For instance, these new features have led to AI Overviews, Search Snippets, Knowledge Panels, and People Also Ask Questions etc in addition to the classic 10 blue links on the first page of Google Search. Google processes literally trillions of searches per day. This sheer volume of data fuels the new AI models. As a result, the new search features create an insurmountable data advantage for Google. Also, this data advantage underpins Google’s ad-target dynamic capabilities. As a result, Google Search often delivers higher measurable returns on capital investments (ROI) for online advertisers. These unique dynamic capabilities help Google secure better advertiser loyalty, stickiness, and brand recognition.

4. Future Growth:

For Google Search, future growth vectors include better human voice search monetization, Gen AI integration for search user experience optimization, broader global expansion outside North America and Europe, and deeper integration with local search, e-commerce, and user communication. In recent years, global macro financial conditions combine with Google’s next-generation disruptive innovations in online ad modes, targets, and formats to accelerate Google Search sales revenue growth worldwide.

B. YouTube Ads

YouTube stands as the world's largest online video platform. In recent years, YouTube has become a major cultural phenomenon for Google Search. In addition, YouTube serves as a significant online ad powerhouse for Google.

1. Platform Dominance and User Engagement:

YouTube boasts billions of users globally who consume billions of hours of video clips per day. This video content ranges across entertainment, education, news, and user-specific video clips etc. YouTube’s major strength rests in its diverse content library, broad creator ecosystem, and accessibility across smart devices (mobile, desktop, laptop, and TV etc). The online platform benefits substantially from powerful network effects. As more creators attract more viewers, these extra viewers attract more advertisers, and these advertisers serve as new creators in a virtuous cycle.

2. Online Ad Model and Creator Economy:

YouTube's primary sales streams span video advertisements. In this space, advertisers display YouTube online ads before, during, or after video clips. Alternatively, some of the YouTube online ads serve as banner ads on video clips. YouTube shares a significant portion of sales streams with video content creators. This vibrant creator economy further incentivizes high-quality video content production. In support of this new creator economy, YouTube’s online ad model has democratized video content creation, curation, and distribution worldwide. Today, YouTube serves as a central pillar of the online media landscape in many different parts and regions of the world.

3. Competition:

For online video engagement, the global competitive landscape is quite fierce for YouTube. In recent years, new market entrants, rivals, and competitors include Facebook, Instagram, TikTok, Netflix, Apple TV, Disney+, Amazon Prime Video, Alibaba, Tencent, Baidu, Bilibili, and iQiyi etc. In response, YouTube has introduced both short-form and long-form video clips, films, movies, and animations.

4. Future Growth:

Growth levers for YouTube expand the current global audience outside North America and Europe, enhance better monetization of short-form video clips (YouTube Shorts), capture a larger market share of traditional large-screen TV ad budgets (Connective TV (CTV) for YouTube), and further experiment with new subscription models (YouTube Premium, YouTube Music, and NFL Sunday Ticket etc). These strategic initiatives help YouTube further diversify multiple sales streams beyond online ads. In recent years, Gen AI integration further refines YouTube’s dynamic capabilities for better online ad targets, video content recommendations, and monetization opportunities.

C. Google Cloud (GCP)

Google Cloud Platform (GCP) is Alphabet's core business segment for enterprise cloud computation. This online platform provides infrastructure-as-a-service (IaaS), platform-as-a-service (PaaS), and software-as-a-service (SaaS) smart solutions to businesses in many different countries worldwide.

1. Market Position and Growth Trajectory:

GCP is a major challenger in the hyper-scale cloud market. In terms of their relative market shares, GCP trails Amazon Web Services (AWS) and Microsoft Azure. However, GCP has demonstrated steady, robust, and high double-digit sales growth rates in recent years. This core business segment significantly outpaces total sales growth across the tech titan. For GCP, this empirical fact reflects strong global expansion, user acquisition, and brand recognition due to Google’s recent market power, technological prowess, and unique product differentiation in almost all sorts of AI-driven cloud services and smart software services.

2. Strategic Importance:

GCP is strategically vital for Google’s long-term future. GCP diversifies Alphabet's sales streams away from Google’s heavy reliance on online ads, addresses the massive global enterprise cloud market, and further leverages the tech titan’s core competencies in global data centers, Gen AI models, software infrastructure systems, dense neural network, and many other machine-learning (ML) algorithms etc. In recent years, GCP creates powerful synergies by allowing Google to scale up more efficiently its own internal software products across many different cloud data centers worldwide.

3. Investment and Differentiation:

Google has invested heavily in GCP and continues to build out its own global network of data centers, fiber-optic cables, and smart software engineers worldwide. Today, GCP further differentiates itself through global leadership in AI-driven smart software solutions, cloud services, dense neutral networks, machine-learning (ML) algorithms (BigQuery, TensorFlow, and Google AI Studio etc), data analytics, Kubernetes container orchestration, and another robust strategic focus on open-source technological advancements.

