2019-11-15 13:34:00 Fri ET

federal reserve monetary policy treasury dollar employment inflation interest rate exchange rate macrofinance recession systemic risk economic growth central bank fomc greenback forward guidance euro capital global financial cycle credit cycle yield curve

The Economist offers a special report that the new normal state of economic affairs shines fresh light on the division of labor between central banks and governments. The recent U.S. economic outlook combines full employment with low inflation, and this rare combination accords with the Federal Reserve dual mandate of maximum sustainable employment and price stabilization. The New Keynesian Phillips Curve becomes flat in recent times, and there is no inexorable trade-off between inflation and unemployment. The U.S. unemployment rate reaches 3.5% or the lowest level since 1969. The core inflation rate hovers in the range of 1.5%-1.7% or well below the 2% target inflation rate. On the one hand, the Federal Reserve may continue to reduce the interest rate to help sustain the U.S. economic expansion and stock market rally in response to a vocal president.

On the other hand, the dovish interest rate cuts suggest that the U.S. central bank may have fewer monetary policy levers to cope with the next economic recession. Meanwhile, U.S. Treasury continues to offer Americans fiscal stimulus packages in the generic form of both tax incentives and infrastructure expenditures. Whether fiscal deficits can cause higher inflation remains a major economic policy concern.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-06-25 12:43:00 Monday ET

Apple and Samsung are the archrivals for the title of the world's top smart phone maker. The recent patent lawsuit settlement between Apple and Samsung

2017-04-19 17:37:00 Wednesday ET

Apple is now the world's biggest dividend payer with its $13 billion dividend payout and surpasses ExxonMobil's dividend payout record. Despite the

2018-05-09 08:31:00 Wednesday ET

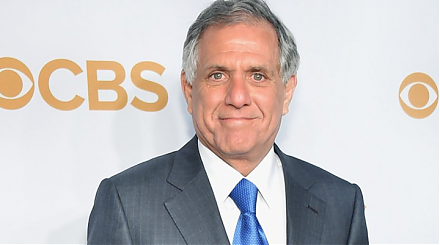

CBS and its special committee of independent directors have decided to sue the Redstone controlling shareholders because these directors might have breached

2017-05-25 08:35:00 Thursday ET

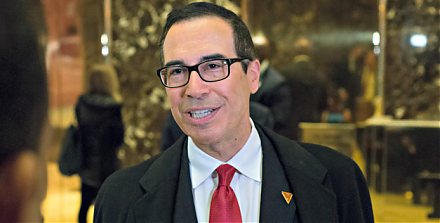

Treasury Secretary Steve Mnuchin has released a 147-page report on financial deregulation under the Trump administration. This financial deregulation seeks

2020-11-01 11:21:00 Sunday ET

Artificial intelligence continues to push boundaries for several tech titans to sustain their central disruptive innovations, competitive moats, and first-m

2019-05-23 10:33:00 Thursday ET

Berkeley professor and economist Barry Eichengreen reconciles the nominal and real interest rates to argue in favor of greater fiscal deficits. French econo