2019-01-07 18:42:00 Mon ET

technology antitrust competition bilateral trade free trade fair trade trade agreement trade surplus trade deficit multilateralism neoliberalism world trade organization regulation public utility current account compliance

Neoliberal public choice continues to spin national taxation and several other forms of government intervention. The key post-crisis consensus focuses on government intervention as the primary root cause of socioeconomic malaise in several OECD countries. Ideology continues to inform public policy, and neoliberalism specifically advocates a minimal role for the state in economic affairs such as taxation, health care, trade, infrastructure, and immigration. Neoliberal public choice emphasizes regulatory failures rather than historical country-specific experiences.

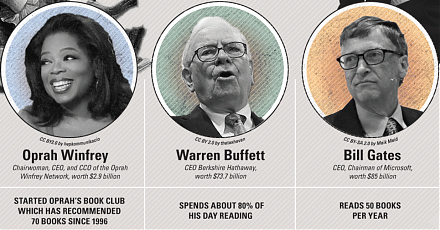

The sheer predominance of utilitarian myopia reflects fundamental misconceptions about the proper role of government. Contrary to the post-crisis consensus, active strategic public-sector investment is critical to both economic revival and financial stability. The state should act as an investor of first resort, rather than a lender of last resort, for greater tech advances and revolutions in finance, energy, transport, medicine, and information communication. The government can learn much from the best business minds of Warren Buffet and George Soros in finance, Elon Musk in energy and autonomous transport, Peter Diamandis and James Brewer in health care and medicine, as well as Steve Jobs, Tim Cook, Bill Gates, Larry Page, and Jeff Bezos in information communication technology. Effective capitalism calls for facilitative state involvement in economic governance and regulation.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-09-27 11:41:00 Thursday ET

Michael Kors pays $2.3 billion to acquire the Italian elite fashion brand Versace. In accordance with Michael Kors's 5-year plan, the joint company grow

2019-04-30 07:15:00 Tuesday ET

Through our AYA fintech network platform, we share numerous insightful posts on personal finance, stock investment, and wealth management. Our AYA finte

2023-09-07 11:30:00 Thursday ET

Michael Woodford provides the theoretical foundations of monetary policy rules in ever more efficient financial markets. Michael Woodford (2003)

2019-05-23 10:33:00 Thursday ET

Berkeley professor and economist Barry Eichengreen reconciles the nominal and real interest rates to argue in favor of greater fiscal deficits. French econo

2018-11-09 11:35:00 Friday ET

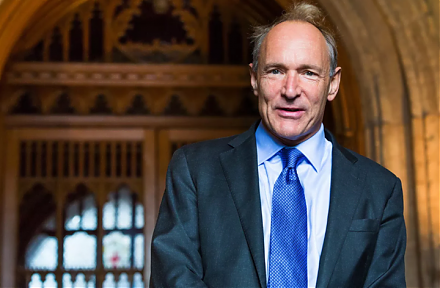

The Internet inventor Tim Berners-Lee suggests that several tech titans might need to be split up in response to some recent data breach and privacy concern

2018-06-09 16:40:00 Saturday ET

The Trump administration introduces new tariffs on $50 billion Chinese goods amid the persistent bilateral trade dispute. The tariffs effectively boost cost