4. Path to Profitability:

Due to Google’s aggressive capital investments in cloud infrastructure for many years, GCP operated at significant losses to gain traction on the global stage. In recent years, GCP has demonstrated a clear path to profitability, starts to report operating profits, and continues to emphasize significant improvements in scale economies and customer acquisitions in many countries worldwide. Today, this profitability serves as a crucial cornerstone for investor confidence and the tech titan’s current stock market valuation.

D. Other Bets

This other business segment serves as Alphabet's venture arm. Specifically, this business segment houses a wide array of long-term speculative projects. In accordance with what the co-founders Larry Page and Sergey Brin emphasize as part of Google’s corporate culture, these long-term projects aim at pioneering smart solutions for grand problems, challenges, and even new industries. Although these Other Bets continue to be financially modest in sales revenue generation with low and stable operating losses, these speculative projects serve as crucial moon shots for better understanding Alphabet’s strategic vision for disruptive innovations and technological advancements in the long run.

1. Strategic Purpose:

Other Bets continue to embody Google's commitment to a rare unique moonshot mindset. The basic rationale is for Google to invest early in disruptive innovations, and these speculative moonshot projects could become multi-billion-dollar industries in several decades. In turn, this moonshot mindset leverages Google’s cash capacity and scientific expertise. Specifically, this moonshot mindset provides a new global macro environment for new disruptive innovations, especially when these disruptive innovations might not fit within Google’s core business operations.

2. Key Examples of Other Bets:

Waymo: Waymo serves as a global leader in autonomous robotaxi technology. This long-term moonshot project aims to commercialize fully autonomous vehicles for ride-hailing services, robotaxis, and logistics. Today, Waymo operates driverless services in several cities such as San Francisco, Los Angeles, Phoenix, Austin, and Atlanta.

Verily and Calico: Verily and Calico serve as Google’s new subsidiaries in life sciences, biomedical diagnoses, medications, treatments, and therapies. These companies address chronic diseases such as heart diseases, diabetes, Alzheimer’s and Parkinson’s diseases, and the modern science of longevity.

DeepMind: DeepMind is a world-class AI research lab. This company pushes the boundaries of AI-driven dynamic capabilities with AlphaGo and AlphaFold. In recent years, AlphaGo mastered the ancient Chinese game of Go, defeated several world champions, and inspired revolutionary AI systems. With AlphaFold, biomedical scientists help accelerate the major identification of new compounds in better clinical trials. Specifically, AlphaFold analyzes how some sequence of amino acids folds into the particular shape for some sort of protein. In essence, AlphaFold helps identify the more complex set of rules for some sequence of amino acids to fold biomedically into the same shape for some sort of protein in the human body. With tremendous success worldwide, AlphaFold accelerates and so revolutionizes the new wave of innovative drug discovery in support of smarter, faster, better, and leaner AI-driven medications, treatments, and therapies. In October 2024, Google DeepMind CEO and Co-Founder Sir Demis Hassabis and DeepMind Director Dr John Jumper won the Nobel Prize in Chemistry for their recent design and development of AlphaFold for predicting more than 6 hundred million structures of different proteins from their amino acid sequences. Hassabis and Jumper shared this Nobel Prize with Dr David Baker who worked on computational protein design.

Google Fiber: Google Fiber helps provide high-speed Internet access in many countries, parts, and regions of the world.

Sidewalk: Sidewalk aims to attain disruptive innovations and technological advancements for urban infrastructure, energy, and transport etc.

3. Financial Implications:

Other Bets consistently report substantial operating losses due to hefty R&D outlays, capital investments, and long commercialization timelines. Over many years, Google’s highly profitable core business segments help offset these operating losses from Other Bets. For stock market valuation, many investment banks and other institutional investors often regard Other Bets as a drag on near-term EPS growth prospects, profits, and cash flows for Google. Other Bets represent significant call options on future technological advancements and disruptive innovations. Some of these long-term projects may unlock entirely new sales streams for new strategic sectors worldwide.

Google operates at the nexus of several dynamic and fiercely competitive strategic sectors. Google’s strategic position shapes its rare unique ability to maintain tech-savvy dominance in some well-known global markets for online search, cloud, and software etc. At the same time, Google seeks to capture additional sales streams in new nascent niche markets worldwide.

A. Online Advertisement

1. Market Dynamics: The global online ad market is vast and continues to grow rapidly in light of the paradigm shift of advertisement budgets from traditional media to online platforms, especially mobile video ads on Google, Meta, and Amazon etc. Programmatic online ads, data-driven targets, and performance metrics serves as the key mega trends in this space. Today, Google, Meta, and Amazon form a functional oligopoly with a significant majority of global online ad sales.

