2024-03-19 03:35:58 Tue ET

stock market technology competition free trade fair trade multilateralism neoliberalism regulation compliance economic growth asset management finance federalism congress supreme court inclusive institutions

We delve into the 5 major economic themes of the U.S. presidential election between Biden and Trump in 2024. This election is a fundamental market event in light of the stark economic policy differences between the incumbent president Joseph Biden and the former president Donald Trump. These differences span both polar extremes of the congressional spectrum between Democrats and Republicans. Here we map out the key economic issues and asset market shifts, which may occur in case the global asset markets present useful opportunities for institutional investors, fund managers, and retail traders to garner early exposure to these major themes. These themes include the U.S. fiscal policy, tax deregulation, homeland trade industrial policy, Federal Reserve System monetary policy, and geopolitical support.

As of mid-March 2024, the latest presidential election polls show that Trump leads Biden by several single-digit percentage points in the major swing states. These polls span CNN, New York Times, Ipsos, Reuters, YouGov, and USA Today; and the 5 major swing states include Arizona, Georgia, Michigan, Pennsylvania, and Wisconsin. In this context, Trump is likely to win his second presidential bid in November 2024, if he survives numerous U.S. prosecution trials and investigations in due course.

We would expect to see significant shifts in the fiscal stance, because these shifts are more likely to happen under unification across the new U.S. administration and Congress. A clean sweep by either party, especially Republicans, would raise risks of a fresh fundamental fiscal expansion in all major fiscal policy domains (such as social security, health care, education, defense, commerce, and transportation). Typically, this sweep would boost U.S. total GDP growth, interest rates, and more broadly asset prices and returns, especially for U.S. stocks. By contrast, however, the probable shift in fiscal stance in 2024 is substantially smaller than the fiscal shift was back in 2020, as both U.S. presidential candidates seek to attract greater centrist support in swing states this time. With much lower unemployment, stubbornly higher inflation, and possible dovish interest rate cuts later from 2024 to 2026, any fiscal expansion would impact the U.S. economic policy outlook more than the growth outlook. The new U.S. government may reinforce the upward pressure on Treasury bond yields, recent greenback strength, and temporary gains in asset market valuation. In support of a steeper yield curve, the next fiscal expansion may thus fuel fresh worries about the premium for investors to hold longer-term Treasury bonds. In response, U.S. stock market investors can focus on the AI-driven tech stocks and some cyclical value stocks in trade, finance, and health care.

If the Republicans win majority seats in both chambers of the U.S. Congress, the new Trump administration would likely extend the individual income tax cuts, windfall credits, and other tax incentives from 2017 beyond January 2026. Although neither party has outlined the next tax agenda at this stage, a Republican sweep would lead to the consideration of both further corporate income tax breaks and fresh frameworks for financial deregulation. In contrast to the climate change reforms under President Biden’s Build Back Better legislation, the Trump administration would retain a friendlier policy stance toward fossil-fuel production, probably with less support for green energy resources such as nuclear plants and solar power panels. In this broader context of U.S. protectionism, a Republican sweep would seem favorable to the brighter outlook for after-tax profit margins in Corporate America. In response to Trump tax cuts, credits, and other tax incentives, the Biden administration introduces progressively higher taxes on large corporations and the richest residents in America. On balance, the tax shifts may turn out to be much more moderate for both parties than the prior election in 2020, because both Biden and Trump now seek to acquire greater centrist support in order to win the electoral-college votes in crucial swing states: Arizona, Georgia, Michigan, Pennsylvania, and Wisconsin. During election years, moving to the center remains the best policy principle in accordance with the median voter theorem.

