2018-08-09 16:36:00 Thu ET

stock market gold oil stock return s&p 500 asset market stabilization asset price fluctuations stocks bonds currencies commodities funds term spreads credit spreads fair value spreads asset investments

President Trump applies an increasingly bellicose stance toward the Iranian leader Hassan Rouhani as he rejects a global agreement to curb Iran's nuclear program. As Trump withdraws from the previous multilateral Iran nuclear deal, the U.S. plans to carry out its next implementation of stringent economic sanctions on Iran in late-2018. The Trump administration appears to apply the same strategy of draconian economic sanctions on North Korea to the Iran-U.S. nuclear negotiations. Rouhani consequently threatens to disrupt global oil shipments through the Strait of Hormuz, which serves as a strategic waterway for oil exports from the middle east.

Numerous stock market experts and pundits point out that the world would witness a sharp spike in oil prices toward $90-$100 per barrel if Iran decides to shut down the trade route. As one of the Top 5 oil supply countries, Iran may adversely affect the global energy transmission and deployment. An oil price spike often translates into higher costs of both consumption and production.

Higher inflation then induces central banks to raise interest rates to better balance the inexorable trade-off between price stability and employment. From a pragmatic perspective, the resultant energy price increases render international monetary policies less effective due to greater cost gyrations.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-02-27 09:35:00 Tuesday ET

Fed's new chairman Jerome Powell testifies before Congress for the first time. He vows to prevent price instability for U.S. consumers, firms, and finan

2018-11-27 10:37:00 Tuesday ET

Warren Buffett offloads a few stocks from the Berkshire Hathaway portfolio in mid-November 2018. The latest S.E.C. report shows that the Oracle of Omaha sol

2017-11-13 07:42:00 Monday ET

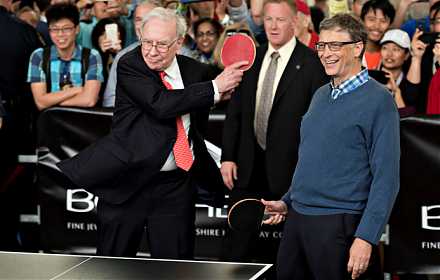

Top 2 wealthiest men Bill Gates and Warren Buffett shared their best business decisions in a 1998 panel discussion with students at the University of Washin

2017-05-25 08:35:00 Thursday ET

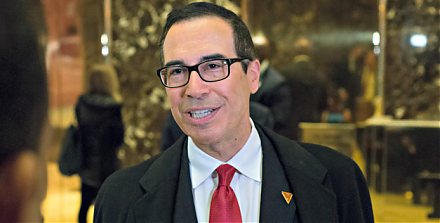

Treasury Secretary Steve Mnuchin has released a 147-page report on financial deregulation under the Trump administration. This financial deregulation seeks

2020-03-12 09:32:00 Thursday ET

Google CEO Eric Schmidt and his co-authors show the innovative corporate culture and mission of the Internet search tech titan. Eric Schmidt, Jonathan Ro

2017-11-23 10:42:00 Thursday ET

As the TV host of Mad Money, Jim Cramer provides 5 key reasons against the purchase and use of cryptocurrencies such as Bitcoin. First, no one knows the ano