2. Competitive Advantages: Google continues to enjoy global reach (across Search, Cloud, YouTube, Android, and its online ad display network), vast proprietary amounts of user data for more precise ad targets (search queries, YouTube watch history, location data, and app usage), and AI/ML-driven dynamic capabilities as formidable economic moats.

3. Threats:

Privacy Changes: Through Privacy Sandbox, Google continues to invest heavily in privacy protection for better online ad targets. Further, Google needs to better adapt to regulatory headwinds (GDPR and CCPA) and platform changes (Apple’s app-tracking transparency with third-party cookie deprecation). These structural shifts can cause adverse ripple effects on the efficacy, cost efficiency, and profitability of Google’s online ad products.

Regulatory Scrutiny: In North America and Europe, antitrust investigations globally target Google's online ad tech stacks and search ad practices. These antitrust concerns might lead to involuntary divestitures, hefty fines and penalties, or even structural changes in anti-competitive business practices.

Competition: Google faces fierce competition from cloud service providers (Amazon Braket and Microsoft Azure), online ad platforms (Meta, TikTok, Snapchat, Reddit, and Pinterest), e-commerce platforms (Amazon and Alibaba), and new market entrants such as Tencent, Baidu, Netflix, Bilibili, and iQiyi etc. These new market entrants, rivals, and competitors provide alternative avenues for online advertisers to reach global audiences for specific products, services, and demographic profiles.

B. Cloud Computation

The global cloud market often requires massive capital expenditures, competitive prices, constant product upgrades, hyper scale economies, and aggressive user acquisitions. Google Cloud needs to leverage smart software solutions, state-of-the-art machine-learning (ML) algorithms, and data analytics to scale up the tech titan’s AI-driven cloud services worldwide. In the meantime, Google Cloud faces fierce competition from Amazon Braket and Microsoft Azure.

C. Artificial Intelligence

1. Google's Foundational Role: Google has been at the forefront of AI research for decades. The tech titan has made seminal contributions across machine-learning (ML) algorithms, dense neural networks, natural language processes (NLP), and computer vision etc. Google not only develops AI-driven smart software solutions as new products, but the tech titan also embeds AI systems across its entire ecosystem from search engine optimization (SEO) to YouTube video recommendations and technical enhancements for Android, Google Play, Chrome, Waymo, DeepMind, Google Maps, and Google Photos etc. The recent strategic acquisition of DeepMind shines new light on the key priorities for AI-driven cloud services and smart software solutions across the vast majority of Google’s core business segments.

2. Competitive Advantage: Google’s AI competitive advantage arises from its vast proprietary datasets, world-class AI research talents, and immense cloud data centers with TPUs and GPUs worldwide. This internal infrastructure allows the tech titan to scale up state-of-the-art AI models, systems, robots, agents, and avatars on the global stage.

3. Future Impact: From Gemini, Imagen, and Veo to Notebook LM and Vertex across the full Google AI Studio, the recent rise of Gen AI with large language models (LLM) serves as a significant technological paradigm shift. In recent years, Google continues to aggressively integrate these AI-driven dynamic capabilities into the core products, cloud services, and other smart software solutions. However, the sheer size, scale, and global user adoption of AI models might heighten ethical risks, threats, competitive pressures, and other considerations around online search bias, misinformation, data privacy, and the broader societal impact of Gen AI. Today, these ethical considerations now necessitate robust AI model governance, deployment, and responsible development in the next decade.

D. Autonomous Vehicles (Waymo)

1. Market Dynamics: The global market for autonomous vehicles holds immense long-term growth potential for disrupting urban mobility, transportation, and logistics operations in many different countries. However, this global market faces significant technological hurdles around sensor fusion, real-time navigation, and AI judgment in complex environments. For Google, Waymo still needs to overcome many regulatory challenges from federal, state, and local laws and public acceptance issues.

2. Strategic Position: Many experts now regard Waymo as a global market leader in Level-4 and Level-5 autonomous vehicles. Waymo has accumulated billions of real-world miles to demonstrate a high degree of safety. Waymo has yet to scale up commercial operations in more cities around the world. Waymo requires significant capital investments in vehicle fleets and operational hubs to support the next global expansion into more cities worldwide. Now Waymo faces fierce competition from Tesla, GM Cruise, Rivian, NIO, and BYD.

E. Healthcare (Verily and Calico)

1. Market Dynamics: For biomedical diagnoses, medications, treatments, and therapies, massive growth opportunities arise from the current interplay between healthcare and technology. At Google, Verily focuses on data-driven approaches to healthcare, and Calico targets the modern science of longevity.

2. Challenges: These new ventures, Verily and Calico, face long R&D cycles, stringent FDA approval processes, high capital requirements, and complex ethical considerations. For Google, the new monetization pathways are long-term, slow, and uncertain, but the potential societal impact can be enormous.