Both Republicans and Democrats seek to adopt a more forceful homeland industrial policy for fair trade, in response to anti-competitive trade practices, Section 301 violations, in China. A second Trump term would likely lead to more fundamental shifts in bilateral trade relations (especially U.S. bilateral trade relations with China and Europe). The Trump administration already imposed 10% across-the-board tariffs on all kinds of imports from China. To further contain the recent rise of China, the Biden administration applied restrictions on critical tech transfers, especially AI semiconductor microchips and graphical processing units (GPUs). More recently, the Congress passed new legislation to require the Chinese parent company, ByteDance, to divest the popular video-sharing app TikTok due to national security concerns. Any further trade barriers, such as higher tariffs and even embargoes, would likely boost the U.S. dollar at the margin. As a result, the stronger greenback would mean more competitive prices for U.S. imports. In this negative light, the prospect of broader tariffs, especially during a second Trump term, would likely lead global markets to anticipate a substantially stronger U.S. dollar against key Asian and European currencies, specifically yen, renminbi, euro, and sterling. Pervasive fears of higher tariffs may further weigh on non-U.S. stocks, funds, ADRs, and commodities. Additional U.S. government intervention can shine new light on historically gray areas such as anti-trust tech transfers and restrictions on foreign direct investment.

The U.S. presidential election outcome should not directly affect monetary policy decisions, especially subsequent dovish interest rate cuts, of the Federal Reserve System, which runs and operates independently of the White House and Congress. However, Trump has stated that he would not reappoint Fed Chair Jerome Powell when Powell’s term ends in 2026. In this broader scenario, we expect to see some sort of Fed subordination in response to global asset market concerns about the triple play of output, inflation, and the neutral interest rate. To the extent that the Federal Reserve Board prefers to keep the federal funds rate near the current peak of 5.25% to 5.5% as core inflation declines back down to the 2% average target, Fed Chair Jay Powell would probably prefer to delay dovish interest rate cuts in the next few quarters of 2024-2026. With Republican majority approval in Senate and House, the second Trump administration would likely appoint highly dovish successors to Fed Chair Jay Powell. As the successful Fed Chair appointments would be more conventional, future interest rate cuts would help with substantial improvements in the U.S. economy and stock market rally. In addition, more restrictive immigration policies and border controls would surface under a Republican administration, and then may lead to widespread fears and worries of relatively tighter labor market conditions. In light of this fundamental sea change, tighter labor supply would likely add to ubiquitous fears and worries of persistently higher inflation above the 2% target. These additional concerns are well beyond the mere monetary policy independence of the Fed.

A new second-term Republican administration and Congress would likely look less favorably on ongoing economic and military support for Ukraine in its war with Russia. The Republican majority House of Representatives has so far blocked an extension of foreign aid to Ukraine. Any further support for Ukraine would likely lead to a ceasefire, a peaceful resolution of the conflict in Eastern Europe, and more Russian oil and natural gas supplies available on the market. The adverse impact of the Russia-Ukraine war on world oil and natural gas supplies may be more modest, because OPEC+ countries continue to provide ample energy supplies despite economic sanctions from the U.S. and its western allies. Depending on the form of any resolution to the conflict, especially an interim ceasefire, U.S. and European assets may ultimately experience some further relief. However, global markets may anticipate tensions between the U.S. and its European allies on Ukraine, the Hamas-Israel war, trade, and the NATO. A new second-term Trump administration seems more likely to heighten restrictions on Iran and North Korea for better regional security. Hence, the upside tail from world energy supply disruptions may emerge from this broader context of geopolitical risks.

Overall, we can expect asset market volatility to be higher during the U.S. election seasons. The basic distribution of outcomes is likely to look wider, especially for interest rates and the U.S. dollar. Economic policy uncertainty tends to gradually dissolve with more stable asset prices and returns as the U.S. general election approaches in November 2024. On balance, a Republican victory, especially a clean sweep, would substantially improve the chances of a stronger U.S. dollar, higher breakeven inflation rates, higher Treasury bond yields, and a steeper yield curve. A Trump-led sweep may further increase the tails in both directions for world energy prices. Higher bond yields, commodity price hikes, and a stronger U.S. dollar combine to make more likely non-U.S. Asian and European asset market outperformance.