Google’s sheer size, scale, and complexity combine to require effective senior leadership, management, and a robust corporate governance framework.

A. Key Leadership

Sundar Pichai (CEO, Alphabet and Google): Pichai oversees all products and platforms for Alphabet and Google. During his tenure, Pichai tends to focus on AI integration across products, cloud services, and other smart software solutions. As Google continues to navigate intense regulatory pressures, Pichai emphasizes product excellence, long-term vision, and strategic alignment.

Ruth Porat (CFO, Alphabet and Google; President, Chief Investment Officer): Porat serves as a highly reputable financial expert. As a British-American financial economist, she is well-known for instilling fiscal discipline into Google’s corporate culture. Porat further focuses on Google’s capital allocation efficiency via the recent share buyback programs. Porat seeks to improve Google’s overall profitability across the core business segments. Today, Porat seeks to better manage capital expenditures in more speculative Other Bets.

Larry Page and Sergey Brin (Co-Founders, Board Members): Although they have strategically chosen to step back from day-to-day management, Page and Brin retain significant influence through their Class B shares with majority votes and their continual presence on the board. Page and Brin embody Google’s original innovative and ambitious moonshot corporate culture.

B. Organizational Culture and Innovation Focus

Google's organizational culture relies on disruptive innovations, software development excellence, and the rare unique moonshot mentality. This moonshot mentality often encourages co-founders and senior managers to take on more risks to provide extensive resources for mergers and acquisitions (M&A), R&D outlays, and capital expenditures (CapEx). In this context, disruptive innovators can often pursue audacious product ideas, lofty goals, and even almost impossible dreams. This corporate culture has been instrumental in driving Google’s recent technological breakthroughs in some strategic sectors and blue-ocean niche markets. In recent years, Google continues to make significant R&D investments in AI-driven cloud services and smart software solutions. In turn, these steady hefty R&D investments reflect the long-term moonshot commitment.

C. Dual-Class Stock Structure

Alphabet maintains a special dual-class stock structure:

Class A Shares ($GOOGL) are in public trade circulation with one vote per share on Nasdaq.

Class B Shares represent 10 votes per share for the co-founders Larry Page and Sergey Brin and some early executive investors.

Class C Shares ($GOOG) are in public trade circulation with non-voting rights on Nasdaq.

This special dual-class stock structure grants Page and Brin effective control over the company's strategic direction, insulates senior management from short-term investor pressures, and further empowers the executive team to pursue long-term growth projects, Other Bets, in new, nascent, and blue-ocean niche markets worldwide. This stock structure has clear advantages for long-term team vision, but this stock structure concentrates corporate power in the co-founders Page and Brin and some early executive investors. At the same time, this special stock structure helps limit the potential power and influence of public shareholders on corporate governance matters.

D. Board of Directors Composition

The Board typically comprises a mix of independent directors with diverse backgrounds in finance, technology, academia, and public policy. The Board's role is critical in overseeing strategic direction, risk management, and executive compensation. Both the co-founders and early executive investors work with independent directors to help better balance institutional knowledge with external board oversight.

E. ESG Considerations

In recent years, Google starts to face greater regulatory scrutiny on Environmental, Social, and Governance (ESG) fronts. Specifically, Google spends billions of dollars on significant energy consumption for training, tuning, and running large-scale AI models across its data centers worldwide. Google balances its near-term energy demands by setting aggressive targets for renewable energy procurement and carbon neutrality in accordance with the new laws, rules, and regulations worldwide in support of better environmental protection in many different countries.

On the social front, Google requires robust privacy protection measures, data controls, and transparent user policies in response to constant pressures from the regulators in North America, Europe, and some parts of East Asia. Also, Google manages vast user content generation on YouTube, NotebookLM, and several other platforms in order to curtail harmful content, discrimination, and misinformation with human moderation teams. In addition, Google makes the best efforts to improve diversity within the tech-savvy workforce.

On the governance front, the dual-class stock structure remains a major point of debate with respect to corporate social responsibility (CSR), shareholder democracy, and executive accountability. Ethical AI advances combine with transparent data protocols to better inform corporate governance matters across Google’s core business segments.

Google’s recent financial performance continues to showcase a powerful mix of both mature and highly profitable core business segments (Google Search, Cloud, Android, and AI Studio etc) and new moonshot ventures (Other Bets).

A. Sales Growth

1. Historical Trends:

Google has consistently delivered strong double-digit sales growth over the past decade primarily due to the global expansion of the current online ad ecosystem. Even as Google’s core business segments seem to have matured in due course, the tech titan’s sheer size, scale, and dominance in online advertisement have helped boost sales growth from year to year.

2. Segment Breakdown:

Across the tech titan’s core business segments, Google Search remains the largest sales stream with steady, stable, and robust growth.

YouTube has been another significant sales growth engine due to the recent structural shift to online video, social media, and Connective TV (CTV).

Google Cloud continues to show the highest sales growth across almost all of the tech titan’s core business segments worldwide. In the cloud space, Google only trails Amazon and Microsoft. Google Cloud now serves as the primary growth engine for a more diverse set of future sales streams worldwide.

Other Bets generate only a few hundred million dollars in annual sales, and these sales streams pale in comparison to the other core business segments within the tech titan. Google’s moonshot mindset supports these long-term speculative projects for future sales streams.

Google derives significant sales from non-U.S. countries. These foreign sales streams provide greater geographic diversification for Google, although some currency fluctuations impact financial results in recent years. Global markets represent new growth opportunities as Internet user adoption rises in many different non-U.S. countries, parts, and regions of the world.

B. Profitability

1. Gross Margins:

Google often achieves high gross margins of 55% to 65% due to the software-centric and data-driven nature of its core cloud, search, and online ad business segments. However, Google faces sharp increases in capital expenditures for data centers, cloud networks, and video content acquisitions for YouTube. These higher costs may eventually reduce Google’s gross margins in the next few years.

2. Operating Profit Margins:

Across Google’s core business segments, the operating profits margins are in the reasonable range of 35% to 40% in recent years. Google specifically enjoys high operating leverage in the AI-driven cloud, online ad, and search business segments. These operating profits and free cash flows often help offset the operating losses from the more speculative projects, Other Bets, in support of new disruptive innovations.

SG&A expenses tend to grow with new sales streams at a slower pace. For this reason, Google enjoys substantial scale economies in the core cloud, search, and online ad business segments.

R&D expenses serve as another major line item for Google’s new disruptive innovations, especially in Gen AI cloud services, search queries, and smart software solutions. In recent years, the vast majority of Google’s R&D expenditures tend to focus on AI-driven cloud services, first-generation quantum computers, and Other Bets.

C. Fortress Balance Sheet

1. Cash Capacity:

Over many years, Google maintains a strong fortress balance with a massive war chest of cash over $100 billion. This cash capacity provides Google with immense financial flexibility for strategic mergers and acquisitions (M&A), R&D outlays, capital expenditures (CapEx), and share repurchases. Today, cash is king in the new data economy. Google keeps this cash capacity as another major competitive advantage for strategic reasons. In support of its fortress balance sheet, Google often keeps low levels of long-term liabilities in comparison to its near-term cash capacity.

2. Google continues to spend heavily on capital expenditures (CapEx) in support of data centers, servers, and cloud networks worldwide. In recent years, these capital investments continue to bolster the global footprint of Google’s core cloud services, search queries, new AI research projects, and even Waymo autonomous vehicle fleets in some major American cities.

3. Google continues to maintain substantial shareholder equity and hefty stock market valuation as a result of many years of hard efforts, profitable core business operations (Google Search, Cloud, and AdSense etc), and new disruptive innovations (Other Bets).

D. Cash Flows

1. Operating Cash Flows (OCF):

Google makes hefty operating cash flows (OCF) from its highly profitable core business segments. This economic moat is a true testament to Google’s AI-driven dynamic capabilities and efficient operations for better monetization.

2. Investing Cash Flows (ICF):

Google often attracts negative substantial investing cash flows (ICF) due to hefty capital expenditures for data centers, cloud networks, fiber optic cables, and servers worldwide. Sometimes Google seeks to acquire lean-startup ventures as part of broader strategic acquisitions, alliances, and partnerships.

3. Financing Cash Flows (FCF):

Google makes new financing cash flows (FCF) to fund significant share repurchases in recent years. Share buyback serves as a key mechanism for Google to return cash capital flows to shareholders with no regular dividends.

4. Free Cash Flows (FCF):

Google continues to be a prolific generator of free cash flows (OCF minus CapEx). Although Google’s recent capital expenditures are high, the operating cash flows are often so large that the tech titan still generates tens of billions in free cash flows (FCF) each year. In turn, these free cash flows further fuel share repurchases, strategic acquisitions, and Other Bets.

E. Key Financial Ratios

ROE and ROA: For Google, these key financial ratios often reflect strong profitability in the reasonable range of high single digits to low double digits across the core business segments (search, cloud, and online advertisement etc). Other Bets still cannot contribute to these returns on shareholder equity funds (ROE) and total assets (ROA).

Debt-to-Equity Ratios and Current Ratios: For Google, these key financial ratios support Google's financial strength, flexibility, and near-term liquidity with relatively low levels of both short-term and long-term liabilities.

A. Stock Price Ratio Analysis:

We compare and contrast Google’s stock market valuation to the respective benchmarks for historical average trends, the other Magnificent 7 tech titans, and high-tech sector benchmarks.