The 2024 U.S. presidential election is unusual in many ways. Both Biden and Trump emerge as the clear victors unusually early in the nomination process. Across the U.S. congressional spectrum between Democrats and Republicans, identifying the presumptive nominees often takes at least several months before Super Tuesday in early-March of the U.S. election year. Former President Donald Trump’s legal issues leave substantial economic policy uncertainty. In fact, the setup for the U.S. general election in November 2024 is even more unusual. The U.S. public seems to seek a popular rematch between Biden and Trump. In U.S. history, no former U.S. president, Trump, has had a rare chance to challenge the incumbent president, Biden, who won the U.S. presidential bid about 4 years ago, since 1892. Head-to-head polls suggest that Trump comfortably leads Biden by low single-digit percentage points, especially in the 5 major swing states Arizona, Georgia, Michigan, Pennsylvania, and Wisconsin. Due to public concerns about higher inflation and geopolitical instability in Europe and the Middle East, Biden fails to secure centrist support, which is absolutely necessary for him to win his second term. The poor polls for Biden turn out to be an unusual outlier itself, even for several U.S. presidents who eventually lost the re-election: Gerald Ford, Jimmy Carter, and George H.W. Bush.

The current reversal of fortune between Biden and Trump further makes election-year policy dynamism particularly unusual at this stage. Biden faces a greater incentive to push through economic policy carrots and sticks to help his re-election. On the policy front, these additions can even involve compromises that Biden would not normally make during his presidency. If the White House is open to big policy concessions for small pre-election gains, Republican lawmakers would less likely take easy policy wins. Instead, both the presumptive Republican presidential nominee, Donald Trump, and his Republican allies in Senate and House would probably choose to retain those crucial policy issues for the election campaign.

On U.S. immigration, the Senate is close to reaching a deal on tighter border control policies with substantially more federal finance for the U.S. Mexico border. Given this federal finance on better border control, Republican senators made a condition of providing further foreign aid to Ukraine. However, any border deal would probably help remove the sense of urgency in association with broader campaign issues to the detriment of Democrats in both chambers of Congress. Trump opposed more foreign aid to Ukraine and so has come out against the conditional compromise on the border deal. Between many Republican lawmakers and their presidential leader, the conflict of views may make House passage rather difficult. In light of this party interplay, we would expect the odds of either additional aid to Ukraine or a border deal to be well below 50% before the U.S. presidential election in November 2024.

A similar situation prevails in regard to the current U.S. fiscal policy stance. Democrats seek an extension of child tax credits from 2022 to at least 2026, in return for restoring Republican business tax incentives. This tax deal would induce Democrats to make hefty concessions, with a reduction of $140 billion in business tax receipts per year, for relatively small gains of $10 billion more in child tax credits each year. Although the House may pass the tax deal in a strong bipartisan vote, progressive Democrats from the Senate object to the resultant fiscal imbalances. Also, a few conservative Republicans from both Senate and House convey their concerns about all sorts of pre-election Biden bucks on the table. Even if the odds of success are reasonably higher for this tax deal (than the odds of House passage for the border deal), election-year campaign politics may lean against the probable ultimate enactment of the tax deal.

On the current U.S. fiscal policy stance, Trump can choose to introduce fresh tax breaks for American businesses. Because Trump has been an unusual outlier among Republicans for declining to propose benefit cuts, Biden might seek to create a wedge issue to gain greater centrist support by proposing new taxes on large corporations and the richest residents on U.S. soil to fund any further benefit expansion. In response, Trump may move to the center by launching additional broad-brush tariffs on U.S. imports, especially on U.S. imports from China and Europe. Trump can send these signals as self-fulfilling prophecies if he wins the presidential bid for a second term.

In her recent book, Primary Politics, Elaine Kamarck describes in detail the U.S. presidential election process. The U.S. presidential election process reflects the importance of American federalism during the U.S. establishment as an independent and separate sovereign nation in the 1780s-1790s. In America, both the presidential and congressional elections are state-run, as the U.S. founding fathers enshrined state authority over elections in the Constitution. In this broader context, U.S. state law governs the vast majority of technical aspects of U.S. elections, such as both candidate and voter eligibility, state administration of elections, and the state primaries.

The presidential election typically begins with state primaries. In each state primary (among Democrats or Republicans), voters choose each party’s presidential nominee. The primary results determine the allocation of delegates to each candidate. Within each party, delegates are individuals who vote on behalf of a group of people, and are often early supporters of a particular candidate, local party leaders, or party activists. Candidates accumulate delegates throughout the primary season that runs from January to June of the election year. After the last primary, the Democratic and Republican parties host national conventions. During these conventions, the parties officially nominate the presidential candidates who won the majority of delegates through the primary season.