In response to stock market sentiments, sales growth expectations, profit margins, and cash returns to shareholders, Google’s P/E, P/S, and P/B ratios have historically fluctuated in the respective ranges of 25 times to 35 times, 7 times to 8 times, and 8 times to 9 times. For Google, these stock price ratios compare favorably with the respective counterparts for both the other Magnificent 7 tech titans and high-tech sector benchmarks.

B. Enterprise Value Ratio Analysis:

With EV/EBITDA and EV/S ratios, these other financial metrics for enterprise value are useful for comparing tech titans with different capital structures, cash stockpiles, and high-growth core business segments such as Google Search, Google Cloud, and AdSense etc. For Google, these financial metrics compare favorably with the respective counterparts for both the other Magnificent 7 tech titans and high-tech sector benchmarks.

C. Sum-of-the-Parts (SOTP) DCF Valuation Analysis:

For each of Google’s core business segments, we discount the respective future free cash flows to the present, take the sum of these parts, and then subtract the potential total loss due to Other Bets. For AI-driven search queries, online ads, cloud services, and so forth, we can apply discount rates (WACC) in the reasonable range of 7.5% to 10.5% respectively. In comparison to the stock market valuation for the other Magnificent 7 tech titans, Google’s current stock market valuation seems to price in an impressive and exceptional success story with high sales growth expectations across almost all of the core business segments. We can infer from this analysis that Google continues to enjoy a hefty premium in its current stock market valuation both by historical trends and sectoral comparisons to the other Magnificent 7 tech titans.

Despite its formidable financial strengths, competitive advantages, and economic moats, Google faces a wide variety of regulatory risks, concerns, and other external pressures. For Google, the primary regulatory risks revolve around antitrust concerns with respect to the tech titan’s global market dominance in online search (with more than 90% to 95% of Internet search traffic), online advertisement (as part of a functional oligopoly with Meta and Amazon), cloud computation (as part of another oligopoly with Amazon Braket and Microsoft Azure), and Android ecosystem monopolization.

In the meantime, antitrust lawsuits and further investigations remain active in America (Department of Justice (DoJ), Federal Trade Commission (FTC), and state attorneys general), Europe, Britain, India, Australia, and several other countries, regions, and jurisdictions. These regulatory actions could result in significant fines and penalties (multi-billion dollars in past E.U. cases), structural changes to anti-competitive business practices, involuntary spin-offs and divestitures, higher compliance costs, and new laws, rules, and regulations for data safety, privacy protection, and consumer protection, such as General Data Protection Regulation (GDPR) in Europe and California Consumer Protection Act (CCPA) in America.

Google continues to serve as one of the Magnificent 7 tech titans with unique competitive advantages, economic moats, and multiple sales streams worldwide. In the new data economy, Google keeps, secures, refines, and improves the core business segments for online search, online advertisement, and cloud computation. Specifically, Google faces fierce competition from cloud service providers (Amazon Braket and Microsoft Azure), online ad platforms (Meta, TikTok, Snapchat, Reddit, and Pinterest), e-commerce platforms (Amazon and Alibaba), and new market entrants such as Tencent, Baidu, Netflix, Bilibili, and iQiyi etc. These new market entrants, rivals, and competitors provide alternative avenues for online advertisers to reach global audiences for specific products, services, and demographic profiles.

The secondary segments for Other Bets span diverse early-stage, high-risk, and high-reward ambitious ventures such as Waymo (autonomous robotaxi technology), Verily and Calico (healthcare), DeepMind (state-of-the-art AI research), and many other experimental technological advances. These new advances help address significant global challenges with new niche market paradigms. This strategic separation underscores Google’s unique approach to tapping into new disruptive innovations. As a result, this approach better balances the formidable scale, cost efficiency, and profitability of Google’s core business operations with a Silicon Valley approach to incubating numerous next-generation disruptive innovations, technological advancements, and blue-ocean market strategies.

Disclaimer: This analysis is for illustrative purposes and does not constitute investment advice. Investors should conduct their own due diligence, and these investors should consult with professional financial advisors before these investors make any stock investment decisions. Financial data changes rapidly, and this comprehensive fundamental analysis relies on the recent complete assessment of the public company’s key competitive advantages, fundamental forces, technological advancements, and even external government interventions.

With U.S. fintech patent approval, accreditation, and protection for 20 years, our AYA fintech network platform provides proprietary alpha stock signals and personal finance tools for stock market investors worldwide.

We build, design, and delve into our new and non-obvious proprietary algorithmic system for smart asset return prediction and fintech network platform automation. Unlike our fintech rivals and competitors who chose to keep their proprietary algorithms in a black box, we open the black box by providing the free and complete disclosure of our U.S. fintech patent publication. In this rare unique fashion, we help stock market investors ferret out informative alpha stock signals in order to enrich their own stock market investment portfolios. With no need to crunch data over an extensive period of time, our freemium members pick and choose their own alpha stock signals for profitable investment opportunities in the U.S. stock market.

Smart investors can consult our proprietary alpha stock signals to ferret out rare opportunities for transient stock market undervaluation. Our analytic reports help many stock market investors better understand global macro trends in trade, finance, technology, and so forth. Most investors can combine our proprietary alpha stock signals with broader and deeper macro financial knowledge to win in the stock market.

Through our proprietary alpha stock signals and personal finance tools, we can help stock market investors achieve their near-term and longer-term financial goals. High-quality stock market investment decisions can help investors attain the near-term goals of buying a smartphone, a car, a house, good health care, and many more. Also, these high-quality stock market investment decisions can further help investors attain the longer-term goals of saving for travel, passive income, retirement, self-employment, and college education for children. Our AYA fintech network platform empowers stock market investors through better social integration, education, and technology.

Andy Yeh (online brief biography)

Co-Chair

AYA fintech network platform

Brass Ring International Density Enterprise ©

President Trump refreshes American fiscal fears and sovereign debt concerns through the One Big Beautiful Bill Act.

Podcast: https://bit.ly/4eSEU1w

President Trump poses new threats to Fed Chair monetary policy independence again.

Podcast: https://bit.ly/4ebeoQH

What are the mainstream legal origins of President Trump’s tariff policies?

Podcast: https://bit.ly/3ZnNMG7

Article: https://ayafintech.network/blog/mainstream-legal-origins-of-recent-trump-tariffs/

American exceptionalism often turns out to be the heuristic rule of thumb for better economic growth, low and stable inflation, full employment, and macro-financial stability.

Podcast: https://bit.ly/4iuWuJ9

In the broader modern monetary policy context, central banks learn to weigh the trade-offs between output and inflation expectations and macro-financial stress conditions.

Podcast: https://bit.ly/42SwrXG

Is higher stock market concentration good or bad for Corporate America?

Podcast: https://bit.ly/3F1fpgN

Geopolitical alignment often reshapes and reinforces asset market fragmentation in the broader context of financial deglobalization.

Podcast: https://bit.ly/3ZpGMcD

The global cloud infrastructure helps accelerate the next high-tech revolutions in electric vehicles (EV), virtual reality (VR) headsets, artificial intelligence (AI) online services, and the metaverse.

Podcast: https://bit.ly/47pDk3z

How can generative AI tools and LLMs help enhance human productivity?

Podcast: https://bit.ly/4elAFKv

Both BYD and Tesla have become serious global manufacturers of electric vehicles (EV) worldwide.

Podcast: https://bit.ly/3BgL0sL

Article: https://ayafintech.network/blog/mainstream-technological-advances-in-the-global-auto-industry/

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fundamental analysis of Meta Platforms (U.S. stock symbol: $META).

Podcast: https://bit.ly/3Vt1Sng

Article: https://ayafintech.network/blog/gen-ai-fundamental-analysis-of-meta-platforms-meta/

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fundamental analysis of Alphabet Google (U.S. stock symbol: $GOOG).

Podcast: https://bit.ly/46yuX5T

Article: https://ayafintech.network/blog/gen-ai-fundamental-analysis-of-alphabet-google-goog/

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fundamental analysis of Nvidia (U.S. stock symbol: $NVDA).

Podcast: https://bit.ly/3Kh8Qta

Article: https://ayafintech.network/blog/gen-ai-fundamental-analysis-of-nvidia-nvda/

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fundamental analysis of Tesla (U.S. stock symbol: $TSLA).

Podcast: https://bit.ly/4nRGLqy

Article: https://ayafintech.network/blog/gen-ai-fundamental-analysis-of-tesla-tsla/

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fundamental analysis of Apple (U.S. stock symbol: $AAPL).

Podcast: https://bit.ly/4ndXt3K

Article: https://ayafintech.network/blog/gen-ai-fundamental-analysis-of-apple-aapl/

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fundamental analysis of Amazon (U.S. stock symbol: $AMZN).

Podcast: https://bit.ly/46fUWQE

Article: https://ayafintech.network/blog/gen-ai-fundamental-analysis-of-amazon-amzn/

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fundamental analysis of Microsoft (U.S. stock symbol: $MSFT).

Podcast: https://bit.ly/46biKoG

Article: https://ayafintech.network/blog/gen-ai-fundamental-analysis-of-microsoft-msft/

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fundamental analysis of IonQ (U.S. stock symbol: $IONQ).

Podcast: https://bit.ly/3IXfnss

Article: https://ayafintech.network/blog/gen-ai-fundamental-analysis-of-ionq-ionq/

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fundamental analysis of Oracle (U.S. stock symbol: $ORCL).

Podcast: https://bit.ly/47fF94u

Article: https://ayafintech.network/blog/gen-ai-fundamental-analysis-of-oracle-orcl/

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fundamental analysis of Netflix (U.S. stock symbol: $NFLX).