During the general election, voters cast their votes for their preferable presidential candidate, although they indeed vote for the candidate’s slate of electors, who are generally chosen by the state party leaders. Americans elect the president through the Electoral-College process. The U.S. Electoral-College comprises 538 electors, and the presidential candidate who wins 270 electoral votes in November becomes the U.S. president-elect. In about mid-December, the Electoral College meets to confirm the election outcome in support of the new president. In accordance with U.S. federalism, this Electoral-College process differs dramatically from proportional representation in many western liberal democracies with parliamentary systems.

In terms of the presidential nomination process, the political parties control this process, and the Supreme Court protects this important role of Democrats and Republicans. Specifically, the Supreme Court has stated that the First Amendment’s freedom of association supports this important role of the parties. Over about 100 years, the presidential nomination process was a party-run system. In 1972, the state primaries began to select presidential candidates. However, this fundamental shift arose not from a change in law, but from a reform movement within the Democratic Party. This reform movement led to a basic change in party rules that connected primary results to delegate selection. Later, the Republican Party further adopted this change.

Nowadays, the parties select delegates through state primaries, although state party leaders can still select delegates in a different way. At each national convention, the delegates vote to confirm their presidential candidate on behalf of state voters. Through the primary season, the candidate who wins the majority of delegates becomes the party’s presidential nominee. The Federal Election Commission and state capitals attest and ensure that the presidential nominees’ names automatically appear on ballots.

Early primary contests such as the Iowa Republican caucus and the New Hampshire primary for Democrats are more of a beauty contest for presidential candidates to generate greater publicity by actively debating a wide variety of policy issues and ideas. Through the primary season, delegates pledge to loyally support each Democratic or Republican party’s nominee, and the candidates themselves are quite intent to be careful with their delegate selection for obvious reasons.

The U.S. constitutional presumption that states run elections means that Congress may not be able to set a national primary day. This specification would require impossible agreement between all 50 state legislatures, 100 Democratic and Republican state parties, and the 2 national parties. The parties often like to exercise control over the nomination process, and each state party has its own views on the appropriate timetable for its primary, even as some local primary differences persist. At the core of U.S. elections, state politics prevail over the country.

At this stage, the presumptive presidential nominee has often been the person who won the early primaries. In some years, the race goes on until the final primaries in June, as was the case with Reagan and Ford in 1976, Carter and Kennedy in 1980, and Clinton and Obama in 2008. The delegate count continues to be top-of-mind. Delegates tend to accumulate in large quantities from Super Tuesday in March of the election year. A presidential candidate must win a majority of delegates to secure the party nomination. Party law governs up until Election Day. When the Electoral College meets to confirm the new president-elect in mid-December, the Constitution applies afterwards.

Unfortunately, the nationwide popular vote plays essentially no role in the U.S. presidential election process, because the American founding fathers enshrined the Electoral College in the Constitution. Each state shall appoint electors in accordance with state legislature. Now 48 states choose to award all their electors to the winner of the state popular vote. Over the past 3 decades, the winner of the nationwide popular vote failed to win the presidency only twice (Bush in 2000 and Trump in 2016). These exceptions to the rule of thumb reflect some dramatic shifts in the distribution of U.S. population over the last few decades. Indeed, the U.S. population used to be relatively evenly spread throughout the country. However, much of the U.S. population now lives in the major coastal cities, as the U.S. agricultural revolution took huge swaths of middle America. The Electoral College has not changed to reflect these dramatic shifts in the distribution of U.S. population.

In America, it is relatively difficult for a third party to play a significant role in the presidential election process. Political parties are useful because they serve as a shorthand for people to understand what each party represents (topical policy issues, special constituent interests, ideological shifts, cultural values, and so on). Most Americans generally know what they get when they vote Democrat or Republican. The U.S. electoral system presents a challenge to a third party, because U.S. voters usually have no idea what third-party candidates represent. The U.S. has a first-past-the-post electoral system, whereby Americans cast their votes and the candidate with the majority of Electoral College votes wins the election. By contrast, third parties play a prominent role in several parliamentary systems. On the basis of proportional representation, the parliamentary systems allocate seats in government and legislature on the basis of each party’s vote share. As a result, this allocation gives third-party candidates more bargaining power to push through their agendas with cabinet slots.