Podcast: https://bit.ly/4q7cTss

Article: https://ayafintech.network/blog/gen-ai-fundamental-analysis-of-netflix-nflx/

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fundamental analysis of Palantir (U.S. stock symbol: $PLTR).

Podcast: https://bit.ly/4gZTiWO

Article: https://ayafintech.network/blog/gen-ai-fundamental-analysis-of-palantir-pltr/

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fundamental analysis of AT&T (U.S. stock symbol: $T).

Podcast: https://bit.ly/4q2VfG4

Article: https://ayafintech.network/blog/gen-ai-fundamental-analysis-of-att-t/

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fundamental analysis of T-Mobile (U.S. stock symbol: $TMUS).

Podcast: https://bit.ly/4mV2ays

Article: https://ayafintech.network/blog/gen-ai-fundamental-analysis-of-t-mobile-tmus/

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fundamental analysis of Cisco Systems (U.S. stock symbol: $CSCO).

Podcast: https://bit.ly/48gGjxM

Article: https://ayafintech.network/blog/gen-ai-fundamental-analysis-of-cisco-systems-csco/

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fundamental analysis of AMD (U.S. stock symbol: $AMD).

Podcast: https://bit.ly/470BoPm

Article: https://ayafintech.network/blog/gen-ai-fundamental-analysis-of-amd-amd/

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fundamental analysis of Salesforce (U.S. stock symbol: $CRM).

Podcast: https://bit.ly/46LpXvZ

Article: https://ayafintech.network/blog/gen-ai-fundamental-analysis-of-salesforce-crm/

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fundamental analysis of Uber Technologies (U.S. stock symbol: $UBER).

Podcast: https://bit.ly/4nOTVFm

Article: https://ayafintech.network/blog/gen-ai-fundamental-analysis-of-uber-technologies-uber/

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fundamental analysis of IBM (International Business Machines) (U.S. stock symbol: $IBM).

Podcast: https://bit.ly/4ohozqT

Article: https://ayafintech.network/blog/gen-ai-fundamental-analysis-of-ibm-ibm/

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fundamental analysis of Intuit (U.S. stock symbol: $INTU).

Podcast: https://bit.ly/4ohAKUE

Article: https://ayafintech.network/blog/gen-ai-fundamental-analysis-of-intuit-intu/

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fundamental analysis of Texas Instruments (U.S. stock symbol: $TXN).

Podcast: https://bit.ly/4nVq0Ly

Article: https://ayafintech.network/blog/gen-ai-fundamental-analysis-of-texas-instruments-txn/

Industry Analysis

AYA ebook hyperlink: https://bit.ly/4hxvrwy

AYA ebook length: 283 pages (21 chapters and 122,241 words).

Stock Synopses for the Top 20 Tech Titans

AYA ebook hyperlink: https://bit.ly/3VR7Ka5

AYA ebook length: 449 pages (20 chapters and 168,639 words).

Top-Tier Self-Improvement Book Reviews

AYA ebook hyperlink: https://bit.ly/46Iqkrc

AYA ebook length: 133 pages (10 chapters and 54,529 words).

Bidenomics

AYA ebook hyperlink: https://bit.ly/44CdDu7

AYA ebook length: 206 pages (18 chapters and 90,405 words)

Trump Economic Reforms

AYA ebook hyperlink: https://bit.ly/2ZwYfiE

AYA ebook length: 507 pages (21 chapters and 97,854 words)

Modern management macro themes, insights, and worldviews

AYA ebook hyperlink: https://bit.ly/2IezdQh

AYA ebook length: 225 pages (top 40 recent management book reviews)

Economic science macro themes, insights, and worldviews

AYA ebook hyperlink: https://bit.ly/3FaegyI

AYA ebook length: 220 pages (top 40 recent economic science book reviews).

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-08-25 12:33:00 Saturday ET

President Trump warns Google, Facebook, and Twitter that these tech titans now tread on troublesome territory. Specifically, Trump accuses Google of rigging

2019-11-26 11:30:00 Tuesday ET

AYA Analytica finbuzz podcast channel on YouTube November 2019 In this podcast, we discuss several topical issues as of November 2019: (1) The Trump adm

2018-12-18 10:38:00 Tuesday ET

President Trump threatens to shut down the U.S. government in 2019 if Democrats refuse to help approve $5 billion public finance for the southern border wal

2019-08-18 11:33:00 Sunday ET

House Judiciary Committee summons senior executive reps of the tech titans to assess online platforms and their market power. These companies are Facebook,

2018-06-02 09:35:00 Saturday ET

The finance ministers of Britain, Canada, France, Germany, Italy, and Japan team up against U.S. President Donald Trump and Treasury Secretary Steven Mnuchi

2019-11-17 14:43:00 Sunday ET

New computer algorithms and passive mutual fund managers run the stock market. Morningstar suggests that the total dollar amount of passive equity assets re