This analytic essay cannot constitute any form of financial advice, analyst opinion, recommendation, or endorsement. We refrain from engaging in financial advisory services, and we seek to offer our analytic insights into the latest economic trends, stock market topics, investment memes, personal finance tools, and other self-help inspirations. Our proprietary alpha investment algorithmic system helps enrich our AYA fintech network platform as a new social community for stock market investors: https://ayafintech.network.

We share and circulate these informative posts and essays with hyperlinks through our blogs, podcasts, emails, social media channels, and patent specifications. Our goal is to help promote better financial literacy, inclusion, and freedom of the global general public. While we make a conscious effort to optimize our global reach, this optimization retains our current focus on the American stock market.

This free ebook, AYA Analytica, shares new economic insights, investment memes, and stock portfolio strategies through both blog posts and patent specifications on our AYA fintech network platform. AYA fintech network platform is every investor's social toolkit for profitable investment management. We can help empower stock market investors through technology, education, and social integration.

We hope you enjoy the substantive content of this essay! AYA!

Andy Yeh (online brief biography)

Co-Chair

AYA fintech network platform

Brass Ring International Density Enterprise ©

Do you find it difficult to beat the long-term average 11% stock market return?

It took us 20+ years to design a new profitable algorithmic asset investment model and its attendant proprietary software technology with fintech patent protection in 2+ years. AYA fintech network platform serves as everyone's first aid for his or her personal stock investment portfolio. Our proprietary software technology allows each investor to leverage fintech intelligence and information without exorbitant time commitment. Our dynamic conditional alpha analysis boosts the typical win rate from 70% to 90%+.

Our new alpha model empowers members to be a wiser stock market investor with profitable alpha signals! The proprietary quantitative analysis applies the collective wisdom of Warren Buffett, George Soros, Carl Icahn, Mark Cuban, Tony Robbins, and Nobel Laureates in finance such as Robert Engle, Eugene Fama, Lars Hansen, Robert Lucas, Robert Merton, Edward Prescott, Thomas Sargent, William Sharpe, Robert Shiller, and Christopher Sims.

Follow our Brass Ring Facebook to learn more about the latest financial news and fantastic stock investment ideas: http://www.facebook.com/brassring2013.

Follow AYA Analytica financial health memo (FHM) podcast channel on YouTube: https://www.youtube.com/channel/UCvntmnacYyCmVyQ-c_qjyyQ

Free signup for stock signals: https://ayafintech.network

Mission on profitable signals: https://ayafintech.network/mission.php

Model technical descriptions: https://ayafintech.network/model.php

Blog on stock alpha signals: https://ayafintech.network/blog.php

Freemium base pricing plans: https://ayafintech.network/freemium.php

Signup for periodic updates: https://ayafintech.network/signup.php

Login for freemium benefits: https://ayafintech.network/login.php

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-07-13 07:17:00 Saturday ET

Japanese prime minister Shinzo Abe outlines the main economic priorities for the G20 summit in Osaka, Japan. First, Asian countries need to forge the key Re

2017-12-19 09:39:00 Tuesday ET

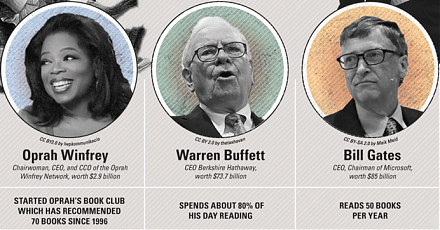

From Oprah Winfrey to Bill Gates, this infographic visualization summarizes the key habits and investment styles of highly successful entrepreneurs:

2022-04-25 10:34:00 Monday ET

Corporate ownership governance theory and practice The genesis of modern corporate governance and ownership studies traces back to the seminal work

2019-08-22 11:35:00 Thursday ET

Fundamental factors often reflect macroeconomic innovations and so help inform better stock investment decisions. Nobel Laureate Eugene Fama and his long-ti

2023-07-28 11:28:00 Friday ET

Lucian Bebchuk and Jesse Fried critique that executive pay often cannot help explain the stock return and operational performance of most U.S. public corpor

2018-01-19 11:32:00 Friday ET

Most major economies grow with great synchronicity several years after the global financial crisis. These economies experience high stock market valuation,